IoT Insurance Market Size, Share, Trends & Forecast | 35.7% CAGR

Global IoT Insurance Market Size, Share, Analysis Report By Component (Services, Solution), Insurance Type (Health and Life Insurance, Property and Casualty Insurance, Others Insurance Types), Application (Agriculture, Automotive and Transportation, Buildings, Retail, Health and Life, Other Applications) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

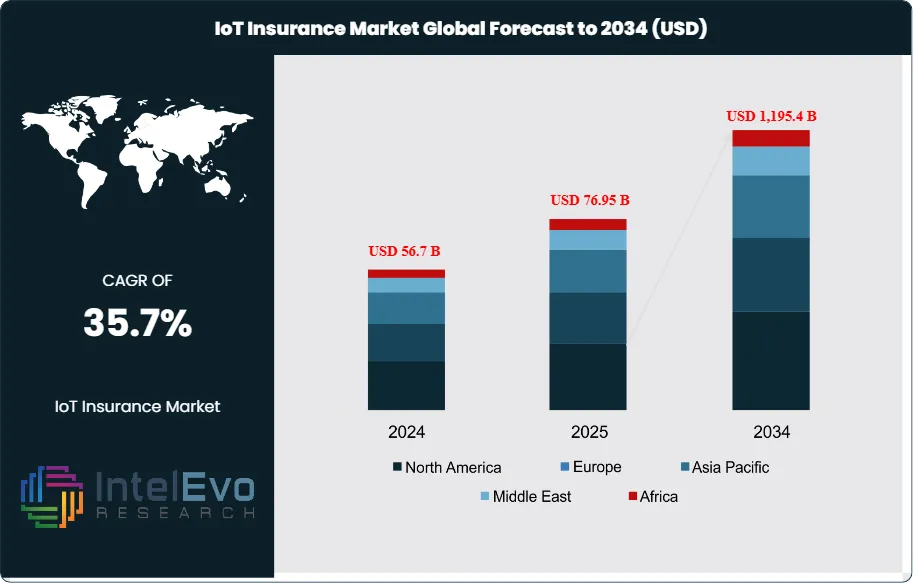

The IoT Insurance Market size is expected to be worth around USD 1,195.4 Billion by 2034, up from USD 56.7 Billion in 2024, growing at a CAGR of 35.7% during the forecast period from 2025 to 2034. The rapid integration of IoT-enabled devices across automotive, healthcare, and smart home ecosystems is revolutionizing risk management and claims processing. Insurers are leveraging real-time data analytics, AI, and connected technologies to create personalized, usage-based policies, driving exponential market growth. The fusion of IoT with predictive analytics is reshaping the future of the insurance industry—making it smarter, faster, and more customer-centric.

Get More Information about this report -

Request Free Sample ReportThis market encompasses solutions and services that leverage IoT-enabled devices such as telematics systems, wearable health monitors, smart home sensors, and connected vehicle technologies to provide real-time data analytics for risk assessment, policy customization, and claims processing. The integration of IoT technologies enables insurers to shift from reactive to proactive risk management models, offering personalized policies based on actual behavior patterns and real-time risk factors rather than historical data alone.

Several key factors are driving the remarkable growth of the IoT insurance market, including the proliferation of connected devices across various sectors, advancing 5G connectivity infrastructure, and increasing consumer acceptance of usage-based insurance models. The market is further propelled by regulatory support for telematics-based insurance programs, growing awareness of preventive healthcare through wearable devices, and the insurance industry's digital transformation initiatives. Additionally, the rising frequency of cyber threats and climate-related risks has intensified the demand for real-time monitoring and predictive analytics capabilities that IoT solutions provide.

