Home Fragrance Market Size & Share | Global Industry Growth, Trends & Forecast 2025–2034

Global Home Fragrance Market Size, Share & Growth Analysis By Product Type (Candles, Diffusers, Room Sprays, Essential Oils, Incense & Others), By Fragrance Type (Natural, Synthetic, Blended), By Distribution Channel (Online Retail, Specialty Stores, Supermarkets & Hypermarkets, Direct-to-Consumer), By End Use (Residential, Commercial, Hospitality & Wellness), By Price Range (Mass, Premium, Luxury), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) – Industry Outlook, Consumer Trends, Sustainability Impact, Competitive Landscape, Strategic Insights & Forecast 2025–2034

Report Overview

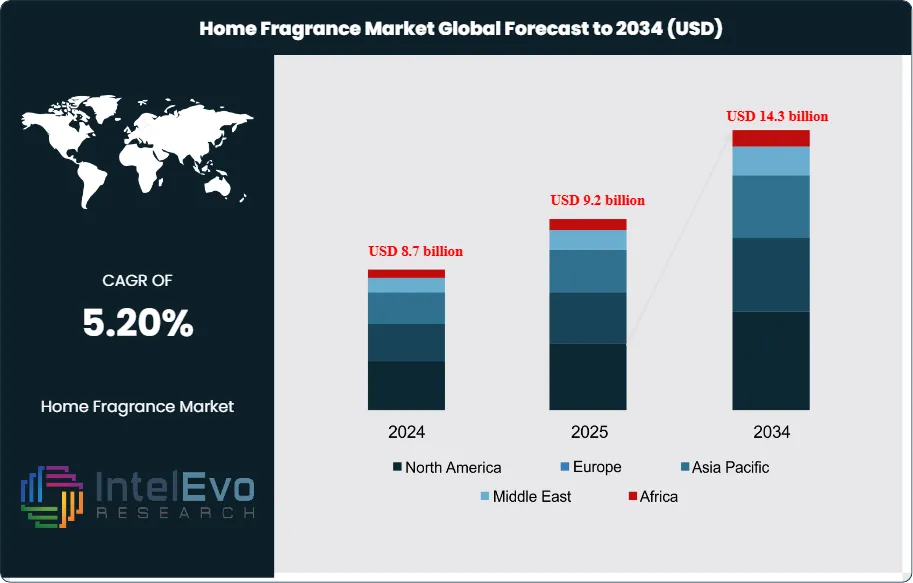

The Home Fragrance Market is estimated at USD 8.7 billion in 2024 and is projected to reach approximately USD 14.3 billion by 2034, registering a compound annual growth rate (CAGR) of about 5.2% during 2025–2034. This sustained expansion is driven by rising consumer focus on wellness, stress reduction, and personalized living environments, with home fragrance increasingly positioned as an essential lifestyle and self-care product rather than a discretionary purchase. Growth is further supported by the rapid adoption of aromatherapy, premium candles, and smart diffusers, alongside strong momentum in e-commerce and subscription-based sales models that improve repeat purchases. Expanding urban populations, higher disposable incomes in emerging markets, and increasing demand for natural, clean-label, and sustainable fragrance solutions are also reinforcing long-term market momentum, making home fragrance a high-engagement and resilient consumer category across global platforms.

Get More Information about this report -

Request Free Sample ReportHome fragrance products such as candles, diffusers, sprays, and essential oils have shifted from discretionary décor items to routine wellness purchases, supported by rising time spent at home and a stronger focus on mental wellbeing. Globally, wellness-oriented formats already account for an estimated 55% of category revenues, with aromatherapy-positioned products growing at close to 7% per year.

