Intraocular Lens Market Size, Growth Trends & Forecast | CAGR 6.4%

Global Intraocular Lens (IOL) Market Size, Share & Ophthalmology Analysis By Product Type (Monofocal, Multifocal, Toric, EDOF), By Material, By End User (Hospitals, Eye Clinics), Cataract Surgery Volumes, Aging Population Impact, Premium Lens Adoption, Regional Healthcare Trends, Key Companies & Forecast 2025–2034

Report Overview

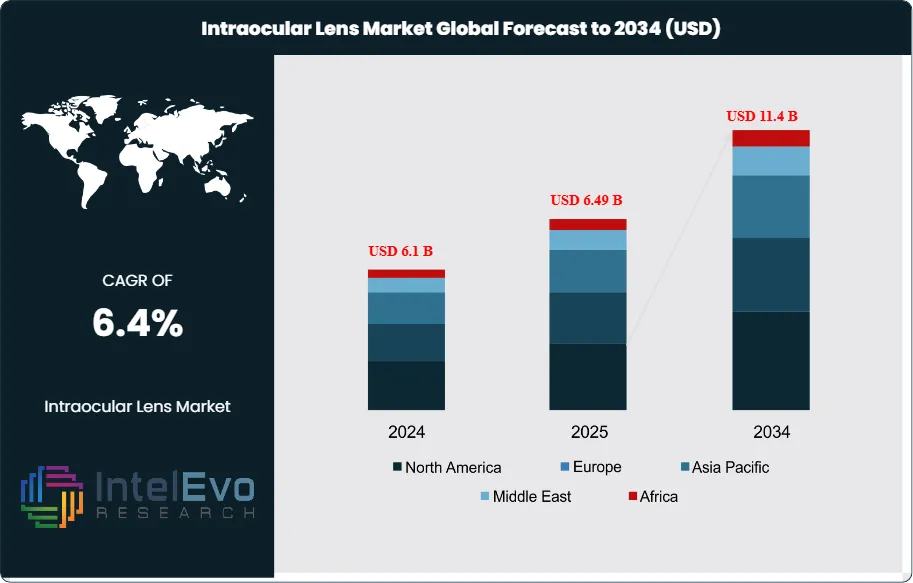

The Intraocular Lens (IOL) Market is estimated at USD 6.1 billion in 2024 and is projected to reach approximately USD 11.4 billion by 2034, registering a compound annual growth rate (CAGR) of about 6.4% during 2025–2034. This sustained expansion is driven by the rising global prevalence of cataracts, rapid growth in the aging population, and increasing adoption of advanced premium IOLs such as multifocal, toric, and extended depth-of-focus lenses. Technological advancements in lens materials and designs, along with higher cataract surgery volumes across emerging and developed markets, are further strengthening demand. Additionally, improving access to ophthalmic care and growing patient preference for vision-correcting solutions that reduce dependence on spectacles are supporting long-term market momentum.

Get More Information about this report -

Request Free Sample ReportThe market has expanded steadily over the past decade, supported by rising surgical volumes and broader access to ophthalmic care. Cataracts remain the leading cause of blindness worldwide, accounting for nearly 45% of global visual impairment cases, and the rising prevalence of age-related eye disorders continues to drive demand for intraocular lens (IOL) procedures. In 2023, more than 28 million cataract surgeries were performed globally, and this figure is projected to exceed 40 million annually by 2033, underscoring the scale of opportunity for IOL manufacturers.

Growth is reinforced by favorable reimbursement frameworks, government-backed initiatives to reduce surgical backlogs, and expanding healthcare infrastructure in emerging economies. Demand-side factors include an aging population, higher life expectancy, and growing awareness of preventive eye care. On the supply side, manufacturers are introducing advanced lens designs, including toric and multifocal IOLs, which improve visual outcomes and reduce dependence on corrective eyewear. However, pricing pressures, regulatory scrutiny, and uneven access to skilled ophthalmic surgeons remain key challenges that could temper growth in certain markets.

Technology is reshaping adoption patterns. Digital surgical platforms, femtosecond laser-assisted cataract surgery, and AI-driven diagnostic tools are improving precision and patient outcomes. Premium IOLs, which command higher margins, are gaining traction in developed markets, while cost-effective monofocal lenses continue to dominate in lower-income regions. The integration of real-time imaging and automated surgical guidance is expected to accelerate adoption of advanced IOLs over the forecast horizon.

