IoT in Retail Market Size, Share, Trend, Forcast | 25.07% CAGR

Global Internet of Things (IoT) in Retail Market Size, Share, Analysis Component (Services, Hardware - leads, Platform), Technology (Zigbee, Bluetooth Low Energy, Near Field Communication - leads, Others), Deployment (Cloud - leads, On-Premises), Application (Operations Management - leads, Advertising and Marketing, Customer Management, Asset Management, Others) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

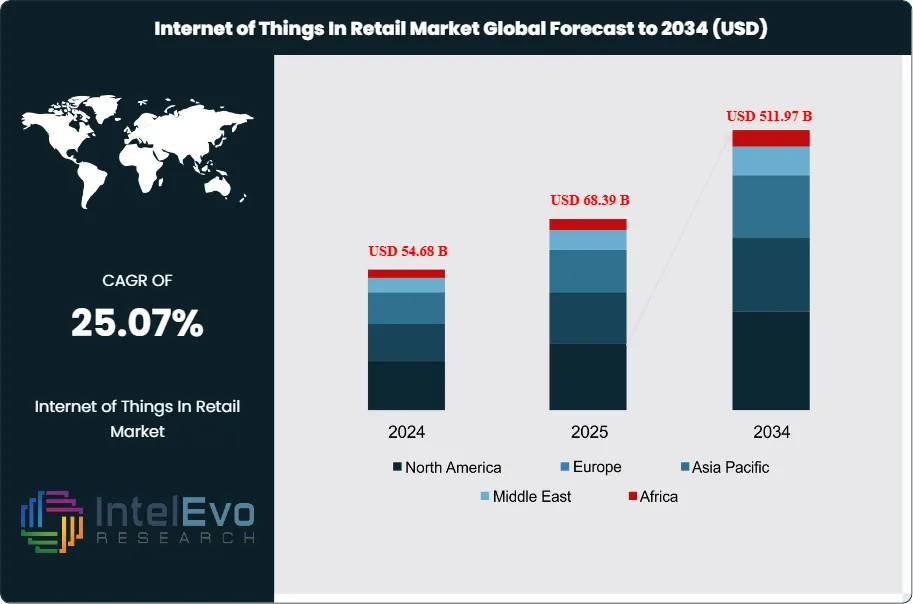

The Internet of Things in Retail Market size is expected to be worth around USD 511.97 Billion by 2034, up from USD 54.68 Billion in 2024, growing at a CAGR of 25.07% during the forecast period from 2024 to 2034. This rapid expansion is driven by widespread adoption of smart shelves, RFID-enabled inventory management, connected point-of-sale systems, and real-time customer analytics. As retailers prioritize omnichannel experiences, loss prevention, and data-driven merchandising, IoT-enabled retail ecosystems are becoming central to digital-first store transformation and competitive differentiation globally.

Get More Information about this report -

Request Free Sample ReportThe Internet of Things (IoT) in retail market represents a transformative technological ecosystem that integrates connected devices, sensors, and digital platforms to revolutionize traditional retail operations. This market encompasses hardware components, software platforms, and services that enable real-time data collection, analysis, and automation across various retail touchpoints. The global IoT in retail market is demonstrating exceptional growth potential driven by digital transformation initiatives and evolving consumer expectations.

Key factors affecting the market include the increasing adoption of omnichannel retail strategies, rising demand for personalized shopping experiences, and the need for operational efficiency through automated inventory management and supply chain optimization. The proliferation of smartphones, improved internet connectivity, and the advent of 5G technology are creating favorable conditions for IoT deployment in retail environments. Additionally, the COVID-19 pandemic has accelerated digital adoption, with retailers seeking contactless solutions and enhanced customer analytics to navigate changing consumer behaviors and preferences.

