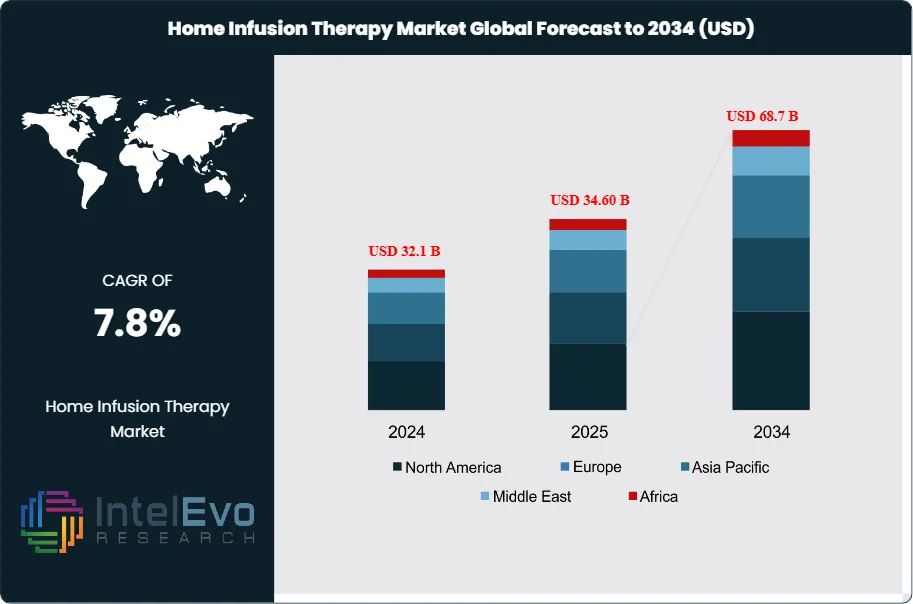

Home Infusion Therapy Market Size | $68.7Bn by 2034 at 7.8% CAGR

Global Home Infusion Therapy Market Size, Share & Analysis Report by Therapy Type (Anti-Infective, Hydration, Parenteral Nutrition, Chemotherapy, Pain Management, Specialty Biologics), Device (Infusion Pumps – Ambulatory, Smart, Syringe, Elastomeric; Gravity Infusion Sets, Accessories), End-User (Home Care, Specialty Pharmacies, Hospital-at-Home, Assisted Living & Long-Term Care), Region & Key Players – Overview, Dynamics, Strategies, Trends & Forecast 2025–2034

Report Overview

The Home Infusion Therapy Market size is expected to be worth around USD 68.7 Billion by 2034, up from USD 32.1 Billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2024 to 2034. The home infusion therapy market encompasses a broad range of medical treatments administered intravenously or subcutaneously in a patient’s home, including antibiotics, antivirals, parenteral nutrition, hydration, chemotherapy, pain management, and specialty biologics.

Get More Information about this report -

Request Free Sample ReportThis market represents a vital and rapidly expanding segment within the global healthcare continuum, offering patients a cost-effective, convenient, and clinically effective alternative to prolonged hospital stays or outpatient clinic visits. Home infusion therapy leverages advanced infusion devices, remote monitoring technologies, and coordinated care models to deliver high-quality treatment in the comfort and safety of the patient’s home.

The home infusion therapy market is experiencing robust growth driven by the rising prevalence of chronic diseases, an aging global population, and the increasing shift toward value-based, patient-centric healthcare. Key growth catalysts include advances in infusion pump technology, the expansion of specialty pharmaceuticals, and the growing acceptance of home-based care by payers, providers, and patients. The market benefits from ongoing healthcare cost containment efforts, which incentivize the transition of appropriate therapies from inpatient to home settings, reducing hospital-acquired infection risks and improving patient quality of life.

