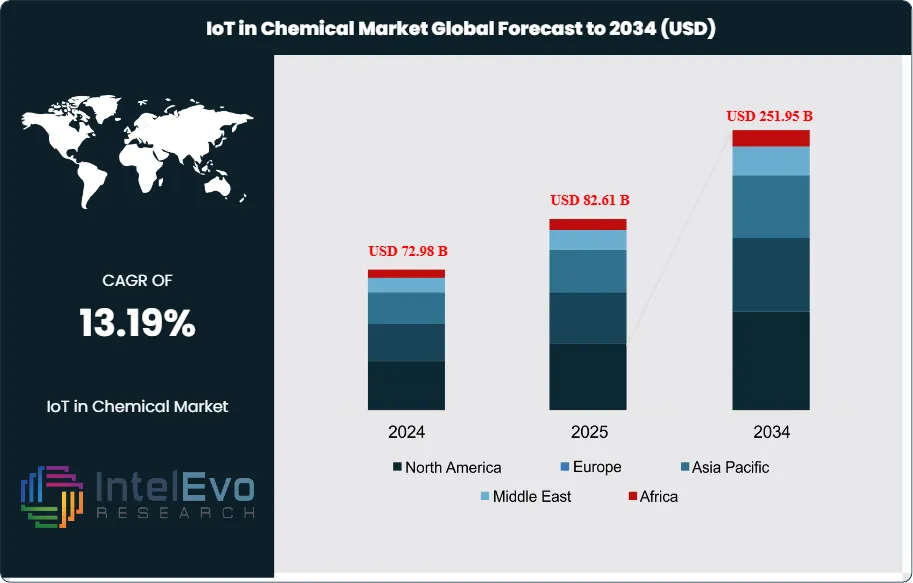

IoT in Chemical Market Size,Share to Reach $251.95 Bn by 2034 | 13.19% CAGR

Global IoT in Chemical Market Size, Share, Analysis ,Forecast Report Type By Technology (Operational Technology, Enabling Technology),By Component (Software, Hardware, Services), By Verticals (Pharmaceuticals, Chemicals, Mining and Metals, Food and Beverages, Paper and Pulp), Enterprise Size (Small and Medium Enterprises, Large Enterprises) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

The IoT in Chemical Market size is expected to be worth around USD 251.95 Billion by 2034, from USD 72.98 Billion in 2024, growing at a CAGR of 13.19% during the forecast period from 2024 to 2034. The Internet of Things (IoT) in chemical market encompasses comprehensive digital solutions that leverage connected devices, sensors, and analytics platforms to optimize chemical manufacturing processes, enhance operational efficiency, and improve safety protocols.

Get More Information about this report -

Request Free Sample ReportThis market includes hardware components such as sensors, actuators, and gateways, software platforms for data analytics and process control, and integrated services for implementation and maintenance. The IoT ecosystem serves diverse chemical industry verticals including petrochemicals, pharmaceuticals, specialty chemicals, fertilizers, and agrochemicals, enabling real-time monitoring, predictive maintenance, and automated process control across manufacturing facilities worldwide.

The IoT in chemical market is experiencing robust growth driven by increasing demand for process optimization and operational efficiency enhancement across chemical manufacturing operations. Key growth catalysts include the integration of advanced technologies such as artificial intelligence, machine learning, and digital twins that enable predictive analytics and intelligent decision-making capabilities. The market benefits from rising emphasis on predictive maintenance strategies that minimize equipment downtime and reduce operational costs through real-time asset monitoring and condition-based maintenance scheduling. Additionally, stringent regulatory compliance requirements and growing focus on workplace safety are pushing chemical companies to adopt IoT-enabled monitoring systems for hazardous material handling and environmental compliance reporting.

