Image Recognition in Retail Market Size, Share & Forecast 2025–2034

Global Image Recognition in Retail Market Size, Share & Growth Analysis by Component (Hardware, Software, Services), by Technology (AI, Computer Vision, Deep Learning), by Application (Shelf Monitoring, Loss Prevention, Customer Behavior Analysis, Smart Checkout, Visual Search), by Retail Format (Supermarkets, Convenience Stores, Fashion & Apparel, E-commerce), Regional Outlook, Key Players, Market Dynamics, Trends, Opportunities & Forecast 2025–2034

Report Overview

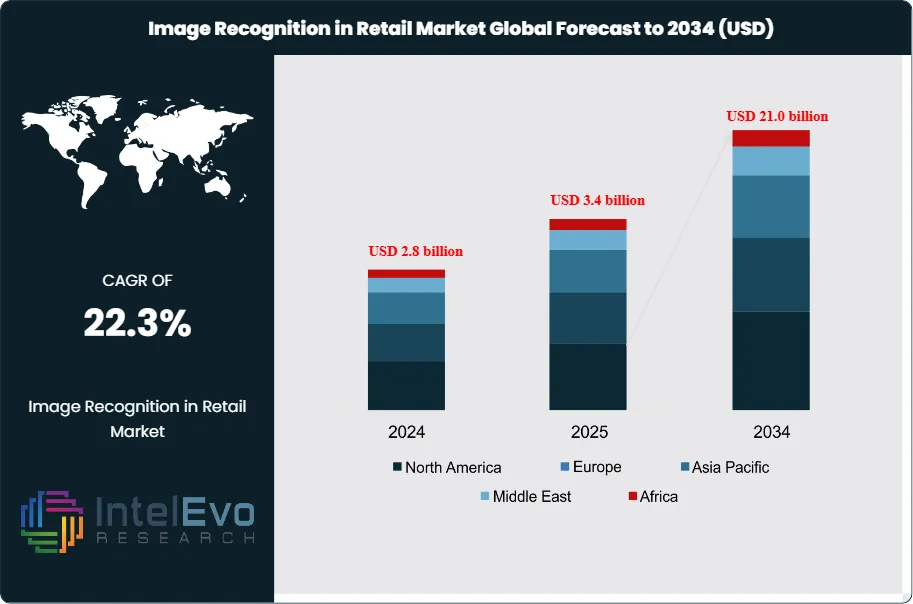

The Image Recognition in Retail Market is estimated at USD 2.8 billion in 2024 and is on track to reach roughly USD 21.0 billion by 2034, implying a compound annual growth rate of 22.3% over 2024–2034. This rapid expansion is driven by retailers’ increasing adoption of AI-powered visual analytics to enhance in-store experience, optimize shelf management, and reduce theft through automated loss prevention systems. Growing integration with smart cameras, computer vision, and real-time data platforms is further accelerating deployment across supermarkets, fashion stores, and omnichannel retail formats, positioning image recognition as a core enabler of next-generation retail intelligence.

Get More Information about this report -

Request Free Sample ReportImage recognition is moving from pilot to scaled deployment in retail formats worldwide. Large chains use computer vision to automate shelf monitoring, loss prevention, and queue management, while digital-native players embed visual search in apps to shorten the path from discovery to purchase. Rising labor costs, margin pressure, and elevated expectations for seamless journeys create strong demand-side pull. On the supply side, rapid advances in deep-learning algorithms, cloud infrastructure, and edge-compute cameras are lowering unit costs and enabling deployment across mid-sized and specialty retailers.

Strategic focus is shifting from isolated use cases to integrated smart store platforms. Retailers combine image data with transaction logs and loyalty profiles to generate near real-time insights on traffic flows, planogram compliance, and promotion performance. Early adopters report shrinkage reductions of 15–20%, inventory accuracy improvements of 3–5 percentage points, and uplift in conversion when visual search and recommendation engines guide product discovery. At the same time, vendors differentiate through accuracy rates that now approach 96% in controlled conditions, application-specific models, and flexible pricing that blends licenses with outcome-based contracts.

Regulation and risk shape adoption patterns. Data-privacy regimes in Europe and parts of Asia impose strict rules on biometric and in-store video analytics, forcing retailers to invest in consent management, anonymization, and secure data storage. Cybersecurity, algorithmic bias, and the risk of operational disruption during rollout remain key board-level concerns. Vendors respond with on-device processing, explainable AI modules, and governance features that document model behavior and audit trails.

