Iron Casting Market Size, Share & Growth Forecast | 6.7% CAGR

Global Iron Casting Market Size, Share & Analysis By Product (Gray Cast Iron, Malleable Cast Iron, Ductile Cast Iron), By Application (Automotive, Railways, Machinery & Tools, Pipes & Fittings, Railways, Power Generation,), By End-User Industry Regions & Key Players – Capacity Expansion, Cost Trends & Forecast 2025–2034

Report Overview

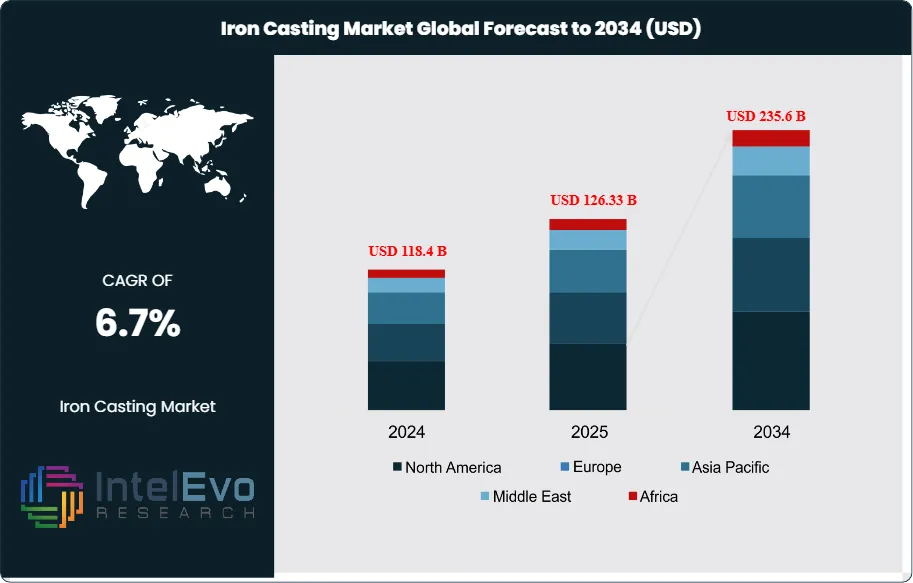

The Iron Casting Market is projected to grow from USD 118.4 Billion in 2024 to approximately USD 235.6 Billion by 2034, expanding at a CAGR of around 6.7% during 2025–2034. Rising infrastructure development and industrial manufacturing are fueling long-term demand for iron cast components. The shift toward lightweight, high-strength casting materials is enhancing performance across automotive, construction, and heavy machinery sectors. Increasing investments in foundry automation and sustainability-driven production are shaping the next phase of industry transformation.

Get More Information about this report -

Request Free Sample ReportThis steady expansion reflects the enduring importance of iron casting as a core industrial process, widely adopted for its ability to deliver high-strength, complex-shaped components at competitive costs. As industries prioritize durability, precision, and scalability, iron casting remains a vital enabler of large-scale manufacturing across automotive, machinery, construction, and energy sectors.

The market landscape is shaped by the versatility of iron casting, with product variants such as gray iron, ductile iron, and malleable iron offering tailored solutions for different performance needs. Gray iron is preferred for applications requiring high vibration damping and thermal conductivity, while ductile iron is valued for its toughness and fatigue resistance, making it essential in critical automotive and infrastructure components. Malleable iron, though smaller in volume, continues to serve specialized use cases requiring a balance of machinability and strength. This material diversity positions the iron casting industry as both resilient and adaptive to shifting industrial requirements.

Growth is being fueled by several converging factors. Rising demand from the automotive sector, particularly for engine blocks, transmission cases, and brake components, is a significant driver, alongside ongoing infrastructure investments worldwide. Additionally, advancements in metallurgy, process automation, and simulation-based design have enhanced precision, reduced defects, and optimized resource utilization, making casting more efficient and sustainable. However, challenges such as rising raw material costs, stringent environmental regulations, and competition from alternative lightweight materials present headwinds that manufacturers must navigate.

Technological innovation is also reshaping the industry’s outlook. Integration of digital twins, advanced mold-making techniques, and computer-aided engineering (CAE) is streamlining production cycles and reducing lead times. At the same time, the adoption of cleaner technologies and recycling practices is improving sustainability, aligning with global climate commitments and regulatory expectations.

