HR Analytics Market Size, Share & Forecast to 2034 | 12.8% CAGR

Global HR Analytics Market Size, Share & Analysis By Solution (Employee Engagement & Development, Payroll & Compensation, Recruitment, Retention, Talent Analytics, Workforce Planning), By Service (Implementation & Integration, Support & Maintenance, Training & Consulting), By Deployment (Hosted, On-premise), By Enterprise Size, (Large Enterprise,SME), By End-User (Academia, BFSI, Government, Healthcare, IT & Telecom, Manufacturing, Retail) Digital HR Trends & Forecast 2025–2034

Report Overview

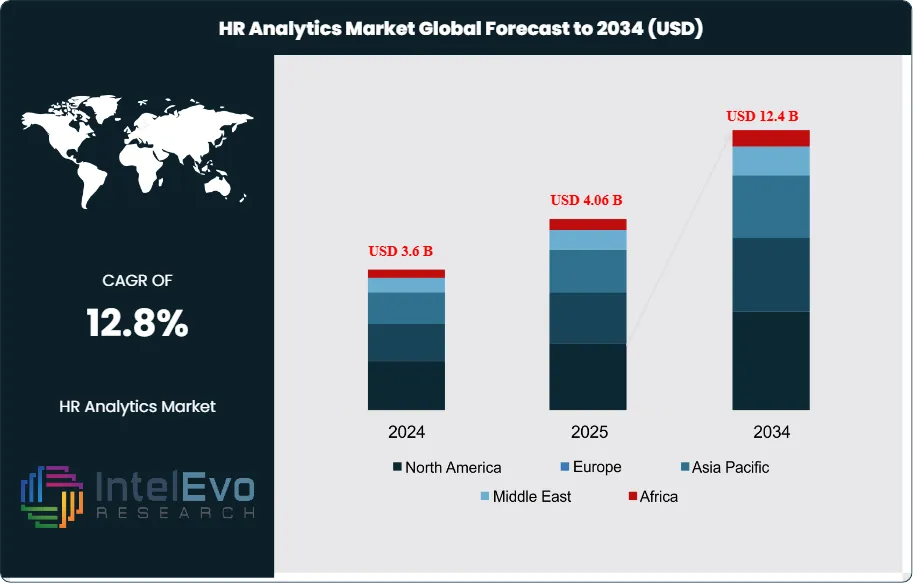

The HR Analytics Market is projected to grow from USD 3.6 Billion in 2024 to approximately USD 12.4 Billion by 2034, expanding at a CAGR of around 12.8% during 2025–2034. Organizations worldwide are accelerating the shift toward data-driven workforce decisions, increasing demand for AI-powered HR analytics platforms. The rise of hybrid work, predictive talent intelligence, and real-time performance insights is transforming modern HR operations.

Get More Information about this report -

Request Free Sample ReportAs companies prioritize productivity optimization and employee experience, HR analytics is becoming a core pillar of digital workplace strategy. This steady expansion underscores the increasing reliance of organizations on data-driven insights to optimize human resource functions, strengthen workforce productivity, and support strategic decision-making in an era of rapid workplace transformation.

HR Analytics, also referred to as People Analytics, has emerged as a critical enabler for modern enterprises by applying advanced data techniques to improve talent acquisition, employee engagement, and retention strategies. The market’s evolution reflects the growing recognition that workforce data, when effectively leveraged, can deliver significant business value—ranging from reduced operational costs and improved hiring efficiency to predictive workforce modeling and performance enhancement.

A key growth driver is the heightened demand for tools that enable HR teams to navigate complex challenges such as high employee turnover, dispersed workforces, and the rising cost of talent management. The global shift towards hybrid and remote work models has accelerated the adoption of analytics platforms capable of managing employee experience, productivity, and engagement across geographically diverse teams. Additionally, the adoption of HR analytics is strengthening in industries undergoing rapid digital transformation, where workforce agility is vital to maintaining competitiveness.

