Industrial Solvent Separation Membranes Market Size | 10.9% CAGR

Global Industrial Solvent Separation Membranes Market Size, Share & Analysis By Material type (Polyamide (PA), Polytetrafluoroethylene (PTFE), Mixed Cellulose Ester (MCE), Polyvinylidene Fluoride (PVDF), Polyether Ether Ketone (PEEK), Others), By Technology (Ultrafiltration, Microfiltration, Nanofiltration, Reverse Osmosis), By Application (Halogenated Solvents, Non-aqueous Solvents, C6 Hydrocarbons or Higher), By End-Use (Chemicals, Pharmaceutical, Food & Beverage, Paints & Coatings, Others), Industry Outlook, Sustainability Benefits & Forecast 2025–2034

Report Overview

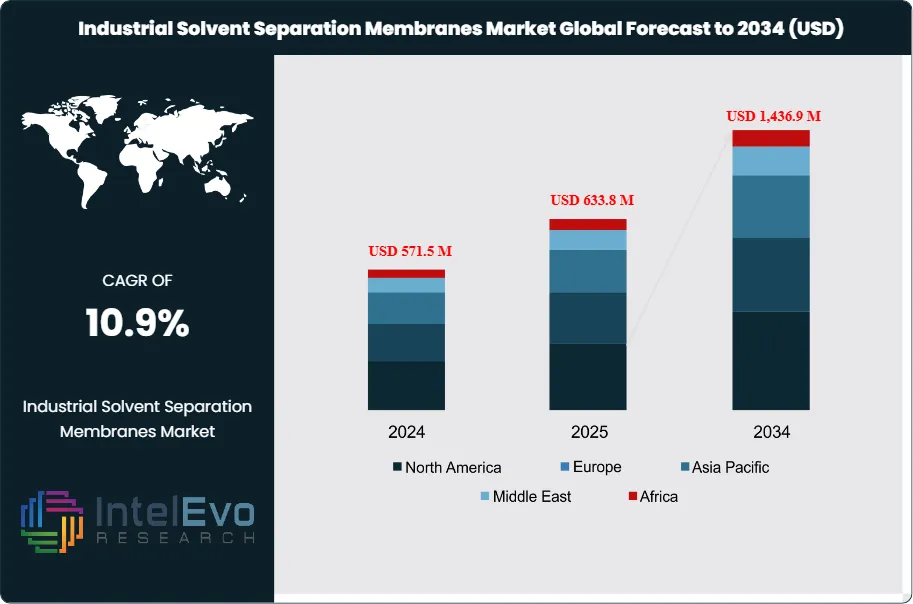

The Industrial Solvent Separation Membranes market is estimated at USD 571.5 million in 2024 and is on track to reach approximately USD 1,436.9 million by 2034, implying a strong compound annual growth rate of about 10.9% over 2025–2034. Rising adoption of membrane-based purification in pharmaceuticals, specialty chemicals, and petrochemical applications is accelerating demand globally. With industries shifting toward energy-efficient, solvent-recovery technologies, membranes are rapidly replacing traditional thermal separation systems. As sustainability mandates tighten worldwide, the market is gaining traction for its ability to reduce operational costs and lower carbon emissions. The growing push for zero-liquid-discharge (ZLD) solutions and circular solvent reuse is expected to further elevate adoption across high-growth sectors.

Get More Information about this report -

Request Free Sample ReportThis growth reflects a structural shift in industrial separation practices, driven by the rising need for efficient, low-energy alternatives to traditional solvent recovery methods. Historically reliant on distillation, industries are turning to membrane-based separation technologies that offer improved selectivity, reduced energy consumption, and lower operational costs. These membranes are engineered to function in chemically aggressive environments, making them suitable for applications involving organic solvents across sectors such as pharmaceuticals, chemicals, food and beverage, and wastewater treatment.

