Home Improvement Services Market Size, Share & Forecast | 6.9% CAGR

Global Home Improvement Services Market Size, Share & Analysis By Deployment (Online, Offline), By Repairs & Maintenance (Non-HVAC Home Appliances, Ventilation and Air Conditioning, Electricity, Gas, Heating, Plumbing), By Home Improvement Type (Interior Design, Construction), Industry Demand Drivers, Digital Platforms Impact, Competitive Landscape & Forecast 2025–2034

Report Overview

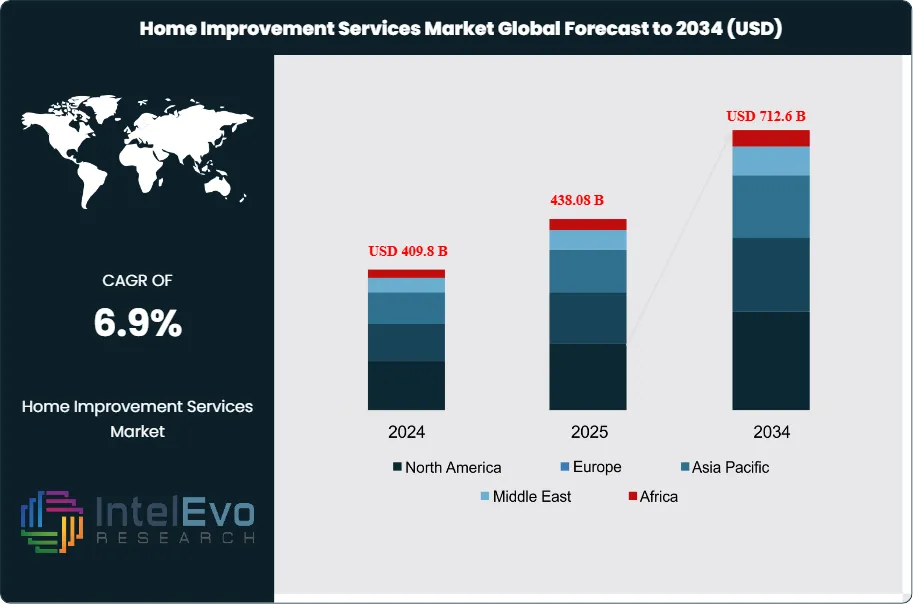

The Home Improvement Services Market is projected to grow from USD 409.8 Billion in 2024 to approximately USD 712.6 Billion by 2034, expanding at a CAGR of around 6.9% during 2025–2034. Rising renovation activity—especially among owners of aging homes—is fueling strong demand for remodeling, energy-efficient upgrades, and modern interior redesigns. The surge in smart home adoption and sustainable materials is reshaping consumer expectations and driving premium service offerings worldwide.

Get More Information about this report -

Request Free Sample ReportAs digital tools, AI-powered design, and eco-friendly solutions gain momentum, the sector is entering a new era of tech-enabled, value-driven home improvement. This, driven by rising consumer demand for personalized, efficient, and sustainable residential upgrades, offering strategic opportunities for manufacturers, contractors, and investors. This market reflects a dynamic intersection of lifestyle enhancement, economic conditions, and technological innovation, shaping its trajectory as a cornerstone of modern residential development.

Over the past decade, the sector has transitioned from primarily functional repairs to a comprehensive focus on lifestyle-oriented renovations, such as kitchen and bathroom remodels, energy-efficient installations, and outdoor living enhancements. While the market experienced a 14% decline in kitchen and bathroom renovation revenues in 2024, totaling USD 165.4 billion, this contraction underscores the cyclical nature of discretionary spending rather than a long-term downturn. At the same time, supply chain realignments revealed shifting priorities—import shipments dropped by 30.1% in early 2024, whereas U.S. manufacturing shipments rose by 3.8%, highlighting an emerging preference for domestic production and localized supply resilience.

Several demand-side drivers continue to propel market expansion, including the aging housing stock in developed economies, heightened homeownership rates among Baby Boomers and Gen X (notably 84% in 2024), and rising expectations for energy-efficient and sustainable solutions. These dynamics are further amplified by supply-side innovations, with smart home technologies, automation tools, and AI-enabled design platforms reshaping consumer decision-making and project execution. However, the sector also faces constraints such as fluctuating raw material costs, labor shortages, and evolving regulatory frameworks focused on environmental standards, all of which require agile adaptation by market participants.

