HRM Software Market to Hit $61.2B Bn by 2034 | CAGR of 14.5%

Global Human Resources Management (HRM) Software Market Size, Share & Analysis Report by Product Type (Core HR, Talent Management, Payroll, Analytics, Recruitment, Engagement), Deployment (Cloud, On-Premise), Application (Talent, Payroll, Analytics, Onboarding, Performance, Engagement), Industry Region & Key Players – Segment Overview, Dynamics, Strategies, Trends & Forecast 2025–2034

Report Overview

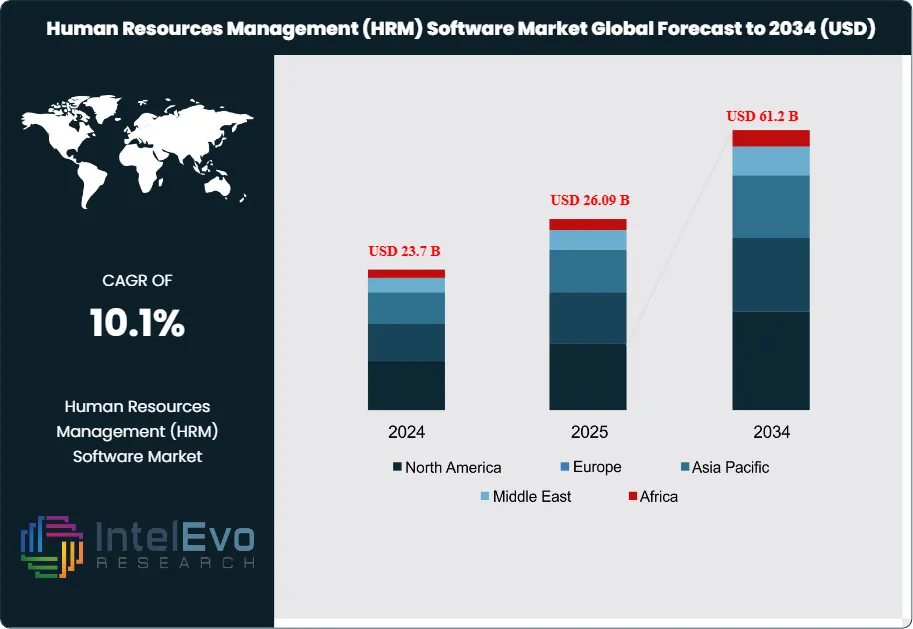

The Human Resources Management (HRM) Software Market is projected to reach approximately USD 61.2 billion by 2034, rising from USD 23.7 billion in 2024, and expanding at a CAGR of 10.1% during the forecast period from 2024 to 2034. This growth is fueled by rising adoption of cloud-based HR platforms, increasing focus on workforce analytics, and the need for streamlined talent acquisition, payroll, and performance management solutions. The integration of AI, automation, and employee experience tools is further transforming HR operations, enabling organizations to enhance productivity, compliance, and data-driven decision-making across global enterprises.

Get More Information about this report -

Request Free Sample ReportThe HRM software market encompasses a broad ecosystem of digital solutions designed to streamline, automate, and optimize human resource functions across organizations of all sizes. This market includes core HR platforms, talent management suites, payroll and benefits administration, workforce analytics, recruitment and onboarding tools, performance management, and employee engagement solutions. HRM software serves a diverse range of end-users, from small and medium-sized enterprises (SMEs) to large multinational corporations, as well as public sector organizations, each with unique compliance, scalability, and integration requirements.

Market growth is being driven by the accelerating pace of digital transformation, the rise of remote and hybrid work models, and increasing demand for data-driven HR decision-making. Key growth catalysts include advancements in artificial intelligence (AI), machine learning, and cloud computing, which are enabling more personalized, predictive, and scalable HR solutions. The market is also benefiting from the growing emphasis on employee experience, diversity and inclusion initiatives, and regulatory compliance, which are prompting organizations to invest in modern HRM platforms.

