IT Solution for Dialysis Market Forecast 2024–2034 | 8.6% CAGR

Global IT Solution for Dialysis Market Size, Share & Analysis By Deployment Type (On-premise, Cloud-based), By Application (Data Acquisition, Data Management, Quality Assurance, Others) Industry Outlook, Healthcare Digitalization & Forecast 2025–2034

Report Overview

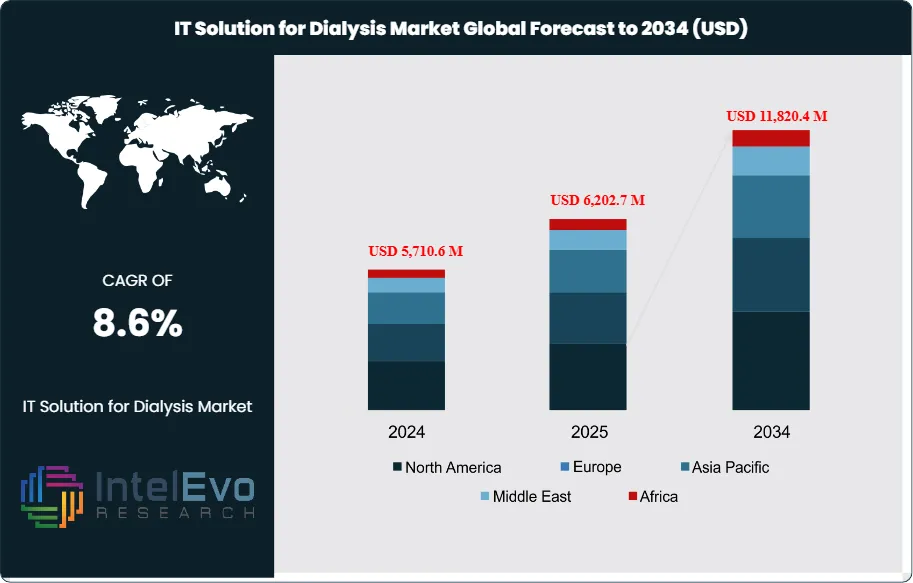

The IT Solution for Dialysis Market is valued at USD 5,710.6 million in 2024 and is projected to reach approximately USD 11,820.4 million by 2034, reflecting a robust CAGR of about 8.6% during 2025–2034. Growing digital transformation across dialysis centers, increasing adoption of workflow automation, and rising integration of AI-driven clinical decision tools are accelerating market expansion. As patient volumes climb and remote care models mature, dialysis providers are prioritizing scalable IT ecosystems, driving strong global demand. This shift positions dialysis IT solutions as a critical enabler of precision care and operational efficiency worldwide.

Get More Information about this report -

Request Free Sample ReportRising incidence of kidney failure and the growing need for accessible, cost-efficient dialysis treatment are accelerating the adoption of IT-driven systems in nephrology care. Over the past decade, the market has shifted from facility-based hemodialysis models to more patient-centric home treatment options, enabled by digital interfaces and real-time monitoring tools. This evolution reflects broader healthcare trends favoring decentralized care and automation. As of 2023, the number of dialysis patients globally surpassed 3.5 million, with a consistent year-on-year increase driven by aging populations and rising rates of diabetes and hypertension.

Demand-side growth is further supported by the expanding use of home dialysis technologies, which reduce treatment time and hospital dependency. On the supply side, manufacturers are scaling R&D investments to enhance software integration, remote diagnostics, and predictive analytics. However, high implementation costs, regulatory constraints, and risks of data breaches pose notable barriers. Interoperability with hospital information systems and compliance with health data privacy regulations also remain significant concerns for healthcare providers.

Technological advances are shaping the market trajectory. Cloud-based platforms, AI-powered patient monitoring, and remote diagnostic capabilities now play a central role in improving clinical outcomes. For instance, AI algorithms are being developed to predict fluid imbalance or detect early signs of vascular access failure. These tools reduce complications, minimize hospital visits, and support clinical decision-making.

