Indonesia AI in Language Translation Market Size, & Forecast | CAGR 9.07%

Indonesia AI in Language Translation Market Size, Share & Industry Analysis By Component (Software, Services), By Deployment Mode (Cloud-Based, On-Premise), By End-Use (BFSI, IT & Telecommunications, Healthcare, Travel & Tourism, Education, Commercial Use), By Language Type & Application Industry Region & Key Players – Industry Segment Overview, Market Drivers, Restraints, Competitive Strategies, Technology Trends & Forecast 2025–2034

Report Overview

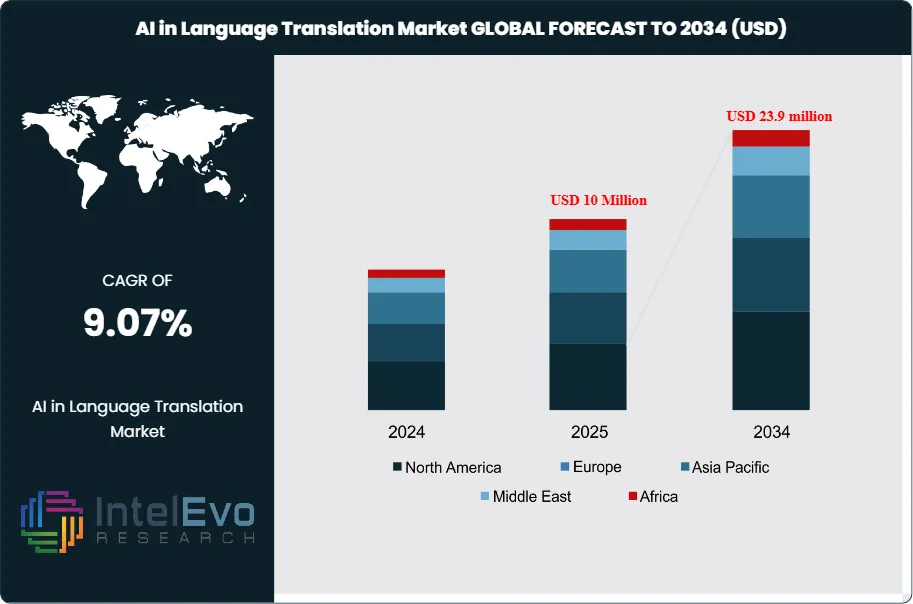

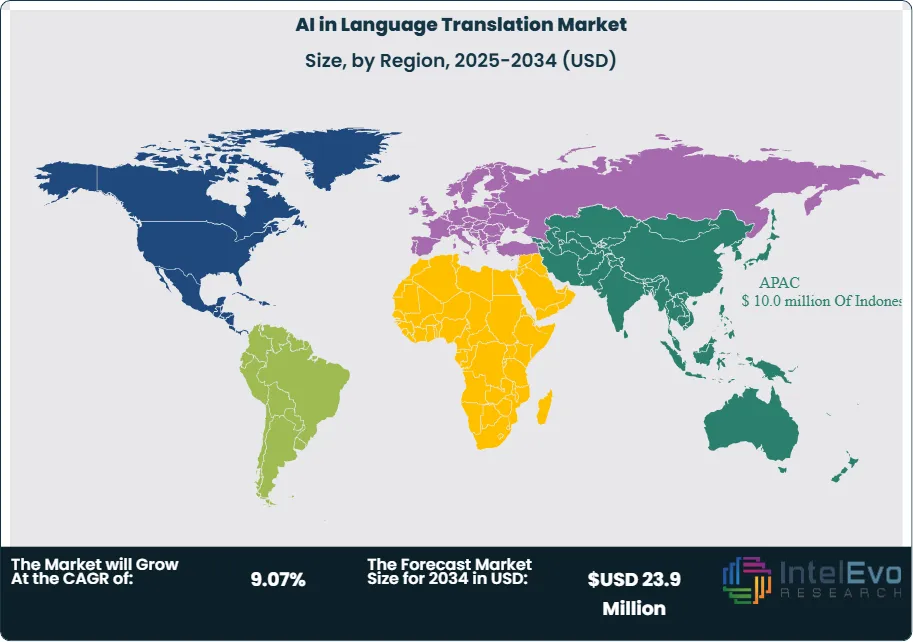

The Indonesia AI in Language Translation Market is valued at approximately USD 10 Million in 2025 and is projected to reach around USD 23.9 Million by 2034, expanding at a compound annual growth rate (CAGR) of about 9.07% during the forecast period from 2026 to 2034. Market growth is driven by rising global digital content consumption, increasing demand for real-time multilingual communication, and rapid adoption of AI-powered translation tools across enterprises, e-commerce, and media platforms. In addition, advancements in neural machine translation, large language models, and speech-to-text integration are enhancing accuracy and contextual understanding, positioning the market for sustained expansion across business, education, and cross-border communication applications.

AI in language translation applies machine learning and natural language processing to automate translation of content between languages. Neural engines and cloud APIs now outperform traditional systems, reducing cost per word and turnaround time. Growing cross-border e-commerce, streaming content, and remote work increase the volume of multilingual interactions, driving adoption of AI-based translation in customer service, marketing, documentation, and collaboration.

A survey by the Institute of Translation and Interpreting indicates that 76% of consumers prefer to purchase products with information in their own language, making localization a direct driver of revenue and loyalty. Yet English still accounts for about 52.6% of websites, while other major languages remain in low single-digit shares, creating a gap between content supply and local-language demand. Research by Translated’s Research Center suggests that adding translation for the United States, China, Japan, and Germany can open access to around 50% of global sales potential, supporting investment in scalable AI platforms. On the supply side, hyperscale cloud providers, specialist language service firms, and device manufacturers provide integrated offerings. The language translation device segment is projected to grow from about USD 1.33 billion in 2023 to USD 3.17 billion by 2032 at a CAGR of 10.4%, signaling rising use in travel, retail, and public services.