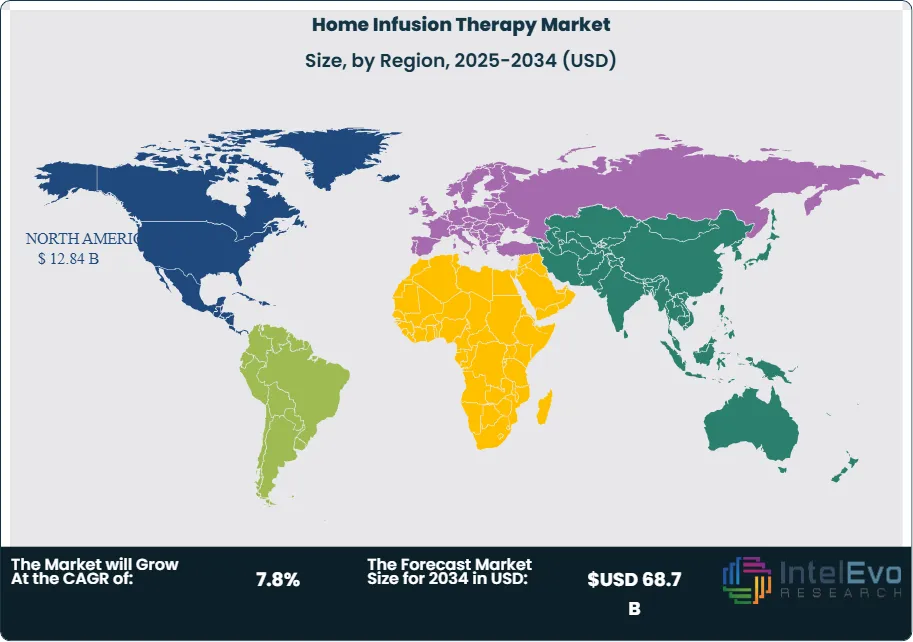

North America dominates the global home infusion therapy market, with leadership stemming from a mature healthcare infrastructure, favorable reimbursement policies, and a strong presence of leading home infusion providers. Europe follows as the second-largest market, with Asia-Pacific representing the fastest-growing region due to rapid healthcare modernization, increasing chronic disease burden, and expanding access to home-based medical services.

The COVID-19 pandemic fundamentally accelerated the adoption of home infusion therapy as healthcare systems sought to minimize hospital crowding, reduce infection risks, and maintain continuity of care for vulnerable populations. The crisis highlighted the importance of flexible, resilient care delivery models and spurred investment in telehealth, remote monitoring, and digital health platforms that support home-based infusion services.

Rising demand for specialty biologics, immunotherapies, and complex drug regimens has significantly influenced the home infusion therapy market, creating opportunities for providers to develop new clinical protocols, expand service offerings, and invest in workforce training. The market is also witnessing increased demand for integrated care models, data-driven decision support, and patient engagement tools that enhance safety, adherence, and outcomes.

Key Takeaways

- Market Growth: The Home Infusion Therapy Market is expected to reach USD 68.7 Billion by 2034, fueled by the shift to home-based care, rising chronic disease prevalence, and ongoing healthcare innovation.

- Therapy Type Dominance: Anti-infective and hydration therapies lead market share due to their widespread use in both acute and chronic care.

- Device Dominance: Infusion pumps, particularly ambulatory and smart pumps, dominate the device segment, driven by technological advancements and safety features.

- End-User Dominance: Home care settings and specialty infusion pharmacies account for the majority of therapy administration, but hospital-at-home programs are growing rapidly.

- Driver: Key drivers accelerating growth include healthcare cost containment, patient preference for home-based care, and the expansion of specialty pharmaceuticals.

- Restraint: Growth is hindered by reimbursement complexities, workforce shortages, and challenges in care coordination and patient monitoring.

- Opportunity: The market is poised for expansion due to opportunities like telehealth integration, emerging market penetration, and the development of personalized and specialty infusion therapies.

