IR Website Builder Software to Hit $668.4M by 2034 | CAGR of 12.9%

Global Investor Relations (IR) Website Builder Software Market Size, Share, Analysis Report By Component (Services, Software) Deployment Mode (Cloud, On-Premises) Enterprise Size (Large Enterprises, Small and Medium Enterprises) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

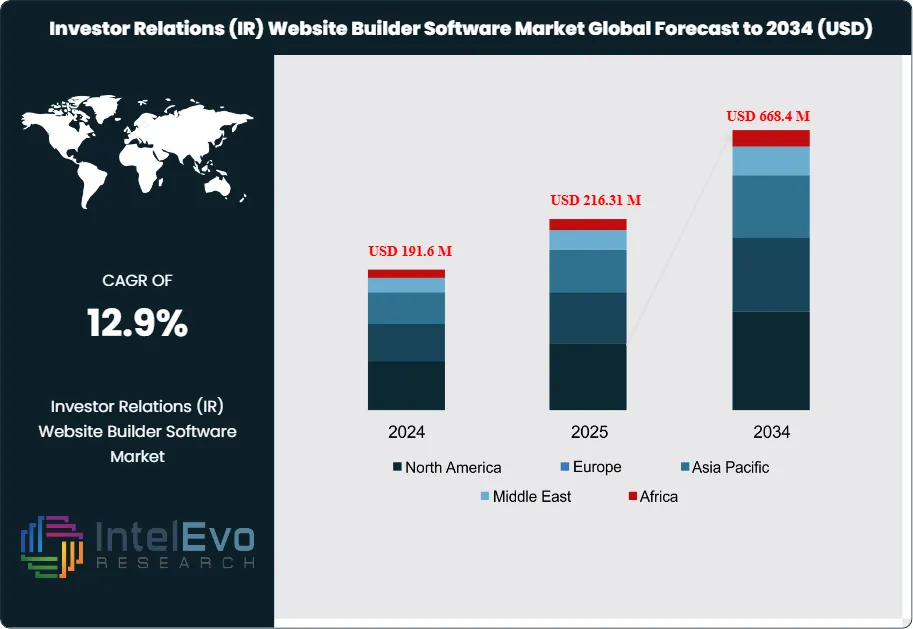

The Investor Relations (IR) Website Builder Software Market size is projected to reach approximately USD 668.4 Million by 2034, up from USD 191.6 Million in 2024, growing at a steady CAGR of 12.9% during the forecast period from 2025 to 2034. The rising emphasis on corporate transparency, digital-first communication strategies, and real-time investor engagement is driving the rapid adoption of IR website builder platforms. As public companies and startups focus on strengthening investor confidence through AI-driven analytics, interactive dashboards, and responsive design, demand for innovative IR web solutions is expected to accelerate globally. This trend highlights the growing intersection of technology and finance, positioning IR website platforms as a core element of modern corporate communication.

Get More Information about this report -

Request Free Sample ReportThe Investor Relations (IR) Website Builder Software Market is witnessing significant momentum, driven by the rising demand for transparent and timely financial communication, stricter compliance regulations, and the increasing expectations of investors.

These platforms empower organizations to create interactive, secure, and customizable websites that serve as a central hub for financial disclosures, earnings announcements, investor presentations, and ESG (Environmental, Social, and Governance) updates. The market is broadly segmented into software and services, with software capturing a larger share owing to its ability to automate content management, provide real-time updates, and integrate seamlessly with CRM and analytics tools. The availability of cloud-based deployment options has further accelerated adoption due to their affordability, scalability, and ease of remote access.

Organizations ranging from large public enterprises to small and medium-sized companies are adopting these solutions to enhance investor engagement, maintain regulatory compliance, and gain a competitive edge. The cloud deployment model, in particular, is gaining traction as it allows continuous updates, virtual investor interactions, and efficient data management without the infrastructure costs associated with on-premise systems.

Several factors are fueling market growth, including the surge in shareholder activism, increased demand for corporate accountability, and a heightened focus on ESG performance. Moreover, regulatory bodies across the globe are tightening disclosure requirements, compelling companies to implement robust and compliant IR solutions. As digital literacy improves and investor demographics shift toward more tech-savvy individuals, the reliance on digital IR communication platforms is expected to deepen.