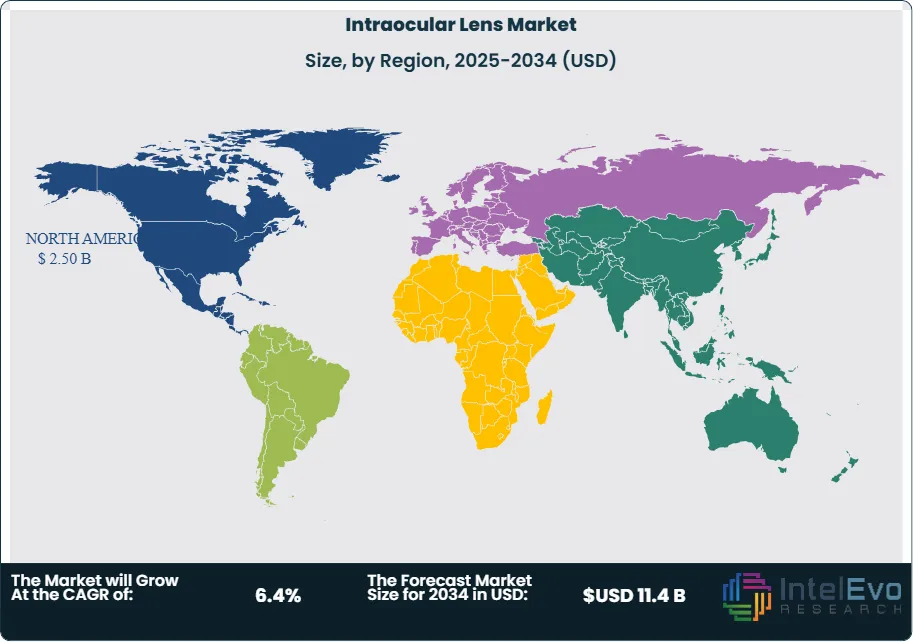

Regionally, North America and Europe remain the largest markets, supported by high surgical penetration rates and strong reimbursement systems. Asia-Pacific is emerging as the fastest-growing region, with China and India accounting for a significant share of global cataract surgeries due to large patient pools and expanding public health programs. Latin America and the Middle East are also gaining attention as investment hotspots, where rising healthcare expenditure and private sector participation are creating new opportunities. For investors, the combination of demographic shifts, technological progress, and policy support positions the intraocular lens market as a resilient growth sector through 2034.

Key Takeaways

- Market Growth: The global intraocular lens (IOL) market stood at USD 6.1 billion in 2024 and is anticipated to climb to USD 11.4 billion by 2034, advancing at a CAGR of 6.4%. Market expansion is underpinned by the growing incidence of cataracts, a steady rise in surgical procedures, and supportive reimbursement frameworks that encourage adoption.

- Product Type: Multifocal intraocular lenses accounted for 56.9% of global revenue in 2023. Their ability to correct presbyopia and reduce dependence on spectacles has driven adoption, particularly in developed markets.

- Material: Hydrophobic acrylic lenses represented 39.3% of the market in 2023. Their high refractive index, lower risk of posterior capsule opacification, and ease of surgical insertion make them the preferred choice among ophthalmic surgeons.

- Driver: Rising cataract incidence, with over 28 million surgeries performed globally in 2023, is the primary growth driver. Government initiatives to reduce surgical backlogs and expand access to ophthalmic care further accelerate demand.

- Restraint: High costs of premium IOLs, which can be two to three times more expensive than monofocal lenses, limit adoption in low- and middle-income countries. Unequal access to skilled ophthalmic surgeons also constrains penetration in emerging markets.

- Opportunity: Asia-Pacific is expected to record the fastest CAGR of over 7% through 2033. Expanding healthcare infrastructure in India and China, coupled with large patient pools, positions the region as a key investment hotspot.

- Trend: Adoption of premium IOLs, including toric and extended depth-of-focus lenses, is rising. Companies such as Alcon and Johnson & Johnson Vision are investing in AI-assisted surgical platforms and femtosecond laser technologies to improve precision and outcomes.

- Regional Analysis: North America led with 41.3% of global revenue in 2023, supported by high surgical penetration and favorable insurance coverage. Asia-Pacific is emerging as the fastest-growing region, while Latin America and the Middle East are gaining traction due to rising healthcare expenditure and private sector participation.

Type Analysis

The intraocular lens market in 2025 continues to be led by multifocal lenses, which accounted for more than 56% of global revenue in 2023 and are projected to maintain dominance through the next decade. Their ability to provide clear vision across multiple focal points has made them the preferred choice for patients seeking spectacle independence after cataract surgery. Rising adoption in developed markets, where premium lens categories are gaining traction, is expected to sustain growth.

