IT Infra Mgmt Tools Market: $53.71B by 2034, 8.53% CAGR!

Global IT Infrastructure Management Tools Market Size, Share, Analysis Report By Component (Hardware, Services, Software) Deployment Model (Cloud-Based, On-Premises) Organization Size (SMEs, Large Enterprises) Industry Vertical (BFSI, Healthcare, Retail, Manufacturing, IT and Telecommunications, Government, Others) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

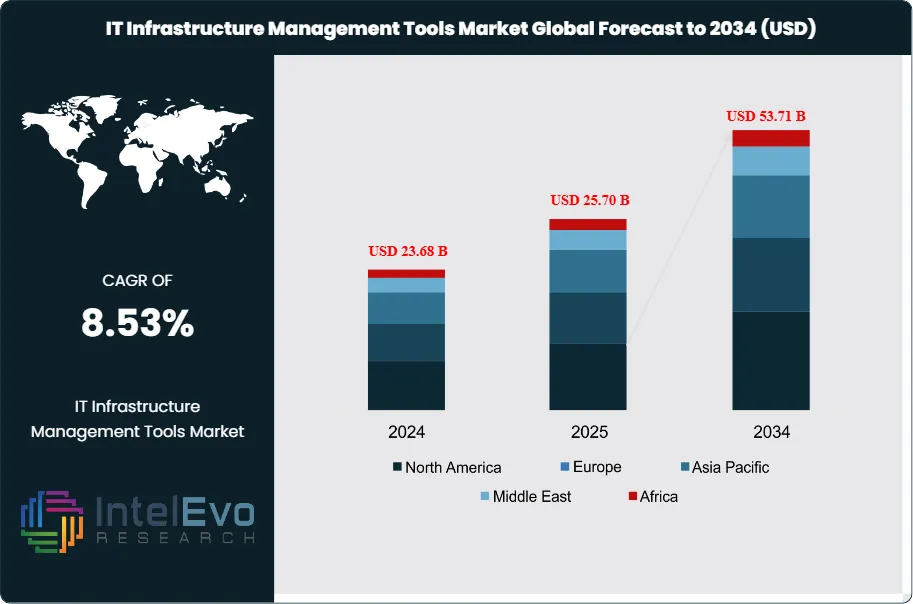

The IT Infrastructure Management Tools Market size is expected to be worth around USD 53.71 billion by 2034, rising from USD 23.68 billion in 2024, and expanding at a CAGR of 8.53% during the forecast period from 2024 to 2034. This growth is driven by increasing adoption of hybrid and multi-cloud environments, rising demand for real-time infrastructure monitoring, and the growing complexity of IT ecosystems across enterprises. The integration of AI-driven automation, predictive analytics, and observability platforms is further enhancing operational efficiency, cost optimization, and system reliability, making infrastructure management tools essential for modern digital enterprises.

Get More Information about this report -

Request Free Sample ReportThe Engineering Services Outsourcing (ESO) market refers to the practice where businesses delegate engineering-related functions such as product design, prototyping, testing, and system integration to specialized third-party providers rather than managing them in-house. This approach enables firms to tap into a broader pool of technical talent, access advanced digital tools, and achieve greater efficiency and scalability. ESO often involves leveraging expertise in emerging domains like artificial intelligence, the Internet of Things (IoT), and digital twins, giving organizations the ability to accelerate innovation cycles while maintaining cost competitiveness. The global ESO market has witnessed robust growth as companies seek to navigate increasing project complexity, sustain operational agility, and control expenditure by utilizing capabilities available in talent-rich and cost-competitive regions.

Several factors drive the expansion of the ESO sector. First, intensifying competition compels organizations to focus on core activities and outsource non-core, engineering-heavy processes to trusted partners with specialized knowledge and technology. Cost efficiency remains a key motivator, with outsourcing to locations where engineering labor is more affordable freeing up capital for strategic investments. Furthermore, the growing trend towards digital transformation and the rapid adoption of Industry 4.0 solutions have made expertise in automation, data analytics, and cloud platforms more critical than ever. EOS providers are investing heavily in cybersecurity, intellectual property protection, and regulatory compliance to meet the stringent requirements of highly regulated industries such as aerospace, automotive, and healthcare. However, concerns regarding data privacy, cross-border legal frameworks, and potential loss of direct control continue to influence outsourcing decisions, prompting companies to carefully select partners based on security, compliance, and domain-specific experience.

Regionally, the Asia-Pacific region anchors the global ESO market, owing to its extensive talent base, favorable cost structures, and impressive advancements in engineering education and digital infrastructure. India, China, and Southeast Asian countries consistently attract significant ESO contracts due to ongoing investments in technical capability and supportive government policies. Europe and North America are experiencing increasing engagement in ESO, often emphasizing collaborative research, advanced engineering quality, and compliance with local regulations. Emerging markets like Eastern Europe and Latin America are also gaining traction, favored as nearshore alternatives due to their industry/domain expertise and cultural affinity, offering more flexibility for multinational clients seeking diversified delivery models.