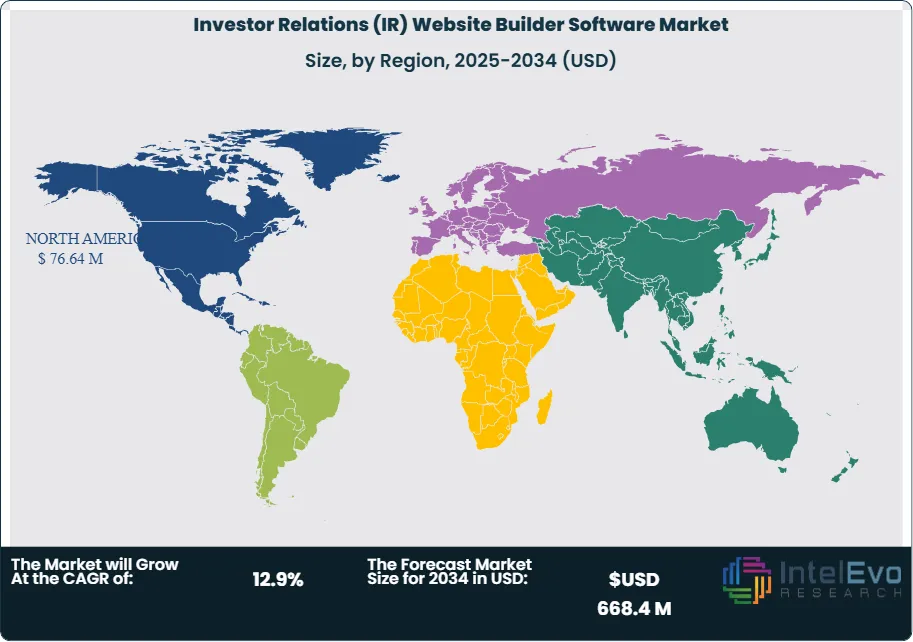

Regionally, North America leads the market due to its advanced financial landscape, large investor community, and the presence of major IR solution providers such as Q4 Inc., Nasdaq Corporate Solutions, and Broadridge Financial Solutions. Europe follows with strong adoption fueled by ESG reporting standards and regulatory mandates, while Asia Pacific is emerging as a high-growth region, supported by digital transformation, IPO activity, and rising investor participation.

The COVID-19 pandemic served as a tipping point for the industry, pushing companies to adopt digital communication tools. With physical meetings curtailed, many businesses swiftly embraced cloud-based IR platforms to host virtual earnings calls, update stakeholders, and ensure business continuity through digital channels.

Key Takeaways

- Market Growth: The Investor Relations (IR) Website Builder Software Market is expected to reach USD 668.4 Million by 2034, due to digitization, regulatory compliance needs, and increased investor engagement.

- Component Dominance: Software leads the market owing to its scalable, customizable, and automation-driven features that enhance investor engagement.

- Deployment Mode Dominance: Cloud deployment leads due to cost-efficiency, data accessibility, and easy upgrades, making it the preferred choice for both SMEs and large enterprises.

- Enterprise Size Dominance: Large enterprises dominate the usage of IR software as they have extensive investor bases and are under greater scrutiny from shareholders and regulators.

- Driver: Rising demand for real-time financial communication and transparency is a major driver for the market.

- Restraint: High cost of implementation and concerns about data security are key restraints in wider adoption.

- Opportunity: The growing adoption of AI and analytics in investor platforms opens new avenues for IR software vendors.

- Trend: Increasing focus on ESG (Environmental, Social, Governance) reporting and integration of interactive tools are emerging trends.

- Regional Analysis: North America leads due to technological infrastructure and regulatory demands; Asia Pacific is set to grow owing to digital initiatives and expanding capital markets.

Component Analysis:

Software Leads With more than 70% Market Share In Investor Relations (IR) Website Builder Software Market. Software remains the dominant component in the IR website builder software market. Companies are increasingly investing in sophisticated software solutions that support seamless financial disclosure, real-time updates, mobile responsiveness, and integration with CRM systems. The software allows for dynamic website creation and management, automated newsfeeds, and compliance-ready modules. Additionally, advanced security protocols, multilingual support, and analytics tools make software a more favorable option compared to standalone services. Meanwhile, services such as training, consulting, and support continue to play a supportive but secondary role.