Risk and regulation shape growth. Data protection laws and cross-border data transfer limits require strict governance of training data, model deployment, and output storage. Limited high-quality datasets for low-resource languages constrain accuracy and slow expansion into smaller markets. North America holds an estimated 35% share of current revenue, followed by Europe at 30%, while Asia-Pacific is the fastest-growing region with expected growth above 25% per year, led by China, Japan, India, and South Korea. Emerging opportunities in Latin America and the Middle East center on tourism, customer contact centers, and digital government programs. As AI translation embeds into content management, collaboration, and customer engagement platforms, it is shifting from a narrow utility to a strategic enabler of global operating models.

Get More Information about this report -

Request Free Sample ReportKey Takeaways

- Market Growth: The Global AI in language translation market was valued at 2.2 billion USD, 2024, USD 2.6 billion in 2025 and is projected to reach USD 18.2 billion by 2034, reflecting a CAGR of 23.1% over 2026-2034.

- Segment Dominance: By component, the software segment led the market with a 64.5% share, 2023, corresponding to approximately 1.2 billion USD, 2023 in revenue.

- Segment Dominance: By deployment mode, cloud-based solutions dominated with a 75.3% share, 2023, equivalent to an estimated: 1.4 billion USD, 2024 in aligned market value.

- Driver: Growing adoption of multilingual digital services and cross-border digital commerce accelerates AI translation demand, with enterprises expected to automate a significant share of high-volume workflows (estimated: 70.0%, 2025).

- Restraint: High requirements for quality training data and integration costs constrain adoption for smaller organizations, which may limit addressable demand by an estimated: 25.0%, 2024 relative to potential.

- Opportunity: The commercial use segment, which commanded a 68.0% share, 2023, can expand further as enterprises deploy AI translation into customer support and content platforms, creating incremental revenue potential of estimated: 3.5 billion USD, 2030.

- Trend: The market continues to shift toward cloud-native AI translation platforms, building on the 75.3% cloud share, 2023 and moving toward an estimated: 82.0%, 2028 as vendors scale subscription and API-based models.