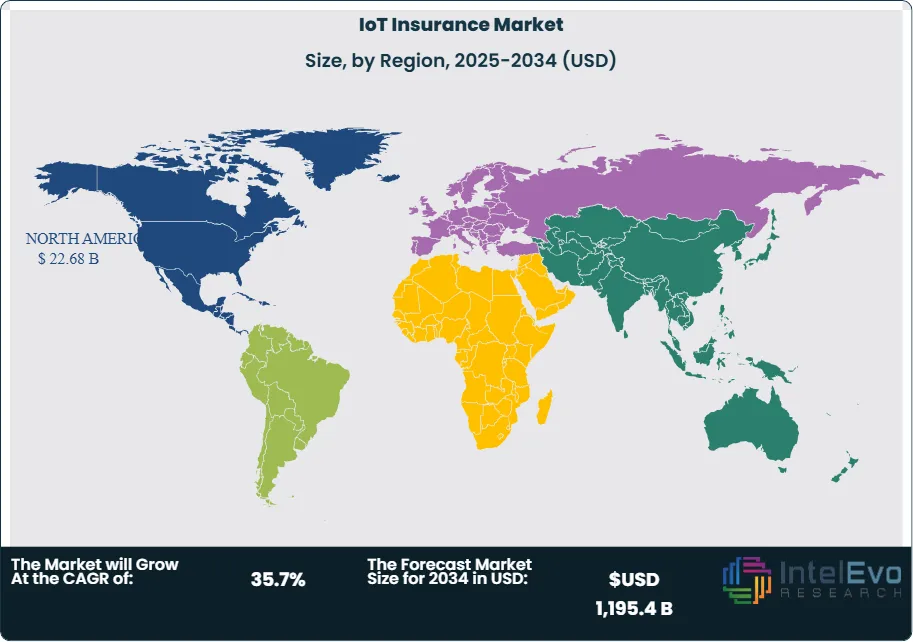

North America continues to dominate the IoT insurance market with approximately 38% market share, driven by established digital infrastructure, early adoption of telematics technology, and strong partnerships between insurers and technology companies. The region benefits from regulatory frameworks that support usage-based insurance models and a tech-savvy consumer base willing to embrace connected insurance solutions.

The COVID-19 pandemic accelerated the adoption of IoT insurance solutions as social distancing measures increased reliance on digital technologies and remote monitoring capabilities. Health insurance segments experienced significant growth in wearable device integration for remote patient monitoring, while automotive insurance saw temporary disruptions due to reduced driving but later benefited from increased focus on usage-based models as driving patterns normalized.

Ongoing geopolitical tensions and trade disputes between major economies have created supply chain challenges for IoT device manufacturing, potentially impacting the availability and cost of connected sensors and hardware components essential for IoT insurance solutions. Tariffs on electronic components and semiconductors have increased operational costs for insurance technology providers, while data sovereignty concerns have led to increased emphasis on local data processing and storage solutions. These factors have prompted insurers to diversify their technology supply chains and invest in regional partnerships to mitigate risks associated with international trade disruptions.

Key Takeaways

- Market Growth: The IoT Insurance Market is expected to reach USD 1,195.4 Billion by 2034, due to rising connected device adoption and the need for real-time risk assessment. Solutions and services that enable data-driven underwriting are propelling revenue generation across insurance types and applications.

- Component Dominance: Solutions hold the largest share of the market, as insurers prioritize IoT-enabled platforms and analytics systems to enhance operational efficiency and reduce claims costs.

- Insurance Type Dominance: Health and Life Insurance dominates insurance types, driven by widespread use of wearables and connected health devices that monitor policyholder wellness.

- Application Dominance: Automotive and Transportation is the leading application, with telematics and UBI policies revolutionizing motor insurance models and fostering safer driving practices.

- Driver: Increasing regulatory support for risk-based pricing and advancements in sensor technology are significant drivers enabling insurers to offer innovative, customized policies.

- Restraint: Data security concerns and high initial implementation costs limit market adoption, particularly among small and mid-sized insurers.

- Opportunity: Growing demand for personalized policies and the expansion of IoT ecosystems in emerging economies present lucrative opportunities for market players.