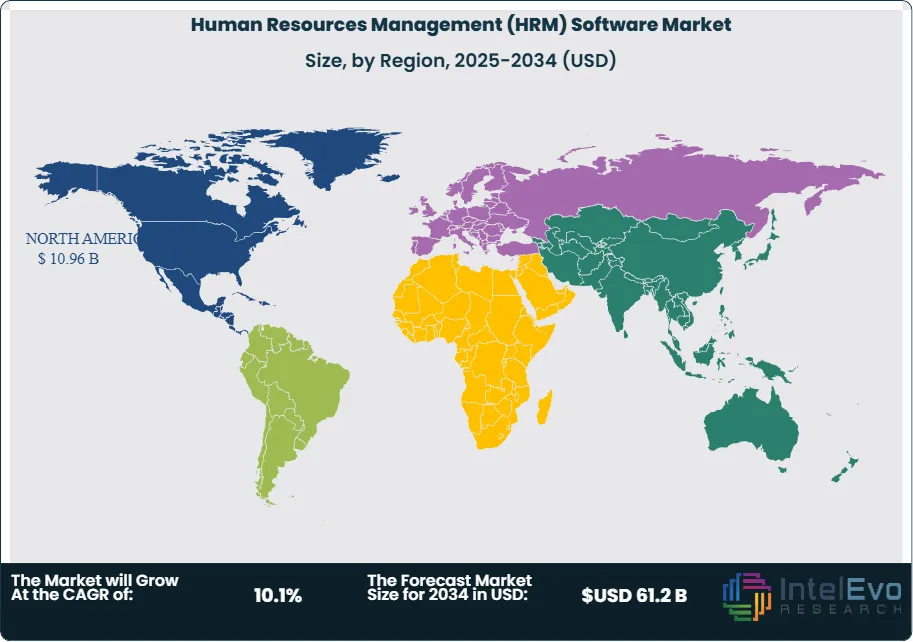

North America leads the global HRM software market, underpinned by high technology adoption rates, a mature enterprise landscape, and significant investments in digital infrastructure. The Asia-Pacific region is the fastest-growing market, fueled by rapid economic development, expanding digitalization, and increasing awareness of the strategic value of HR technology. Europe maintains a strong market presence, supported by robust data privacy regulations and a focus on workforce productivity and compliance.

The COVID-19 pandemic accelerated the adoption of HRM software as organizations sought to manage distributed workforces, ensure business continuity, and support employee well-being. The crisis highlighted the importance of agile, cloud-based HR solutions and drove innovation in areas such as virtual onboarding, digital learning, and real-time workforce analytics.

Rising competition for talent, evolving workforce expectations, and the need for agile HR operations are reshaping market dynamics. Data security and privacy concerns, as well as integration challenges with legacy systems, remain key restraints. However, the ongoing shift toward cloud-based, mobile-first, and AI-powered HRM solutions is creating significant opportunities for vendors and end-users alike.

Key Takeaways

- Market Growth: The HRM Software Market is expected to reach USD 61.2 Billion by 2034, driven by digital transformation, remote work trends, and the adoption of AI and cloud technologies.

- Product Type Dominance: Core HR platforms and cloud-based HRM solutions lead the market, owing to their scalability, integration capabilities, and support for remote workforce management.

- Deployment Type Dominance: Cloud-based deployment dominates due to lower upfront costs, ease of updates, and accessibility for distributed teams.

- Application Type Dominance: Talent management and workforce analytics are the fastest-growing applications, reflecting the need for data-driven recruitment, retention, and performance optimization.

- Driver: Key drivers include the shift to hybrid work, demand for real-time workforce insights, and regulatory compliance requirements.

- Restraint: Growth is hindered by data privacy concerns, integration complexity with legacy systems, and high switching costs for large enterprises.

- Opportunity: Opportunities abound in AI-powered HR analytics, mobile HR applications, and expansion into emerging markets with growing digital infrastructure.

- Trend: Emerging trends include the integration of generative AI for recruitment and employee engagement, adoption of self-service HR portals, and the use of predictive analytics for workforce planning.

- Regional Analysis: North America leads due to advanced digital infrastructure and high HR tech adoption. Asia-Pacific is the fastest-growing region, while Europe remains strong due to regulatory focus and workforce modernization.

Product Type Analysis

Core HR platforms and cloud-based HRM solutions have emerged as the backbone of modern human resources management. These platforms excel at centralizing employee data, automating routine administrative tasks such as attendance, leave management, and payroll, and ensuring compliance with ever-evolving labor regulations.

Their modular architecture allows seamless integration with talent management, payroll, and workforce analytics, creating a unified HR ecosystem that supports the entire employee lifecycle. The shift toward cloud-based HRM is especially pronounced among small and medium-sized enterprises (SMEs) and organizations with geographically dispersed teams. Cloud solutions offer unmatched scalability, cost efficiency, and the flexibility to access HR functions remotely, making them ideal for today’s dynamic and distributed work environments.

