Industrial Heaters Market Size, Growth & Forecast 2025–2034

Global Industrial Heaters Market Size, Share & Thermal Technology Analysis By Heater Type (Electric, Gas, Infrared, Induction), By End-Use Industry (Oil & Gas, Chemicals, Food Processing, Pharmaceuticals, Manufacturing), Energy-Efficient Heating Trends, Smart & IoT-Enabled Systems, Regional Outlook, Key Vendors & Forecast 2025–2034

Report Overview

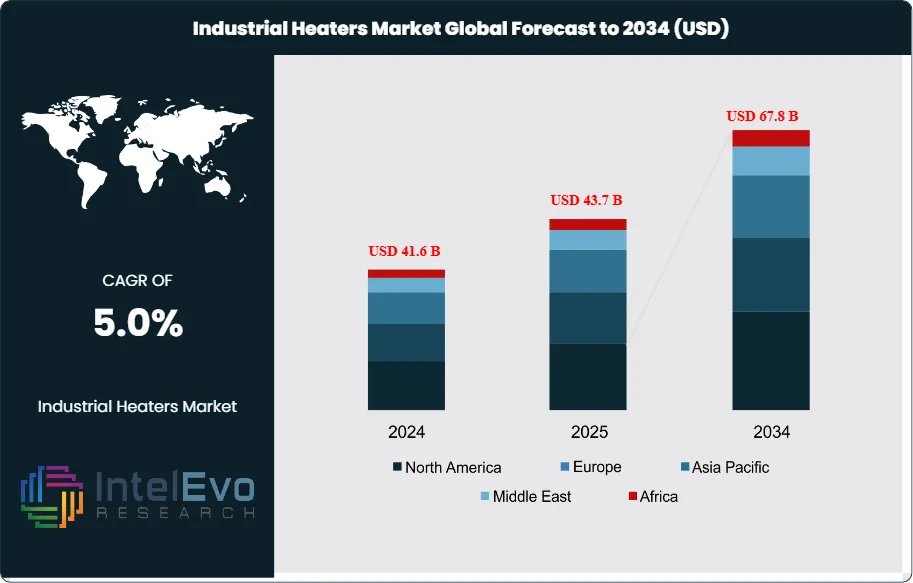

The Industrial Heaters Market is estimated at USD 41.6 billion in 2024 and is projected to reach approximately USD 67.8 billion by 2034, registering a compound annual growth rate (CAGR) of 5.0% over 2025–2034. This steady expansion reflects rising demand for precise thermal processing across chemicals, pharmaceuticals, metals, and food manufacturing, where temperature control directly impacts efficiency and product quality. The transition toward energy-efficient electric and hybrid heaters, driven by decarbonization targets and tightening emission regulations, is further supporting market momentum. In addition, growing adoption of smart and IoT-enabled heating systems for predictive maintenance and energy optimization is enhancing long-term growth visibility and reinforcing the market’s relevance across both mature and emerging industrial economies.

Get More Information about this report -

Request Free Sample ReportIndustrial heaters form the backbone of thermal management in manufacturing, processing, and production environments. Their role spans across oil and gas, chemicals, automotive, and food processing, where precise temperature control and operational reliability are non-negotiable. The market has expanded steadily over the past decade, supported by industrialization in Asia-Pacific and modernization of facilities in North America and Europe. This trajectory is expected to continue as industries prioritize energy efficiency and regulatory compliance.

Growth is being driven by rising demand for energy-efficient heating systems and the global shift toward sustainable manufacturing. Retrofitting of older facilities with advanced heating solutions is accelerating adoption, while emerging economies are fueling demand through rapid industrial expansion. On the supply side, manufacturers face challenges around fluctuating raw material costs and the need to align with stricter emissions standards. However, government-backed incentives for clean energy adoption are mitigating these risks and creating new opportunities.

Technology is reshaping the market. Integration of IoT-enabled sensors allows predictive maintenance and real-time monitoring, reducing downtime and energy waste. Automation and AI-driven controls are improving process accuracy, while infrared and immersion heaters are gaining traction for their efficiency in high-demand environments. These advances are not only reducing operational costs but also aligning with global decarbonization goals.

Regional trends highlight clear investment hotspots. Asia-Pacific remains the largest market, driven by China and India’s expanding industrial base. Europe is advancing through regulatory mandates, with the UK allocating £530 million under the Public Sector Decarbonisation Scheme to replace outdated heating systems with low-carbon alternatives. This initiative alone is projected to save £650 million annually in energy costs by 2037. In the United States, over $545 million has been deployed across 39 states for clean energy projects, while training programs have prepared more than 200,000 workers for roles in the clean energy sector. These measures are reinforcing the ecosystem for industrial heating solutions and signaling long-term growth potential.

