Industrial PC Market Size, Trends, Growth outlook | CAGR of 6.9%

Global Industrial PC Market Size, Share, Analysis Report By Product Type (Panel IPC, Box IPC, Embedded IPC, Rack Mount IPC, DIN Rail IPC) Display Type (Capacitive, Resistive) Storage Medium (Solid State, Rotating) End-Use Industry (Manufacturing, Automotive, Aerospace & Defense, Semiconductor & Electronics, Energy & Power) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

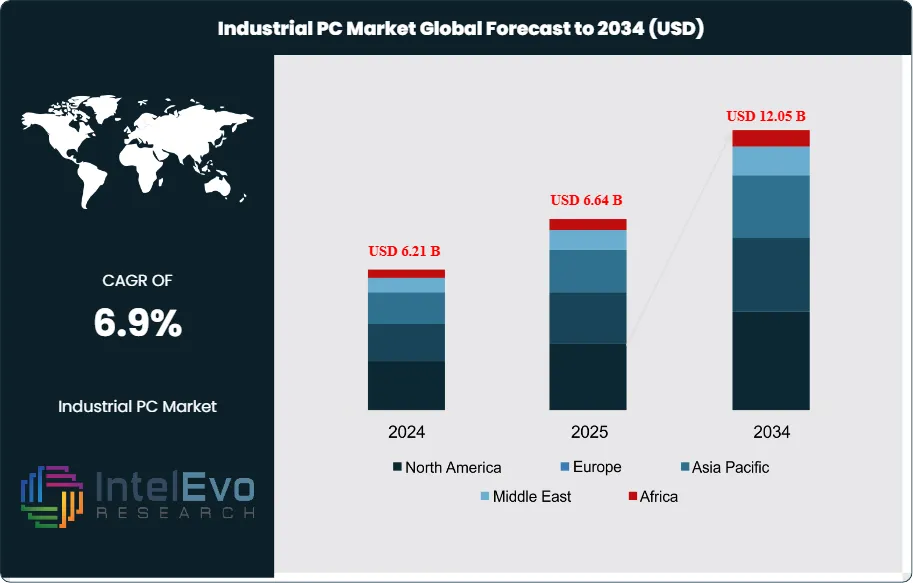

The Industrial PC Market is projected to reach approximately USD 12.05 Billion by 2034, up from USD 6.21 Billion in 2024, growing at a CAGR of around 6.9% during 2025–2034. Growth is driven by increasing automation in manufacturing, rising adoption of Industry 4.0 solutions, and the need for reliable computing systems in harsh industrial environments. Advancements in edge computing, AI integration, and IoT connectivity are further accelerating market expansion. Industrial PCs are becoming a core backbone of smart factories, enabling higher efficiency, predictive maintenance, and real-time data control.

Get More Information about this report -

Request Free Sample ReportThe Industrial PC market encompasses ruggedized computing systems specifically designed for industrial applications, featuring enhanced durability, extended temperature ranges, and specialized interfaces. These systems serve critical roles in manufacturing automation, process control, data acquisition, and human-machine interface applications across diverse industrial sectors. The market includes various form factors such as panel PCs, box PCs, embedded systems, rack mount units, and DIN rail-mounted computers, each tailored to specific industrial requirements and environmental conditions.

The industrial PC market is experiencing robust growth driven by the accelerating adoption of Industry 4.0 initiatives and smart manufacturing technologies. Industry 4.0 and cyber-physical systems demand cableless connectivity and edge computing for real-time data processing. Digital transformation across manufacturing sectors is creating unprecedented demand for reliable computing platforms capable of handling complex automation tasks, real-time data processing, and seamless integration with IoT ecosystems. The integration of artificial intelligence capabilities into industrial computing systems is further propelling market expansion as organizations seek to leverage advanced analytics and machine learning for operational optimization.