- Trend: Emerging trends including remote monitoring, digital health platforms, and value-based care models are reshaping the market by enabling new service delivery approaches and improving patient outcomes.

- Regional Analysis: North America leads owing to advanced healthcare infrastructure and reimbursement. Asia-Pacific shows high promise due to rapid healthcare modernization and rising chronic disease burden.

Therapy Type Analysis

Anti-Infective and Hydration Therapies Lead With Over 50% Market Share in the Home Infusion Therapy Market: Anti-infective therapies (including antibiotics, antivirals, and antifungals) and hydration therapies remain the cornerstone of the home infusion therapy market. These treatments are widely used for managing acute and chronic infections, dehydration, and supportive care in both pediatric and adult populations. Anti-infective infusions are critical for patients with resistant infections, post-surgical complications, or compromised immune systems, while hydration therapy is essential for those with gastrointestinal disorders, cancer, or chronic illnesses.

Parenteral nutrition, chemotherapy, pain management, and specialty biologics are also significant therapy segments, particularly as the complexity of home-based care increases. The segment’s leadership is reinforced by several factors. Firstly, the growing prevalence of chronic diseases and multi-drug resistant infections drives consistent demand for anti-infective and hydration infusions. Secondly, advances in drug formulation, stability, and delivery devices have expanded the range of therapies suitable for home administration. Thirdly, payer and provider support for home-based care models is accelerating the transition of complex therapies from hospital to home.

However, the segment is not without constraints. The need for skilled nursing, rigorous infection control, and comprehensive patient education can limit scalability and increase operational complexity. Nevertheless, growth prospects remain strong, with the proliferation of specialty infusion therapies, biologics, and personalized medicine demonstrating continued diversification and innovation within the category.

Device Analysis

Infusion Pumps Dominate, With Ambulatory and Smart Pumps Leading Growth: Infusion pumps—particularly ambulatory and smart pumps—are the dominant devices in the home infusion therapy market. These devices enable precise, programmable, and safe delivery of medications, fluids, and nutrients in home settings. Ambulatory pumps are lightweight, portable, and designed for patient mobility, while smart pumps incorporate advanced safety features such as dose error reduction systems, wireless connectivity, and remote monitoring capabilities.

Gravity infusion sets, elastomeric pumps, and syringe pumps are also used, especially for short-term or less complex therapies. The segment’s leadership is driven by ongoing technological innovation, including the integration of digital health platforms, real-time data transmission, and user-friendly interfaces that enhance patient safety and adherence.

Device selection is influenced by therapy complexity, patient mobility, and provider preference. The increasing adoption of connected devices and remote monitoring solutions is enabling providers to track infusion parameters, detect complications, and intervene proactively, further supporting the shift to home-based care.

End-User Analysis

Home Care Settings and Specialty Pharmacies Dominate, Hospital-at-Home Expands: Home care settings—including patient residences, assisted living facilities, and long-term care homes—remain the largest end-users of home infusion therapy, accounting for a significant share of global therapy administration. Specialty infusion pharmacies play a critical role in compounding, dispensing, and coordinating home-based infusions, often providing clinical support, patient education, and 24/7 on-call services.

Hospital-at-home programs are experiencing rapid growth, driven by the need to reduce hospital admissions, lower costs, and improve patient satisfaction. These programs leverage home infusion therapy as a core component of acute and post-acute care, supported by remote monitoring, telehealth, and multidisciplinary care teams.

The expansion of integrated care models, payer-provider partnerships, and value-based reimbursement is further driving adoption across diverse end-user segments.

Region Analysis

North America Leads, Asia-Pacific Is Fastest-Growing: North America dominates the global home infusion therapy market, accounting for over 40% of market share in 2024. The region benefits from advanced healthcare infrastructure, favorable reimbursement policies, and a strong presence of leading home infusion providers. The United States, in particular, has a mature ecosystem of specialty pharmacies, home health agencies, and integrated delivery networks that support widespread adoption.