Deployment Type Analysis

Cloud-based deployment models now dominate the HRM software landscape, capturing the largest market share due to their inherent flexibility, lower upfront investment, and rapid implementation. These solutions allow organizations to scale resources up or down as needed, benefit from automatic updates, and ensure business continuity even in remote or hybrid work scenarios.

While on-premises solutions remain relevant for organizations with strict data security, privacy, or regulatory requirements—such as those in government or highly regulated industries—the overall market trend is decisively toward cloud adoption. Vendors are continuously enhancing the security and compliance features of their cloud offerings, further reducing barriers for organizations considering migration from legacy systems.

Application Type Analysis

Talent management and workforce analytics are the fastest-growing application segments within the HRM software market. As competition for skilled talent intensifies, organizations are increasingly leveraging AI and machine learning to automate candidate screening, personalize employee development, and predict workforce trends. These applications provide actionable insights that help HR teams attract, develop, and retain top talent, directly impacting organizational performance.

Payroll and benefits administration remain foundational to HR operations, but the market focus is shifting toward holistic employee experience and engagement. Modern HRM platforms now emphasize tools for continuous feedback, well-being, and career development, reflecting the evolving expectations of today’s workforce and the strategic role of HR in driving business success.

Region Analysis

North America leads the global HRM software market, driven by high technology adoption, a large base of enterprise customers, and ongoing investment in digital transformation. The region benefits from a mature vendor landscape and a strong focus on employee experience and compliance. Asia-Pacific is the fastest-growing region, propelled by rapid economic growth, digitalization, and increasing awareness of HR technology's strategic value. Countries such as China, India, and Southeast Asian nations are investing in HRM solutions to support expanding workforces and modernize HR operations.

Europe maintains a significant market presence, supported by strict data privacy regulations (such as GDPR), a focus on workforce productivity, and a tradition of strong labor protections. The region is characterized by demand for compliance-driven and multilingual HRM solutions. Latin America and Middle East & Africa are emerging markets with growing adoption, driven by economic development, workforce expansion, and increasing digital infrastructure.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

Product Type

- Core HR Platforms

- Talent Management Suites

- Payroll & Benefits Administration

- Workforce Analytics

- Recruitment & Onboarding Tools

- Performance Management Solutions

- Employee Engagement Platforms

Deployment Type

- Cloud-Based

- On-Premises

Application Type

- Talent Management

- Payroll & Benefits

- Workforce Analytics

- Recruitment & Onboarding

- Performance Management

- Employee Engagement

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 26.09 B |

| Forecast Revenue (2034) | USD 61.2 B |

| CAGR (2025-2034) | 10.1% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type (Core HR Platforms, Talent Management Suites, Payroll & Benefits Administration, Workforce Analytics, Recruitment & Onboarding Tools, Performance Management Solutions, Employee Engagement Platforms) Deployment Type (Cloud-Based, On-Premises) Application Type (Talent Management, Payroll & Benefits, Workforce Analytics, Recruitment & Onboarding, Performance Management, Employee Engagement) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | SAP SE, UKG Inc. (Ultimate Kronos Group), Workday, Inc., ADP, Inc. (Automatic Data Processing), Oracle Corporation, Ceridian HCM Holding Inc., Gusto, Microsoft Corporation, IBM Corporation, Sage Group plc, Talentsoft, Kronos Incorporated, Cezanne HR, Accenture, Mercer, PricewaterhouseCoopers (PwC) |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Human Resources Management (HRM) Software Market?

HRM Software Market set to reach $61.2B by 2034! Discover 10.1% CAGR, key drivers & trends transforming HR tech, talent management & employee experience.

Who are the major players in the Human Resources Management (HRM) Software Market?

SAP SE, UKG Inc. (Ultimate Kronos Group), Workday, Inc., ADP, Inc. (Automatic Data Processing), Oracle Corporation, Ceridian HCM Holding Inc., Gusto, Microsoft Corporation, IBM Corporation, Sage Group plc, Talentsoft, Kronos Incorporated, Cezanne HR, Accenture, Mercer, PricewaterhouseCoopers (PwC)

Which segments covered the Human Resources Management (HRM) Software Market?

Product Type (Core HR Platforms, Talent Management Suites, Payroll & Benefits Administration, Workforce Analytics, Recruitment & Onboarding Tools, Performance Management Solutions, Employee Engagement Platforms) Deployment Type (Cloud-Based, On-Premises) Application Type (Talent Management, Payroll & Benefits, Workforce Analytics, Recruitment & Onboarding, Performance Management, Employee Engagement)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Human Resources Management (HRM) Software Market

Published Date : 02 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date