Deployment Mode Analysis:

Cloud-based deployment dominates the market as organizations across sectors prioritize flexibility, cost-efficiency, and scalability. Cloud solutions offer rapid implementation and regular updates without significant capital expenditure. Especially during COVID-19 and the post-pandemic hybrid work environment, cloud platforms ensured continuity in investor communications. Furthermore, cloud IR software allows companies to access features such as real-time analytics, virtual event hosting, and secure document sharing from anywhere, making it particularly attractive for global companies.

Enterprise Size Analysis:

Large enterprises lead the adoption of IR website builder software due to their expansive operations, greater number of stakeholders, and heightened regulatory responsibilities. These companies typically have dedicated IR teams that require feature-rich platforms for handling earnings calls, shareholder meetings, and analyst interactions. While SMEs are catching up, budget constraints and fewer compliance obligations slow their pace. However, the rise of affordable, scalable cloud-based tools is bridging this gap, making IR platforms more accessible to smaller firms.

Region Analysis:

North America Leads With nearly 40% Market Share In Investor Relations (IR) Website Builder Software Market. North America continues to lead the global Investor Relations (IR) website builder software market, primarily due to its advanced financial infrastructure, high adoption of digital technologies, and stringent regulatory requirements. The region benefits from a strong concentration of institutional investors, which places greater pressure on public companies to maintain transparent and real-time communication with stakeholders. As a result, firms are increasingly adopting robust IR platforms to streamline financial disclosures, host virtual investor events, and comply with complex regulatory standards such as the SEC guidelines. Leading players like Q4 Inc., Nasdaq Corporate Solutions, and Broadridge Financial Solutions are headquartered in this region and consistently invest in innovation, offering comprehensive solutions that integrate AI, analytics, and secure cloud features.

Europe holds a sizable portion of the market, driven by stringent disclosure regulations like the Market Abuse Regulation (MAR) and the growing importance of Environmental, Social, and Governance (ESG) reporting. Many European firms are adopting IR tools to align with evolving compliance and sustainability expectations.

Asia-Pacific is projected to be the fastest-growing region. Countries like China, India, and Southeast Asian nations are witnessing a surge in IPOs and investor activity. Rising digitalization, coupled with increasing corporate governance awareness, is prompting companies—especially in manufacturing, IT, and financial services—to adopt cloud-based IR solutions. This trend is expected to gain further momentum as cloud infrastructure matures across the region.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Component

- Services

- Software

Deployment Mode

- Cloud

- On-Premises

Enterprise Size

- Large Enterprises

- Small and Medium Enterprises

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 216.31 M |

| Forecast Revenue (2034) | USD 668.4 M |

| CAGR (2025-2034) | 12.9% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component (Services, Software); Deployment Mode (Cloud, On-Premises); Enterprise Size (Large Enterprises, Small and Medium Enterprises) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Q4 Inc., Intrado, Marketwired, Nasdaq Corporate Solutions, EQS Group, IPR Software, IR Solutions, Sharon Merrill Advisors, Equisolve, B2i Technologies, Cision, Broadridge Financial Solutions, Intrado Digital Media, S&P Global Market Intelligence, Ipreo, Merrill Corporation, Shareholder.com |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Investor Relations (IR) Website Builder Software Market?

The IR Website Builder Software market is growing at a 12.9% CAGR, expected to hit $668.4M by 2034. Uncover the drivers of this dynamic market and its future.

Who are the major players in the Investor Relations (IR) Website Builder Software Market?

Q4 Inc., Intrado, Marketwired, Nasdaq Corporate Solutions, EQS Group, IPR Software, IR Solutions, Sharon Merrill Advisors, Equisolve, B2i Technologies, Cision, Broadridge Financial Solutions, Intrado Digital Media, S&P Global Market Intelligence, Ipreo, Merrill Corporation, Shareholder.com

Which segments covered the Investor Relations (IR) Website Builder Software Market?

Component (Services, Software); Deployment Mode (Cloud, On-Premises); Enterprise Size (Large Enterprises, Small and Medium Enterprises)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Investor Relations (IR) Website Builder Software Market

Published Date : 12 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date