The COVID-19 pandemic exerted a transformative influence on the ESO sector. While disruptions to supply chains and workforces temporarily delayed projects in industries like automotive and manufacturing, the crisis also revealed the importance of digital collaboration tools and remote delivery models. Sectors such as healthcare, pharmaceuticals, and technology intensified their reliance on outsourced engineering services to pivot rapidly and scale innovation. This shift accelerated the adoption of agile engagement models between clients and ESO partners, catalyzing investments in secure, cloud-based collaborative environments and reinforcing the value proposition of outsourcing as a means to achieve resilience in uncertain times.

Regional conflicts and the imposition of tariffs, particularly between global heavyweights such as the U.S. and China, have complicated ESO dynamics. Elevated tariffs on goods and heightened geopolitical tensions can raise the cost of outsourcing, disrupt established provider relationships, and undermine supply chain reliability. To mitigate these risks, businesses are increasingly exploring alternative sources for engineering services, including nearshoring to locations like Mexico and Eastern Europe. Diversifying outsourcing portfolios, consolidating vendors, and prioritizing partners in politically stable regions with minimal tariff exposure has become a critical strategy, allowing firms to balance cost, quality, and supply chain risk in an evolving global environment.

Trade agreements between major economies continue to shape the contours of the ESO market. Bilateral and multilateral deals that facilitate digital trade, harmonize intellectual property protection standards, and lower barriers for cross-border data flows significantly enhance the attractiveness of outsourcing engineering services. Such agreements not only reduce the direct cost impact of tariffs and trade frictions but also simplify compliance for complex, cross-jurisdictional projects. Efforts to foster global collaboration through streamlined regulatory frameworks and digital economy agreements are accelerating innovation and investment across the engineering services value chain, supporting the continued expansion and sophistication of the EOS market.

Key Takeaways

- Market Growth: The IT Infrastructure Management Tools Market is expected to reach USD 53.71 Billion by 2034, powered by the rapid adoption of cloud, AI, and automation, the need for operational resilience, and shifting to digital-first business models.

- Component Dominance: Software solutions are the primary force in the market, thanks to their affordability, scalability, and frequent enhancements in features.

- Deployment Model Dominance: Although on-premises deployment remains widely utilized, cloud-based tools are rapidly expanding in popularity, driven by their flexibility and the reduction they offer in IT management costs.

- Organization Size Dominance: Large enterprises make up the bulk of users, drawn by the advantages of integrated management platforms for overseeing intricate IT environments.

- Industry Vertical Dominance: The BFSI sector is the leading industry user, with strong uptake also seen across IT and telecom, healthcare, and manufacturing, largely due to their strict compliance, security, and uptime demands.

- Drivers: Digital transformation and rising IT complexity fuel demand through automation, proactive monitoring, and scalability.

- Restraints: High initial investments and shortage of skilled personnel restrain growth by increasing deployment barriers and operational risks.

- Opportunities: AI-driven automation and sustainability-focused tools enable smarter, greener infrastructure management.

- Trends: Integration of AI/ML, cybersecurity features, SaaS, and sustainability analytics are reshaping the market’s value proposition.

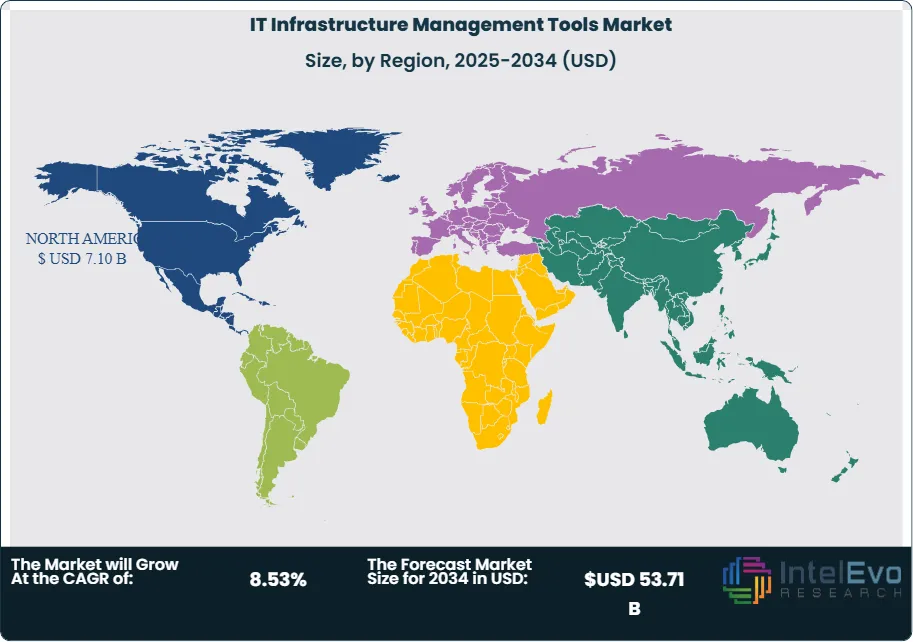

- Regional Leader: North America leads owing to high IT maturity, security compliance, and cloud adoption. APAC shows high promise with robust investment, digital expansion, and demand from SMEs.