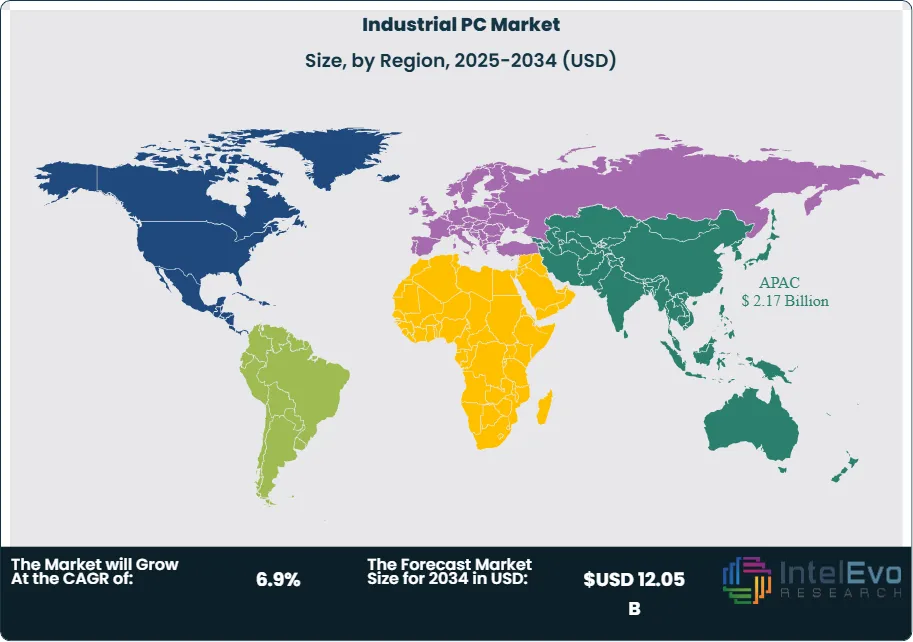

Asia Pacific currently dominates the industrial PC market, accounting for a share of 38.3% in 2024. The dominance is fueled by the rapid industrialization, the growth of manufacturing sectors, increasing adoption of automation technologies, and significant investments in smart factory initiatives across countries like China, Japan, South Korea, and India. North America follows as the second-largest market, driven by advanced manufacturing capabilities and early adoption of Industry 4.0 technologies. Europe maintains a strong position, particularly in automotive and aerospace applications, with Germany leading industrial automation initiatives.

The COVID-19 pandemic initially disrupted supply chains and manufacturing operations, causing temporary market contractions in 2020-2021. However, the crisis accelerated digital transformation initiatives as organizations recognized the critical importance of automation and remote monitoring capabilities. The pandemic highlighted the need for resilient, automated manufacturing systems, leading to increased investments in industrial PC solutions for unmanned operations, predictive maintenance, and real-time monitoring applications.

Global trade tensions and geopolitical conflicts have influenced supply chain strategies, with companies seeking to diversify sourcing and manufacturing locations. The ongoing semiconductor shortage has impacted production timelines and costs, while trade restrictions have prompted regional players to strengthen their market positions. These factors have created opportunities for regional manufacturers while challenging global supply chain optimization strategies.

Key Takeaways

- Market Growth: The Industrial PC Market is expected to reach USD 12.05 Billion by 2034, owing to demand for industrial automation, IoT integration, and smart manufacturing (Industry 4.0)

- Product Type Dominance: Panel IPC leads due to integrated display functionality and cost-effective automation solutions.

- Display Type Dominance: Capacitive displays dominate market share, driven by superior touch sensitivity and industrial durability

- Storage Medium Dominance: Solid State storage holds the largest share, owing to enhanced reliability and performance.

- End-Use Industry Dominance: Manufacturing holds the largest share, driven by automation adoption and performance requirements.

- Driver: Key drivers accelerating growth include Industry 4.0 adoption and IoT integration, which boost market expansion through enhanced automation and real-time data processing capabilities.

- Restraint: Growth is hindered by high initial costs and complex integration requirements, which create challenges such as extended implementation timelines and technical complexity.

- Opportunity: The market is poised for expansion due to opportunities like AI integration and edge computing adoption, which enable advanced analytics and real-time processing capabilities.

- Trend: Emerging trends including modular PC designs and fanless cooling technologies are reshaping the market by improving flexibility and reliability in harsh environments.

- Regional Analysis: Asia-Pacific leads market share owing to rapid industrialization and manufacturing growth.

Product Type Analysis:

Panel IPCs maintain their strong market position through strategic advantages that directly address manufacturing industry pain points. Their integrated display architecture eliminates the complexity of separate computing and visualization systems, reducing both procurement overhead and potential failure points in mission-critical applications. The all-in-one design significantly streamlines installation processes, requiring minimal wiring and cabinet space while ensuring consistent performance through optimized hardware-software integration. In manufacturing environments, these systems excel by providing operators with intuitive touch interfaces that enable direct process control and real-time visualization without network latency issues. The cost benefits extend beyond initial purchase price to include reduced maintenance complexity, consolidated vendor relationships, and simplified support structures.

