IoT Fleet Management Market to Hit USD 41.2 Bn by 2034 | CAGR of 14.5%

Global IoT Fleet Management Market Size, Share, Analysis Report By Product Type (Telematics Devices, Sensors & Actuators, Fleet Management Software, Predictive Maintenance Solutions) Application Type (Logistics & Transportation, Public Transportation, Construction & Mining, Oil & Gas, Government Fleets) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

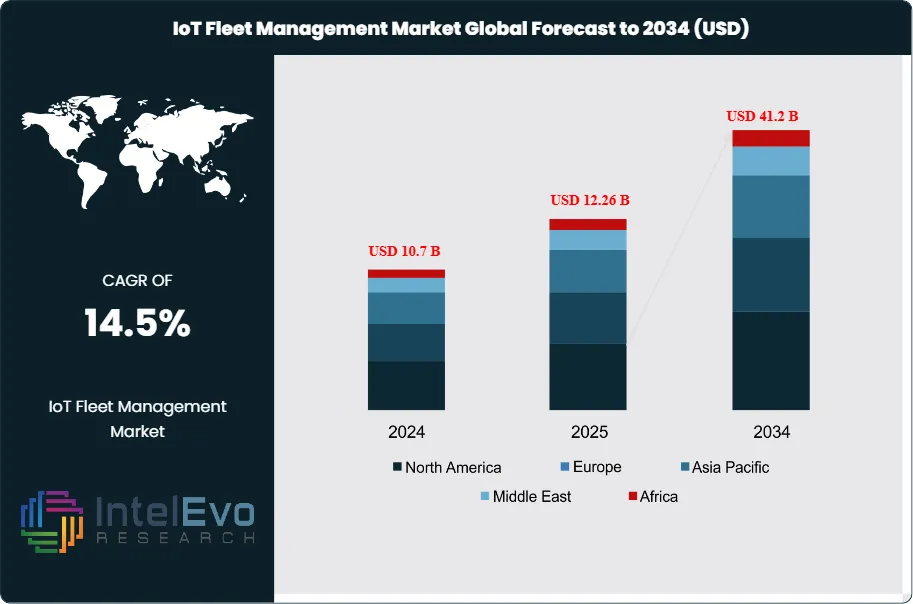

The IoT Fleet Management Market is projected to reach approximately USD 41.2 Billion by 2034, up from USD 10.7 Billion in 2024, growing at a CAGR of 14.5% during the forecast period from 2024 to 2034. This surge is being fueled by the convergence of 5G connectivity and AI-driven predictive maintenance, turning traditional logistics into a hyper-connected ecosystem. As autonomous vehicles and real-time data analytics become industry standards, companies failing to bridge the digital gap risk being left in the rearview mirror.

Get More Information about this report -

Request Free Sample ReportThe IoT fleet management market encompasses a comprehensive ecosystem of connected devices, software platforms, and services that enable real-time monitoring, optimization, and automation of vehicle fleets across industries. This market includes telematics devices, sensors, GPS tracking, fleet management software, predictive maintenance solutions, and data analytics platforms designed to serve diverse transportation and logistics needs. The market serves multiple end-user segments, including logistics providers, public transportation, delivery services, and construction, oil & gas, and government fleets, creating a multifaceted industry with varying requirements for scalability, security, and operational efficiency.

The market is experiencing robust growth driven by the increasing adoption of connected vehicle technologies, rising demand for operational efficiency, and the need for regulatory compliance in fleet operations. Key growth catalysts include advancements in AI-powered analytics, 5G connectivity, and cloud-based fleet management platforms that enhance real-time decision-making and reduce operational costs. The market benefits from growing e-commerce activity, urbanization, and the expansion of last-mile delivery services, which are increasing the demand for intelligent fleet solutions. Additionally, government mandates for vehicle safety, emissions monitoring, and electronic logging are accelerating IoT adoption in fleet management.

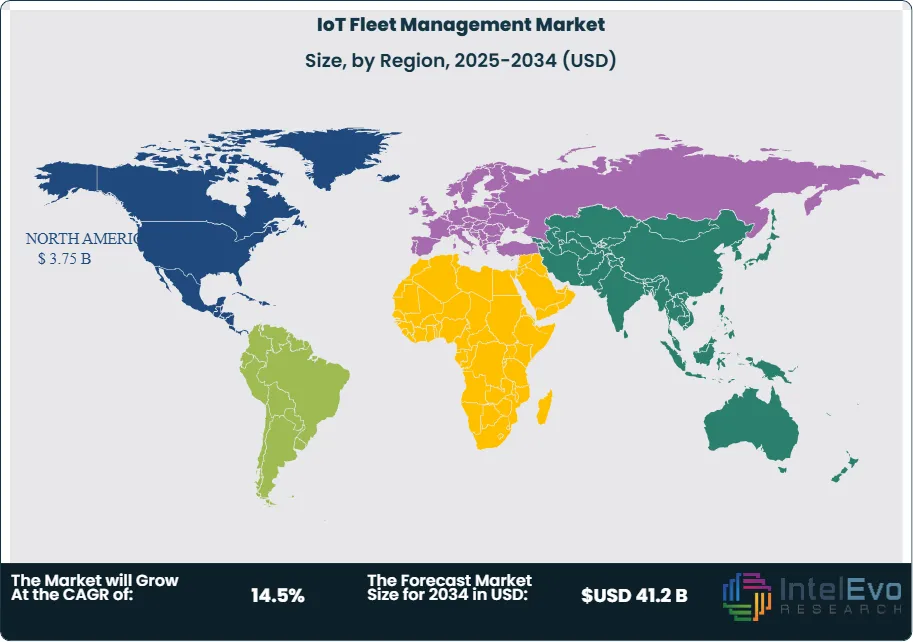

North America leads the global IoT fleet management market, supported by a mature logistics sector, high technology adoption rates, and stringent regulatory frameworks. The Asia-Pacific region is the fastest-growing market, driven by rapid urbanization, expanding transportation networks, and government initiatives to modernize logistics infrastructure. Europe maintains a significant market presence due to established automotive industries, strong regulatory compliance, and a focus on sustainability and green logistics.