For investors and industry participants, the combination of regulatory support, technological progress, and rising demand for sustainable processes positions the industrial heaters market as a resilient and expanding opportunity over the coming decade.

Key Takeaways

- Market Growth: The global industrial heaters market was valued at USD 41.6 billion in 2024 and is projected to reach USD 67.8 billion by 2034, expanding at a CAGR of 5.0%. Growth is supported by rising demand for energy-efficient heating systems and stricter regulatory frameworks promoting low-emission technologies.

- Product Type: Immersion heaters accounted for 39% of total revenue in 2023, driven by their widespread use in chemical processing, oil and gas, and water treatment applications where direct fluid heating ensures efficiency and reliability.

- Technology: Electric-based heaters held a 35% share in 2023, reflecting strong adoption in industries prioritizing precise temperature control and reduced maintenance costs compared with fuel-based alternatives.

- End Use: The pharmaceutical sector represented 41% of demand in 2023, supported by stringent requirements for controlled heating environments in drug manufacturing and bioprocessing facilities.

- Driver: Government-backed decarbonization programs are accelerating adoption. For example, the UK allocated £530 million under the Public Sector Decarbonisation Scheme to replace outdated heating systems, with projected annual energy savings of £650 million by 2037.

- Restraint: Volatility in raw material prices, particularly metals used in heating elements, is pressuring margins. Rising input costs can increase equipment prices by 8–12% annually, limiting adoption in cost-sensitive industries.

- Opportunity: Asia-Pacific presents significant growth potential, with industrial expansion in India and Southeast Asia expected to push regional demand at a CAGR above 5% through 2033. Investments in manufacturing hubs and energy-efficient infrastructure will sustain momentum.

- Trend: Integration of IoT-enabled heaters is gaining traction, enabling predictive maintenance and real-time monitoring. Early adopters report energy savings of up to 15% and reduced downtime, making smart heating systems a priority for large-scale facilities.

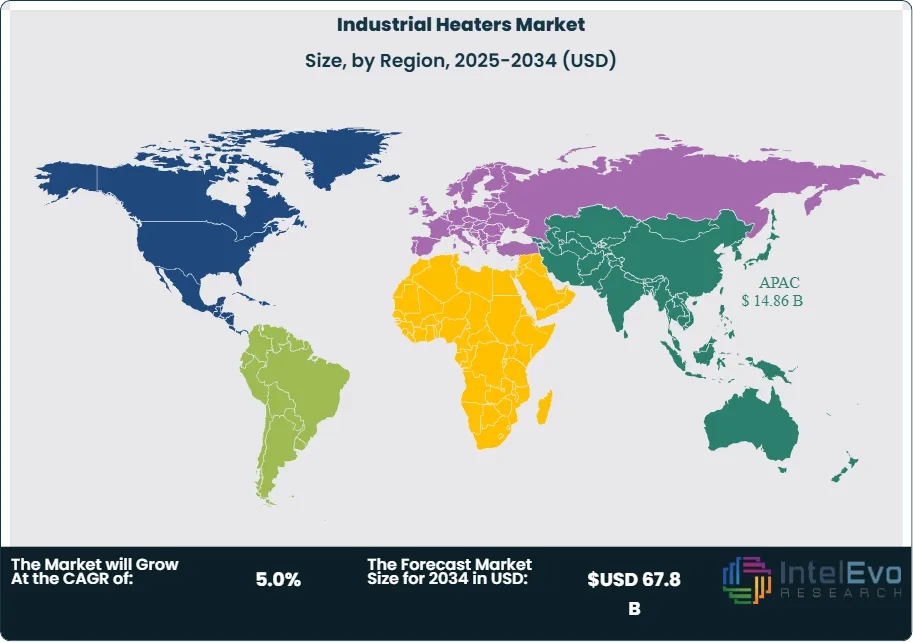

- Regional Analysis: Asia-Pacific led the market with a 34% share and USD 12.6 billion in revenue in 2023, supported by rapid industrialization. Europe is advancing through regulatory mandates, while North America benefits from federal clean energy investments exceeding USD 545 million across 39 states, reinforcing long-term adoption.

Type Analysis

As of 2025, immersion heaters continue to dominate the industrial heaters market, accounting for nearly 38–40% of total revenue. Their ability to deliver direct, efficient heat transfer into liquids makes them indispensable in sectors such as chemicals, oil and gas, and water treatment. The demand for immersion heaters is further supported by industries requiring precise temperature control and high reliability, particularly in continuous processing environments.

