IT Devices Market Size, Share and Booms with 9.38% CAGR Forecast

Global IT Devices Market Size, Share, Analysis Report By Product (Networking Equipment, Mobile Devices, Peripheral Devices, Computers and Laptops), Operating system (Linux, macOS, iOS, Android, Windows, Others), Distribution Channel (Offline, Online), Application (Consume, Enterprise, Industrial and Manufacturing) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

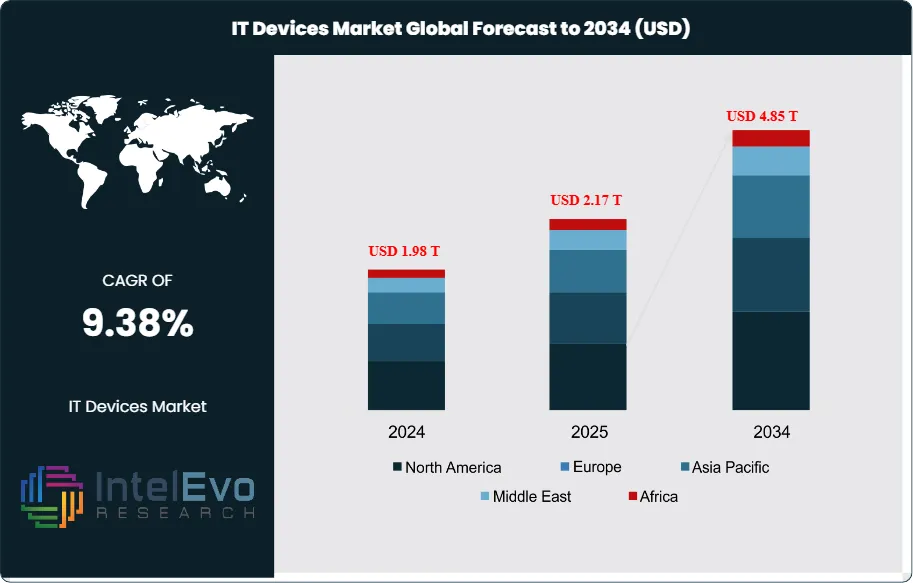

The IT Devices Market size is expected to be worth around USD 4.85 Trillion by 2034, from USD 1.98 Trillion in 2024, growing at a CAGR of 9.38% during the forecast period from 2024 to 2034. The IT Devices market is a critical component of the global technology ecosystem, encompassing a wide range of hardware solutions including smartphones, laptops, tablets, and desktop computers, servers, networking equipment, and emerging smart devices.

Get More Information about this report -

Request Free Sample ReportThese devices form the backbone of digital infrastructure for businesses and consumers worldwide, enabling communication, productivity, entertainment, and business operations across all sectors. The market's growth is driven by continuous technological innovation, increasing digitalization across industries, and the proliferation of remote work models that demand advanced computing capabilities. The integration of artificial intelligence, 5G connectivity, and edge computing technologies is reshaping device capabilities and creating new market opportunities for manufacturers and solution providers.

Several key factors influence the expansion and evolution of the IT devices market. The acceleration of digital transformation initiatives across enterprises drives demand for advanced computing hardware that can support cloud-based applications, data analytics, and collaborative workflows. The rise of hybrid and remote work models has fundamentally altered device requirements, with organizations investing in portable, high-performance devices that enable productivity from any location. Consumer behavior shifts toward multi-device ecosystems and seamless connectivity experiences further fuel market growth. Additionally, the emergence of Internet of Things (IoT) applications, smart home technologies, and industrial automation creates new device categories and expands total addressable market opportunities. Sustainability concerns and circular economy principles are also influencing purchasing decisions and product development strategies.