Pharmaceutical manufacturers use these membranes to purify active pharmaceutical ingredients and minimize solvent usage. In the chemicals sector, they enable complex separations where traditional techniques fall short. Food and beverage companies adopt them to ensure purity and regulatory compliance. In wastewater treatment, solvent-resistant membranes support removal of hazardous organics and facilitate water reuse—key concerns in tightening environmental frameworks.

Tougher global emissions and waste discharge regulations are accelerating this market’s expansion. Regulatory bodies across North America, Europe, and parts of Asia-Pacific are mandating stricter solvent recovery and pollution control standards, which is pushing companies to integrate more sustainable separation methods. On the supply side, research in solvent-stable materials is driving technical improvements. Advancements such as nanofiber membranes and polymer composites are expanding operational lifespans and compatibility across diverse solvent systems.

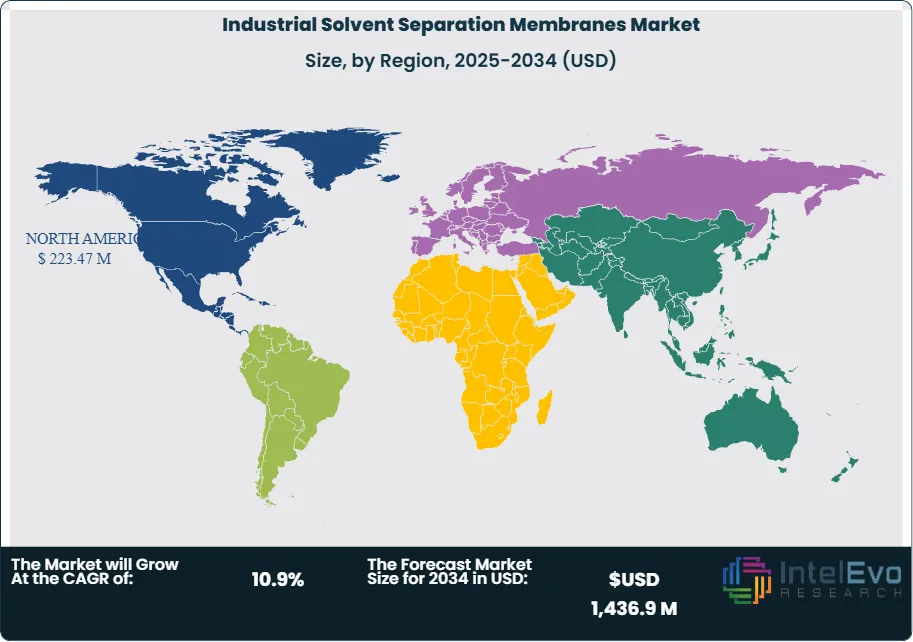

The Asia-Pacific region leads the global market, fueled by rapid industrialization and stringent environmental directives in China, India, and Southeast Asia. Europe and North America follow, where early regulatory frameworks and technology adoption are supporting market maturity. Meanwhile, Latin America and the Middle East are emerging as promising investment zones due to expanding manufacturing footprints and growing environmental awareness.

For investors, the opportunity lies in advanced membrane technologies with high durability and performance across varied solvent chemistries. As industries seek cleaner, faster, and more cost-effective recovery methods, solvent separation membranes are positioned to play a critical role in modern industrial ecosystems through 2034.

Geopolitical Impact Analysis: Ongoing geopolitical tensions, particularly between major economies like the U.S. and China, have exposed vulnerabilities in global membrane supply chains. Trade restrictions and raw material shortages—especially for critical components such as polyamide and PTFE—have increased input costs and delayed production timelines. As a result, manufacturers are reassessing supplier relationships and shifting toward regional sourcing to ensure operational continuity.

At the same time, government-led initiatives in Asia-Pacific and Europe are pushing for domestic membrane production to reduce external dependencies. In China and India, industrial policy is aligning with environmental goals, prompting significant investment in local membrane R&D and manufacturing. While this fragmentation may increase short-term costs, it is also driving innovation and accelerating regional market development. For global stakeholders, geopolitical risks are now a key factor influencing investment decisions, supplier diversification, and technology localization strategies.