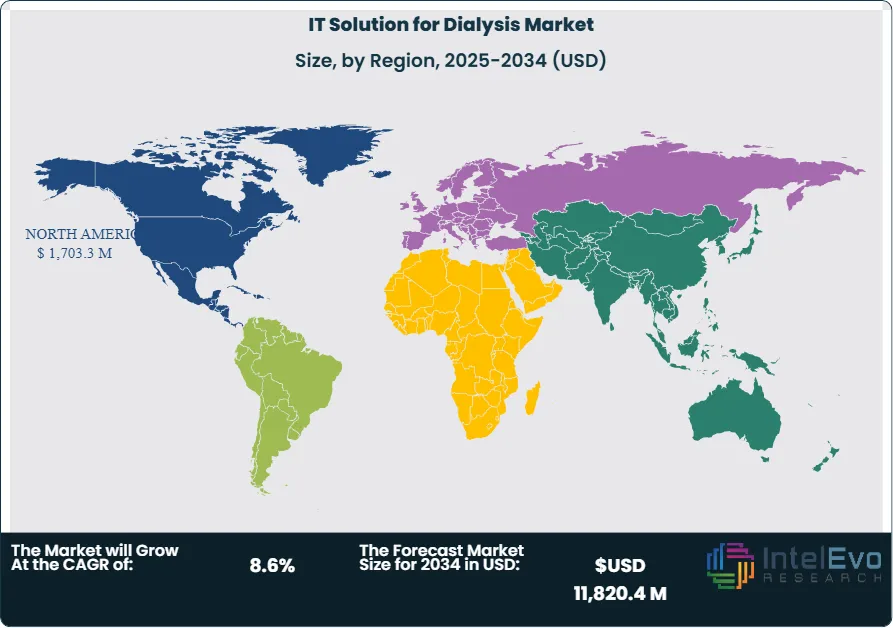

Regionally, North America leads the market due to strong healthcare IT infrastructure, reimbursement support, and high adoption of home dialysis solutions. Europe follows, driven by public health initiatives and increasing preference for digital tools in chronic care management. Meanwhile, Asia-Pacific is emerging as a high-growth region, particularly in countries like China and India where ESRD (End-Stage Renal Disease) cases are rising and healthcare digitization is expanding rapidly. Investors should monitor these emerging markets closely, where infrastructure gaps are narrowing and demand for scalable treatment solutions continues to rise.

As global health systems prioritize cost containment and remote care, IT solutions for dialysis are becoming integral to next-decade renal care delivery.

Key Takeaways

- Market Growth: The global IT solution for dialysis market reached USD 5,710.6 million in 2024 and is projected to reach USD 11,820.4 million by 2034, expanding at a CAGR of 8.6%. Growth is driven by rising global dialysis procedures and the shift toward home-based treatment supported by digital platforms.

- Deployment Type: On-premise solutions accounted for 58.3% of market share in 2023, driven by demand for greater data control and security within hospital and clinic-based dialysis centres.

- Application: Data acquisition held 35.2% of the market in 2023, as real-time patient monitoring and electronic data capture remain critical for treatment accuracy and regulatory compliance.

- Driver: Increasing dialysis prevalence due to the global rise in chronic kidney disease (CKD) cases, particularly linked to diabetes and hypertension, is boosting IT infrastructure investments in nephrology services.

- Restraint: High implementation costs and ongoing maintenance of IT systems limit adoption among small- to mid-sized healthcare facilities, particularly in price-sensitive markets.

- Opportunity: Asia-Pacific presents a strong growth opportunity, with expanding healthcare access and rising ESRD (End-Stage Renal Disease) rates. The region is expected to register a CAGR above the global average through 2033.

- Trend: Integration of artificial intelligence and advanced analytics is gaining traction. AI-driven systems are being used to predict dialysis-related complications, enhancing clinical decision-making and reducing hospitalization rates.

- Regional Analysis: North America led the market in 2023 with a 39.2% share and USD 1,703.3 million in revenue, supported by established healthcare IT systems and reimbursement models. Asia-Pacific is emerging rapidly, driven by increased investment in digital healthcare infrastructure and growing dialysis demand.