Pipe heaters and duct heaters represent the next largest categories, serving applications where targeted heating of fluids or airflows is essential. These systems are increasingly adopted in petrochemical and HVAC operations, where energy efficiency and safety are critical. Circulation heaters and cartridge heaters, while holding smaller shares, are gaining traction in compact industrial setups. Their adoption is expected to rise at a CAGR above 5% through 2030, supported by technological improvements that enhance durability and reduce maintenance costs.

The overall product mix reflects a shift toward solutions that balance efficiency with operational flexibility. While immersion heaters remain the backbone of the market, specialized heater types are carving out growth opportunities in industries with unique thermal management requirements.

Technology Analysis

Electric-based heaters remain the leading technology in 2025, holding more than one-third of the global market. Their dominance is reinforced by the global transition toward electrification and decarbonization, with industries prioritizing clean, consistent heating solutions. In sectors such as pharmaceuticals and food processing, electric heaters are preferred due to their ability to eliminate combustion byproducts and maintain contamination-free environments.

Fuel-based heaters continue to play a role in industries with high heat load requirements, particularly in regions where electricity costs remain prohibitive. Hybrid heaters, which combine electric and fuel-based systems, are gaining adoption as companies seek to balance energy efficiency with operational resilience. This segment is projected to expand at a CAGR of 6% through 2030, reflecting its appeal in industries undergoing gradual energy transitions.

Steam-based heaters, though representing a smaller share, remain critical in large-scale processing plants where steam is readily available as a byproduct. Their relevance is particularly strong in legacy industries such as pulp and paper, textiles, and heavy chemicals. The diversity of technology adoption highlights how industrial heating solutions are adapting to both environmental regulations and operational cost pressures.

End-Use Industry Analysis

Pharmaceuticals remain the largest end-use sector in 2025, accounting for more than 40% of global demand. Stringent requirements for temperature-controlled environments in drug formulation, storage, and bioprocessing continue to drive adoption. The sector’s reliance on precision heating solutions is reinforced by regulatory compliance standards and the expansion of biologics manufacturing.

The oil and gas industry follows as a major consumer, using industrial heaters in refining, petrochemical processing, and natural gas treatment. With global energy companies investing in efficiency upgrades, demand for high-capacity heaters in this sector remains strong. The food and beverages industry also represents a significant share, with heaters used in sterilization, pasteurization, and other thermal processes critical for product safety.

Automotive and other industrial sectors, while smaller in scale, are expanding their use of heaters in applications such as paint curing, component drying, and advanced materials processing. Collectively, these industries highlight the broad relevance of industrial heaters in ensuring operational efficiency, safety, and compliance across diverse production environments.

Regional Analysis

Asia-Pacific remains the largest regional market in 2025, accounting for more than one-third of global revenue, valued at over USD 14.86 billion. Growth is driven by rapid industrialization in China, India, and Southeast Asia, alongside rising investments in manufacturing and energy infrastructure. The region is expected to maintain a CAGR above 5% through 2030, supported by government-backed industrial expansion and energy efficiency initiatives.

North America continues to benefit from advanced manufacturing capabilities and strong regulatory frameworks promoting sustainable heating technologies. Federal and state-level clean energy programs are accelerating the adoption of electric-based heaters, particularly in pharmaceuticals and food processing. Europe, while a mature market, remains a leader in regulatory-driven adoption, with industries investing in low-carbon heating systems to meet stringent emissions targets.

The Middle East and Africa are witnessing steady growth, supported by the expansion of oil and gas operations and diversification strategies that emphasize energy efficiency in industrial processes. Latin America, though smaller in scale, is experiencing rising demand as modernization efforts in Brazil and Mexico drive adoption of advanced heating technologies. Collectively, these regional dynamics underscore a global market that is both expanding and diversifying, with Asia-Pacific setting the pace for long-term growth.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Product Type

- Pipe Heaters

- Immersion Heaters

- Duct Heaters

- Circulation Heaters

- Cartridge Heaters

By Technology

- Electric-based

- Fuel-based

- Hybrid-based

- Steam-based

By End-Use Industry

- Pharmaceuticals

- Oil & Gas

- Food & Beverages

- Automotive

- Other End-Use Industries

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 41.6 B |

| Forecast Revenue (2034) | USD 67.8 B |

| CAGR (2024-2034) | 5.0% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type, (Pipe Heaters, Immersion Heaters, Duct Heaters, Circulation Heaters, Cartridge Heaters,) By Technology, (Electric-based, Fuel-based, Hybrid-based, Steam-based), By End-Use Industry, (Pharmaceuticals, Oil & Gas, Food & Beverages, Automotive, Other End-Use Industries) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Chromalox, Powrmatic Ltd., Dragon Power Electric Co. Ltd., Elmatic Ltd., Winterwarm, Watlow Electric Manufacturing Company, Auzhan Electric Appliances Co. Ltd., Thermal Flow Technologies, Wattco, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date