Investment Banking Market Size, Growth | CAGR 11.2%

Global Investment Banking Market Size, Share & Analysis By Service Type (Mergers and Acquisitions (M&A) Advisory, Debt Capital Markets, Equity Capital Markets, Syndicated Loans, Other Service Types), By End-User (Corporate Clients, Institutional Investors, Government and Public Sector, Individuals), By Deal Size, By Region Industry Overview, Fee Pool Dynamics, Competitive Benchmarking, Digitalization Trends & Forecast 2025–2034

Report Overview

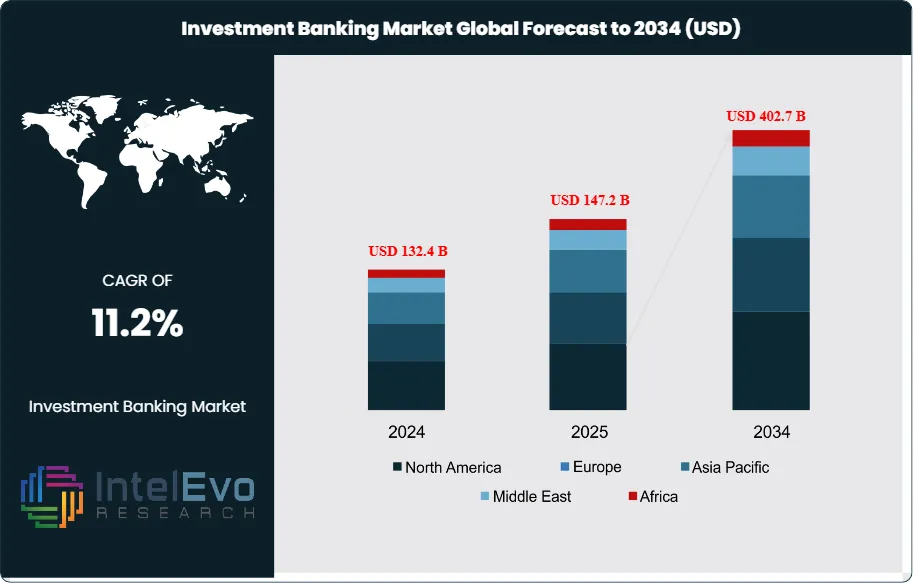

The Investment Banking Market is valued at approximately USD 132.4 billion in 2024 and is projected to reach nearly USD 402.7 billion by 2034, registering a robust CAGR of around 11.2% during 2025–2034. Growing deal activity in private markets, digital banking transformation, and rising cross-border M&A are reshaping global investment banking demand. With AI-driven analytics, automated advisory tools, and sovereign wealth fund expansion accelerating capital flows, the sector is entering a new phase of high-value strategic transactions and technology-enabled dealmaking.

Get More Information about this report -

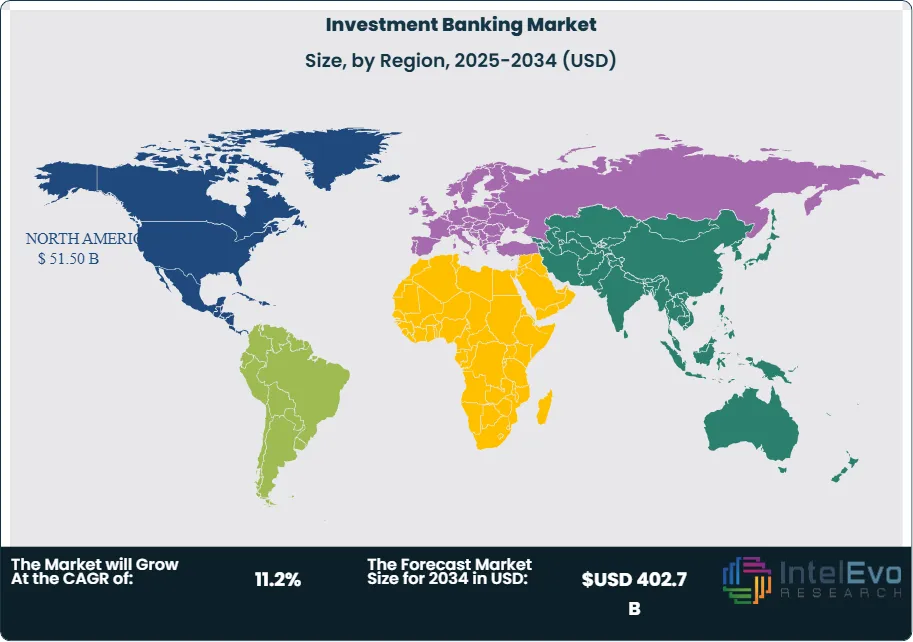

Request Free Sample ReportThe fee pool has expanded materially from its pandemic-era trough as equity issuance normalizes, debt capital markets reopen across investment-grade and high-yield tiers, and advisory pipelines remain elevated on the back of portfolio reshaping, carve-outs, and cross-border consolidation. North America retains clear primacy with a 38.9% revenue share—about USD 47.26 billion in 2023—supported by deep capital markets, robust private credit participation, and resilient corporate balance sheets. At the top end of the industry, scale advantages persist: the largest U.S. bank by market capitalization stood at USD 491.76 billion (assets: USD 3.744 trillion as of January 2024), underscoring the capital firepower and technology investment capacity shaping competitive dynamics.