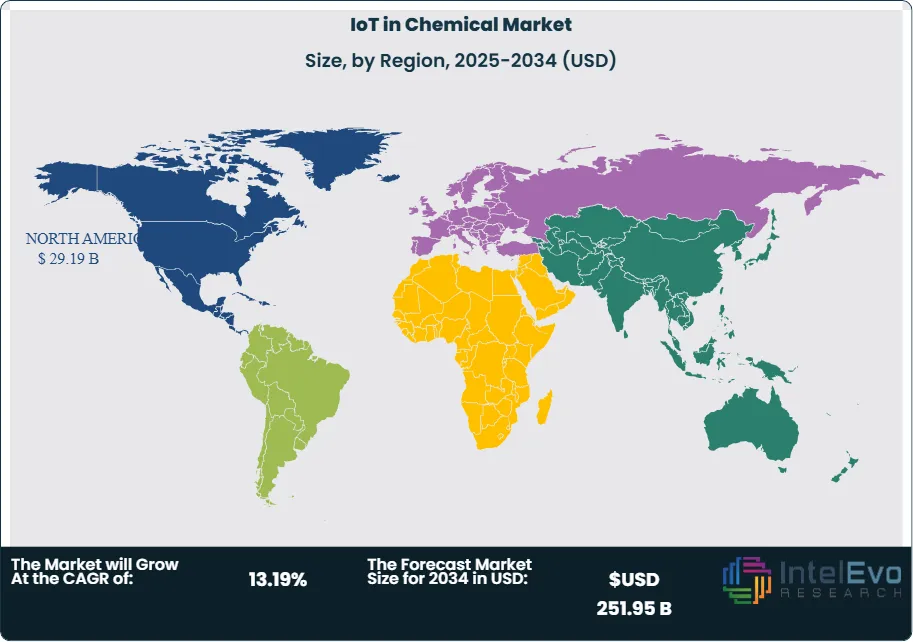

North America maintains its position as the leading regional market for IoT applications in the chemical industry, commanding the largest global market share and generating the highest revenues within the sector. This market dominance is attributed to the region's early embrace of Industry 4.0 technologies, well-established chemical manufacturing base, and significant capital investments in digital transformation programs undertaken by major chemical corporations. The United States serves as the primary contributor to North America's market leadership, with substantial revenue generation and strong growth projections driven by robust adoption rates. Meanwhile, the Asia-Pacific region emerges as the most rapidly expanding market segment, propelled by accelerating industrialization processes, expanding chemical production capabilities, and governmental policies that actively encourage the implementation of smart manufacturing technologies across emerging economies throughout the region.

The COVID-19 pandemic accelerated digital transformation initiatives across the chemical industry as companies sought remote monitoring capabilities and automated processes to maintain operations during lockdowns and social distancing measures. The crisis highlighted the importance of IoT-enabled systems for ensuring business continuity, enabling remote facility monitoring, and reducing dependency on on-site personnel. While initial supply chain disruptions temporarily affected IoT hardware availability, the long-term impact has been positive, with increased recognition of digital technologies' value in building operational resilience and enabling distributed workforce management.

Rising geopolitical tensions and trade restrictions have influenced IoT adoption patterns in the chemical industry, with companies seeking to reduce dependency on single-source suppliers and diversify their technology procurement strategies. International sanctions and export controls on advanced technologies have created opportunities for domestic IoT solution providers while challenging global supply chains. Additionally, increasing focus on supply chain transparency and security has driven demand for blockchain-enabled IoT solutions that provide end-to-end traceability and ensure compliance with international trade regulations.

Key Takeaways

- Market Growth: The IoT in Chemical Market is expected to reach USD 251.95 Billion by 2034, fueled by growing demand for process optimization and operational efficiency improvements across chemical manufacturing facilities, driven by advanced technology integration including artificial intelligence, machine learning, and digital twins that enable predictive analytics and intelligent decision-making.

- Technology Dominance: Enabling Technology leads the segment, due to foundational role in IoT infrastructure and rapid technological advancement.

- Component Dominance: Hardware components dominate the segment, driven by essential role in data collection and process control.

- Enterprise Size Dominance: Large Enterprises lead the enterprise segment, primarily due to higher investment capacity and complex operational requirements.

- Verticals Dominance: Chemicals holds the largest share, owing to broad application scope and automation requirements.

- Driver: Key drivers accelerating growth include process optimization demand and predictive maintenance adoption, which boost market expansion through enhanced operational efficiency and cost reduction capabilities.

- Restraint: Growth is hindered by high initial investment costs and cybersecurity concerns, which create challenges such as capital barriers and data security risks.

- Opportunity: The market is poised for expansion due to opportunities like AI integration and emerging market penetration, which enable advanced analytics capabilities and geographic diversification.

- Trend: Emerging trends including digital twins implementation and 5G connectivity adoption are reshaping the market by enabling real-time simulation and low-latency communications.

- Regional Analysis: North America leads owing to early technology adoption and established manufacturing infrastructure. Asia-Pacific shows high promise due to rapid industrialization and increasing chemical production capacity.