Technological innovation is playing a pivotal role in shaping the HR Analytics landscape. Artificial intelligence (AI) and machine learning (ML) are significantly enhancing predictive analytics capabilities, enabling organizations to forecast workforce needs and identify potential performance gaps with greater precision. Integrations of natural language processing and sentiment analysis are providing deeper insights into employee feedback, offering organizations the ability to proactively address workplace challenges and improve employee satisfaction. The increasing availability of cloud-based platforms further supports scalability and accessibility, particularly for small and mid-sized enterprises (SMEs), opening new avenues for market growth.

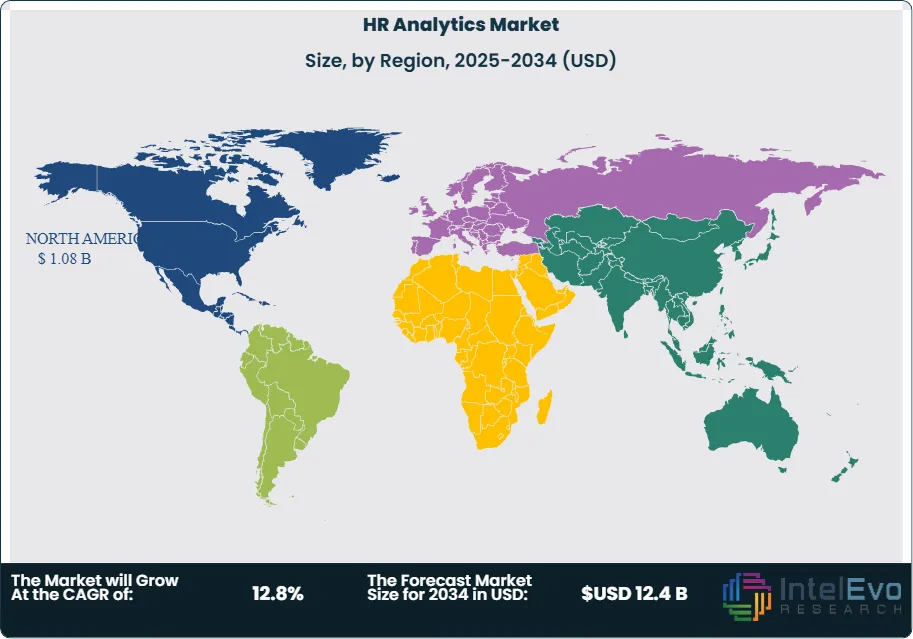

Regionally, North America leads adoption due to its advanced digital infrastructure and high investment in HR technology, while Europe follows closely, supported by regulatory emphasis on employee well-being and data-driven workforce strategies. Meanwhile, Asia-Pacific is emerging as a high-growth region, driven by expanding corporate digitization and the rising need for effective workforce planning across diverse and fast-growing economies. These factors position the HR Analytics market as a crucial investment area for organizations seeking sustainable growth through data-empowered human capital strategies.

Key Takeaways

- Market Growth: The HR Analytics market is set to expand significantly, reaching USD 12.4 Billion by 2034, up from USD 3.6 Billion in 2024, reflecting a 12.8% CAGR. This trajectory is supported by organizations’ growing reliance on data-centric workforce strategies to reduce costs, improve efficiency, and enhance employee experience.

- Application (Workforce Planning): Workforce planning is the standout growth area, forecast to climb at a 25.0% CAGR, as enterprises prioritize predictive modeling tools to better anticipate staffing requirements and link human capital with long-term strategic objectives.

- Services (Implementation & Integration): Implementation and integration services remain the leading service category, driven by strong enterprise demand for HR systems that connect seamlessly with ERP, payroll, and productivity platforms, enabling data-driven decision-making at scale.

- Deployment Model: While on-premise deployment accounts for 55.0% of market share, valued for security and customization, hosted/cloud models are gaining momentum at a 17.3% CAGR, propelled by cost-efficiency, scalability, and wider adoption of multi-cloud strategies.

- Enterprise Size: Large enterprises contribute over 55.0% of revenues, reflecting their need to manage extensive employee datasets and advanced analytics capabilities. Meanwhile, SMEs are projected to expand at 16.0% CAGR, leveraging affordable, cloud-native tools to optimize workforce performance and retention.

- End-Use Industry: The IT & telecom sector holds a 20.0% share, driven by its globally distributed teams and reliance on compliance-ready HR analytics platforms. Tools such as Deel and Rippling are being adopted to streamline payroll, cross-border hiring, and workforce management.

