Kaolin Market Size, Share, Industry Forecast | CAGR 5.1% Growth

Global Kaolin Market Size, Share & Analysis Report by Application (Paper & Paperboard, Ceramics & Sanitaryware, Paints & Coatings, Rubber & Plastics, Construction, Pharmaceuticals & Personal Care), Grade (Water-Washed, Calcined, Delaminated, Air-Floated, Surface-Modified, Metakaolin), End-User (Industrial, Construction, Consumer Goods, Pharma & Personal Care), Region & Key Players – Segment Overview, Market Dynamics, Trends & Forecast 2025–2034

Report Overview

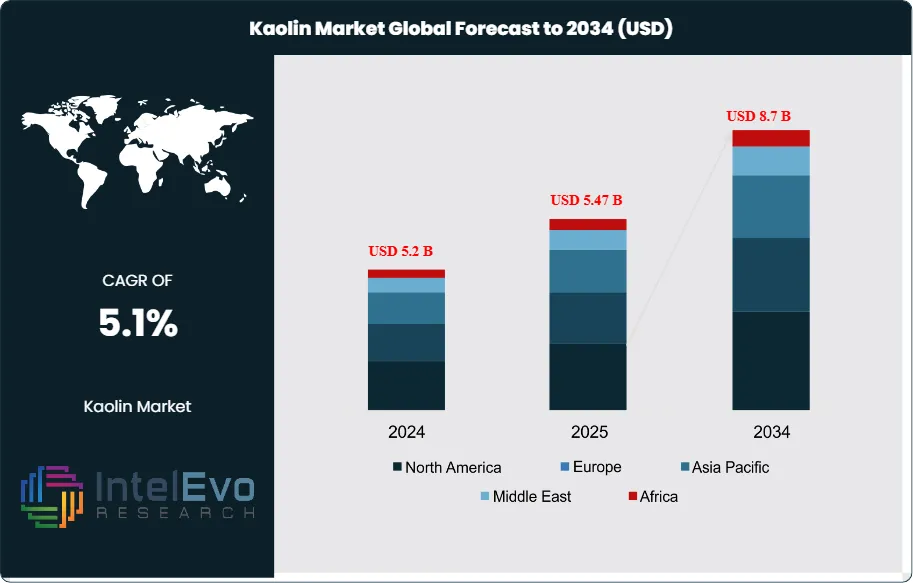

The Kaolin Market size is expected to be worth around USD 8.7 Billion by 2034, up from USD 5.2 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2024 to 2034. The kaolin market encompasses the mining, processing, and distribution of kaolin (also known as china clay), a naturally occurring, soft white clay mineral primarily composed of the mineral kaolinite.

Get More Information about this report -

Request Free Sample ReportKaolin is a critical industrial mineral used extensively in the production of paper, ceramics, paints and coatings, rubber, plastics, pharmaceuticals, and personal care products. The market represents a vital segment of the global industrial minerals industry, supporting a wide range of downstream manufacturing sectors and enabling the production of high-quality, value-added products.

The kaolin market is experiencing steady growth driven by the expansion of the paper and packaging industry, rising demand for ceramics and sanitaryware, and the increasing use of kaolin as a functional additive in paints, coatings, and polymers. Key growth catalysts include technological advancements in kaolin processing, the development of high-purity and specialty grades, and the growing emphasis on sustainable and eco-friendly materials. The market benefits from ongoing investments in mining infrastructure, R&D, and the integration of digital technologies for resource management and quality control.