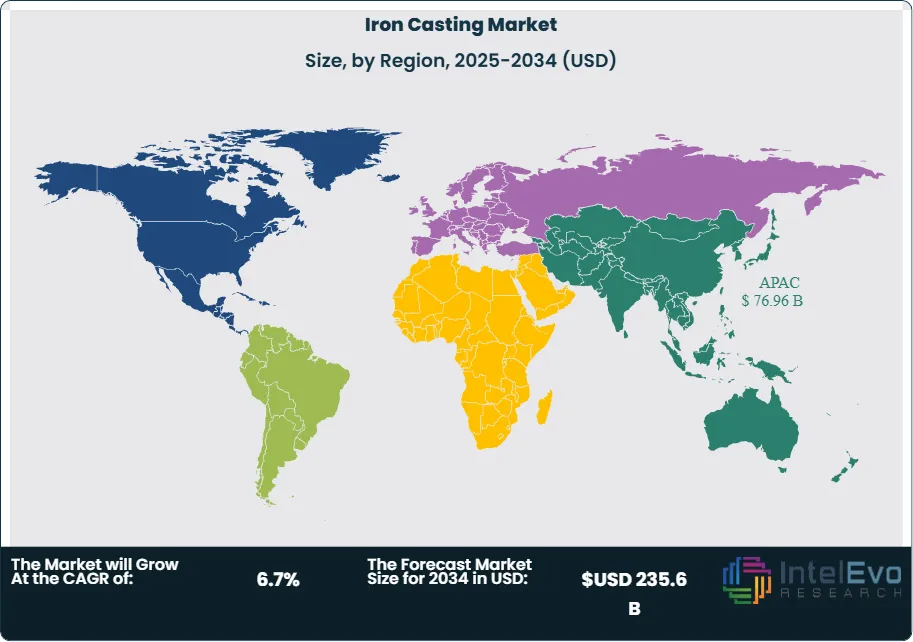

Regionally, Asia-Pacific dominates the market due to strong manufacturing ecosystems in China and India, backed by large-scale automotive production and infrastructure development. North America and Europe remain significant markets, benefiting from advanced process innovation and regulatory focus on high-quality standards. Emerging markets in Latin America and the Middle East & Africa are also expected to contribute steadily as industrialization and construction activities accelerate. Collectively, these dynamics position iron casting as a durable, evolving market that continues to underpin the foundations of modern industrial growth.

Key Takeaways

- Market Growth: The Global Iron Casting Market is projected to expand from USD 118.4 billion in 2024 to USD 235.6 billion by 2034, advancing at a CAGR of 6.7%. Growth is driven by sustained demand from automotive, machinery, and infrastructure sectors, coupled with process innovations that enhance efficiency and precision.

- Type: Gray cast iron holds the leading position with a 62.4% share, owing to its cost-effectiveness, machinability, and widespread use in engine blocks, brake systems, and structural components across multiple industries.

- Application: The automotive sector represents the largest application segment, accounting for 30.1% of demand. Iron castings are critical for producing high-strength components such as engine parts, transmission housings, and chassis elements, with demand reinforced by global vehicle production.

- Driver: Industrialization in emerging economies, particularly across Asia-Pacific, is accelerating demand for cast iron components in construction, manufacturing equipment, and transportation infrastructure.

- Restraint: Rising raw material and energy costs, coupled with tightening environmental regulations on emissions and waste from foundries, present challenges to cost competitiveness and operational efficiency.

- Opportunity: Growing adoption of digital foundry technologies, including simulation-based casting design, automation, and recycling of scrap metal, provides opportunities for manufacturers to improve yield, reduce waste, and align with sustainability goals.

- Trend: The industry is witnessing increased integration of digital twins, computer-aided engineering (CAE), and advanced mold-making techniques, enabling greater precision and reduced lead times in high-volume production environments.

- Regional Analysis: Asia-Pacific dominates the market with a 65.4% share, supported by large-scale manufacturing in China and India and extensive infrastructure development. North America and Europe remain important due to their emphasis on advanced process innovation and high-quality standards, while Latin America and the Middle East & Africa are emerging as growth contributors through industrial expansion and urbanization.