- Driver: The acceleration of remote and hybrid work has intensified demand for HR analytics platforms that track engagement, collaboration, and productivity across dispersed teams.

- Restraint: Persistent concerns over data protection and regulatory compliance continue to challenge adoption, particularly as sensitive employee records are increasingly managed through cloud-based platforms.

- Opportunity: Expanding use of AI- and ML-enabled analytics—including predictive retention modeling, performance forecasting, and sentiment analysis—presents strong opportunities, especially within SMEs and high-growth emerging markets.

- Trend: The adoption of NLP-driven sentiment analysis and real-time employee feedback systems is transforming HR analytics from static reporting to proactive workforce engagement solutions.

- Regional Analysis: North America leads with a 30.0% market share, reflecting advanced digital infrastructure and high enterprise uptake of cloud-based HRM systems. Meanwhile, Asia-Pacific is on track for 16.3% CAGR growth, supported by rapid enterprise digitization, cloud investments, and heightened emphasis on data-driven talent management.

Solution Analysis

The HR Analytics market in 2025 continues to evolve with solutions spanning employee engagement & development, recruitment, payroll and compensation, workforce planning, retention, and talent analytics. Workforce planning remains the most dynamic solution area, forecast to expand at a CAGR of around 25.0% through 2034. This momentum reflects enterprises’ increasing need for integrated, cross-location workforce management systems that streamline scheduling, optimize staffing, and support productivity in dispersed working environments.

Talent analytics is another fast-emerging segment, expected to grow at nearly 16.5% CAGR. Organizations are increasingly using advanced analytics to identify skill gaps, predict attrition, and align talent acquisition with business priorities. With digitalization and automation replacing manual HR processes, companies are leveraging tools that integrate predictive modeling, performance evaluation, and AI-driven decision support. This shift highlights how HR analytics is transitioning from a back-office function to a core strategic enabler of organizational growth.

Service Analysis

Implementation and integration services hold a commanding position in 2025, supported by strong enterprise demand for seamless deployment of analytics solutions across cloud and hybrid IT environments. Companies increasingly require integration services that connect HR tools with existing ERP and CRM systems, ensuring smooth data flow and maximizing return on IT investments.

The service segment is further buoyed by the rise of automation and the need to enable real-time workforce insights. Beyond implementation, support & maintenance and training & consulting services are gaining traction as organizations invest in optimizing their HR systems post-deployment. These services are proving critical for companies adopting advanced HR analytics platforms that require continuous fine-tuning, customization, and workforce upskilling.

Deployment Analysis

On-premise deployment continues to hold a significant share of the HR analytics market in 2025, accounting for more than half of total revenues. Enterprises with stringent data security and compliance requirements favor on-premise models, as they offer full control over IT infrastructure, customizable features, and minimized exposure to cyber risks. This model is particularly attractive to industries such as banking, defense, and healthcare, where employee data sensitivity is paramount.

At the same time, hosted and cloud-based deployments are gaining ground, expanding at a CAGR of over 17.0% through 2034. The shift is fueled by the scalability of multi-cloud environments, cost efficiency, and rapid improvements in cloud connectivity. Companies of all sizes are increasingly drawn to SaaS-based HR analytics solutions that allow faster upgrades, reduced infrastructure overhead, and real-time accessibility across global operations.

Enterprise Size Analysis

Large enterprises represent the largest share of the market in 2025, contributing over 55.0% of revenues. Their need to analyze vast amounts of workforce data—spanning payroll, performance, training, and retention—drives adoption of advanced HR analytics platforms. Big data integration enables these enterprises to reduce costs, enhance workforce productivity, and apply predictive analytics to strategic workforce planning.

Small and medium-sized enterprises (SMEs), while more resource-constrained, are emerging as a key growth segment with expected CAGR of 16.0% through 2034. SMEs are adopting HR analytics to manage distributed teams, streamline operations, and track real-time employee sentiment and productivity. The affordability of cloud-based platforms is lowering entry barriers, enabling SMEs to embrace HR analytics as a means of fostering efficiency and strengthening organizational culture.