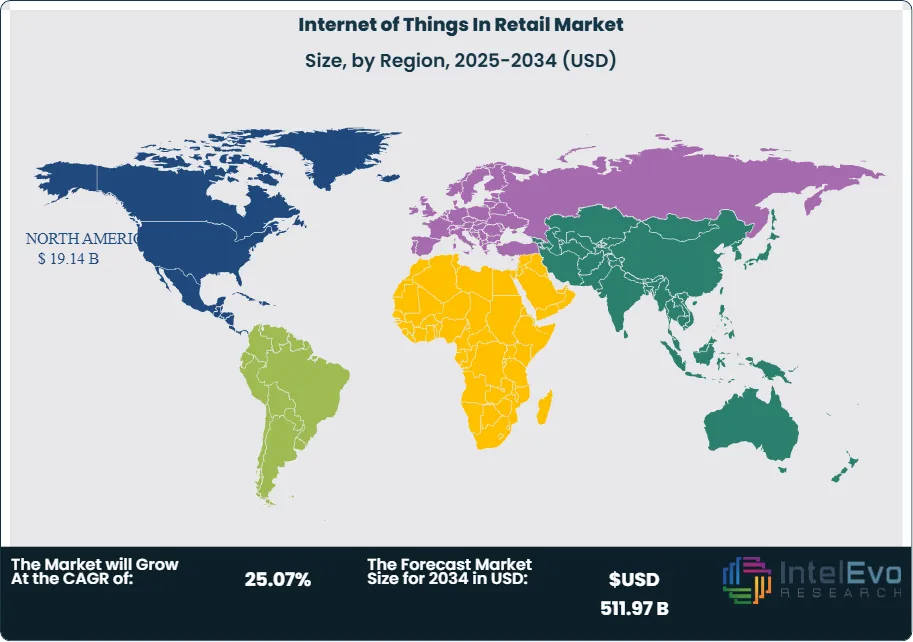

Regional Analysis: North America IoT in Retail Market hold the largest market share owing to the presence of major players, increasing adoption of advanced technologies in the retail sector, and tech-savvy consumer base. The region benefits from mature retail infrastructure, favorable regulatory environment, and strong consumer demand for personalized experiences, positioning it as the global leader in IoT retail adoption.

The pandemic significantly accelerated IoT adoption in retail as businesses sought to minimize human contact, automate operations, and gain deeper insights into rapidly changing consumer behaviors. Retailers implemented contactless payment systems, automated inventory management, and enhanced customer tracking solutions to maintain operations during lockdowns. The crisis highlighted the importance of digital transformation and real-time data analytics, driving increased investments in IoT infrastructure and creating new opportunities for market expansion.

Global trade tensions and regional conflicts, particularly between major economies like the US and China, have created challenges for IoT retail market growth through supply chain disruptions and increased tariffs on electronic components. These geopolitical factors have forced retailers to diversify their technology suppliers and consider regional manufacturing options, potentially increasing costs but also driving innovation in local IoT solutions. Trade restrictions on semiconductor components and telecommunications equipment have impacted the availability and pricing of IoT devices, leading to strategic shifts in vendor relationships and technology partnerships within the retail sector.

Key Takeaways

- Market Growth: The Internet of Things In Retail Market is expected to reach USD 511.97 Billion by 2034, due to increased digitalization and customer-centric strategies.

- Component Dominance: Hardware components dominate the market due to high demand for sensors, beacons, and RFID systems for smart inventory and customer tracking.

- Technology Dominance: Near Field Communication (NFC) leads the technology segment, enabling fast, secure, and contactless transactions.

- Deployment Dominance: Cloud deployment holds the largest market share owing to scalability, cost-effectiveness, and remote accessibility.

- Application Dominance: Operations management is the leading application, leveraging IoT for real-time monitoring, asset tracking, and process automation.

- Driver: The increasing demand for personalized shopping experiences is a major driver, prompting investments in IoT-powered analytics.

- Restraint: Concerns over data privacy and high implementation costs are significant barriers to widespread adoption.

- Opportunity: The rise in omni channel retailing and integration of AI with IoT devices offer strong growth opportunities.

- Trend: Retailers are adopting smart shelves, digital signage, and customer engagement platforms driven by real-time analytics.

- Regional Analysis: North America remains the leader due to a mature retail ecosystem and early technology adoption, while Asia-Pacific is the fastest-growing market.