Display Type Analysis:

Capacitive Leads With over 55% Market Share In Industrial PC Market. Capacitive touchscreen technology dominates industrial display applications through superior performance characteristics that align with demanding operational requirements. Their electromagnetic interference resistance ensures reliable operation in electrically noisy manufacturing environments where precision control is essential. The multi-touch functionality enables sophisticated gesture controls and simultaneous operator interactions, enhancing productivity in complex manufacturing processes. Superior touch accuracy and responsiveness reduce operator errors and improve process control efficiency, particularly critical in applications requiring precise adjustments or emergency responses. Unlike resistive alternatives that can degrade under repeated use, capacitive displays maintain consistent performance over extended operational lifecycles, reducing replacement costs and downtime. The technology's ability to function through protective gloves while maintaining accuracy makes it ideal for industrial safety requirements.

Storage Medium Analysis:

Solid-state storage technology has become the cornerstone of industrial computing infrastructure due to its exceptional resilience and performance advantages in demanding operational environments. The absence of mechanical components eliminates vibration sensitivity and shock vulnerability, critical factors in manufacturing facilities with heavy machinery and equipment. SSDs deliver consistent read/write speeds regardless of ambient temperature fluctuations and electromagnetic interference common in industrial settings. Their instant data access capabilities support real-time control applications where millisecond response times are essential for process optimization and safety systems. The enhanced durability translates to significantly reduced maintenance windows and unplanned downtime events, directly impacting operational efficiency and cost management.

End-Use Industry Analysis:

Manufacturing dominates the industrial PC market through its comprehensive digital transformation initiatives that require robust computing infrastructure for advanced automation systems. The sector's Industry 4.0 adoption drives demand for high-performance platforms capable of executing complex control algorithms, machine learning models, and predictive analytics in real-time environments. Manufacturing facilities require seamless enterprise system integration, connecting production floor operations with ERP, MES, and supply chain management systems for comprehensive operational visibility. The sector's emphasis on quality control, traceability, and regulatory compliance necessitates reliable computing solutions that can handle continuous data acquisition and processing without interruption. Manufacturing environments present unique challenges including electromagnetic interference, temperature variations, and vibration exposure, making ruggedized industrial PCs essential for maintaining operational continuity.

Region Analysis:

Asia-Pacific Leads With more than 35% Market Share In Industrial PC Market. Asia-Pacific maintains its position as the global leader in the Industrial PC market, primarily driven by China's manufacturing dominance and rapid industrialization across the region. The region benefits from concentrated manufacturing activities, government initiatives promoting smart manufacturing, and significant investments in automation technologies. Japan and South Korea contribute substantially through advanced technology adoption and precision manufacturing requirements, while India represents a growing market driven by expanding manufacturing capabilities and digital transformation initiatives.

North America holds the second-largest market position, characterized by early adoption of Industry 4.0 technologies and advanced manufacturing processes. The region's strength lies in high-value applications across aerospace, defense, and automotive sectors, where stringent quality requirements drive demand for premium industrial computing solutions. Europe maintains a strong market presence, particularly in Germany, which serves as a global leader in industrial automation and manufacturing technology innovation, with significant contributions from automotive and machinery manufacturing sectors.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

Product Type

- Panel IPC

- Box IPC

- Embedded IPC

- Rack Mount IPC

- DIN Rail IPC

- Other Types

Display Type

- Capacitive

- Resistive

- Other Display Types

Storage Medium

- Solid State

- Rotating

End-Use Industry

- Manufacturing

- Automotive

- Aerospace & Defense

- Semiconductor & Electronics

- Energy & Power

- Others

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 6.64 B |

| Forecast Revenue (2034) | USD 12.05 B |

| CAGR (2025-2034) | 6.9% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type (Panel IPC, Box IPC, Embedded IPC, Rack Mount IPC, DIN Rail IPC, Other Types); Display Type (Capacitive, Resistive, Other Display Types); Storage Medium (Solid State, Rotating); End-Use Industry (Manufacturing, Automotive, Aerospace & Defense, Semiconductor & Electronics, Energy & Power, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Advantech Co. Ltd., Siemens, Beckhoff Automation, IEI Integration Corporation, B&R Automation, Kontron, AAEON, EVOC, Norco, Mitsubishi Electric, OnLogic, Premio Inc., Moxa, Panasonic Industrial Devices. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date