- Regional Analysis: North America and Europe together are likely to account for an estimated: 60.0%, 2024 of global AI translation revenue, while Asia Pacific is set to deliver the fastest expansion with annual growth above an estimated: 24.0%, 2024 over 2024-2034.

By Component

Software continued to hold the largest share of the AI language translation market in 2023, accounting for 64.5 percent of global revenue. This position strengthens further in 2025 as businesses expand their cross-border operations and increase digital content output. The demand for automated translation tools continues to rise as organizations seek precise and fast multilingual communication without the high recurring cost of human translation. AI models equipped with neural processing now handle context, tone, and industry terminology with greater accuracy, which reinforces the software segment's lead.

The shift toward cloud-delivered software is amplifying adoption across both multinational enterprises and small firms. These platforms offer instant updates and allow users to access machine learning improvements without maintaining local infrastructure. Real-time translation and integration capabilities with productivity tools have made software the preferred component for organizations that manage high content volumes across multiple markets.

By 2025, AI-driven software solutions also integrate speech recognition, automated voice output, and multilingual content management. These functionalities support global customer service centers, travel ecosystems, and education technology platforms. As companies strengthen their multilingual communication strategies, the software segment maintains its lead and remains the primary revenue generator in the component landscape.

By Deployment Mode

Cloud-based deployment held 75.3 percent of the market in 2023 and remains the dominant model in 2025. The preference for cloud platforms is driven by flexibility, lower operating costs, and ease of scaling translation capacity. Global enterprises increasingly choose cloud tools because they reduce the need for dedicated IT infrastructure and provide continuous access to updated algorithms and security enhancements.

The cloud model allows rapid deployment across teams working in different regions and time zones. This supports real-time translation for customer interactions, compliance documents, and enterprise workflows. For small and midsize companies, the pay-as-you-use approach supports predictable operating expenditure and aligns with their expansion plans into non-native language markets.

In 2025, cloud adoption grows further as providers strengthen encryption, audit trails, and compliance with international data protection rules. These improvements address concerns around the handling of sensitive communication data. The on-premise segment remains relevant for sectors with strict data-sovereignty obligations, but the cloud model continues to expand its share as companies pursue faster deployment cycles and consistent model performance across their global operations.

By End Use

Commercial applications accounted for 68 percent of the global market in 2023 and remain the primary source of demand in 2025. Sectors such as BFSI, IT and telecommunications, healthcare, travel, and education rely on translation tools to improve accuracy, reduce communication delays, and support multilingual engagement. In banking and healthcare, where regulatory compliance is essential, AI translation ensures consistent interpretation of documents and customer communication.

Travel and tourism companies depend on real-time translation to support customer bookings, assistance services, and multilingual marketing content. In education, digital learning platforms use AI translation to make course content more accessible and expand international enrollment. The rise of remote work has also increased the need for text and voice translation tools across multinational teams involved in technology and service delivery.

Personal use applications continue to grow but remain a smaller portion of total spending. Consumers use AI translation for travel, social communication, and digital content consumption. However, it is the commercial segment that drives the market’s long-term trajectory, supported by enterprise digitalization and expanding global customer bases.

By Region

North America accounted for 37.1 percent of the global market in 2023 and continues to lead in 2025. The region benefits from strong digital infrastructure, high enterprise adoption of AI, and the presence of leading technology companies developing advanced translation models. The market was valued at 0.4 billion USD in 2023 and expands through 2025 as organizations formalize cross-border communication systems in technology, healthcare, public services, and education.

Europe follows with strong adoption in government, retail, and industrial sectors. Strict regional language requirements across member states support demand for accurate digital translation tools. Asia Pacific displays the fastest growth rate, supported by digital commerce expansion in China, India, Japan, and Southeast Asia. The region’s diverse linguistic landscape increases the need for scalable translation systems across both SMEs and multinational corporations.