Toric intraocular lenses represent the second-largest segment and are forecast to expand at one of the fastest rates through 2033. These lenses address moderate to high astigmatism, a condition affecting nearly 30% of cataract patients worldwide. By reducing or eliminating the need for additional corrective procedures, toric IOLs are increasingly favored by both surgeons and patients. Monofocal and accommodative lenses continue to serve large patient pools, particularly in cost-sensitive markets, but their growth is expected to be slower compared with premium lens categories.

Material Analysis

Hydrophobic acrylic materials remain the leading choice, capturing over 39% of the market in 2023 and projected to expand further by 2033. Their low water content, high refractive index, and foldable properties make them well-suited for minimally invasive cataract procedures. Clinical studies confirm that hydrophobic acrylic lenses reduce the risk of posterior capsule opacification, a common complication, which further strengthens their adoption.

Polymethylmethacrylate (PMMA) lenses, while less advanced, continue to hold a significant share due to their affordability. PMMA was the first material used in IOL production and remains widely adopted in lower-income regions where cost is a critical factor. Europe and parts of Asia still rely on PMMA lenses for large-scale cataract programs. Silicone and hydrophilic acrylic lenses occupy smaller shares but are expected to see steady uptake in niche applications where flexibility and biocompatibility are valued.

End-Use Analysis

Hospitals accounted for more than 55% of global intraocular lens procedures in 2023 and remain the dominant end-use segment in 2025. High surgical volumes, advanced infrastructure, and access to skilled ophthalmologists make hospitals the primary setting for cataract and refractive surgeries. Favorable reimbursement policies in North America and Europe further reinforce this dominance.

Ophthalmology clinics are expanding rapidly in Asia-Pacific and Latin America, where independent practices are meeting rising demand for affordable eye care. These clinics are expected to capture a growing share of procedures, particularly in urban centers. Eye research institutes and academic centers are also playing a larger role, supported by government and private funding for clinical trials and product development. Ambulatory surgery centers, especially in the United States, are gaining traction due to shorter recovery times and lower costs compared with hospital-based procedures.

Regional Analysis

North America led the global market in 2023 with a 41% share, valued at nearly USD 2.0 billion, and is expected to maintain leadership through 2033. High adoption of premium IOLs, strong insurance coverage, and rapid regulatory approvals for advanced products underpin this position. The United States remains the largest contributor, with cataract surgeries exceeding 4 million annually.

Europe is the second-largest market, supported by widespread use of femtosecond laser-assisted cataract surgery and rising adoption of toric and multifocal lenses. The prevalence of cataracts among individuals over 70 years of age exceeds 60% in several countries, creating sustained demand. Germany, France, and the UK are the key revenue contributors.

Asia-Pacific is projected to record the fastest CAGR, exceeding 7% through 2033. The region’s large geriatric population, particularly in China and India, combined with expanding healthcare infrastructure, is driving growth. Latin America is showing steady progress, with Brazil and Mexico leading adoption. In contrast, the Middle East and Africa are expected to grow at a slower pace due to limited reimbursement frameworks and lower awareness, although private sector investment is gradually improving access to advanced eye care solutions.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Type

- Monofocal Intraocular Lens

- Multifocal Intraocular Lens

- Toric Intraocular Lens

- Accommodative Intraocular Lens

By Material

- Polymethylmethacrylate

- Silicone

- Hydrophobic and Hydrophilic Acrylic Materials

- Other Materials

By End-Users

- Hospitals

- Ophthalmology Clinics

- Eye Research Institutes

- Ambulatory Surgery Centers

- Other End-Users

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 6.1 B |

| Forecast Revenue (2034) | USD 11.4 B |

| CAGR (2024-2034) | 6.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Monofocal Intraocular Lens, Multifocal Intraocular Lens, Toric Intraocular Lens, Accommodative Intraocular Lens), By Material (Polymethylmethacrylate, Silicone, Hydrophobic and Hydrophilic Acrylic Materials, Other Materials), By End-Users (Hospitals, Ophthalmology Clinics, Eye Research Institutes, Ambulatory Surgery Centers, Other End-Users) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | HOYA CORPORATION, Aurolab, Truviz Ophthalmic, Johnson and Johnson Vision Care, Inc., Global Ophthalmic Pvt. Ltd., HumanOptics AG, EyeKon Medical, Inc., Appasamy Associates, STAAR Surgical Company, Alcon, Inc., Care Group Sight Solution Pvt. Ltd., Bausch & Lomb Incorporated, Dahlgren India, Omni Lens Pvt Ltd, Lenstec, Inc., Carl Zeiss Meditec AG, NanoVision, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date