Home Appliance Rental Apps Market Size 2034 | 16.1% CAGR

Global Home Appliance Rental Apps Market Size, Share, Analysis Report By Product Type(Washing Machine, Refrigerator, Air Purifier, Television, Microwave, Water Purifier/Water Dispenser, Air Conditioner, Others)By Rental Duration(Long-Term Rentals, Short-Term Rentals)By End-Use(Commercial, Residential) Industry Region and Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

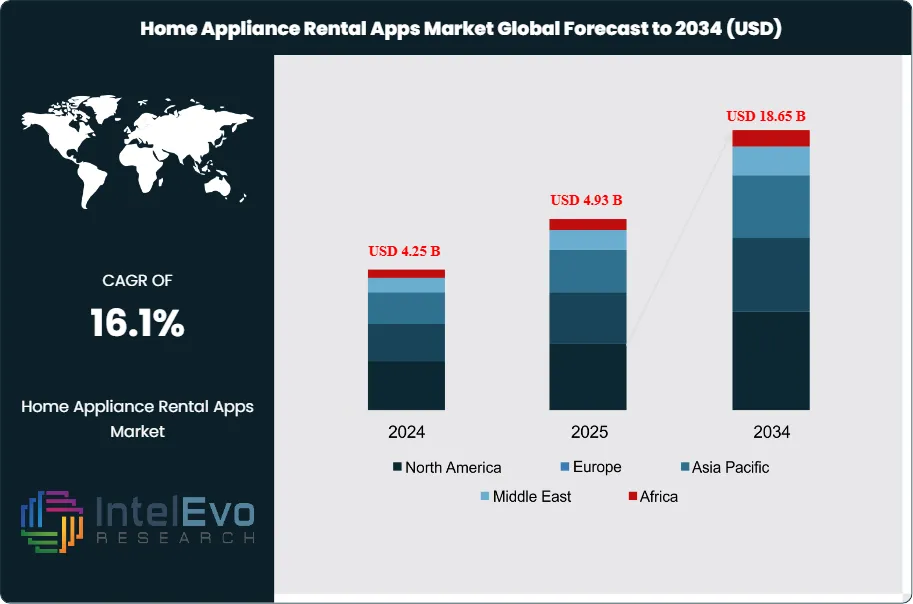

The Home Appliance Rental Apps Market size is projected to reach approximately USD 18.65 Billion by 2034, up from USD 4.25 Billion in 2024, growing at a strong CAGR of 16.1% during the forecast period from 2025 to 2034. With the rise of the sharing economy, digital transformation, and increasing consumer preference for flexible and cost-effective home solutions, rental apps are rapidly reshaping the global appliance industry. This trend is gaining massive traction among millennials and urban professionals, driving a surge in short-term appliance rentals and subscription-based ownership models across emerging and developed markets alike.

Get More Information about this report -

Request Free Sample ReportThe home appliance rental apps market represents a dynamic segment of the sharing economy that has transformed how consumers access essential household appliances. This market encompasses digital platforms that facilitate the rental of various home appliances including washing machines, refrigerators, air purifiers, televisions, microwaves, water purifiers, air conditioners, and other household equipment. The market is driven by several key factors including the growing preference for flexible ownership models, rising urbanization, increasing disposable income among millennials and Gen Z consumers, and the proliferation of smartphone adoption. The subscription-based model offers consumers the advantage of accessing high-quality appliances without the burden of large upfront investments, while also providing maintenance and replacement services that enhance the overall value proposition.

Market dynamics are significantly influenced by changing consumer behavior patterns, particularly among young urban professionals who prioritize convenience and flexibility over traditional ownership models. The rise of nuclear families, frequent relocations due to job changes, and the growing awareness of environmental sustainability have contributed to the market's expansion. Additionally, technological advancements in mobile applications, IoT integration, and digital payment systems have streamlined the rental process, making it more accessible and user-friendly. The market also benefits from the increasing penetration of e-commerce platforms and the growing trust in online service providers, which has facilitated the adoption of appliance rental services across different demographic segments.