Latin America and the Middle East and Africa continue to expand as enterprises in retail, travel, and financial services rely more on multilingual applications to reach regional and global customers. Improvements in digital infrastructure and rising cross-border trade are expected to support sustained investment in AI translation technologies across these markets.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

Component

- Software

- Services

Deployment Mode

- Cloud-Based

- On-Premise

End-Use

- Commercial Use

- BFSI

- IT & Telecommunications

- Healthcare

- Travel & Tourism

- Education

- Others

Regions

- Indonesia

Driver

Rising Demand for Domain-Specific Translation Accuracy

By 2025, demand increases for AI translation tools that can handle specialized content accurately. Global companies work in legal, medical, financial, and technical areas where consistent terminology and accuracy in context are vital. As cross-border transactions and compliance-heavy documents grow, the need for faster turnaround and greater reliability is also rising.

Scalable Multilingual Operations Through AI

AI-powered translation systems meet these needs by training on large datasets specific to each domain. These datasets include industry vocabulary, relevant context, and formatting rules. You can scale multilingual operations without raising costs or staffing levels significantly. As specialized communication grows quickly in regulated sectors, effective AI translation platforms become crucial for global business expansion.

Restraint

Limited Availability of High-Quality Training Data

A significant limitation is the uneven access to high-quality training data in various languages and industries. Many languages do not have enough digitized text, and niche sectors are often not well represented in public datasets. These shortages impact translation accuracy, especially for regional dialects and specific technical terms.

High Data Curation Costs and Compliance Risks

Acquiring data is expensive because training datasets need to be organized, verified, and compliant with privacy and regulatory standards. Errors or biases in the input data can weaken system reliability and slow adoption in sensitive areas like healthcare and finance. This issue restricts the scalability of models and delays commercial rollout for companies operating in different markets.

Opportunity

Expansion of Global Digital and Cross-Border Communication

The growing need for smooth international communication presents a solid opportunity for AI translation platforms in 2025. Cross-border e-commerce continues to grow rapidly, and remote collaboration tools enable teams spread across the globe. Public agencies are also adopting multilingual content systems to enhance accessibility and engage citizens better.

Real-Time Multimodal Translation Adoption

You can take advantage of this chance by implementing AI engines that translate text, speech, and visual content instantly. Companies using machine translation for sales, customer support, and digital onboarding can reduce operational delays and widen their market reach. The necessity to connect with audiences in more than 50 active language groups supports ongoing market growth.

Trend

Dominance of Neural Machine Translation Technologies

Neural machine translation is the leading technology trend shaping the market in 2025. Transformer-based structures and multilingual pretraining models keep improving fluency, understanding of context, and sentence-level accuracy. These advancements set new performance standards across the industry.

Industry-Specific Adaptation and Enterprise Integration

Vendors are increasingly using transfer learning and domain adaptation to customize outputs for specific industries. You gain access to translation engines that can adjust tone, interpret complex sentence structures, and minimize semantic errors. Real-time deployment across e-commerce platforms, customer support systems, and medical interfaces indicates deeper integration within enterprises and a maturing market.

Key Player Analysis

Amazon Web Services, Inc.: Amazon Web Services holds a leadership position in AI-driven language translation due to the scale and maturity of its cloud ecosystem. Amazon Translate remains the core platform, providing neural machine translation for enterprise applications across ecommerce, customer service, and cross-border communication. In 2025, AWS expands its footprint through deeper integration with its broader AI stack, including Amazon Bedrock and its generative AI models. These integrations enable customers to automate multilingual content creation and streamline global workflows. AWS reports continued growth in its AI and machine learning segment, supported by rising enterprise cloud adoption in North America, Europe, and Asia Pacific. The company strengthens its position through partnerships with global system integrators and software vendors that embed translation APIs into enterprise applications. Its differentiators include reliable cloud performance, a wide language library, and strong compliance features that support regulated industries.

Meta Platforms, Inc.: Meta positions itself as an innovator in the AI translation market with a strong focus on open-source multilingual models. The company invests heavily in research on low-resource and dialect-rich languages to support global social connectivity across its platforms. Meta’s AI research group continues to develop large-scale transformer-based models designed to translate speech and text across hundreds of language pairs. By 2025, Meta enhances its translation systems with multimodal capabilities that process text, audio, and visual cues. The company’s reach across Facebook, Instagram, and WhatsApp provides access to billions of daily interactions, which strengthens model refinement and adoption. Meta’s differentiator lies in its ability to deploy translation tools at global consumer scale while also commercializing its models through partnerships and API access for enterprise developers.