- Trend: Integration of artificial intelligence with IoT insurance platforms and the rise of blockchain-based data management are notable trends shaping the market landscape.

- Regional Analysis: North America leads the market due to a robust technological ecosystem and early telematics adoption, while Asia Pacific shows strong growth potential supported by digitization initiatives.

Component Analysis:

Solutions are the backbone of IoT insurance adoption. Insurers are deploying platforms that collect and analyze sensor data, enabling more accurate risk modeling and premium calculations. Predictive analytics tools, policy administration systems, and cloud-based claims management platforms are integral to modern insurance ecosystems. Market leaders like SAP SE and SAS Institute Inc. provide comprehensive solutions that connect IoT device data with underwriting and fraud detection workflows. The emphasis on cost reduction and enhanced customer experiences continues to propel this segment’s dominance.

Insurance Type Analysis:

Health and Life Insurance Leads With more than 45% Market Share In IoT Insurance Market. The Health and Life Insurance segment leads due to widespread adoption of connected health devices and wearables. Insurers incentivize healthier lifestyles by offering lower premiums for customers who share data from fitness trackers and biometric sensors. This proactive monitoring reduces long-term healthcare costs and enables early intervention in chronic conditions. Health and life insurers are also using IoT data to streamline claims adjudication and detect fraud. The growing focus on preventive healthcare is likely to sustain this segment’s growth trajectory.

Application Analysis:

Automotive and Transportation applications command a significant share of the market, as telematics-based insurance has become mainstream. Usage-based insurance models leverage data from vehicle sensors and onboard diagnostics to assess driving behavior, mileage, and accident risks. Insurers are rewarding safe driving habits with premium discounts, enhancing customer loyalty. The growing fleet management market and regulatory mandates for telematics installation in commercial vehicles further strengthen this segment’s leadership.

Region Analysis:

North America Leads With nearly 40% Market Share In IoT Insurance Market. North America maintains its leadership position in the IoT insurance market, accounting for approximately 38% of global market share, primarily due to its well-established digital infrastructure, early adoption of telematics technology, and strong regulatory framework supporting usage-based insurance models. The region benefits from mature partnerships between insurance companies and technology providers, enabling rapid deployment of IoT solutions across automotive, health, and property insurance sectors. Major insurers in the United States and Canada have successfully implemented large-scale telematics programs that demonstrate clear value propositions for both companies and consumers.

Europe represents the second-largest market, driven by stringent data protection regulations that have actually enhanced consumer trust in IoT insurance solutions by ensuring robust privacy safeguards. The European market shows strong growth in smart home insurance applications and automotive telematics, supported by government initiatives promoting digital transformation and sustainable transportation. Asia-Pacific emerges as the fastest-growing region, fueled by increasing smartphone penetration, government digitalization programs, and rapidly expanding middle-class populations in countries like China and India. The region's growth is further accelerated by supportive regulatory environments and significant investments in 5G infrastructure that enable advanced IoT applications.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Component

- Services

- Solution

Insurance Type

- Health and Life Insurance

- Property and Casualty Insurance

- Others Insurance Types

Application

- Agriculture

- Automotive and Transportation

- Buildings

- Retail

- Health and Life

- Other Applications

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 76.95 B |

| Forecast Revenue (2034) | USD 1,195.4 B |

| CAGR (2025-2034) | 35.7% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component: (Services, Solution), Insurance Type: (Health and Life Insurance, Property and Casualty Insurance, Others Insurance Types), Application: (Agriculture, Automotive and Transportation, Buildings, Retail, Health and Life, Other Applications) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | SAP SE, Accenture PLC, Wipro, SAS Institute Inc., Cisco Systems Inc., Flatirons Development, LLC, Cognizant, Allerin Tech Pvt Ltd., Intel Corporation, Telit Cinterion, StreamLabs, Inc., Microsoft Corporation, Synechron, IBM Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date