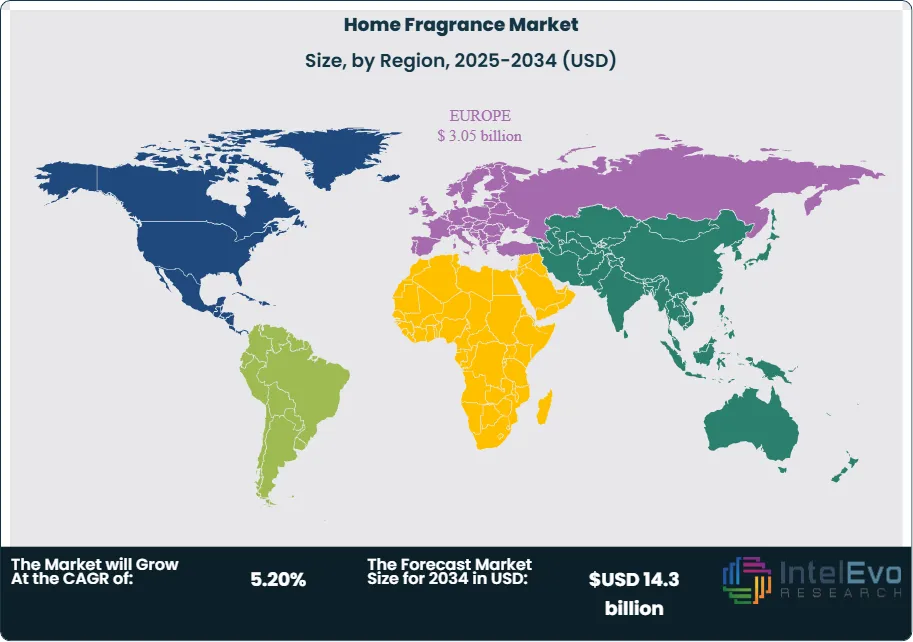

Europe remains the anchor market, supported by deep perfume and essential oil supply chains; France, Germany, the United Kingdom, and Spain together represent around 35% of global demand. France alone imported essential oils worth more than EUR 250 million in 2021 while also ranking among the top perfume exporters worldwide, which underpins strong upstream capabilities for brands seeking premium scent profiles. At the same time, rapid export growth from countries such as Mauritius and Togo signals an emerging supplier base and new sourcing options for your business. Demand is supported by premiumization, natural ingredient claims, and gifting occasions, while supply is shaped by access to high quality essential oils, sustainable packaging, and distinctive brand storytelling. AI and analytics now inform fragrance development, consumer segmentation, and e-commerce personalization. Automated filling and packaging lines increase consistency and cost efficiency.

However, you must navigate tightening regulations on allergens, volatile organic compounds, and labeling in both the European Union and North America. Certification expectations around vegan, cruelty-free, and recyclable formats add further compliance and sourcing complexity but also support price premiums. Market saturation is moderate to high in Europe and North America, where established labels such as Yankee Candle, Diptyque, and Jo Malone command strong shelf presence and loyal communities.

By contrast, Asia Pacific, Latin America, and parts of Africa still show lower household penetration levels, supporting double-digit growth opportunities in urban middle-income segments. For investors and strategists, the most attractive plays sit in natural and sustainable concepts, direct-to-consumer digital brands, and co-branded lifestyle collaborations that can capture higher margins while aligning with wellness and home comfort priorities.

Key Takeaways

- Market Growth: The Home Fragrance Market is projected to reach about USD 8.7 billion in 2024, expanding at a CAGR of roughly 5.2 percent. Growth is driven by rising demand for wellness-oriented aromas, higher household spending, and stronger adoption of premium scent formats.

- Product Type: Candles account for an estimated 34 percent of 2024 revenues and continue to lead due to strong consumer preference for ambiance and relaxation. You should expect steady demand as aromatherapy-positioned candles grow at more than 6 percent annually.

- Distribution Channel: Supermarkets and hypermarkets held more than 47 percent share in 2024 due to broad product visibility and impulse purchases. Their role remains central as retailers expand premium and natural fragrance assortments.

- Driver: Wellness and self-care priorities continue to shift fragrance use into daily routines, lifting aromatherapy and essential-oil formats. Over 55 percent of consumers report using home scents for stress relief, which supports consistent category growth.

- Restraint: Regulatory pressure on volatile organic compounds and allergen disclosure increases compliance costs by an estimated 8 to 12 percent for manufacturers. Smaller brands face margin compression due to testing and labeling requirements in Europe and North America.

- Opportunity: Asia Pacific presents one of the strongest expansion paths, with urban fragrance penetration still below 25 percent. Rising disposable incomes and rapid premium scent adoption position the region for high single-digit CAGR through 2034.

- Trend: AI-assisted fragrance formulation and digital personalization are gaining adoption, enabling brands to create targeted scent profiles and strengthen direct-to-consumer conversions. Large fragrance houses have begun integrating data-driven profiling tools to speed product development.

- Regional Analysis: Europe leads with about 36 percent market share, supported by strong essential oil imports and a mature luxury scent culture. Emerging markets in Asia Pacific, Latin America, and Africa are set to outpace global growth as household spending rises and retail distribution expands.

Type Analysis

The market for home fragrance products continues to expand in 2025 as consumers prioritize comfort, wellness, and personalization within their living spaces. Candles remain the largest product category. They held more than 34 percent of global revenues in 2023 and are projected to grow at a pace above 6 percent annually through 2034. Their appeal comes from a mix of sensory value, décor versatility, and strong gifting demand. You see steady product innovation in scent blends, clean-burning waxes, and reusable containers, which supports repeat purchases across premium and mass-market tiers.

