Insect Protein Market Size, Growth Forecast | CAGR of 28.5%

Global Insect Protein Market Size, Share & Analysis By Source (Coleoptera, Lepidoptera, Orthoptera, Hymenoptera, Hemiptera, Other Sources), By Application (Food & Beverages, Animal Nutrition, Pharmaceuticals & Supplements, Personal Care and Cosmetics), By Distribution Channel, Industry Regions & Key Players – Alternative Protein Trends & Forecast 2025–2034

Report Overview

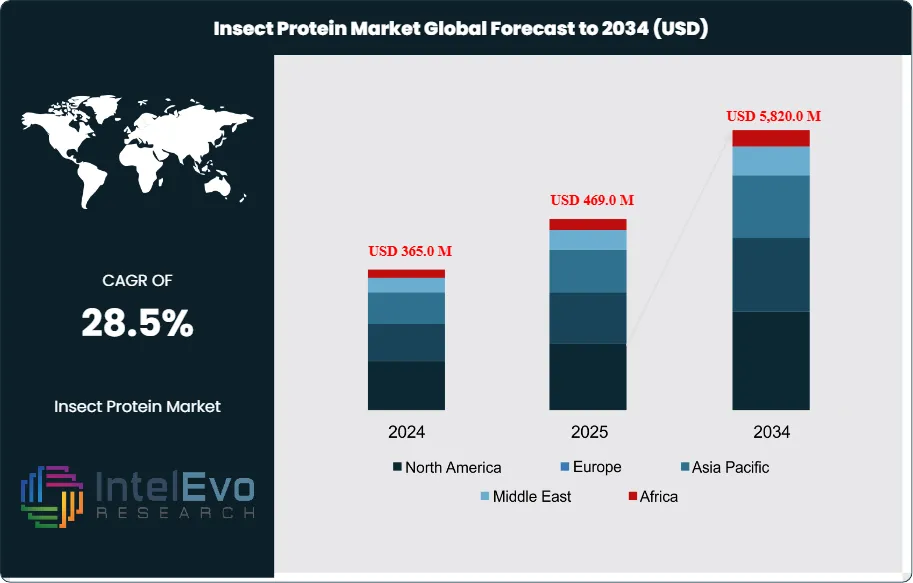

The Insect Protein Market is estimated at USD 365.0 million in 2024 and is on track to reach roughly USD 5,820.0 million by 2034, implying a compound annual growth rate of around 28.5% over 2025–2034. Growing demand for sustainable feed ingredients, advances in black soldier fly (BSF) farming, and rising adoption in premium pet food continue to accelerate market expansion. As global food and feed industries shift toward circular, low-carbon protein sources, insect protein is gaining mainstream relevance across aquaculture, pet nutrition, and functional food applications.

Get More Information about this report -

Request Free Sample ReportInsect protein, once seen as a niche choice, has moved from small-scale production to large-scale manufacturing. This change is driven by the urgent need for sustainable, effective ingredients that can replace traditional soymeal and fishmeal in animal feed. By 2034, the insect protein market is projected to add over USD 5 billion in new value, showing its emergence as a reliable, scalable protein source.

Three main factors are driving this growth. First, insect meal offers strong performance in aquaculture and pet diets by improving gut health, feed conversion rates, and digestibility. This leads to more frequent use. Second, producers can rear larvae at very high densities using food waste and agricultural leftovers, leading to attractive cost advantages as production increases. Third, many consumers are already familiar with insects, with more than 2 billion people worldwide eating them in some form. This cultural basis makes it easier for products like protein powders, bars, and fortified foods to enter the market.

Manufacturers are quickly improving extraction and processing technologies to increase yields and quality consistency. Automated tray handling systems, AI monitoring, and optimized substrate management are becoming common in new facilities. Typical black soldier fly (BSF) and cricket meal products contain 55 to 65% crude protein by dry weight. Precision drying, which aims for 5 to 8% residual moisture, extends shelf life and stabilizes nutrient profiles, while defatting processes recover 25 to 35% insect oil, producing high-value co-products for pet food, oleochemical blends, and specialty industrial formulations.

The regulatory environment is becoming more favorable. The European Union and North America have broadened approvals for insect meal in aquaculture, poultry, swine, and pet food, greatly expanding commercial opportunities. Standardized labeling and safety guidelines are reducing risks for global brands and prompting strategic partnerships with insect protein manufacturers. As compliance improves, major feed producers and consumer brands are increasingly willing to enter into multi-year supply agreements.