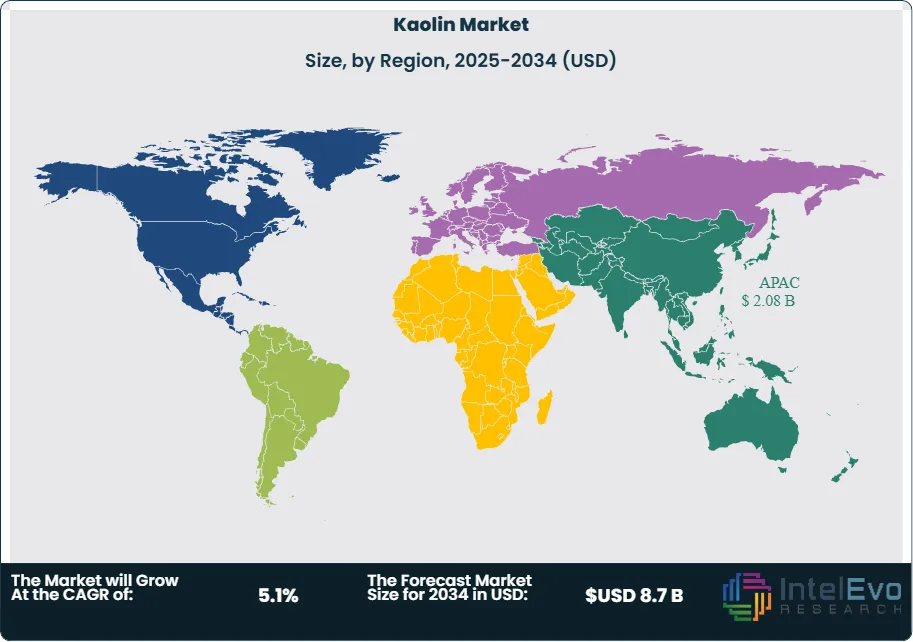

Asia-Pacific dominates the global kaolin market, with leadership stemming from abundant reserves, a robust manufacturing base, and strong demand from the paper, ceramics, and construction industries. North America and Europe are mature markets, characterized by advanced processing technologies, high product quality standards, and a focus on specialty applications. Latin America and the Middle East & Africa represent emerging markets, driven by infrastructure development, urbanization, and increasing investments in manufacturing.

The COVID-19 pandemic temporarily disrupted kaolin supply chains and demand patterns, particularly in the paper and ceramics sectors. However, the market has rebounded as economic activity resumed, and manufacturers renewed their focus on product innovation, quality improvement, and supply chain resilience.

Rising concerns about environmental sustainability, resource conservation, and regulatory compliance have significantly influenced the kaolin market, creating opportunities for producers to differentiate through sustainable mining practices, energy-efficient processing, and the development of eco-friendly kaolin products. The market is also witnessing increased demand for high-performance, engineered kaolin grades tailored to specific end-use applications.

Key Takeaways

- Market Growth: The Kaolin Market is expected to reach USD 8.7 Billion by 2034, fueled by the expansion of paper, ceramics, and construction industries, and ongoing innovation in processing and applications.

- Application Dominance: Paper and paperboard production remains the largest application segment, but ceramics, paints & coatings, and rubber are rapidly growing end-uses.

- Grade Dominance: Water-washed kaolin leads the market due to its high purity and versatility, while calcined and delaminated grades are gaining traction in specialty applications.

- End-User Dominance: Industrial manufacturing sectors, especially paper, ceramics, and construction, account for the majority of kaolin consumption.

- Driver: Key drivers accelerating growth include rising demand for high-quality paper, ceramics, and paints, as well as the shift toward sustainable and functional additives.

- Restraint: Growth is hindered by environmental regulations, resource depletion, and competition from alternative materials.

- Opportunity: The market is poised for expansion due to opportunities like the development of high-performance kaolin grades, sustainable mining, and new applications in advanced materials.

- Trend: Emerging trends including digitalization in mining, circular economy initiatives, and the use of kaolin in high-tech and green applications are reshaping the market.

- Regional Analysis: Asia-Pacific leads owing to abundant reserves and strong manufacturing demand. North America and Europe remain important for specialty and high-purity kaolin.

Application Analysis

Paper and Paperboard Production Leads With Over 35% Market Share in the Kaolin Market: Paper and paperboard production remains the cornerstone of the global kaolin market. Kaolin is used as a coating and filling agent in paper manufacturing, improving printability, brightness, smoothness, and opacity. The sector’s market leadership is driven by the essential role of kaolin in producing high-quality coated and uncoated papers for packaging, publishing, and specialty applications.

Ceramics is the second-largest application segment, with kaolin serving as a key raw material in the production of porcelain, sanitaryware, tiles, and tableware. The unique properties of kaolin—such as whiteness, plasticity, and refractory characteristics—make it indispensable in ceramic formulations.

Other significant applications include paints and coatings (where kaolin acts as a functional extender and rheology modifier), rubber (as a reinforcing filler), plastics (for improved mechanical properties), and pharmaceuticals and personal care (as an inert, non-toxic ingredient).