Lionbridge Technologies, Inc.: Lionbridge operates as a prominent service provider that combines human expertise with AI-driven translation tools. The company positions itself as a challenger in the AI translation market by integrating automation into traditional localization workflows. In 2025, Lionbridge continues to expand its AI and machine learning capabilities through internal R&D and targeted acquisitions of niche language technology firms. Its portfolio includes enterprise-grade translation, content localization, and multilingual data training services for sectors such as technology, healthcare, and financial services. Lionbridge’s global network of linguists remains a key differentiator, enabling the company to validate and refine AI-generated content for accuracy-sensitive applications. The firm strengthens its competitive position through investments in workflow automation, secure data environments, and hybrid AI-human translation models that address both speed and quality requirements for global enterprises.

Market Key Players

- KantanAI

- Meta Platforms, Inc.

- Smartling

- Amazon Web Services, Inc.

- TransPerfect

- SYSTRAN

- LILT Inc.

- Microsoft Corporation

- Lionbridge Technologies, Inc.

- Google LLC

- IBM Corporation

- Other Key Players

Recent Developments

Dec 2024 – Phrase: Phrase announced a major release of AI tools for its localization platform, adding an advanced content adaptation engine, dynamic machine translation customization, and automated quality assessment that can cut review costs by up to 65 percent and processing time by 99 percent. The update strengthens Phrase’s position in enterprise localization by tying AI translation more closely to content management and quality workflows.

Dec 2024 – Wordly: Wordly introduced automatic language selection and push-to-talk features for its live AI translation service, improving language detection and interaction for multilingual meetings and events at no additional cost. The launch enhances Wordly’s competitiveness in the events and conferencing segment by improving usability for large, multilingual audiences.

Feb 2025 – Google Cloud: Google Cloud extended its Translation LLM so customers can translate directly between any supported language pair without routing through English, while also improving latency and quality. This step reinforces Google Cloud’s role in high-volume enterprise translation and makes its AI stack more attractive for global customer engagement platforms.

Jun 2025 – DeepL: DeepL expanded its platform with additional languages and continued to grow its enterprise offerings across translation, writing assistance, and voice, serving more than 200,000 business customers and covering over 100 languages. This expansion increases DeepL’s addressable market and deepens its relevance for large organizations standardizing on a single language AI provider.

Aug 2025 – Google: Google Translate rolled out new AI features for live conversations and language learning, enabling natural back-and-forth translation across more than 70 languages on Android and iOS. The release links translation more tightly with consumer engagement and language education, which supports higher usage and strengthens Google’s consumer-side data and product flywheel.

Nov 2025 – DeepL: DeepL hosted its Dialogues 2025 event and announced several products, including DeepL Voice for Zoom, DeepL Marketplace, and DeepL Agent, an AI assistant designed to handle enterprise workflows. These launches move DeepL beyond standalone translation into broader language-centric productivity, which increases stickiness with large enterprise accounts and intensifies competition with hyperscale cloud providers.

| Report Attribute | Details |

| Market size (2025) | USD 10 Million |

| Forecast Revenue (2034) | USD 23.9 Million |

| CAGR (2025-2034) | 9.07% |

| Historical data | 2021-2024 |

| Base Year For Estimation | 2025 |

| Forecast Period | 2026-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component, (Software, Services), Deployment Mode, (Cloud-Based, On-Premise), End-Use, (Commercial Use, BFSI, IT & Telecommunications, Healthcare, Travel & Tourism, Education, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | KantanAI, Meta Platforms, Inc., Smartling, Amazon Web Services, Inc., TransPerfect, SYSTRAN, LILT Inc., Microsoft Corporation, Lionbridge Technologies, Inc., Google LLC, IBM Corporation, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Indonesia AI in Language Translation Market

Published Date : 04 Feb 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date