The COVID-19 pandemic initially disrupted supply chains and reduced transportation demand, but it ultimately accelerated digital transformation in fleet management. The crisis highlighted the importance of real-time visibility, remote diagnostics, and contactless operations, driving investment in IoT-enabled solutions for fleet safety and efficiency.

Rising fuel costs, driver shortages, and increasing pressure for sustainability are significantly influencing market dynamics. International trade growth and cross-border logistics are creating opportunities for global IoT fleet management providers, while data privacy and cybersecurity concerns present ongoing challenges. The market is also witnessing increased demand for electric vehicle (EV) fleet management and integration with smart city infrastructure.

Key Takeaways

- Market Growth: The IoT Fleet Management Market is expected to reach USD 41.2 Billion by 2034, fueled by the proliferation of connected vehicles, regulatory mandates, and the need for operational efficiency.

- Product Type Dominance: Telematics Devices lead the segment, primarily due to their critical role in real-time vehicle tracking, diagnostics, and driver behavior monitoring.

- Application Type Dominance: Logistics & Transportation holds the largest share, driven by the need for route optimization, asset tracking, and delivery efficiency.

- Driver: Key drivers include the surge in e-commerce, rising demand for real-time fleet visibility, and regulatory requirements for safety and emissions compliance.

- Restraint: Growth is hindered by high initial investment costs, data privacy concerns, and integration complexity with legacy systems.

- Opportunity: The market is poised for expansion through opportunities such as the adoption of electric and autonomous vehicles, integration with smart city platforms, and the development of AI-driven predictive analytics.

- Trend: Emerging trends include the adoption of 5G connectivity, AI-powered fleet analytics, and the integration of IoT with blockchain for secure data sharing.

- Regional Analysis: North America leads due to advanced logistics infrastructure and regulatory support. Asia-Pacific shows high growth potential due to rapid urbanization and government investments in smart transportation.

Product Type Analysis

Telematics devices are the most important and widely used products in the IoT fleet management market. These are electronic devices installed in vehicles that collect and transmit data about the vehicle’s location, health, and how it’s being driven. Fleet operators (companies that manage groups of vehicles) rely on telematics to: track vehicles in real time, so they always know where their assets are., monitor vehicle health and performance, which helps with maintenance and reduces breakdowns. Telematics devices are popular because they can connect with many other sensors and software, making them useful for things like planning better routes and predicting when a vehicle will need repairs. They’re also affordable and can be used by both small companies and large enterprises, making them the go-to solution for most fleet management needs.

Application Type Analysis

Logistics & Transportation Leads With Over 45% Market Share. The logistics and transportation sector dominates the IoT fleet management market, reflecting the critical need for efficient asset tracking, route planning, and delivery optimization in a highly competitive environment. This segment drives demand for advanced telematics, real-time analytics, and automated compliance reporting. The sector’s leadership is sustained by the growth of e-commerce, the expansion of last-mile delivery networks, and the increasing complexity of global supply chains.

Region Analysis

North America Leads with More Than 35% Market Share. North America holds a commanding position in the global IoT fleet management market, supported by a mature logistics industry, high adoption of connected vehicle technologies, and robust regulatory frameworks. The region benefits from advanced infrastructure, a strong presence of leading technology providers, and significant investment in digital transformation initiatives.

The Asia-Pacific region is the fastest-growing market, driven by rapid urbanization, expanding transportation networks, and government initiatives to modernize logistics and public transportation. Countries such as China, India, and Japan are investing heavily in smart transportation and fleet digitization. Europe maintains a significant market share due to its established automotive sector, focus on sustainability, and stringent regulatory requirements for fleet safety and emissions.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

Product Type

- Telematics Devices

- Sensors & Actuators

- Fleet Management Software

- Predictive Maintenance Solutions

Application Type

- Logistics & Transportation

- Public Transportation

- Construction & Mining

- Oil & Gas

- Government Fleets

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 12.26 B |

| Forecast Revenue (2034) | USD 41.2 B |

| CAGR (2025-2034) | 14.5% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type (Telematics Devices, Sensors & Actuators, Fleet Management Software, Predictive Maintenance Solutions) Application Type (Logistics & Transportation, Public Transportation, Construction & Mining, Oil & Gas, Government Fleets) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Geotab Inc., Verizon Connect, Trimble Inc., Omnitracs LLC, Fleet Complete, Teletrac Navman, TomTom Telematics, AT&T Fleet Complete, MiX Telematics, Samsara Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the IoT Fleet Management Market?

Discover insights on the IoT Fleet Management Market, projected to grow at 14.5% CAGR, reaching USD 41.2 Billion by 2034 from USD 10.7 Billion in 2024.

Who are the major players in the IoT Fleet Management Market?

Geotab Inc., Verizon Connect, Trimble Inc., Omnitracs LLC, Fleet Complete, Teletrac Navman, TomTom Telematics, AT&T Fleet Complete, MiX Telematics, Samsara Inc.

Which segments covered the IoT Fleet Management Market?

Product Type (Telematics Devices, Sensors & Actuators, Fleet Management Software, Predictive Maintenance Solutions) Application Type (Logistics & Transportation, Public Transportation, Construction & Mining, Oil & Gas, Government Fleets)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date