Component Analysis:

Software Leads With over 30% Market Share In IT Infrastructure Management Tools Market: The software segment outpaces hardware and services due to user preference for scalable, easily updated, and cost-effective solutions that can automate management across diverse infrastructure. SaaS and cloud-based models provide strong ROI, low maintenance, and adaptability, making them essential for digital transformation. While hardware and services are integral for deployment and ongoing operations, continual software innovation is setting the pace for competitive differentiation.

Deployment Model Analysis:

On-premises models retain dominance due to data privacy, regulatory compliance, and integration concerns, especially in highly regulated sectors (e.g., finance, government). However, the rapid shift to cloud-based tools is evident as organizations seek flexibility, OPEX-based cost structures, and cloud-native scalability for new projects or hybrid environments. Vendors increasingly offer hybrid deployment to meet evolving customer needs and address legacy lock-in.

Organization Size Analysis:

Large enterprises dominate share due to the scale and complexity of managing multi-site, multi-cloud, and hybrid infrastructures with strict compliance and uptime mandates. Their adoption of integrated management platforms allows for centralized governance, continuous optimization, and incident response.

Industry Vertical Analysis:

BFSI providers face the greatest regulatory and performance pressures, making them leading adopters of integrated, automated management tools. IT & Telecom companies focus on scalability, uptime, and global reach, while healthcare and manufacturing are increasing investments to support compliance (HIPAA, FDA), IoT, and digital production environments.

Regional Analysis

North America Leads With more than 30% Market Share In IT Infrastructure Management Tools Market: North America retains its commanding position as the leader in both scale and innovation within the IT infrastructure management market. This dominance is anchored by a well-established digital foundation, broad adoption of cloud technologies, and progressive regulatory frameworks that foster ongoing development. The United States stands at the center of this regional strength, with advanced efforts in digitization and stringent cybersecurity policies propelling sustained growth and setting industry benchmarks for security and operational excellence.

The Asia-Pacific (APAC) region emerges as the sector’s fastest-expanding market. This growth is propelled by rapid digital transformation, particularly in China, India, and Southeast Asian countries, where governments and businesses are making significant investments in modernizing infrastructure and increasing access to emerging technologies. A key factor is the substantial uptake of IT management platforms among small and medium-sized enterprises (SMEs), fueling widespread regional adoption and driving innovation at multiple organizational levels.

Meanwhile, Europe demonstrates consistent advancement characterized by rigorous adherence to data protection regulations and sustainability imperatives. The enforcement of privacy laws such as GDPR and the focus on green IT solutions position the region as a model for compliant, energy-efficient infrastructure management. In contrast, Latin America and the Middle East & Africa are starting to gain ground as digital transformation accelerates and mobile infrastructure projects advance. Although these markets currently trail global frontrunners in maturity, their ongoing developments point to significant long-term potential as adoption intensifies.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

Component

- Hardware

- Services

- Software

Deployment Model

- Cloud-Based

- On-Premises

Organization Size

- SMEs

- Large Enterprises

Industry Vertical

- BFSI

- Healthcare

- Retail

- Manufacturing

- IT and Telecommunications

- Government

- Others

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 23.68 B |

| Forecast Revenue (2034) | USD 53.71 B |

| CAGR (2025-2034) | 8.53% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component (Hardware, Services, Software) Deployment Model (Cloud-Based, On-Premises) Organization Size (SMEs, Large Enterprises) Industry Vertical (BFSI, Healthcare, Retail, Manufacturing, IT and Telecommunications, Government, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | IBM, Microsoft, HPE (Hewlett Packard Enterprise, ServiceNow , ManageEngine, ScienceLogic, SolarWinds, Infosys , EPAM Systems, Sunbird Software |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the IT Infrastructure Management Tools Market?

IT Infrastructure Management Tools Market booming to $53.71B by 2034! Explore 8.53% CAGR & drivers shaping IT operations, cloud adoption & automation.

Who are the major players in the IT Infrastructure Management Tools Market?

IBM, Microsoft, HPE (Hewlett Packard Enterprise, ServiceNow , ManageEngine, ScienceLogic, SolarWinds, Infosys , EPAM Systems, Sunbird Software

Which segments covered the IT Infrastructure Management Tools Market?

Component (Hardware, Services, Software) Deployment Model (Cloud-Based, On-Premises) Organization Size (SMEs, Large Enterprises) Industry Vertical (BFSI, Healthcare, Retail, Manufacturing, IT and Telecommunications, Government, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

IT Infrastructure Management Tools Market

Published Date : 02 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date