Technology Analysis:

The Enabling Technology category stands out as the leading force, serving as the essential infrastructure backbone that supports IoT deployments in chemical manufacturing. This segment encompasses technologies like industrial robotics, machine vision, artificial intelligence, digital twins, and big data analytics, all of which are crucial for enabling sophisticated process control and operational optimization. The prominent role of Enabling Technology is driven by ongoing advancements, fundamental infrastructure needs, and its critical function in supporting holistic IoT ecosystems across chemical facilities.

Component Analysis:

Hardware components hold a leading position in the market, highlighting their vital role in data acquisition, process monitoring, and control system functions within challenging chemical manufacturing environments. This category includes sensors, actuators, gateways, RFID tags, and embedded systems designed to endure extreme temperatures, corrosive substances, and hazardous conditions while ensuring dependable performance. The prominence of hardware is driven by the growing need for durable, industrial-grade devices capable of continuous operation and the fundamental importance of physical infrastructure in supporting IoT deployments.

Enterprise Size Analysis:

Large enterprises dominate the market, reflecting that extensive chemical manufacturing operations with complex demands primarily drive the need for comprehensive IoT solutions. These organizations have the financial capacity, technical knowledge, and operational scale required to deploy advanced IoT platforms, while also contending with the most rigorous regulatory compliance and safety standards that necessitate sophisticated monitoring and control systems.

Verticals Analysis:

Chemicals Leads With more than 35% Market Share In IoT in Chemical Market. The chemicals vertical holds a leading position in the market, driven by its wide range of application demands and intricate process monitoring requirements across petrochemical, specialty chemical, and industrial chemical manufacturing sectors. Its prominence is supported by extensive IoT use cases such as reactor monitoring, batch process control, quality assurance, and safety compliance systems. This segment benefits from significant automation investments, stringent regulatory compliance, and the vital importance of process optimization in sustaining competitiveness and ensuring operational safety.

Region Analysis:

North America Leads With nearly 40% Market Share In IoT in Chemical Market. North America stands as the clear leader in the global IoT market within the chemical industry, supported by its highly advanced manufacturing infrastructure, proactive adoption of Industry 4.0 technologies, and significant investments by major corporations in digital transformation. The region boasts a mature network of IoT solution providers, robust research and development capabilities, and long-standing technology partnerships, all of which collectively drive widespread innovation and deployment of IoT solutions across chemical manufacturing. The United States, in particular, plays a pivotal role in shaping industry trends due to its focus on integrating real-time process monitoring, data analytics, and operational optimization.

In contrast, the Asia-Pacific region is experiencing the fastest market growth, fueled by rapid industrialization, increasing chemical production capacity, and strong government policies championing smart manufacturing. Countries such as China and India are at the forefront of this expansion, with many chemical companies accelerating the modernization of their facilities and investing in advanced process control systems to improve efficiency, safety, and regulatory compliance. These developments are further propelled by broader digital infrastructure enhancements and collaborative industry initiatives across the region.

Europe continues to maintain a substantial presence through well-established chemical production hubs and a regulatory environment that prioritizes environmental sustainability. The region's adoption of IoT is significantly influenced by stringent environmental compliance requirements and the active involvement of leading technology providers who specialize in developing innovative industrial IoT solutions. Additionally, European manufacturers benefit from close industry-academia collaborations and government-supported R&D projects, ensuring that the sector remains competitive and technology-driven.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Technology

- Operational Technology

- Enabling Technology

Component

- Software

- Hardware

- Services

Verticals

- Pharmaceuticals

- Chemicals

- Mining and Metals

- Food and Beverages

- Paper and Pulp

Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 82.61 B |

| Forecast Revenue (2034) | USD 251.95 B |

| CAGR (2025-2034) | 13.19% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Technology (Operational Technology, Enabling Technology), Component (Software, Hardware, Services), Verticals (Pharmaceuticals, Chemicals, Mining and Metals, Food and Beverages, Paper and Pulp), Enterprise Size (Small and Medium Enterprises, Large Enterprises) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Siemens AG, General Electric Company (GE), ABB Ltd, Honeywell International Inc, Schneider Electric SE, Cognite AS, PTC Inc., Seeq Corporation , Altizon Inc, Yokogawa Electric Corporation, Emerson Electric Co., Mitsubishi Electric Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date