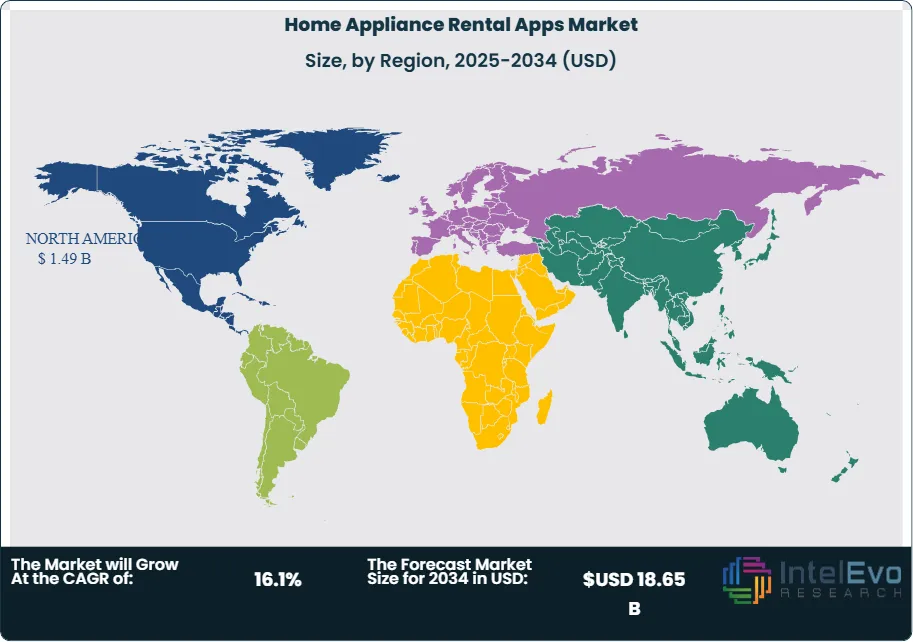

The North American region dominates the global home appliance rental apps market due to high smartphone penetration, advanced digital infrastructure, and strong consumer acceptance of sharing economy models. The region's mature e-commerce ecosystem and well-established logistics networks provide a solid foundation for appliance rental services to flourish.

The COVID-19 pandemic significantly impacted the home appliance rental apps market, initially causing disruptions in supply chains and delivery services. However, the pandemic also accelerated the adoption of digital services as consumers increasingly turned to online platforms for their household needs. The extended periods of remote work and home-based activities increased the demand for home appliances, particularly air purifiers, washing machines, and kitchen appliances, driving growth in the rental market as consumers sought cost-effective solutions.

Key Takeaways

- Market Growth: The Home Appliance Rental Apps Market is expected to reach USD 18.65 Billion by 2034, fueled by rising consumer demand for affordable, flexible living solutions and the proliferation of app-based rental services.

- Product Type Dominance: Refrigerators remain the leading product category due to their essential utility in both residential and commercial settings. The demand is especially high among urban dwellers who prefer renting high-end refrigerators to avoid large upfront costs.

- Rental Duration Dominance: Long-term rentals account for the largest share, as customers increasingly opt for year-long or multi-year rental agreements that provide better value, hassle-free maintenance, and convenience over time.

- End-Use Dominance: The residential sector dominates the market because of increasing home relocation, urban migration, and the growing trend of asset-light living among young professionals and nuclear families.

- Driver: The market is primarily driven by the shift toward flexible consumption models and the growing preference for asset-light living among younger demographics. Rising urbanization and increasing mobility of the workforce create sustained demand for temporary and flexible appliance solutions.

- Restraint: Market growth is constrained by consumer concerns regarding hygiene and the quality of used appliances, along with the long-term cost implications of rental versus purchase. Traditional ownership mindsets in certain demographic segments also pose challenges to market expansion.

- Opportunity: Significant opportunities exist in expanding into emerging markets with growing middle-class populations and increasing digitalization. The integration of smart home technologies and IoT-enabled appliances presents avenues for premium service offerings and enhanced customer experiences.

- Trend: The market is witnessing a trend toward sustainability-focused rental models and the integration of artificial intelligence for personalized appliance recommendations. Subscription-based models with flexible terms and add-on services are becoming increasingly popular among service providers.

- Regional Analysis: North America maintains market leadership due to advanced digital infrastructure and high consumer acceptance of sharing economy models. The Asia-Pacific region shows the highest growth potential driven by rapid urbanization and increasing smartphone penetration in emerging economies.

Product Type Analysis:

Refrigerators are the most dominant product category in the home appliance rental apps market. Their indispensable role in modern living makes them a priority rental appliance for both residential and commercial users. Many consumers find purchasing high-capacity or energy-efficient refrigerators prohibitively expensive. Rental apps bridge this affordability gap by offering premium models at a fraction of the cost, bundled with maintenance and free upgrades. The surge in working professionals relocating to urban centers, co-living spaces, and shared accommodations has contributed significantly to the sustained demand for refrigerator rentals. Additionally, seasonal requirements, such as festivals or temporary housing, further bolster the segment’s relevance. Providers like Rentomojo and Furlenco have capitalized on this demand by offering flexible plans, sanitized products, and doorstep delivery, which attract both new and repeat customers.

