K-12 EdTech Market Size, Growth Outlook | 15.2% CAGR

Global K-12 Education Technology Market Size, Share & Analysis By Type (Hardware, Software, Content), By Sector (Preschool, K-12), By Solution (LMS, Virtual Classrooms, AI Tutors), By Deployment, By End-User Industry Regions & Key Players – Digital Learning Trends & Forecast 2025–2034

Report Overview

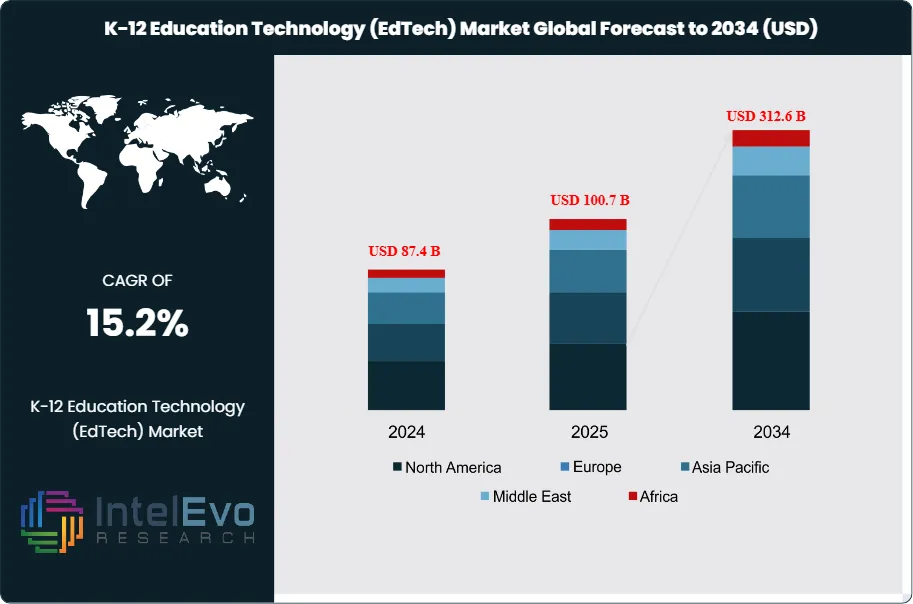

The K-12 Education Technology (EdTech) market is estimated at USD 87.4 billion in 2024 and is on track to reach approximately USD 312.6 billion by 2034, implying a strong compound annual growth rate of about 15.2% over 2025–2034. Accelerated digital adoption in classrooms, expanding 1:1 device programs, and rising demand for AI-powered learning tools continue to reshape global K-12 ecosystems. Governments and private institutions are investing heavily in personalized learning platforms, virtual classrooms, and STEM-focused digital content.

Get More Information about this report -

Request Free Sample ReportAs hybrid and competency-based learning models strengthen, EdTech is evolving from supplementary support to a core instructional infrastructure. The rise of adaptive learning algorithms, immersive AR/VR content, and real-time assessment analytics is driving deeper engagement and improved academic outcomes. With parents, teachers, and policymakers aligned on long-term digital transformation, the K-12 EdTech market is set for unprecedented global momentum.

EdTech has become a foundational element in K-12 education, offering a wide range of tools such as learning management systems, digital content platforms, interactive applications, and smart classroom hardware. Adoption has accelerated in recent years, driven by the shift toward personalized, data-informed learning. The integration of AI and machine learning into classroom technologies enables adaptive platforms that respond to individual student progress in real time, improving both engagement and academic outcomes.

A key growth driver is the ongoing transition to blended learning models, which combine face-to-face instruction with digital content delivery. These models have gained institutional support, especially in districts investing in long-term digital infrastructure. Government-led digital initiatives and increased funding in school technology further support adoption. According to recent analysis, more than 70% of educational institutions plan to launch online learning programs over the next three years, highlighting the growing role of technology in formal instruction.

However, challenges around digital equity persist. Access to devices and high-speed internet remains uneven, especially across rural and lower-income communities. These gaps directly impact student participation and performance. In addition, there is continued concern over data privacy, system reliability, and the long-term effectiveness of tech-based instruction when compared with traditional teaching methods.