Demand-side drivers include renewed CEO confidence, secular capex in energy transition and digital infrastructure, and the rise of private capital as both financing partner and buyer of assets. On the supply side, improved underwriting backlogs and tighter spreads are expanding deal viability, while balance-sheet optimization and risk transfer to private markets are freeing capacity. Policy and multilateral flows add momentum: the IFC’s record USD 56 billion commitment in FY2024 to private companies and financial institutions, the World Bank’s USD 1.5 billion for India’s low-carbon projects, and the ADB’s lending capacity exceeding USD 20 billion illustrate a durable pipeline in sustainable finance and emerging-market development.

Technological innovation is accelerating adoption and productivity. AI-enabled origination and diligence, model-driven pricing for syndications, digital client onboarding, and algorithmic execution are compressing cycle times and improving hit rates. Advanced analytics in market-making and risk transfer are also sharpening capital allocation, while tokenization of assets and real-time settlement remain watch areas for scalability and regulatory clarity. Key challenges persist: revenue cyclicality tied to rates and volatility, heavier conduct and capital requirements, cyber and model risk, and competition from fintechs and private platforms that disintermediate traditional workflows.

Regionally, North America will remain the anchor market, but investors should watch Asia—particularly India and ASEAN—where reform, infrastructure financing, and domestic capital formation are accelerating. Select EMEA hubs and the Gulf are poised to gain share via sovereign-led diversification and listings. Overall, the market’s trajectory reflects structurally broader participation, deeper sustainability mandates, and a technology-driven shift toward higher-velocity, insights-led banking.

Key Takeaways

- Market Growth: The global Investment Banking market totaled USD 132.4 billion in 2024 and is projected to reach USD 402.7 billion by 2034 at a 11.2% CAGR (2025–2034), supported by reopening equity/debt issuance windows, robust advisory pipelines, and financing tied to energy transition and digital infrastructure.

- Service Type (M&A Advisory): M&A Advisory led with 40.5% share in 2023, equivalent to roughly USD 49.2 billion of fee pool, reflecting portfolio reshaping, carve-outs, and cross-border consolidation that continue to drive high-value advisory mandates.

- End User (Corporate Clients): Corporate clients accounted for 47.5% in 2023 (about USD 57.7 billion), underpinned by balance-sheet optimization, refinancing, and transformation programs that sustain multi-product mandates across advisory, ECM, and DCM.

- Driver: Depth of capital markets remains a core growth engine—North America contributed 38.9% of global fees (about USD 47.26 billion in 2023)—while policy/multilateral flows (e.g., large-scale commitments to private-sector projects) expand pipelines in emerging markets and sustainability-linked finance.

- Restraint: The industry’s revenue cyclicality and regional concentration elevate sensitivity to macro shocks; for example, a 5-percentage-point swing in North America’s share would shift roughly USD 6.1 billion of the 2023 global fee pool, pressuring utilization, staffing, and risk appetite.

- Opportunity: APAC expansion and sustainable finance represent outsized upside; if APAC’s market share rises by 3–5 percentage points by 2033, this translates to ~USD 9.5–15.9 billion incremental annual fees on the 2033 market base, with green/transition financing and domestic listings as key catalysts.

- Trend: Digitization and AI-enabled workflows (deal origination, diligence, KYC/AML, and execution) are compressing cycle times and boosting hit rates, while sustainability-linked and transition instruments broaden addressable fee pools as issuers target lower funding costs and investors seek measurable ESG outcomes.

- Regional Analysis: North America remains the anchor at 38.9% of revenues given deep liquidity and private-capital participation; Asia (notably India and ASEAN) is set to outpace global growth on reforms, infrastructure finance, and active IPO calendars, while EMEA/Gulf benefit from sovereign-led diversification and listings momentum.

Type Analysis

M&A advisory remains the anchor product, accounting for an estimated ~40.5% of fee pools in 2023 and benefiting from a visible pipeline of portfolio realignments, carve-outs, and cross-border consolidation. After a cyclical trough, global M&A activity reaccelerated in late 2024 and into 2025—M&A value was up ~9% YTD to US$2.82 trillion by November 2024, setting the stage for stronger advisory revenues as financing markets normalize and boardroom confidence improves.

Debt Capital Markets (DCM) are set to be the volume workhorse through 2025–2026 as issuers tackle the refinancing wall. Investment-grade bond issuance reached ~US$1.5 trillion in 2024 (+~24% YoY), while high-yield issuance recovered to ~US$302 billion, aided by tighter spreads and robust demand; rating agencies forecast another year of issuance growth in 2025. The structural context is supportive: outstanding global corporate bonds climbed to ~US$35 trillion by end-2024. Syndicated lending also surged—global syndicated loans hit a record ~US$5.9 trillion in 2024 (+32% YoY)—underpinned by acquisition finance and large recapitalizations, with CLO demand reinforcing bank distribution capacity.