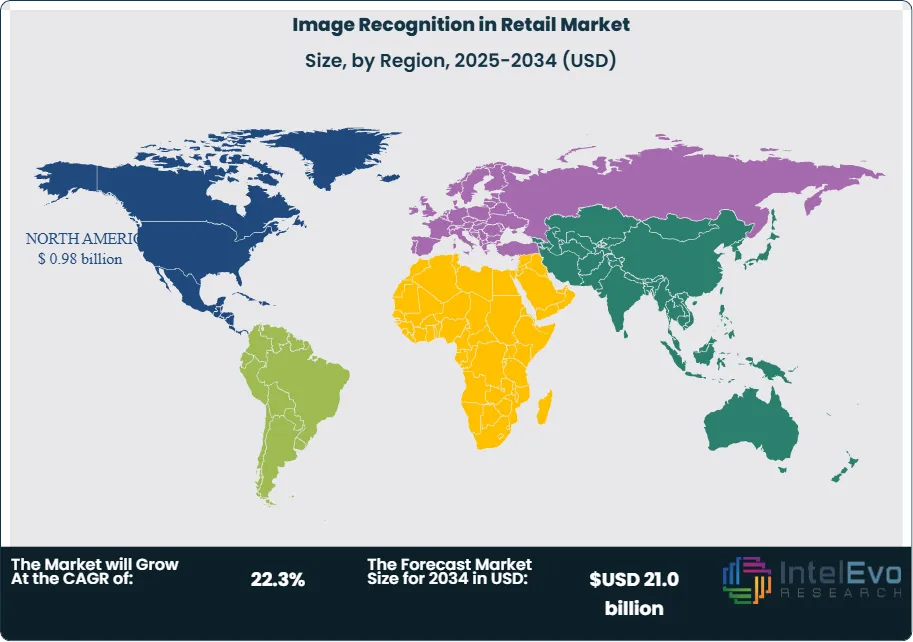

North America currently accounts for an estimated 35% of global spending, supported by large-format retailers and technology partnerships. Europe holds roughly 27%, with emphasis on compliance and store modernization. Asia-Pacific represents the most dynamic growth corridor, with forecast CAGRs above 25% as China, Japan, South Korea, and India accelerate investment in autonomous stores, computer-vision-based payments, and augmented reality overlays. Venture and corporate investors increasingly target platform providers that can extend image recognition beyond stores into logistics, last-mile delivery, and media-rich commerce ecosystems.

Key Takeaways

- Market Growth: The Image Recognition in Retail Market stands at estimated: USD 2.8 billion, 2024 and is on course to reach USD 21.0 billion, 2034. This trajectory implies a rapid expansion at a CAGR of 22.3%, 2024-2034.

- Component: The Software segment leads overall spending with a 47.0% share, 2023, reflecting strong demand for AI-driven recognition engines. This segment is likely to maintain a commanding position with an estimated: 21.0% CAGR, 2024-2034 as retailers scale analytics and automation.

- Deployment: Cloud deployment models dominate the architecture mix with a 60.0% share, 2023 in the image recognition in retail sector. Cloud-based solutions are projected to rise further to estimated: 75.0% share, 2030 as enterprises consolidate workloads and pursue scalable rollouts.

- Driver: High automation needs and advanced analytics requirements act as primary growth catalysts, aligned with the 22.5% CAGR, 2024-2034. Adoption among large retail chains is expected to reach estimated: 40.0% penetration, 2026 as they prioritize store intelligence and loss reduction.

- Restraint: Data-privacy, integration complexity, and upfront investment continue to slow full-scale rollout, delaying an estimated: 20.0% of planned projects, 2024. Compliance and security spending tied to image data governance is projected to reach estimated: 0.3 billion USD, 2024.

- Opportunity: Object Recognition applications already hold a 30.6% share, 2023, while Visual Product Search accounts for 30.5% share, 2023, creating strong cross-sell potential. Combined, these use cases could unlock an estimated: 6.0 billion USD revenue pool, 2030 as retailers enhance discovery and navigation.

- Trend: Vendors and retailers increasingly favor end-to-end platforms that bundle software, cloud services, and vertical models, lifting platform-based deals to estimated: 55.0% of new contracts, 2025. Continuous model upgrades aim to sustain accuracy levels above 96.0%, 2024 in production-grade deployments.

- Regional Analysis: North America leads with estimated: 35.0% share, 2024, followed by Europe at estimated: 28.0% share, 2024 driven by compliance-focused innovation. Asia Pacific exhibits the fastest expansion with an estimated: 27.0% CAGR, 2024-2034 as China, India, and Southeast Asia accelerate AI-led store modernization.

By Component

The software segment continues to sit at the core of image recognition in retail. In 2023 it accounted for more than 47% of global revenue and is expected to retain a similar or slightly higher share through 2025 as retailers deepen spending on computer vision models, API-based recognition engines, and analytics platforms. You see software acting as the main layer that ingests visual data from cameras and smartphones, runs AI models, and feeds results into merchandising, pricing, and loyalty systems. Vendors increasingly ship modular platforms that support rapid updates, which is crucial as models need retraining on new product assortments and store formats.

Hardware spending grows at a steadier pace but still forms a significant cost base, especially where you deploy dedicated cameras, sensors, and edge gateways. Retailers move from basic CCTV to high-resolution IP cameras capable of supporting real-time analytics, which keeps hardware replacement cycles active over 2025 to 2028. Services, including integration, model training, managed operations, and consulting, gain share as many retailers lack in-house AI teams. By 2025 services already represent an estimated 25 to 30% of total project value, particularly in multi-country rollouts that require localization and compliance support.