Key Takeaways

- Market Growth: The global industrial solvent separation membranes market is projected to grow from USD 571.5 million in 2024 to USD 1,436.9 million by 2034, registering a CAGR of 10.9%. Growth is driven by rising demand for solvent recovery, environmental regulations, and efficiency-focused production in pharmaceuticals and chemicals.

- Material Type: Polyamide membranes hold the largest share at 45.3%, due to their strong chemical resistance and superior membrane-forming properties, making them suitable for aggressive solvent environments.

- Technology: Reverse osmosis accounts for 54.1% of the market, supported by its high removal efficiency across a wide spectrum of organic solvents and impurities in industrial separation processes.

- Application: Halogenated solvents lead with a 44.4% market share. Their extensive use in pharmaceuticals, chemicals, and electronics sectors, where high-purity solvents are essential, sustains demand.

- End Use: The chemicals industry dominates with 58.5% of global revenue, driven by continuous demand for solvent purification and reuse in large-scale manufacturing and process intensification.

- Driver: Tightening environmental regulations worldwide are compelling industries to adopt membrane technologies. This shift is especially strong in sectors where solvent disposal and recovery compliance directly impact operating licenses and cost structures.

- Restraint: High capital costs and performance degradation in extreme solvent conditions limit adoption in smaller operations and emerging markets, constraining penetration outside established industrial hubs.

- Opportunity: Emerging economies in Asia-Pacific, particularly India and Southeast Asia, present strong growth potential. Rapid industrialization and evolving regulatory environments are expected to drive double-digit regional CAGR through 2034.

- Trend: Advancements in solvent-stable nanofiber and polymer composite membranes are improving lifespan and selectivity. Key manufacturers are investing in R&D for broader chemical compatibility and higher throughput.

- Regional Analysis: North America leads the global market with 39.1% share, supported by mature manufacturing infrastructure and early regulatory compliance. Asia-Pacific is the fastest-growing region, with rising industrial output and increasing focus on solvent recovery technologies.

Material Type Analysis

The industrial solvent separation membranes market is segmented by material into polyamide, polytetrafluoroethylene (PTFE), mixed cellulose ester, polyvinylidene fluoride (PVDF), polyether ether ketone (PEEK), and others. As of 2025, polyamide membranes continue to lead, accounting for 45.3% of global revenue. Their dominance is driven by strong chemical resistance, high mechanical stability, and consistent membrane-forming capability. These properties allow polyamide membranes to perform effectively in demanding environments, particularly where aggressive organic solvents are present.

The compatibility of polyamide materials with advanced technologies like nanofiltration and reverse osmosis enhances their utility across pharmaceutical, chemical, and electronics sectors. Their high flux performance and cost-efficiency make them a preferred material for companies aiming to improve throughput without compromising separation accuracy. Demand is expected to remain strong as industries seek robust membranes that can handle solvent-intensive applications while reducing downtime and replacement costs.

Technology Analysis

Among technologies, reverse osmosis (RO) remains the most widely adopted, holding 54.1% of the market share in 2025. RO is favored for its high rejection rate of dissolved organics and ability to process a broad spectrum of industrial solvents. Its effectiveness in recovering high-purity solvents, coupled with improved membrane durability, supports its strong market position across diverse sectors such as pharmaceuticals, chemicals, and food and beverage.

Recent advancements in RO system design—such as energy-efficient configurations and longer membrane life—have made the technology more attractive for cost-sensitive industries. While nanofiltration and ultrafiltration are gaining traction in niche applications, RO continues to dominate due to its performance in large-scale, high-precision separation processes. Adoption is likely to accelerate further as regulatory pressure increases and companies invest in cleaner production practices.