Equity Capital Markets (ECM) are gradually reopening. Global IPO proceeds totaled ~US$121 billion across 1,215 deals in 2024, then improved in H1-2025 to US$61.4 billion (+17% YoY), with record cross-border flows into U.S. venues. “Other” services—restructuring, fairness opinions, and strategic advisory—remain counter-cyclical buffers and are increasingly data- and AI-enabled, enhancing pitch conversion and diligence efficiency across the product suite.

Application Analysis

Strategic advisory and restructuring services are regaining momentum as CFOs optimize portfolios, exit noncore assets, and address higher-for-longer funding costs. Board-level mandates are increasingly tied to value-creation programs and synergy realization, sustaining fee density even when issuance windows are uneven. The rebound in announced deal value since late 2024 suggests a healthier conversion pipeline for 2025 closings as financing conditions stabilize.

Capital raising and refinancing applications dominate near-term activity. Issuers are front-loading 2025–2026 maturities into favorable windows, reflected in the ~US$1.5 trillion IG and ~US$302 billion HY prints in 2024 and rating-agency expectations for continued growth in 2025. IPOs and follow-ons are selectively active—H1-2025 IPO proceeds rose 17% YoY—with cross-border listings and sector-specific themes (industrial tech, energy transition) leading.

Sustainability-linked and transition finance remain a structural application across DCM and ECM. While definitions and disclosure standards continue to evolve, investor demand for credible transition pathways and use-of-proceeds transparency is supporting steady deal flow and premium pricing for high-quality issuers, particularly in Europe and parts of Asia.

End-Use Analysis

Corporate clients are the largest demand pool (about ~47.5% share in 2023), leveraging multi-product mandates that combine M&A advisory with bridge-to-bond/refi strategies. The reopening of new-money and liability-management windows—plus healthy equity follow-ons (global equity issuance rose ~21.5% in 2024)—has reinforced wallet concentration among frequent issuers.

Institutional investors (pension funds, insurers, asset managers) drive underwriting depth and secondary liquidity. Their role is expanding via alternatives and private credit allocations; notably, U.S. CLO new-issue volume reached ~US$202 billion in 2024, while CLO ETF AUM grew from ~US$6.3 billion (Dec-2023) to ~US$22.5 billion (Dec-2024) and ~US$32 billion by mid-2025, buttressing demand for broadly syndicated loans.

Government & public sector clients remain pivotal for sovereign, agency, and infrastructure issuance, using banks for structuring, ESG labeling, and cross-jurisdictional distribution. Individuals/entrepreneurs and family offices—though a smaller slice—are increasingly active in pre-IPO placements, SPAC-like alternatives, and secondary blocks, aided by digital access and the institutionalization of private-markets platforms.

Regional Analysis

North America retains primacy with a ~38.9% revenue share (about US$51.50 billion in 2024), underpinned by deep dollar liquidity, private-capital participation, and outsized structured-finance activity that reached post-crisis highs in 2024. Europe remains a diversified fee pool with strong ESG issuance and a rapidly expanding private-credit ecosystem; European CLO issuance nearly doubled in 2024 as investors chased yield, and lawyers structured more complex private-credit deals across fragmented jurisdictions.

Asia Pacific is the key growth theatre. H1-2025 saw US$61.4 billion in IPO proceeds globally (+17% YoY) with high cross-border participation; India’s IPO market set a 2024 record at ~US$20.5 billion and carries a strong 2025 pipeline, signaling continued wallet mix shift toward APAC exchanges and depository receipts. Latin America and the Middle East & Africa are emerging hotspots, supported by sovereign diversification agendas, privatizations, and infrastructure finance, albeit with higher policy and FX risk premia.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Service Type

- Mergers and Acquisitions (M&A) Advisory

- Debt Capital Markets

- Equity Capital Markets

- Syndicated Loans

- Other Service Types

By End-User

- Corporate Clients

- Institutional Investors

- Government and Public Sector

- Individuals

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 132.4 B |

| Forecast Revenue (2034) | USD 402.7 B |

| CAGR (2024-2034) | 11.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Service Type (Mergers and Acquisitions (M&A) Advisory, Debt Capital Markets, Equity Capital Markets, Syndicated Loans, Other Service Types), By End-User (Corporate Clients, Institutional Investors, Government and Public Sector, Individuals) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Deutsche Bank AG, Citigroup Inc., Nomura Holdings, Inc., Goldman Sachs Group, Inc., UBS Group AG, Barclays PLC, HSBC Holdings plc, Morgan Stanley, BNP Paribas, JPMorgan Chase & Co., Wells Fargo, Credit Suisse Group, Bank of America Corporation, Other Key Player |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date