Component Analysis:

Hardware forms the backbone of IoT infrastructure in retail. This includes sensors, RFID tags, beacons, cameras, and connected point-of-sale systems. The proliferation of cost-efficient, compact, and intelligent sensors has made hardware the largest revenue-generating component in the IoT retail ecosystem. Retailers are increasingly deploying hardware for real-time inventory monitoring, store surveillance, and customer behavior analytics. RFID tags help manage stock levels, reduce theft, and enable seamless checkout experiences. Smart shelves with weight sensors alert when products need restocking, minimizing manual interventions. These applications underline the indispensable role of hardware in transforming traditional retail models.

Technology Analysis:

Near Field Communication (NFC) technology leads the technology segment due to its wide use in mobile payments and customer interaction. NFC allows short-range communication between compatible devices, which is essential for secure and contactless transactions. The rise of digital wallets like Apple Pay and Google Pay has fueled the demand for NFC-enabled systems in stores. Additionally, NFC is used in loyalty programs, product information delivery, and in-store navigation, enhancing customer engagement. Its low power consumption, fast connectivity, and easy integration with mobile apps make it highly suitable for retail environments.

Deployment Analysis:

Cloud-based deployment models dominate due to their scalability, remote accessibility, and cost-efficiency. Cloud solutions allow centralized data management, real-time analytics, and easy integration with mobile and web-based applications. Retailers can quickly scale services based on demand and ensure business continuity with minimal IT overhead. Cloud platforms also facilitate remote monitoring and control of in-store devices, which is crucial for geographically distributed operations. The ongoing shift towards Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) models further supports cloud adoption.

Application Analysis:

Operations Management Leads With nearly 37% Market Share In Internet of Things In Retail Market

Operations management is the most significant application of IoT in retail, leveraging connected devices to streamline workflows, automate inventory systems, and monitor equipment health. Retailers deploy IoT solutions for predictive maintenance, energy optimization, and real-time asset tracking. Smart HVAC systems, lighting controls, and refrigeration monitoring help reduce operational costs. Additionally, IoT supports dynamic staffing and automated supply replenishment, improving efficiency and reducing downtime. Operations management not only improves backend processes but also ensures better customer experiences through efficient service delivery.

Region Analysis:

North America Leads With over 35% Market Share In Internet of Things In Retail Market. North America leads the global IoT in retail market, holding the largest market share due to the presence of major players, increasing adoption of advanced technologies in the retail sector, and a tech-savvy consumer base. The region's mature retail infrastructure, favorable regulatory environment, and strong consumer demand for personalized experiences create optimal conditions for IoT adoption. The widespread availability of high-speed internet and rapid cloud adoption create a strong foundation for IoT devices, with leading IoT technology providers in the region driving innovation and accessibility in the retail sector.

Europe represents the second-largest market, driven by stringent data privacy regulations that, while creating compliance challenges, also build consumer trust in IoT solutions. The region's focus on sustainability and energy efficiency aligns with IoT capabilities for optimizing resource usage and reducing waste. Asia-Pacific shows the highest growth potential due to rapid urbanization, expanding middle class populations, and increasing smartphone penetration. Countries like China and India are investing heavily in digital infrastructure, creating opportunities for IoT retail solutions.

Get More Information about this report -

Request Free Sample ReportKey Market Segment:

Component

- Services

- Hardware - leads

- Platform

Technology

- Zigbee

- Bluetooth Low Energy

- Near Field Communication - leads

- Others

Deployment

- Cloud - leads

- On-Premises

Application

- Operations Management - leads

- Advertising and Marketing

- Customer Management

- Asset Management

- Others

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 68.39 B |

| Forecast Revenue (2034) | USD 511.97 B |

| CAGR (2025-2034) | 25.07% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component (Services, Hardware - leads, Platform), Technology (Zigbee, Bluetooth Low Energy, Near Field Communication - leads, Others), Deployment (Cloud - leads, On-Premises), Application (Operations Management - leads, Advertising and Marketing, Customer Management, Asset Management, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Losant IoT, Cisco Systems Inc., IBM Corporation, Arm Limited, Intel Corporation, Verizon Communications Inc., SAP SE, Microsoft Corporation, Google LLC, NXP Semiconductors., Oracle Corporation, RETAILNEXT, INC., PTC Inc., Zebra Technologies Corp. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Internet of Things In Retail Market

Published Date : 21 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date