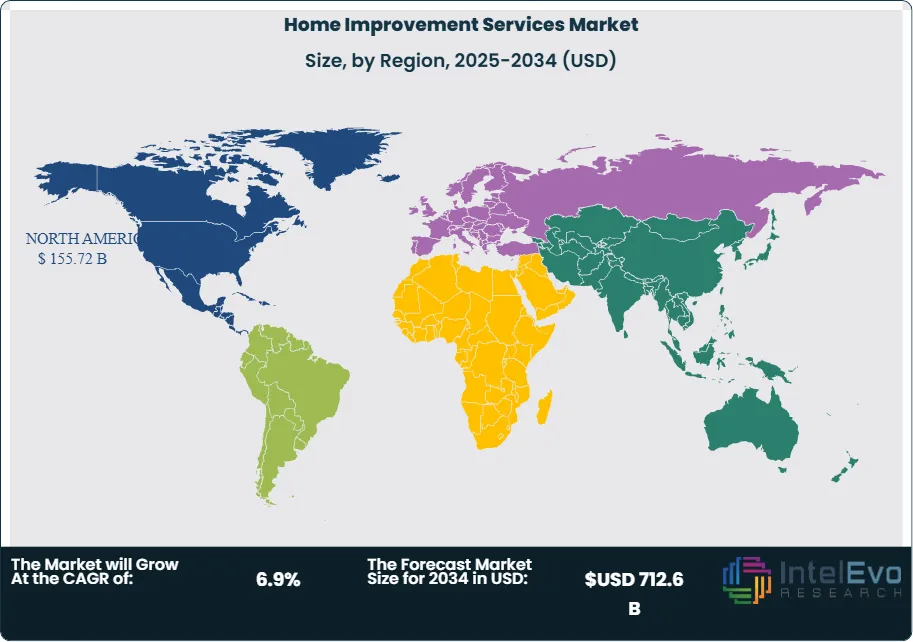

Regionally, North America maintains a dominant share, fueled by high consumer expenditure on remodeling and repair, while Europe follows with robust demand for eco-friendly upgrades aligned with stringent sustainability mandates. Asia-Pacific is emerging as a high-growth investment hub, driven by rapid urbanization, rising middle-class incomes, and increasing adoption of digital platforms for service procurement. Investors are particularly attentive to opportunities in green housing initiatives, modular renovation solutions, and digitally integrated service models across these expanding geographies.

As the Home Improvement Services Market advances toward 2033, stakeholders who prioritize sustainability, digital transformation, and customer-centric solutions will be best positioned to capture long-term value. The sector’s resilience and adaptability amid shifting economic, demographic, and technological landscapes reinforce its role as a critical growth frontier for global residential development.

Key Takeaways

- Market Growth: The Global Home Improvement Services Market was valued at USD 409.8 Billion in 2024 and is projected to reach USD 712.6 Billion by 2034, expanding at a CAGR of 6.90% from 2025 to 2034. Growth is fueled by rising consumer demand for lifestyle upgrades, energy-efficient solutions, and sustainable renovation practices.

- Home Improvement Type: Interior design services accounted for 53% of the market in 2024, reflecting strong consumer preference for aesthetic and functional enhancements within kitchens, bathrooms, and living spaces.

- Deployment Channel: Offline service delivery continues to dominate with a 60% market share, supported by consumer reliance on in-person consultations and established contractor networks, though digital platforms are gradually expanding penetration.

- Repairs & Maintenance: Electrical repair and maintenance represented 22% of total services in 2024, underscoring the growing demand for skilled expertise in addressing power system upgrades, smart wiring, and energy-efficient installations.

- Driver: Rising urbanization and housing stock upgrades, coupled with a homeownership rate of 84% among Baby Boomers and Gen X in 2024, are sustaining long-term demand for renovation and remodeling services.

- Restraint: Supply chain volatility, reflected in a 30.1% decline in import shipments during early 2024, and skilled labor shortages are creating cost pressures and project delays across key markets.

- Opportunity: Asia-Pacific is emerging as a high-growth region, driven by urban infrastructure development and a rapidly expanding middle class, with projected double-digit growth in adoption of smart home and modular renovation services through 2030.

- Trend: Technological integration is reshaping the market, with AI-enabled design tools, digital service platforms, and smart home automation increasingly influencing consumer choices and project execution strategies.

- Regional Analysis: North America dominates with 38% of global market share in 2024, supported by high remodeling expenditure and energy-efficiency initiatives, while Asia-Pacific is forecast to be the fastest-growing region, attracting significant investment in sustainable and digitally driven service models.

Type Analysis

The home improvement services market is segmented by type into high-performance concrete, self-consolidating concrete, and other specialized variants. High-performance concrete continues to capture the largest share, reflecting its durability, superior strength, and ability to withstand extreme weather conditions. As infrastructure and residential projects increasingly emphasize longevity and energy efficiency, demand for high-performance concrete has accelerated, particularly in North America and Europe where sustainability standards are stringent. By 2025, this segment is expected to account for over 45% of type-based revenues, supported by its widespread use in both residential renovations and commercial upgrades.