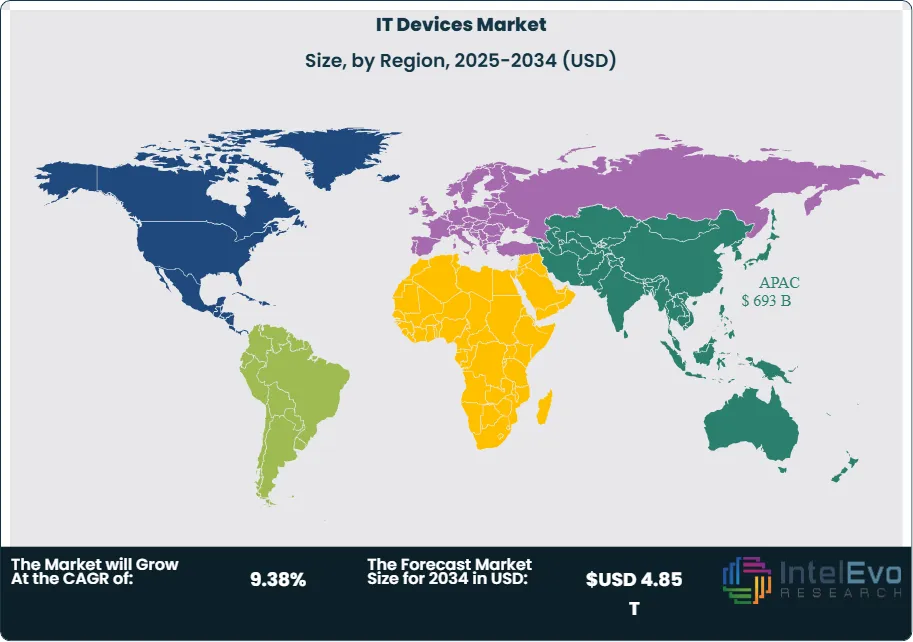

Regionally, the IT Devices market exhibits distinct growth patterns reflecting varying levels of economic development, technology adoption, and infrastructure maturity. Asia-Pacific leads global manufacturing and maintains significant market share, with countries like China, South Korea, and Taiwan serving as major production hubs for smartphones, tablets, laptops, and consumer electronics. North America represents a mature market characterized by high device penetration rates, premium product preferences, and early adoption of emerging technologies like 5G-enabled devices and AI-powered hardware. Europe demonstrates steady growth driven by enterprise digitalization initiatives, regulatory compliance requirements, and sustainability-focused procurement policies. Latin America and the Middle East & Africa represent emerging markets with substantial growth potential as internet penetration increases and economic development accelerates technology adoption.

The COVID-19 pandemic significantly impacted the IT Devices market, creating both challenges and opportunities that continue to influence market dynamics. Initial supply chain disruptions affected manufacturing and distribution, leading to component shortages and delivery delays that persisted into 2024. However, the sudden shift to remote work and digital learning created unprecedented demand for laptops, tablets, webcams, and home networking equipment. Organizations rapidly accelerated device refresh cycles and expanded distributed IT infrastructure to support work-from-home initiatives. Consumer spending patterns shifted toward technology purchases as entertainment and communication moved online, driving growth in gaming devices, smart TVs, and mobile devices. The pandemic's lasting impact includes permanent changes in work patterns that sustain elevated demand for portable computing devices and collaboration technologies.

Geopolitical tensions and trade policies significantly affect the IT devices market through supply chain disruptions, tariff impacts, and technology transfer restrictions. Trade conflicts between major economies, particularly between the United States and China, have led to component sourcing diversification and manufacturing relocation strategies. Semiconductor supply chain vulnerabilities exposed during recent global events highlight the strategic importance of device manufacturing capabilities. Export controls on advanced technologies create compliance challenges for international manufacturers and limit access to cutting-edge components. These dynamics encourage regional manufacturing investment and supply chain localization efforts, though they may increase costs and complexity for global device manufacturers.

International trade agreements and regional partnerships continue to facilitate market growth by reducing barriers to technology commerce and investment. Trade frameworks such as the CPTPP, USMCA, and various bilateral technology agreements promote standardization, intellectual property protection, and cross-border investment in manufacturing facilities. These agreements often include provisions for digital trade, data flows, and technology standards that benefit IT device manufacturers and consumers. Harmonization of safety standards, electromagnetic compatibility requirements, and environmental regulations through international cooperation reduces compliance costs and accelerates global product launches.

Key Takeaways

- Market Growth: The IT Devices Market is expected to reach USD 4.85 Trillion by 2034, driven by digital transformation, remote work adoption, and emerging technology integration.