Segment-specific growth is also reshaping the broader EdTech market. The global Generative AI in EdTech segment is forecast to grow at a CAGR of 41%, reaching USD 8.3 billion by 2033. AI overall in EdTech is projected to reach USD 92.09 billion by the same year, up from USD 3.65 billion in 2023. The broader EdTech and Smart Classroom market is also expanding, expected to reach USD 498.5 billion by 2032 at a CAGR of 15%.

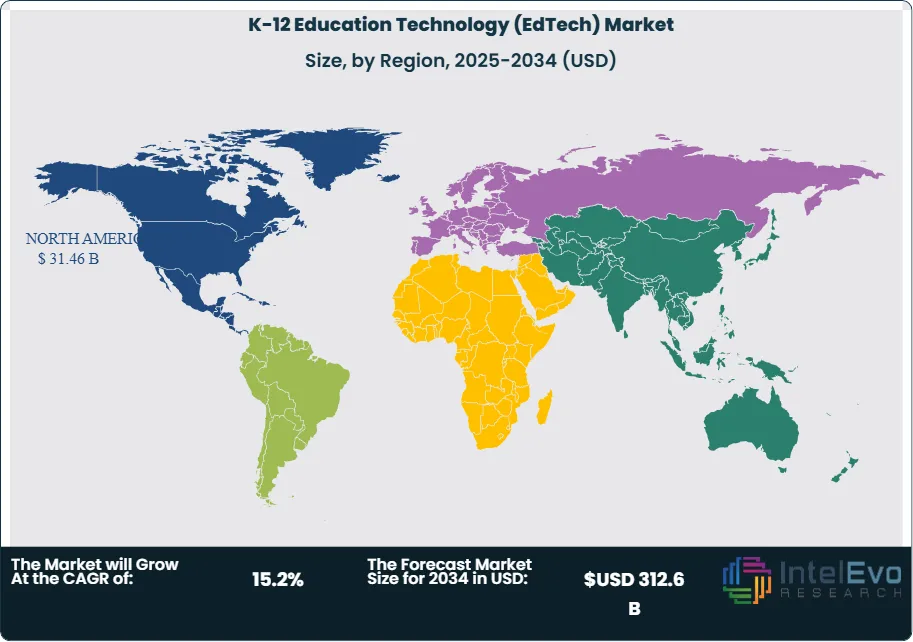

Regional investment continues to rise, particularly in Asia Pacific and North America, where large-scale public-private partnerships are driving digital classroom adoption. For investors and technology providers, the K-12 EdTech market presents sustained opportunity, especially in solutions that improve accessibility, enhance content quality, and align with evolving pedagogical standards.

Key Takeaways

- Market Growth: The global K-12 Education Technology (EdTech) market is projected to grow from USD 87.4 billion to USD 312.6 billion by 2034, reflecting a CAGR of 15.2%. Growth is driven by rising demand for personalized learning, increased integration of AI tools, and expanding digital infrastructure in schools worldwide.

- Deployment Type: Cloud-based solutions accounted for over 70% of the market share in 2023. Their scalability, ease of access, and reduced IT overhead have made them the preferred deployment model for schools and education providers.

- Product Type: Software solutions led the market with a 41% share in 2023, driven by widespread adoption of learning management systems, interactive content platforms, and student performance tracking tools.

- End User: The consumer segment held more than 80% of the market in 2023, reflecting the strong demand for EdTech applications among students, parents, and private tutoring providers outside formal school systems.

- Driver: The surge in AI-driven adaptive learning platforms is enhancing personalized education delivery. Real-time performance tracking and custom content recommendations are increasing both student engagement and learning outcomes.

- Restraint: Digital access gaps remain a key challenge. Inconsistent internet connectivity and limited device availability, especially in rural and low-income areas, continue to hinder widespread adoption of EdTech solutions.

- Opportunity: The Generative AI in EdTech segment is projected to grow at a CAGR of 41%, reaching USD 8.3 billion by 2033. Demand for automated content creation, language translation, and virtual teaching assistants is opening new monetization channels for providers.

- Trend: Blended learning is reshaping traditional instruction models. Schools are integrating synchronous online content with classroom teaching, driving demand for platforms that support hybrid delivery and real-time collaboration.

- Regional Analysis: North America led the global market in 2023, accounting for over 36% of total revenue, or USD 28.1 billion. Meanwhile, Asia Pacific is emerging as a high-growth region, supported by increasing education spending and large-scale digitization initiatives in countries such as India, China, and Indonesia.