Sprays maintain a meaningful position due to their speed and convenience. They serve households seeking immediate odor control and are often paired with other fragrance formats. As indoor air quality becomes a stronger consumer priority, sprays with natural formulations and low-VOC claims continue to gain traction. Diffusers also show consistent growth as they provide long-lasting fragrance without flame or heat. Their adoption accelerates in homes where consumers prefer low-maintenance and health-conscious solutions. Electric and ultrasonic diffuser systems are expanding their share due to steady upgrades in scent intensity control and timer features.

Other formats such as essential oils, incense sticks, and fragrance sachets play an important role in niche and culturally influenced segments. These options help brands target consumers seeking traditional aromatic experiences or natural formats. Combined, these categories broaden market participation and support revenue diversification as sensory preferences evolve across regions.

Application Analysis

Pavers and retaining walls remain the most common settings where home fragrance products are used as consumers integrate scent into relaxation zones and outdoor living areas. Growth in home renovation spending supports this trend. You see rising use of weather-resistant diffusers and essential-oil-based solutions in patios, garden seating areas, and terrace spaces. Developers also incorporate scent features into landscaped designs to create more inviting outdoor environments.

Indoor applications continue to generate the majority of demand. Living rooms, bedrooms, and bathrooms account for more than two-thirds of total usage as households adopt fragrance layering habits. Aromatherapy-focused formats grow rapidly in application areas linked to stress relief, such as bedrooms and home offices. Kitchens remain a functional application area where sprays and odor-neutralizing solutions dominate.

Secondary applications such as small retail stores, spas, and boutique hotels also contribute to growth. These environments use candles and diffusers to shape customer experience and brand identity. As experiential retail strategies expand in 2025 and beyond, the use of curated scent signatures is expected to rise.

End-Use Analysis

Residential buildings represent the largest end-use segment and account for the majority of global consumption. The segment continues to grow at steady mid-single-digit rates, driven by rising household spending on wellness and home personalization. As remote and hybrid work patterns persist, consumers invest more in creating pleasant indoor environments, which sustains strong demand for candles, diffusers, and essential oils.

Commercial buildings also adopt home fragrance products to enhance customer engagement. Hotels, serviced apartments, spas, and salons increasingly use signature scents to strengthen brand recall and improve guest satisfaction. Retail chains experiment with zone-based scent strategies to influence browsing behavior. This segment benefits from stable demand recovery through 2025 as hospitality and travel resume normal activity levels.

Industrial buildings represent a smaller share but show gradual adoption. Facilities use functional fragrance products to manage odors in staff areas and improve working environments. Growth remains limited but steady as companies apply scent solutions in wellness rooms, shared spaces, and administrative zones.

Regional Analysis

Europe continues to lead the global market. The region held about 36 percent revenue share in 2023, valued at close to USD 3 billion, and maintains strong momentum in 2025. Its leadership comes from a long-standing culture of premium fragrance use, high adoption of essential oils, and mature retail networks. Consumers in France, Germany, the United Kingdom, and Spain show strong preference for natural ingredients and sustainable packaging, which aligns with growing demand for clean-label home scent products.

North America follows closely with a large consumer base and strong participation from established brands. The region benefits from high spending on home décor and strong penetration of aromatherapy products. Asia Pacific represents the fastest-growing regional cluster. Rising urban incomes, expanding modern retail, and growing interest in wellness support double-digit growth in countries such as China, India, and Indonesia. Latin America and the Middle East & Africa are emerging markets with increasing demand for affordable fragrance formats and premium imported scents.

Across all regions, product diversification and online accessibility strengthen market penetration. As brands expand premium assortments and sustainable offerings, regional demand is expected to accelerate through 2034.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product Type

- Candles

- Sprays

- Diffusers

- Other Product Types

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 8.7 billion |

| Forecast Revenue (2034) | USD 14.3 billion |

| CAGR (2024-2034) | 5.20% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type, (Candles, Sprays, Diffusers, Other Product Types), By Distribution Channel, (Supermarkets & Hypermarkets, Convenience Stores, Online) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | The Copenhagen Candle Company LTD, 3M Company, Broken Top Candle Company, Seda France, Inc., Esteban Paris, Bridgewater Candle Company, Circle E Candles Inc., ScentAir Technologies, LLC., Newell Brands, Voluspa, Procter & Gamble Company, S. C. Johnson & Son Inc., Reckitt Benckiser Group plc, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date