- Product Dominance: Mobile devices dominate the IT devices market due to their widespread adoption, driven by smartphone penetration, improved connectivity, and the growing dependence on portable technology.

- Operating System Dominance: Android leads the operating system landscape due to its affordability, open-source flexibility, diverse device availability, and global accessibility.

- Distribution Channel Dominance: Offline distribution leads the IT device market as consumers value trust, product assurance, and personalized in-store experiences before making purchases.

- Application Dominance: Enterprises lead the IT devices market, as businesses consistently invest in digital infrastructure, workforce mobility, and secure technological ecosystems.

- Drivers: Key growth drivers include 5G network deployment, AI integration, IoT expansion, and hybrid work model adoption that accelerate demand for advanced computing capabilities.

- Restraints: Growth faces challenges from component shortages, cybersecurity concerns, and environmental regulations that increase manufacturing complexity and costs.

- Opportunities: Market expansion opportunities include edge computing devices, sustainable technology solutions, and emerging markets with accelerating digitalization initiatives.

- Trends: Emerging trends include AI-powered devices, foldable displays, sustainable manufacturing, and convergence between consumer and enterprise device capabilities.

- Regional Analysis: Asia-Pacific leads manufacturing and market size, while North America drives premium segment growth. Europe focuses on sustainability and data privacy compliance requirements.

Product Analysis:

Mobile Devices Lead With Over 45% Market Share In IT Devices Market, Within the product segment, mobile devices account for the largest market share, acting as the central hub for communication, entertainment, banking, e-commerce, and workplace productivity. The rise of 4G and 5G connectivity, advancements in mobile processors, and integration of AI-enabled applications have drastically expanded their utility beyond basic usage, making them indispensable to consumers and professionals alike. Computers and laptops remain critical for businesses, education, and high-performance computing, though their growth is moderate compared to mobile devices. Networking equipment continues to witness demand primarily as infrastructure support, enabling seamless internet access for both enterprises and homes. Peripheral devices, such as printers, storage drives, and accessories, play a supporting role but are secondary to core computing devices. The dominance of mobile devices highlights their central role in bridging digital lifestyles with professional workflows, serving as the most valued category across diverse end-users.

Operating System Analysis:

Android is the leading OS thanks to its dominance in smartphones and tablets, covering a wide spectrum from entry-level to premium devices. Its open-source nature allows manufacturers to customize interfaces, creating device differentiation and affordability for mass adoption in emerging economies. Furthermore, its extensive app ecosystem and compatibility with multiple hardware brands strengthen consumer preference. iOS, while limited to Apple devices, remains strong in premium markets, attracting loyal users through seamless integration and exclusive features. Windows continues to be a vital choice for enterprise and professional users relying on PCs for productivity, while macOS remains popular among designers, developers, and creative professionals seeking optimized performance. Linux has niche traction among programmers, open-source advocates, and enterprises prioritizing customization and cybersecurity. Other operating systems hold marginal presence. The overall market balance reflects Android’s unmatched reach, with iOS and Windows maintaining influential secondary roles.

Distribution Channel Analysis:

Offline channels dominate IT device distribution primarily because customers prefer to physically inspect products—especially high-value gadgets like smartphones, laptops, and networking devices—before finalizing purchases. Brand-exclusive outlets, multi-retail chains, and physical showrooms create trust by offering in-person consultations, after-sales service, and immediate availability. This is particularly relevant for enterprise and institutional buyers investing in large-scale purchases that demand reliability and service guarantees. Online channels, while rapidly growing due to convenience, attractive discounts, and home delivery, often fall behind in categories where buyers seek tangibility, warranty reliability, and personal interaction. Hybrid approaches, such as “click-and-collect” models, are now emerging to complement offline sales. In regions where internet penetration and e-commerce infrastructure are still developing, brick-and-mortar channels remain the undisputed leader. Therefore, despite increasing online traction, offline distribution continues to secure the largest revenue share for IT device sales globally.