Get More Information about this report -

Request Free Sample Report

Deployment Type Analysis

Deployment strategy significantly influences the operational efficiency and data security of dialysis centers implementing IT solutions. In 2025, on-premise solutions continue to lead, accounting for approximately 58.3% of the global market. These systems appeal to hospitals and clinics that prioritize internal data control and compliance, particularly where patient privacy regulations are strict. They also allow for greater customization and integration with legacy systems, which remains important in high-volume treatment centers.

However, the momentum is shifting toward cloud-based deployments. Healthcare providers are increasingly investing in cloud infrastructure to gain remote access to patient data, support telehealth functionality, and reduce dependence on physical IT assets. The cloud model offers scalability that supports fluctuating workloads and enables seamless collaboration between nephrologists, technicians, and administrative staff. With healthcare IT spending projected to rise at a CAGR of over 9% globally through 2030, cloud adoption in dialysis settings is expected to accelerate, especially in regions prioritizing digital health expansion.

Application Analysis

Among dialysis IT applications, data acquisition dominates with a 35.2% share as of 2025. This segment includes the capture of real-time clinical indicators such as blood pressure, treatment history, ultrafiltration levels, and laboratory results. Capturing accurate and timely data is vital for tailoring dialysis protocols, reducing treatment errors, and supporting long-term patient tracking. The demand for integrated monitoring systems is increasing, particularly as providers move toward value-based care models.

Data management is another critical area, focused on secure data storage, structured retrieval, and interoperability with hospital information systems. Efficient data management improves clinical workflow and supports regulatory compliance. Providers increasingly seek platforms that centralize patient records across multiple sites, making this application essential to both public and private sector initiatives.

Quality assurance tools are also gaining ground, particularly in mature healthcare markets. These systems support adherence to international treatment guidelines, monitor procedural deviations, and reduce risks of complications. With regulators tightening oversight on dialysis outcomes, IT solutions that incorporate QA dashboards and automated alerts are seeing wider deployment.

Regional Analysis

North America remains the dominant market, generating USD 1,703.3 million in revenue in 2023 and maintaining a 39.2% global share. This lead is reinforced by large-scale investments in health IT infrastructure, policy support for home-based dialysis, and strong collaborations between software providers and dialysis service operators. For example, Fresenius Medical Care and Acumen Physician Solutions have co-developed nephrology-specific EHR systems, reinforcing their market leadership through specialized digital offerings.

In contrast, Asia Pacific is the fastest-growing region, driven by rising ESRD prevalence, expanding healthcare budgets, and improving broadband access. Countries like India and China are deploying public-private partnerships to scale digital dialysis solutions in underserved areas. The regional market is projected to grow at a CAGR exceeding 8% through 2030.

In the Middle East and Africa, market expansion faces challenges related to logistics and supply chain disruptions. Countries like Saudi Arabia and Egypt have reported difficulties in sourcing equipment and software, which may delay large-scale IT deployments. Meanwhile, regulatory bodies in Europe, such as NHS England, are actively working with renal care networks to ensure continuity of services amid these supply constraints, indicating an evolving support structure but highlighting the risk of regional imbalances in deployment capacity.

Market Key Segments

By Deployment Type

- On-premise

- Cloud-based

By Application

- Data Acquisition

- Data Management

- Quality Assurance

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 5,710.6 M |

| Forecast Revenue (2034) | USD 11,820.4 M |

| CAGR (2024-2034) | 8.6% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Deployment Type (On-premise, Cloud-based), By Application (Data Acquisition, Data Management, Quality Assurance, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Gaia Software, Fresenius Medical Care, CureMD Healthcare, Renalyx, CitiusTech, Visonex, Constellation Kidney Group, B.Braun, Document Storage Systems, Sagekey Software, iSalus Healthcare, Aithent, M Dialysis, Renesan Software, QuantumSys Technologies |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

IT Solution for Dialysis Market

Published Date : 12 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date