Rental Duration Analysis:

Long-Term Rentals Leads With more than 60% Market Share In Home Appliance Rental Apps Market, Long-term rentals are the market’s backbone, driven by customer preference for stability, predictable monthly expenses, and reduced logistic hassles. Consumers increasingly favor 12-24 month contracts, as these arrangements offer cost benefits, consistent service support, and options to upgrade or buy out appliances. Businesses such as co-working spaces, hostels, and small offices also prefer long-term rental contracts to furnish premises without significant capital expenditure. Rental companies benefit from these contracts as they ensure predictable cash flow and higher asset utilization. The trend has been further cemented by subscription models, wherein customers pay monthly installments that cover appliance maintenance and insurance. The post-COVID landscape reinforced this preference, as households sought stability while managing tight budgets, making long-term rentals a compelling proposition.

End-Use Analysis:

The residential end-use segment is the largest contributor to market revenue, accounting for a substantial share of total demand. Rising urbanization, frequent relocations, and the popularity of rental homes have led consumers to rent instead of buying appliances outright. Young professionals, expatriates, and nuclear families appreciate the convenience of rental services, which eliminate transportation and maintenance worries. Subscription-based rentals allow them to customize their living spaces without long-term commitments. The rise of co-living and shared accommodation has further spurred residential rentals, with customers prioritizing affordability and convenience. Providers have responded by offering bundled packages that combine essential appliances with flexible payment options, driving rapid adoption in metropolitan areas.

Region Analysis:

North America Leads With over 35% Market Share In Home Appliance Rental Apps Market. North America is the leading region, accounting for the highest market share. The U.S. and Canada have a mature rental ecosystem with widespread acceptance of subscription models and digital rental apps. High smartphone penetration, robust e-commerce infrastructure, and favorable consumer attitudes toward flexible consumption fuel continued growth. The region also benefits from a high degree of urbanization and a sizable renter population.

Europe follows closely, driven by sustainability trends and the popularity of circular economy practices. Countries like the UK, Germany, and France have witnessed increased adoption among young professionals and eco-conscious consumers who prefer renting refurbished appliances over purchasing new ones.

Asia Pacific is projected to be the fastest-growing market, with India as a key growth engine. Rapid urbanization, a growing middle class, and the proliferation of start-ups like Furlenco and Rentickle have significantly accelerated market penetration. Latin America and the Middle East are emerging markets with high potential, particularly among millennials embracing digital-first lifestyles. In the future, Asia Pacific will likely witness the strongest growth in residential long-term refrigerator rentals, owing to rising disposable incomes and housing mobility.

Get More Information about this report -

Request Free Sample ReportKey Market Segment:

By Appliance Type

- Kitchen Appliances (Refrigerators, Microwaves, Ovens, Dishwashers)

- Home Comfort Appliances (Air Conditioners, Heaters, Fans)

- Laundry Appliances (Washing Machines, Dryers)

- Cleaning Appliances (Vacuum Cleaners, Steam Cleaners)

- Entertainment & Smart Devices (Televisions, Speakers, Projectors)

- Others (Water Purifiers, Air Purifiers, etc.)

By Platform Type

- Android

- iOS

- Web-based Platforms

By Pricing Model

- Subscription-based

- Pay-per-use Model

- Hybrid Rental Model

By Rental Duration

- Long-Term Rentals

- Short-Term Rentals

By Distribution Channel

- App-based (Direct-to-Consumer)

- Third-party Online Platforms

- Offline Rental Service Providers

By End User

- Residential

- Commercial (Hotels, Offices, Co-living Spaces)

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 4.93 B |

| Forecast Revenue (2034) | USD 18.65 B |

| CAGR (2025-2034) | 16.1% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Appliance Type (Kitchen Appliances (Refrigerators, Microwaves, Ovens, Dishwashers), Home Comfort Appliances (Air Conditioners, Heaters, Fans), Laundry Appliances (Washing Machines, Dryers), Cleaning Appliances (Vacuum Cleaners, Steam Cleaners), Entertainment & Smart Devices (Televisions, Speakers, Projectors), Others (Water Purifiers, Air Purifiers, etc.)), By Platform Type (Android, iOS, Web-based Platforms), By Pricing Model (Subscription-based, Pay-per-use Model, Hybrid Rental Model), By Rental Duration (Long-Term Rentals, Short-Term Rentals), By Distribution Channel (App-based (Direct-to-Consumer), Third-party Online Platforms, Offline Rental Service Providers), By End User (Residential, Commercial (Hotels, Offices, Co-living Spaces)) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Rentomojo, Mr Rental, Furlenco, FlexShopper, LLC., Rent-A-Center, Inc., Aaron’s Inc., DrinkPrime, CityFurnish, Livpure Smart Homes Private Limited, Housejoy, Rentickle, Fabrento, Appliancesonrent.com |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Home Appliance Rental Apps Market

Published Date : 09 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date