Global Insect Farming Market to Hit $12.3B by 2034 | CAGR 15.8%

Global Insect Farming Market Size, Share, Analysis By By Insect Type (Black Soldier Fly (BSF), Mealworms, Crickets, Others), By Application (Animal Feed, Human Food, Pet Food, Industrial Applications), By Product (Protein Meal, Insect Oil, Whole Insects, Chitin & Derivatives) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

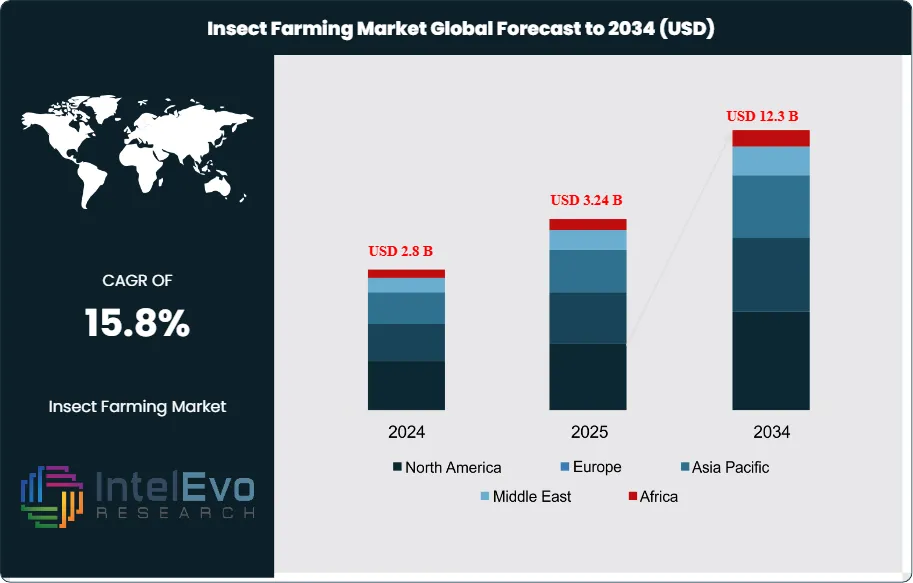

The Global Insect Farming Market is projected to reach approximately USD 12.3 Billion by 2034, up from USD 2.8 Billion in 2024, growing at a CAGR of 15.8% during the forecast period from 2024 to 2034. The Global Insect Farming Market refers to the large-scale cultivation and harvesting of insects such as black soldier flies, mealworms, crickets, and others for use in animal feed, human food, pet food, and various industrial applications. Insect farming leverages the natural efficiency of insects to convert organic waste and low-value biomass into high-quality protein, oils, and micronutrients.

Get More Information about this report -

Request Free Sample ReportThis market is gaining momentum as a sustainable alternative to traditional livestock and fishmeal production, offering significant environmental benefits such as reduced land and water use, lower greenhouse gas emissions, and the ability to upcycle food and agricultural waste. Key drivers of the insect farming market include the rising global demand for sustainable protein sources, increasing pressure on traditional agriculture, and the need for environmentally friendly solutions to feed a growing population.

Insects offer high feed conversion efficiency, rapid growth rates, and the ability to thrive on organic waste, making them an attractive option for both food and feed industries. Regulatory support in regions like Europe, growing consumer acceptance of insect-based products, and advances in automated farming technologies are further accelerating market growth. Additionally, the circular economy benefits of insect farming—such as waste reduction and nutrient recycling—are drawing interest from governments and investors alike.

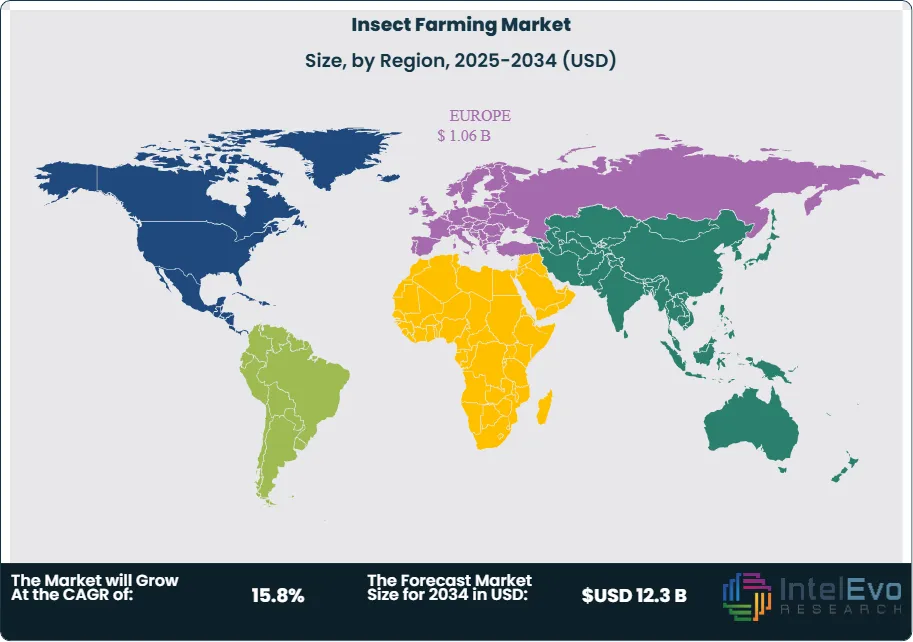

The market is segmented by insect type (black soldier fly, mealworms, crickets, and others), application (animal feed, human food, pet food, and industrial uses), product (protein meal, insect oil, whole insects, and chitin & derivatives), and region (Europe, Asia-Pacific, North America, Latin America, and Middle East & Africa). Black soldier fly dominates due to its high protein yield and waste upcycling ability, while animal feed is the largest application segment, especially in aquaculture and poultry. Protein meal is the primary product, and Europe leads regionally thanks to strong regulatory support and consumer awareness. Europe is the leading region in the global insect farming market, supported by favorable regulations, significant investment in research and development, and early consumer acceptance of insect-based products. Asia-Pacific is the fastest-growing region, driven by traditional insect consumption, rapid urbanization, and population growth, with countries like China, Thailand, and Vietnam at the forefront. North America is expanding quickly as regulatory frameworks evolve and consumer interest in alternative proteins rises. Latin America and the Middle East & Africa are emerging markets, where insect farming is being explored as a solution to food security and sustainable agriculture challenges.