Application Analysis:

The enterprise segment contributes the highest value share within IT device applications, as organizations procure devices in bulk and favor advanced, secure solutions optimized for productivity. Enterprises deploy a range of IT devices, including laptops, mobile devices, networking equipment, and specialized peripherals, making them a larger revenue contributor than the consumer segment, despite lower unit volumes. The shift to hybrid and remote working has further compelled businesses to equip employees with mobile devices and laptops to ensure flexibility. Consumers, in contrast, primarily drive demand for smartphones, gaming devices, and entertainment solutions, accounting for higher sales volumes but at relatively lower device prices. Enterprises also rely heavily on robust operating systems such as Windows and Linux along with offline procurement channels for reliable service. Consequently, enterprises dominate this segment as strategic investments in digital transformation and operational efficiency continue to accelerate.

Regional Analysis

Asia-Pacific Leads With More Than 35% Market Share In IT Devices Market, Asia-Pacific maintains market leadership through dominant manufacturing capabilities, rapid economic growth, and large consumer populations that create substantial domestic demand alongside export production volumes. The region benefits from established supply chains, skilled manufacturing workforces, and government policies that support technology industry development. Countries like China, South Korea, and Taiwan host major device manufacturers and component suppliers that drive innovation and cost competitiveness. Rising middle-class populations across emerging markets create growing demand for smartphones, laptops, and consumer electronics that support the region's market position.

North America represents a mature market characterized by high device penetration rates, premium product preferences, and early adoption of emerging technologies including 5G devices, AI-powered hardware, and enterprise mobility solutions. The region's emphasis on innovation and technological leadership drives demand for cutting-edge devices that support advanced applications and services. Strong enterprise technology spending and sophisticated IT infrastructure requirements create opportunities for specialized device categories and high-value solutions.

Europe demonstrates steady growth driven by digital transformation initiatives, sustainability requirements, and regulatory compliance needs that influence device selection and procurement processes. The region's focus on environmental responsibility encourages adoption of energy-efficient devices and circular economy principles that extend product lifecycles. GDPR and other privacy regulations drive demand for devices with enhanced security features and data protection capabilities. Brexit-related changes and EU digital sovereignty initiatives influence supply chain strategies and regional manufacturing considerations.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Product

- Networking Equipment

- Mobile Devices

- Peripheral Devices

- Computers and Laptops

Operating system

- Linux

- macOS

- iOS

- Android

- Windows

- Others

Distribution Channel

- Offline

- Online

Application

- Consume

- Enterprise

- Industrial and Manufacturing

Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 2.17 T |

| Forecast Revenue (2034) | USD 4.85 T |

| CAGR (2025-2034) | 9.38% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product (Networking Equipment, Mobile Devices, Peripheral Devices, Computers and Laptops), Operating system (Linux, macOS, iOS, Android, Windows, Others), Distribution Channel (Offline, Online), Application (Consume, Enterprise, Industrial and Manufacturing) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Apple Inc., Samsung Electronics Co., Ltd., Microsoft Corporation, Dell Technologies Inc., Lenovo Group Limited, HP Inc., Xiaomi Corporation, ASUS, Acer Inc., NVIDIA Corporation, Intel Corporation, Cisco Systems Inc., Huawei Technologies Co., Ltd., LG Electronics Inc., Sony Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the IT Devices Market?

The global IT Devices Market is expected to surge to USD 4.85 Trillion by 2034 from USD 1.98 Trillion in 2024, registering a 9.38% CAGR. Get the latest market insights!

Who are the major players in the IT Devices Market?

Apple Inc., Samsung Electronics Co., Ltd., Microsoft Corporation, Dell Technologies Inc., Lenovo Group Limited, HP Inc., Xiaomi Corporation, ASUS, Acer Inc., NVIDIA Corporation, Intel Corporation, Cisco Systems Inc., Huawei Technologies Co., Ltd., LG Electronics Inc., Sony Corporation

Which segments covered the IT Devices Market?

Product (Networking Equipment, Mobile Devices, Peripheral Devices, Computers and Laptops), Operating system (Linux, macOS, iOS, Android, Windows, Others), Distribution Channel (Offline, Online), Application (Consume, Enterprise, Industrial and Manufacturing)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date