By Deployment

Cloud deployment has emerged as the preferred model for image recognition in retail. In 2023, cloud-based solutions accounted for more than 60% of deployments and are set to exceed 70% by 2027 as more retailers seek flexible consumption models and central management of models and data. You benefit from the ability to run heavy training workloads in the cloud while pushing lighter inference tasks to the edge, which helps control latency and bandwidth.

On-premises deployment still holds relevance in high-volume or high-sensitivity environments such as large hypermarkets, fuel retail, and jurisdictions with strict data residency rules. These deployments often combine local servers with edge devices to keep video streams on-site while sharing only aggregated metadata to central systems. Over 2025 to 2030, many enterprises move to hybrid architectures, keeping 20 to 30% of workloads on-premises for compliance and latency reasons while shifting the rest to cloud platforms to tap into advanced AI tooling and managed services.

By Technology

Object recognition holds the largest technology share within image recognition in retail. In 2023 it represented more than 30.6% of the market and it continues to grow as you apply it to shelf monitoring, automated replenishment, and fraud detection. Accurate object recognition reduces manual audits, improves on-shelf availability, and supports new formats such as cashierless stores and smart trolleys. Retailers report double-digit reductions in out-of-stock rates when object recognition integrates with inventory and ordering systems.

Facial recognition, code recognition, digital image processing, and other technologies address specific use cases such as access control, loyalty identification, and legacy barcode workflows. Adoption of facial recognition remains uneven because of privacy concerns and regulation, particularly in Europe and parts of North America, which slows broader deployment. Digital image processing and hybrid approaches that anonymize individuals while tracking behavior at a cohort level gain traction, helping you extract insights on traffic patterns and category engagement without storing identifiable data.

By Application

Visual product search is one of the most visible applications to end customers. In 2023 it held more than 30.5% share of application-level revenue and has grown further through 2025 as fashion, beauty, and home retailers add camera-based search to apps and mobile sites. Instead of typing long descriptions, shoppers take a photo and receive similar items, which increases session time and conversion rates. Retailers also use this function in-store, allowing staff to match items from catalog images or social media posts quickly.

Security and surveillance, vision analytics, and marketing and advertising form a broad second cluster of applications. Loss prevention teams use image recognition to identify suspicious behavior and reduce shrink, while store operations teams track queue lengths, heat maps, and dwell times. Vision analytics feeds real-time content triggers on digital signage so that you can run campaigns tailored to time of day, store zone, or observed demographics. As adoption grows, many retailers consolidate these applications on a shared platform to reduce duplication and ensure that insights flow across merchandising, operations, and marketing.

By Region

North America held more than 34.1% of the market in 2023 and remains the largest regional user through 2025, supported by big-box chains, strong technology ecosystems, and high labor costs that favor automation. Most major U.S. and Canadian retailers are past the pilot stage in at least one image recognition use case, such as planogram compliance or self-checkout monitoring. You also see deep collaboration between retailers and cloud hyperscalers that bundle vision services into broader data and analytics deals.

Europe ranks as the second largest region, with strong adoption in grocery and fashion but tighter constraints from data protection rules such as GDPR. Retailers in markets like the United Kingdom, Germany, and the Nordics invest heavily in privacy-by-design approaches and consent management. Asia Pacific shows the fastest growth, led by China, Japan, South Korea, and India, where mobile-first commerce and dense urban retail formats create strong demand for automated shelf tracking and visual search. Latin America and the Middle East & Africa remain smaller in absolute terms but present rising interest from modern trade and mall operators, often working with international platforms and regional system integrators to close capability gaps.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Component

- Software

- Hardware

- Services

By Deployment

- On-Premises

- Cloud

By Technology

- Object Recognition

- Code Recognition

- Digital Image Processing

- Facial Recognition

- Other Technologies

By Application

- Visual Product Search

- Security and Surveillance

- Vision Analytics

- Marketing and Advertising

- Other Applications

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 2.8 billion |

| Forecast Revenue (2034) | USD 21.0 billion |

| CAGR (2024-2034) | 22.3% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component, Software, Hardware, Services, By Deployment, On-Premises, Cloud, By Technology, Object Recognition, Code Recognition, Digital Image Processing, Facial Recognition, Other Technologies, By Application, Visual Product Search, Security and Surveillance, Vision Analytics, Marketing and Advertising, Other Applications |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Snap2Insight Inc., Ricoh Innovations Corporation, Trax Retail, IBM, NEC Corporation, Blippar Ltd., AWS, Catchoom Technologies S.L., Microsoft, Jumio Corporation, Hitachi Ltd., Google, Qualcomm Technologies Inc., Wikitude GmbH, Attrasoft Inc., Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Image Recognition in Retail Market

Published Date : 09 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date