The COVID-19 pandemic had a mixed impact on the insect farming market. While supply chain disruptions and economic uncertainty temporarily slowed the expansion of new facilities and investments, the crisis also heightened awareness of food security and the need for resilient, local protein sources. As a result, interest in sustainable and alternative proteins—including insects—grew among both consumers and producers. The pandemic accelerated digital transformation and automation in insect farming, helping companies adapt to labor shortages and operational challenges.

Geopolitical dynamics influence the insect farming market through trade policies, food safety regulations, and international investment flows. Regulatory harmonization in regions like the European Union has facilitated market growth, while inconsistent regulations in other areas can pose barriers to trade and expansion. Global efforts to address climate change and promote sustainable agriculture are encouraging governments to support insect farming through research funding and policy incentives. However, geopolitical tensions, such as trade disputes or restrictions on agricultural imports and exports, can impact the supply chain and market access for insect-based products.

Key Takeaways

- Market Growth: The Insect Farming Market is expected to reach USD 12.3 Billion by 2034, driven by demand for sustainable protein, animal feed innovation, and circular economy initiatives.

- Product Dominance: Protein meal and oil derived from black soldier fly larvae and mealworms lead the market due to their high nutritional value and versatility.

- Application Dominance: Animal feed is the largest application segment, with aquaculture and poultry industries adopting insect-based feed for improved nutrition and sustainability.

- Drivers: Key drivers include environmental sustainability, resource efficiency, regulatory support, and growing consumer acceptance of insect-based products.

- Restraints: Barriers include regulatory uncertainty in some regions, consumer hesitancy, and challenges in scaling production.

- Opportunities: Growth opportunities lie in pet food, human nutrition, waste management, and the development of novel insect-derived ingredients.

- Trends: Notable trends include the rise of automated insect farming, upcycling of food waste, and the expansion of insect-based products into mainstream retail and foodservice channels.

- Regional Dominance: Europe leads the market, supported by favorable regulations, strong R&D, and early adoption, while Asia-Pacific shows the fastest growth due to traditional insect consumption and rapid urbanization.

Insect Type Analysis

Black Soldier Fly (BSF) holds the largest share of the insect farming market, accounting for approximately 45% of the global market. BSF is favored for its rapid growth cycle, high protein yield, and exceptional ability to upcycle organic waste into valuable protein and oils, making it highly efficient for large-scale production. Mealworms represent about 25% of the market, popular for both animal feed and human food due to their mild flavor, high protein content, and ease of farming. Crickets account for roughly 20%, widely used in human food products such as protein bars, snacks, and powders, especially in North America and Europe where consumer acceptance is rising. Others—including grasshoppers, locusts, and silkworms—make up the remaining 10%, primarily used in niche applications and traditional cuisines in Asia and Africa.

Application Analysis

Animal Feed is the dominant application, comprising nearly 60% of the global insect farming market. Insect protein is increasingly used in aquaculture, poultry, and pet food due to its digestibility, sustainability, and ability to replace fishmeal and soy. Human Food is the fastest-growing segment, currently holding about 20% share, as edible insects gain acceptance in protein-rich snacks, flours, and supplements, particularly in Europe and Asia-Pacific. Pet Food accounts for around 12%, with insect-based pet food gaining traction for its hypoallergenic properties and environmental benefits. Industrial Applications—including fertilizers, bioplastics, and cosmetics—make up the remaining 8%, leveraging insect-derived oils and chitin for various non-food uses.

Region Analysis

Europe leads the global insect farming market with an estimated 38% share, driven by strong regulatory support, significant investment, and high consumer awareness of sustainability. The region’s progressive policies and early adoption have fostered a robust industry ecosystem. Asia-Pacific is the fastest-growing region, currently holding about 32% of the market, propelled by traditional insect consumption, rapid urbanization, and population growth in countries like China, Thailand, and Vietnam. North America accounts for approximately 20%, expanding rapidly as regulatory frameworks evolve and consumer interest in alternative proteins rises, especially in the U.S. and Canada. Latin America & Middle East & Africa collectively represent about 10% of the market, emerging as promising regions with growing interest in sustainable agriculture and food security solutions.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Insect Type

- Black Soldier Fly (BSF)

- Mealworms

- Crickets

- Others

By Application

- Animal Feed

- Human Food

- Pet Food

- Industrial Applications

By Product

- Protein Meal

- Insect Oil

- Whole Insects

- Chitin & Derivatives

By Region

- Europe

- Asia-Pacific

- North America

- Latin America & Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 3.24 B |

| Forecast Revenue (2034) | USD 12.3 B |

| CAGR (2025-2034) | 15.8% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Insect Type (Black Soldier Fly (BSF), Mealworms, Crickets, Others), By Application (Animal Feed, Human Food, Pet Food, Industrial Applications), By Product (Protein Meal, Insect Oil, Whole Insects, Chitin & Derivatives) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Ÿnsect, AgriProtein, Protix, EnviroFlight, InnovaFeed, Entomo Farms, Hexafly, NextProtein, Beta Hatch, Nutrition Technologies |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date