End-User Analysis

The IT and telecom sectors remain the leading adopters of HR analytics, accounting for approximately 20.0% of global market revenue in 2025. With large, globally distributed workforces and complex compliance requirements, these industries rely heavily on advanced HR tools to manage payroll, recruitment, and employee engagement. For example, platforms such as Deel are enabling IT firms to manage cross-border payroll, compliance, and workforce administration in over 150 countries, demonstrating the growing utility of cloud-based HR solutions.

Other sectors—including BFSI, healthcare, and retail—are also increasing adoption as they seek to address workforce shortages, improve retention, and enhance operational efficiency. As industries digitize further, the demand for predictive HR analytics across sectors is expected to expand significantly.

Regional Analysis

North America continues to lead the HR analytics market in 2025, contributing over 30.0% of global revenues. The region’s dominance is supported by advanced digital infrastructure, high enterprise adoption of HRM solutions, and a strong emphasis on workforce productivity. Leading providers such as Visier Inc. and Workday are expanding capabilities through partnerships and acquisitions, further strengthening the region’s market position.

Asia-Pacific, however, is emerging as the fastest-growing region, projected to expand at a CAGR of 16.3% through 2034. Rapid digitization, increasing adoption of cloud technologies, and government-backed initiatives to modernize workforce systems are fueling demand. Start-ups across India, China, and Southeast Asia are also accelerating the use of HR analytics for data-driven talent strategies, making the region a critical growth frontier for global providers. Europe is expected to maintain steady growth, driven by regulatory emphasis on employee well-being, GDPR compliance, and investments in digital HR ecosystems.

Get More Information about this report -

Request Free Sample Report

Key Market Segments

By Solution

- Employee Engagement & Development

- Payroll & Compensation

- Recruitment

- Retention

- Talent Analytics

- Workforce Planning

- Other Solutions

By Service

- Implementation & Integration

- Support & Maintenance

- Training & Consulting

By Deployment

- Hosted

- On-premise

- By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise (SME)

By End-User

- Academia

- BFSI

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Retail

- Other End-Users

Regions

- North America

- Europe

- Asia-Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

| Report Attribute | Details |

| Market size (2024) | USD 3.6 B |

| Forecast Revenue (2034) | USD 12.4 B |

| CAGR (2024-2034) | 12.8% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Solution (Employee Engagement & Development, Payroll & Compensation, Recruitment, Retention, Talent Analytics, Workforce Planning, Other Solutions), By Service (Implementation & Integration, Support & Maintenance, Training & Consulting), By Deployment (Hosted, On-premise, By Enterprise Size, Large Enterprise, Small & Medium Enterprise (SME)), By End-User (Academia, BFSI, Government, Healthcare, IT & Telecom, Manufacturing, Retail, Other End-Users) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | IBM Corporation, Microstrategy Incorporated, Oracle Corporation, SAP SE, UKG Inc., Cegid, Tableau Software, LLC, Sage Software Solutions Pvt. Ltd., Zoho Corporation Pvt. Ltd., Workday, Inc., Other Market Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the HR Analytics Market?

The HR Analytics Market is expected to grow from USD 3.6 Billion in 2024 to USD 12.4 Billion by 2034, at a CAGR of 12.8%. Rising adoption of AI-driven workforce insights, hybrid work models, and predictive HR tools is reshaping talent management and transforming global HR strategies.

Who are the major players in the HR Analytics Market?

IBM Corporation, Microstrategy Incorporated, Oracle Corporation, SAP SE, UKG Inc., Cegid, Tableau Software, LLC, Sage Software Solutions Pvt. Ltd., Zoho Corporation Pvt. Ltd., Workday, Inc., Other Market Players

Which segments covered the HR Analytics Market?

By Solution (Employee Engagement & Development, Payroll & Compensation, Recruitment, Retention, Talent Analytics, Workforce Planning, Other Solutions), By Service (Implementation & Integration, Support & Maintenance, Training & Consulting), By Deployment (Hosted, On-premise, By Enterprise Size, Large Enterprise, Small & Medium Enterprise (SME)), By End-User (Academia, BFSI, Government, Healthcare, IT & Telecom, Manufacturing, Retail, Other End-Users)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date