However, challenges remain. Variability in feedstock, allergen management requirements, and biosecurity risks can disrupt production. Energy-intensive drying and processing can hurt profit margins during times of high energy costs. Public acceptance of insect protein for human consumption is still behind that for animal feed, necessitating targeted education, clean labeling, and transparent sourcing. These challenges underscore the need for strong supply chain resilience and quality certification programs to maintain long-term competitiveness.

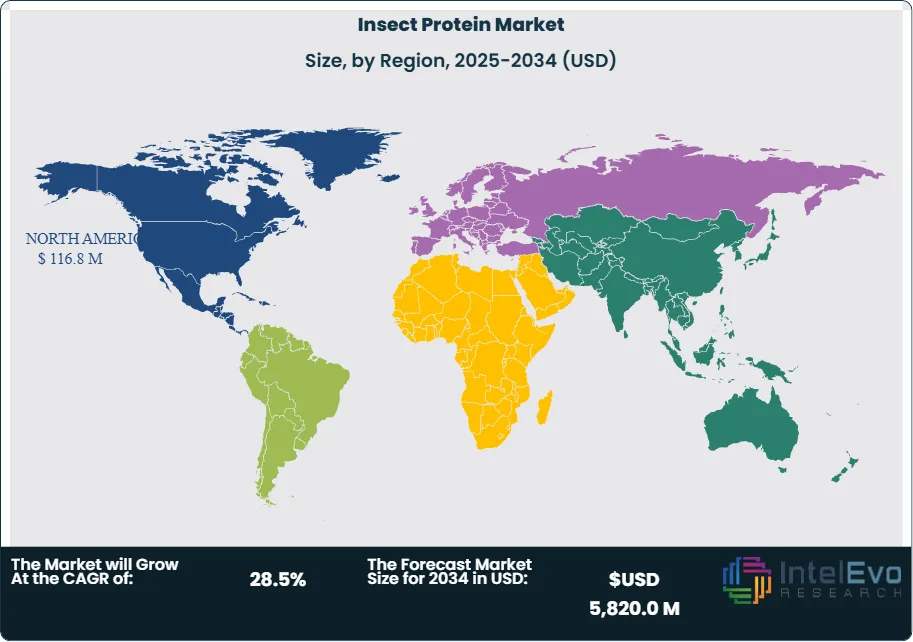

Investment is focusing on Western Europe and North America, where clear regulations, engineering know-how, and long-term agreements provide favorable conditions for growth. The Asia Pacific region is becoming the fastest-growing area due to its large aquaculture sector and access to low-cost feed materials. Africa is also advancing through circular economy projects that turn municipal and agricultural waste into valuable insect protein. For investors and operators, key success factors include production efficiency per square meter, stable substrate contracts, and meeting HACCP, GMP+, and ISO certification standards. Together, these factors will shape the market's strong growth trajectory through 2034.

Key Takeaways

- Market Growth: The global insect protein market reached USD 365.0 million in 2024 and is projected to hit USD 5,820.0 million by 2034, registering a strong CAGR of 28.5%. Growth is driven by rising demand for sustainable protein and increasing applications in feed and food sectors.

- Source Type: Coleoptera (beetles) lead the market due to their high protein yield and adaptability in large-scale processing. Orthoptera species such as crickets and grasshoppers follow closely, favored for human consumption and ease of farming.

- Application: Animal nutrition accounted for the largest revenue share in 2022, driven by demand from aquaculture and poultry feed sectors. Insect-based feed is gaining traction due to superior amino acid profiles and digestibility compared to traditional fishmeal.

- Driver: Regulatory approvals in the EU for insect-based feed in aquaculture and poultry have accelerated market acceptance. The protein conversion efficiency of insects is up to twice that of traditional livestock, making them a cost-effective long-term solution.

- Restraint: High production costs and inconsistent global regulations continue to limit large-scale adoption. Processing costs remain 20–30% higher than soy or fishmeal, impacting competitiveness in price-sensitive markets.

- Opportunity: The food and beverage segment is emerging as a high-growth category, supported by increasing consumer acceptance and protein-rich diet trends. This segment is expected to grow at a CAGR above 35% through 2032.