Product Analysis

As of 2025, gray cast iron continues to dominate the global market, accounting for more than 62% of total revenue. Its widespread adoption is attributed to its low production cost, excellent machinability, vibration-damping capability, and durability under thermal cycling. These properties make gray iron indispensable in the automotive sector, particularly for the production of engine blocks, brake components, and transmission housings. Its ability to deliver structural stability while maintaining cost efficiency ensures its position as the preferred material for large-volume applications.

Meanwhile, ductile cast iron is emerging as the fastest-growing product segment. Its superior tensile strength, ductility, and ability to withstand high impact without fracturing make it suitable for applications requiring toughness and machinability. It is widely used in automotive crankshafts, tractor components, pipe fittings, and heavy machinery. Growing investments in water and wastewater infrastructure are further accelerating demand for ductile iron pipes and fittings. For instance, leading manufacturers are expanding capacity through new facilities in Asia to meet rising infrastructure needs.

Malleable cast iron, though smaller in market share, maintains a steady presence in specialized applications. It is commonly used in electrical fittings, machine parts, and hand tools, owing to its balance of machinability and resilience. Its continued demand underscores the importance of tailored casting solutions across diverse industrial use cases.

Application Analysis

The automotive sector remains the leading application area, representing over 30% of global demand in 2025. Iron castings play a vital role in delivering cost-effective, high-strength solutions for critical components such as engine parts, suspension systems, and braking assemblies. While aluminum castings are gaining share in lightweight vehicle production, iron retains its edge in heavy-duty applications where durability, thermal resistance, and cost efficiency are critical.

The machinery and tools segment also holds a significant share, with iron castings widely used in industrial equipment, agricultural machinery, and manufacturing tools. Strong wear resistance and machinability make cast iron an essential material for precision tools and heavy-duty machinery. Rising investments in manufacturing automation and industrial upgrades are expected to boost demand in this segment.

The railway sector is projected to register the fastest growth over the coming years. Cast iron’s strength, reliability, and wear resistance make it indispensable in producing wheels, couplers, and braking components. Global infrastructure initiatives and large-scale railway modernization programs, particularly in Asia and Europe, are expected to significantly expand this segment’s contribution. Additionally, iron castings continue to find applications in power generation equipment and other industrial sectors, highlighting their role as a versatile backbone of modern engineering.

Regional Analysis

Asia-Pacific leads the global iron casting market, commanding approximately 65% of total revenue as of 2025. China and India remain key production hubs, driven by extensive automotive manufacturing, rapid infrastructure development, and rising demand for ductile iron pipes in water management projects. The region’s strong industrial base, coupled with ongoing government-led investments in transport and energy infrastructure, will sustain its dominance over the forecast period.

North America holds the second-largest share, underpinned by demand from the automotive, machinery, and renewable energy sectors. The region’s focus on modernizing manufacturing systems, coupled with rising investment in clean energy infrastructure, is expected to further drive demand for high-performance castings.

Europe also remains a critical market, supported by infrastructure upgrades and regulatory emphasis on sustainable industrial practices. Investments in water treatment and sanitation infrastructure, as well as modernization of rail systems, continue to stimulate demand for ductile and gray cast iron products. Meanwhile, Latin America and the Middle East & Africa represent emerging markets, with growth opportunities stemming from urbanization, energy projects, and expanding transportation networks.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product

- Gray Cast Iron

- Malleable Cast Iron

- Ductile Cast Iron

By Application

- Automotive

- Railways

- Machinery & Tools

- Pipes & Fittings

- Railways

- Power Generation

- Other Applications

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 118.4 B |

| Forecast Revenue (2034) | USD 235.6 B |

| CAGR (2024-2034) | 6.7% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product (Gray Cast Iron, Malleable Cast Iron, Ductile Cast Iron), By Application (Automotive, Railways, Machinery & Tools, Pipes & Fittings, Railways, Power Generation, Other Applications) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Newby Foundries Ltd, Georg Fischer Ltd, OSCO Industries, Inc, LIAONING BORUI MACHINERY CO., LTD, Hitachi Metals, Ltd, Chamberlin plc, Casting P.L.C, CALMET, Crescent Foundry, Xinxing Cast Pipe Co., Ltd, Brakes India Private Limited, Grupo Industrial Saltillo |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date