Europe is the second-largest market, with countries such as Germany, the United Kingdom, and France investing in home-based care, chronic disease management, and digital health innovation. The region’s focus on cost containment, patient-centered care, and regulatory harmonization is driving demand for home infusion services.

Asia-Pacific is the fastest-growing region, propelled by rapid healthcare modernization, rising chronic disease burden, and expanding access to home-based medical services. Countries such as China, India, Japan, and Australia are witnessing significant market expansion, driven by government initiatives, private investment, and the introduction of innovative care models.

Latin America and the Middle East & Africa are emerging markets, with growing demand for affordable, accessible, and high-quality home infusion services. Investments in local provider networks, workforce training, and digital health infrastructure are unlocking new opportunities for market growth.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Therapy Type

- Anti-Infective Therapy

- Hydration Therapy

- Parenteral Nutrition

- Chemotherapy

- Pain Management

- Specialty Biologics

- Others

Device

- Infusion Pumps (Ambulatory, Smart, Syringe, Elastomeric)

- Gravity Infusion Sets

- Accessories

End-User

- Home Care Settings

- Specialty Infusion Pharmacies

- Hospital-at-Home Programs

- Assisted Living & Long-Term Care Facilities

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 34.60 B |

| Forecast Revenue (2034) | USD 68.7 B |

| CAGR (2025-2034) | 7.8% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Therapy Type (Anti-Infective Therapy, Hydration Therapy, Parenteral Nutrition, Chemotherapy, Pain Management, Specialty Biologics, Others), Device (Infusion Pumps (Ambulatory, Smart, Syringe, Elastomeric), Gravity Infusion Sets, Accessories), End-User (Home Care Settings, Specialty Infusion Pharmacies, Hospital-at-Home Programs, Assisted Living & Long-Term Care Facilities) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Baxter International Inc., B. Braun Melsungen AG, ICU Medical Inc., Option Care Health Inc., Fresenius Kabi AG, Terumo Corporation, Smiths Medical (ICU Medical), CareCentrix Inc., InfuSystem Holdings Inc., PharMerica Corporation, KabaFusion, CVS Health Corporation (Coram Infusion Services), McKesson Corporation, UnitedHealth Group (Optum Infusion), Abbott Laboratories, Medical Infusion Technologies LLC, PromptCare Companies Inc., HCA Healthcare, Amerita, Inc., Chartwell Pennsylvania LP |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Home Infusion Therapy Market ?

Global home infusion therapy market is projected to grow from USD 32.1 Bn in 2024 to USD 68.7 Bn by 2034, registering a CAGR of 7.8%. Explore key trends and growth drivers.

Who are the major players in the Home Infusion Therapy Market ?

Baxter International Inc., B. Braun Melsungen AG, ICU Medical Inc., Option Care Health Inc., Fresenius Kabi AG, Terumo Corporation, Smiths Medical (ICU Medical), CareCentrix Inc., InfuSystem Holdings Inc., PharMerica Corporation, KabaFusion, CVS Health Corporation (Coram Infusion Services), McKesson Corporation, UnitedHealth Group (Optum Infusion), Abbott Laboratories, Medical Infusion Technologies LLC, PromptCare Companies Inc., HCA Healthcare, Amerita, Inc., Chartwell Pennsylvania LP

Which segments covered the Home Infusion Therapy Market ?

Therapy Type (Anti-Infective Therapy, Hydration Therapy, Parenteral Nutrition, Chemotherapy, Pain Management, Specialty Biologics, Others), Device (Infusion Pumps (Ambulatory, Smart, Syringe, Elastomeric), Gravity Infusion Sets, Accessories), End-User (Home Care Settings, Specialty Infusion Pharmacies, Hospital-at-Home Programs, Assisted Living & Long-Term Care Facilities)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Home Infusion Therapy Market

Published Date : 05 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date