- Trend: Companies are deploying AI and automation in insect farming to increase output efficiency and reduce labor dependency. For example, Ynsect and Protix have invested in vertical farming systems to streamline production and scale capacity.

- Regional Analysis: Europe leads with over 42% market share, supported by favorable regulations and sustainability goals. The Asia-Pacific region is expanding rapidly, particularly in China and Thailand, due to established insect consumption habits and lower production costs. North America is gaining momentum through startup funding and pilot-scale facilities.

Application Analysis

Animal nutrition remains the largest application segment in the global insect protein market, accounting for over 75% of total revenue in 2022. This dominance is largely driven by the rising demand for sustainable feed ingredients in aquaculture, poultry, and pet food sectors. Insect protein offers high digestibility and a favorable amino acid profile, making it a reliable alternative to traditional protein sources such as fishmeal and soybean meal. Feed producers are incorporating insect protein in powdered and liquid forms to enhance feed efficiency and animal growth performance, particularly in species with high protein demands.

The food and beverage segment is gaining momentum and is projected to be the fastest-growing application through 2030, driven by increasing regulatory approvals and shifting consumer attitudes toward alternative proteins. Countries in Europe, North America, and Southeast Asia have begun authorizing specific insect species for human consumption. This is encouraging the development of insect-based products such as protein bars, meat substitutes, and functional health foods. As food security concerns rise globally, edible insects are being positioned as a viable, resource-efficient protein source for human diets.

Distribution Channel Analysis

Offline distribution channels continue to account for the majority of insect protein sales, particularly in emerging markets where online infrastructure is limited. Supermarkets, specialty retailers, and feed supply stores remain critical points of sale due to their ability to offer direct, bulk purchasing to farmers, food manufacturers, and pet food producers. This channel is projected to maintain a higher growth rate in countries with limited digital penetration and strong local demand for feed-grade protein.

The online segment, however, is expanding steadily and is expected to register a CAGR of 6.4% through 2030. Growth in e-commerce is being supported by increasing consumer interest in niche dietary products and expanding direct-to-consumer business models. Startups in Europe and North America are using online platforms to market insect-based snacks, protein powders, and supplements, particularly to health-conscious and environmentally aware consumers.

Regional Analysis

Europe leads the global insect protein market, accounting for approximately 32% of total revenue in 2024. Strong regulatory frameworks, including the EU’s approval of insect-based feed for aquaculture, poultry, and pigs, have accelerated market adoption. Demand is particularly concentrated in Germany, France, and the UK, where sustainability goals and consumer awareness of alternative proteins are high. The region also benefits from a mature insect farming ecosystem and favorable investment conditions for scale-up technologies.

North America is the second-largest market, supported by growing interest in sustainable nutrition and increasing awareness of the environmental benefits of insect protein. The US and Canada are witnessing increased funding for insect farming startups and expanding pilot-scale production facilities. Regulatory clarity remains a challenge but is gradually improving, opening opportunities for food and feed applications.

Asia Pacific, with its long-standing cultural acceptance of edible insects, is poised for rapid growth. Countries like Thailand, Vietnam, and China are not only large consumers but also major producers of insect-based raw materials. As global players expand their sourcing and processing operations into the region, Asia Pacific is expected to emerge as a key production and export hub in the second half of the decade.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Source

- Coleoptera

- Lepidoptera

- Orthoptera

- Hymenoptera

- Hemiptera

- Other Sources

By Application

- Food & Beverages

- Animal Nutrition

- Pharmaceuticals & Supplements

- Personal Care and Cosmetics

By Distribution Channel

- Online

- Offline

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 365.0 M |

| Forecast Revenue (2034) | USD 5,820.0 M |

| CAGR (2024-2034) | 28.5% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Source (Coleoptera, Lepidoptera, Orthoptera, Hymenoptera, Hemiptera, Other Sources), By Application (Food & Beverages, Animal Nutrition, Pharmaceuticals & Supplements, Personal Care and Cosmetics), By Distribution Channel (Online, Offline) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Protix, Swarm Nutrition GmbH, Aspire Food Group, Insect Technology Group Holdings Limited, Next Protein Inc., Ynsect NL Nutrition & Health B.V., Entomo Farms, Enviro Flight LLC, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date