Application Analysis

In terms of application, halogenated solvents remain the leading segment, capturing 44.4% of global demand in 2025. This category includes dichloromethane and tetrachloroethylene, widely used in pharmaceuticals, chemical manufacturing, and electronics. These solvents require precise separation due to their toxicity and environmental risk, making membrane-based recovery solutions essential for both compliance and cost reduction.

As environmental regulations become more stringent, particularly around emissions and waste disposal, industries are shifting toward closed-loop solvent recovery systems. Membrane technologies provide a high-efficiency pathway for recycling halogenated solvents, reducing the need for virgin solvent input and lowering waste treatment costs. This application area is projected to remain a critical driver of demand through the end of the decade.

End-Use Analysis

The chemicals industry accounts for the largest share of end-use, representing 58.5% of global market value in 2025. Solvent separation membranes are integral to this sector, particularly in processes involving purification, recovery, and reuse of solvents in continuous production environments. High throughput and compliance requirements have made membrane systems a preferred solution over traditional thermal separation.

Chemical producers are increasingly integrating membrane systems to meet internal sustainability goals and reduce dependency on energy-intensive operations. In addition, membrane technologies provide consistent product quality and reduce solvent loss, which is critical in the manufacture of fine and specialty chemicals. The pharmaceutical sector also shows strong uptake, while food and beverage and paints and coatings represent growing end-use segments with evolving purification needs.

Regional Analysis

North America remains the largest regional market, contributing 39.1% of global revenue in 2025. Its leadership is underpinned by advanced manufacturing infrastructure, stringent environmental standards, and high adoption rates in chemical and pharmaceutical sectors. Regulatory bodies such as the U.S. EPA continue to mandate stricter solvent recovery and emission controls, creating favorable conditions for membrane system investments.

While North America leads in adoption, Asia Pacific is emerging as the fastest-growing region. Rapid industrial expansion in China, India, and Southeast Asia, combined with evolving environmental policies, is expected to drive double-digit regional CAGR through 2030. Meanwhile, Europe maintains steady demand, supported by early technology adoption and strong environmental policy frameworks. Latin America and the Middle East are expected to see moderate growth, driven by increasing industrial activity and rising awareness of solvent management solutions.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Material type

- Polyamide (PA)

- Polytetrafluoroethylene (PTFE)

- Mixed Cellulose Ester (MCE)

- Polyvinylidene Fluoride (PVDF)

- Polyether Ether Ketone (PEEK)

- Others

By Technology

- Ultrafiltration

- Microfiltration

- Nanofiltration

- Reverse Osmosis

By Application

- Halogenated Solvents

- Dichloromethane

- Tetrachloroethylene

- Others

- Non-aqueous Solvents

- Alcohols

- Ketones

- Others

- C6 Hydrocarbons or Higher

- Heptane

- Hexane

- Alkylbenzene

- Others

By End-Use

- Chemicals

- Pharmaceutical

- Food & Beverage

- Paints & Coatings

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 571.5 M |

| Forecast Revenue (2034) | USD 1,436.9 M |

| CAGR (2024-2034) | 10.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Material type (Polyamide (PA), Polytetrafluoroethylene (PTFE), Mixed Cellulose Ester (MCE), Polyvinylidene Fluoride (PVDF), Polyether Ether Ketone (PEEK), Others), By Technology (Ultrafiltration, Microfiltration, Nanofiltration, Reverse Osmosis), By Application (Halogenated Solvents, Non-aqueous Solvents, C6 Hydrocarbons or Higher), By End-Use (Chemicals, Pharmaceutical, Food & Beverage, Paints & Coatings, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Asahi Kasei Corporation, SepPure Technologies, BORSIG GmbH, Pall Corporation, Membrane Solutions, LLC., Sartorius AG, Evonik Industries AG, SolSep BV, Novamem Ltd., Hawach Scientific Co., Ltd., Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Industrial Solvent Separation Membranes Market

Published Date : 09 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date