Deployment Mode Analysis

As of 2025, cloud-based deployment continues to dominate the K-12 Education Technology (EdTech) landscape, accounting for over 70% of market share. Schools and districts increasingly favor cloud solutions for their cost efficiency, remote accessibility, and ease of integration. These platforms allow institutions to avoid heavy upfront infrastructure costs while offering scalable access to learning tools, data analytics, and content management systems.

The ability to support remote and hybrid learning models has been a key factor behind cloud adoption. Real-time collaboration, automatic software updates, and centralized data storage provide both educators and administrators with flexible tools that enhance learning continuity and performance tracking. With ongoing demand for personalized and data-informed instruction, cloud platforms are expected to remain the preferred deployment mode, especially in digitally mature education systems.

Type Analysis

In the EdTech market by type, software solutions accounted for more than 41% of total share in 2025, maintaining their lead over hardware and content segments. Schools increasingly rely on robust platforms such as learning management systems (LMS), assessment tools, and virtual classrooms to support daily instruction and student engagement. These systems have become core to the digital education infrastructure, enabling both classroom and at-home learning.

Software’s scalability and update capabilities allow institutions to continuously adopt new pedagogical tools without additional hardware investment. Furthermore, the rise of AI-powered adaptive learning has strengthened software’s position by enabling personalization at scale. With continued emphasis on customized learning pathways and measurable outcomes, software solutions are projected to drive the largest share of spending in K-12 EdTech through the forecast period.

Sector Analysis

The K-12 segment held a dominant position in 2025, accounting for over 70% of the total EdTech market. This reflects strong demand across primary and secondary school systems for digital tools that support academic instruction, assessment, and skill development. Government investments, curriculum reforms, and international donor support have fueled EdTech integration in classrooms across both developed and emerging markets.

K-12 institutions also benefit from economies of scale, enabling wider implementation of centralized systems for curriculum management and student performance tracking. With growing demand for digital learning in science, mathematics, and literacy, this segment will continue to attract significant investment, particularly in AI-based instruction, gamified learning, and STEM content platforms.

By End-User

The consumer segment continues to lead the K-12 EdTech market in 2025, capturing more than 80% of global share. Increased adoption of supplemental learning tools, homeschooling platforms, and mobile learning applications has driven consumer uptake. Parents and learners are turning to digital platforms for flexible, on-demand content that aligns with school curricula or supports independent study.

The segment’s growth is fueled by improved access to low-cost devices and mobile internet. The surge in app-based learning, supported by AI-driven personalization and gamification, has made EdTech more accessible and engaging. As education spending by households increases, particularly in emerging markets, consumer-focused platforms will continue to shape content delivery and business model innovation.

Regional Analysis

North America remains the leading region in the global K-12 EdTech market, accounting for over 36% of total revenue in 2025, valued at approximately USD 28.1 billion. The region’s strength lies in its advanced infrastructure, high digital literacy rates, and sustained investment in educational technologies. Major players such as Google, Apple, and Microsoft maintain strong partnerships with school districts and education departments across the U.S. and Canada.

Policy support has also played a key role. Initiatives aimed at bridging the digital divide and enhancing STEM learning have accelerated adoption of platforms across public and private schools. Meanwhile, Asia Pacific is emerging as a fast-growth region, with rising education budgets and digital transformation programs in countries like India, China, and Indonesia. These markets present significant long-term potential for EdTech vendors focused on scale, localization, and mobile-first delivery models.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Deployment Mode

- Cloud

- On-Premise

By Type

- Hardware

- Software

- Content

By Sector

- Preschool

- K-12

- By End-User

- Business

- Consume

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 87.4 B |

| Forecast Revenue (2034) | USD 312.6 B |

| CAGR (2024-2034) | 15.2% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Deployment Mode (Cloud, On-Premise), By Type (Hardware, Software, Content), By Sector (Preschool, K-12), By End-User (Business, Consume) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | DreamBox Learning, ABCmouse, Panorama Education, Blockly, IXL Learning, McGraw-Hill Education, Duolingo, Epic!, Outschool, Seesaw, Byju’s, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

K-12 Education Technology (EdTech) Market

Published Date : 10 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date