Self-consolidating concrete is gaining traction as the fastest-growing category, largely due to its efficiency in reducing labor costs and construction times. The material’s ability to flow easily into complex forms without vibration has positioned it as a preferred choice for modern architectural designs and high-rise projects. This segment is projected to grow at a CAGR exceeding 6% through 2030, benefiting from rising adoption in urban housing and infrastructure upgrades across Asia-Pacific. Other types, including specialty blends tailored for decorative finishes or eco-friendly applications, remain niche but are increasingly valued in high-end residential projects focused on customization and sustainability.

Application Analysis

Within applications, pavers represent a significant share of the market, driven by rising investments in outdoor living spaces such as patios, walkways, and driveways. The trend toward enhancing curb appeal and creating multifunctional outdoor environments has boosted demand in North America and Europe, where paver installations are closely tied to premium landscaping projects. By 2025, the segment is forecast to contribute more than 40% of global revenues in application-based categories.

Retaining walls form another core segment, supported by the need for erosion control, land management, and infrastructure development. With rapid urbanization in Asia-Pacific and Latin America, retaining walls are increasingly adopted in residential complexes, road projects, and industrial facilities. The segment is expected to expand steadily at 5–6% CAGR, underpinned by government-backed infrastructure initiatives. Other applications—including decorative elements, façade enhancements, and structural reinforcements—are growing in demand as consumers seek both aesthetic and functional improvements in their living spaces.

End-Use Analysis

Residential buildings dominate the end-use segment, accounting for nearly 55% of global revenues in 2024. Rising homeownership rates, coupled with the sustained trend of remote and hybrid working, are fueling consumer investments in both interior and exterior upgrades. Spending on home improvement in this segment is particularly high in North America, where per-household remodeling expenditure surpasses USD 4,000 annually.

Commercial buildings represent the second-largest segment, with strong momentum in retail, hospitality, and office renovations. Growing demand for energy-efficient retrofits and smart building systems has positioned this category for robust growth, with projected CAGR above 6% through 2030. The industrial segment, while smaller, plays a strategic role in supporting durable flooring, storage infrastructure, and customized workspace layouts. Its growth is closely tied to manufacturing and logistics expansion, particularly in Asia-Pacific economies.

Regional Analysis

North America leads the global market, commanding approximately 38% share in 2024, underpinned by high remodeling activity, mature contractor networks, and rapid adoption of smart home solutions. Energy-efficient upgrades and government incentives for green housing remain key drivers in this region. Europe follows, driven by stringent environmental regulations and consumer demand for sustainable materials. Renovation projects focusing on energy efficiency and architectural preservation are particularly prominent in Germany, France, and the UK.

Asia-Pacific is projected to be the fastest-growing region, expanding at a CAGR of over 7% through 2030. Rapid urbanization, expanding middle-class populations, and rising disposable incomes in China, India, and Southeast Asia are fueling investments in residential and commercial improvements. Latin America is witnessing steady growth, supported by urban development in Brazil and Mexico, though macroeconomic volatility tempers its pace. Meanwhile, the Middle East & Africa market is evolving with demand for luxury and bespoke home upgrades in affluent urban centers, particularly in the UAE and Saudi Arabia, aligning with broader economic diversification agendas.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Deployment

- Online

- Offline

By Repairs & Maintenance

- Non-HVAC Home Appliances

- Ventilation and Air Conditioning

- Electricity

- Gas

- Heating

- Plumbing

By Home Improvement Type

- Interior Design

- Construction

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 409.8 B |

| Forecast Revenue (2034) | USD 712.6 B |

| CAGR (2024-2034) | 6.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Deployment (Online, Offline), By Repairs & Maintenance (Non-HVAC Home Appliances, Ventilation and Air Conditioning, Electricity, Gas, Heating, Plumbing), By Home Improvement Type (Interior Design, Construction) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Belfor, Power Home Remodeling Group, LLC, Venturi Restoration, Rainbow Restoration, Coit Services, Inc., FirstService Corporation, Mr. Handyman, DKI Ventures, LLC, Crane Renovation Group, Servpro, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Home Improvement Services Market?

The Home Improvement Services Market is projected to grow from USD 409.8 Billion in 2024 to USD 712.6 Billion by 2034, at a CAGR of 6.9%. Rising renovation activity, smart home adoption, and demand for sustainable materials are driving global market expansion and reshaping modern home upgrade trends.

Who are the major players in the Home Improvement Services Market?

Belfor, Power Home Remodeling Group, LLC, Venturi Restoration, Rainbow Restoration, Coit Services, Inc., FirstService Corporation, Mr. Handyman, DKI Ventures, LLC, Crane Renovation Group, Servpro, Other Key Players

Which segments covered the Home Improvement Services Market?

By Deployment (Online, Offline), By Repairs & Maintenance (Non-HVAC Home Appliances, Ventilation and Air Conditioning, Electricity, Gas, Heating, Plumbing), By Home Improvement Type (Interior Design, Construction)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Home Improvement Services Market

Published Date : 13 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date