The expansion of packaging, construction, and consumer goods industries is driving demand for kaolin across diverse applications, while ongoing R&D is enabling the development of engineered kaolin grades for high-performance and specialty uses.

Grade Analysis

Water-Washed Kaolin Dominates, Calcined and Delaminated Grades Gain Traction: Water-washed kaolin is the most widely used grade, accounting for the largest share of the global market. This grade is produced by removing impurities through washing and centrifugation, resulting in high-purity kaolin suitable for paper, ceramics, and paints. Water-washed kaolin is valued for its brightness, fine particle size, and versatility across multiple end-uses.

Calcined kaolin, produced by heating kaolin to high temperatures, is gaining traction in specialty applications such as paints, plastics, and rubber, where it imparts improved opacity, whiteness, and electrical properties. Delaminated kaolin, characterized by its platy particle structure, is used in high-quality paper and coatings for enhanced smoothness and printability.

Other grades include air-floated, surface-modified, and metakaolin (used in construction and advanced materials). The development of high-performance, engineered kaolin grades tailored to specific customer requirements is a key trend, enabling producers to capture value in niche and high-growth segments.

End-User Analysis

Industrial Manufacturing Sectors Dominate, Construction and Consumer Goods Expand: Industrial manufacturing sectors—especially paper, ceramics, paints & coatings, and rubber—account for the majority of kaolin consumption. These industries rely on kaolin for its functional properties, cost-effectiveness, and compatibility with existing manufacturing processes.

The construction sector is a growing end-user, with kaolin used in cement, concrete, and specialty building materials for improved strength, durability, and sustainability. The expansion of infrastructure projects, urbanization, and green building initiatives is driving demand for kaolin-based construction products.

Consumer goods, pharmaceuticals, and personal care are emerging end-uses, leveraging kaolin’s inertness, safety, and performance in products such as toothpaste, cosmetics, and medical devices.

Region Analysis

Asia-Pacific Leads, North America and Europe Focus on Specialty Applications: Asia-Pacific holds a commanding position in the global kaolin market, accounting for over 40% of market share in 2024. The region benefits from abundant kaolin reserves (notably in China and India), a robust manufacturing base, and strong demand from the paper, ceramics, and construction industries. China is the world’s largest producer and consumer of kaolin, with significant investments in mining, processing, and R&D.

North America and Europe are mature markets, characterized by advanced processing technologies, high product quality standards, and a focus on specialty and high-purity kaolin for demanding applications. The United States, Brazil, the UK, and Germany are key markets, with established supply chains and a strong emphasis on sustainability and regulatory compliance.

Latin America and the Middle East & Africa are emerging markets, with growing demand for kaolin in construction, packaging, and consumer goods. Investments in mining infrastructure, local processing, and export-oriented production are unlocking new opportunities for market growth.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Application

- Paper & Paperboard

- Ceramics & Sanitaryware

- Paints & Coatings

- Rubber & Plastics

- Construction Materials

- Pharmaceuticals & Personal Care

- Others

Grade

- Water-Washed Kaolin

- Calcined Kaolin

- Delaminated Kaolin

- Air-Floated Kaolin

- Surface-Modified Kaolin

- Metakaolin

End-User

- Industrial Manufacturing

- Construction

- Consumer Goods

- Pharmaceuticals & Personal Care

- Others

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 5.47 B |

| Forecast Revenue (2034) | USD 8.7 B |

| CAGR (2025-2034) | 5.1% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Application (Paper & Paperboard, Ceramics & Sanitaryware, Paints & Coatings, Rubber & Plastics, Construction Materials, Pharmaceuticals & Personal Care, Others), Grade (Water-Washed Kaolin, Calcined Kaolin, Delaminated Kaolin, Air-Floated Kaolin, Surface-Modified Kaolin, Metakaolin), End-User (Industrial Manufacturing, Construction, Consumer Goods, Pharmaceuticals & Personal Care, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Imerys S.A., Thiele Kaolin Company, KaMin LLC, BASF SE, Quarzwerke GmbH, Sedlecký kaolin a.s., I-Minerals Inc., LB Minerals Ltd., Sibelco, EICL Limited, SCR-Sibelco NV, Ashapura Group, Minotaur Exploration Ltd., Veneta Mineraria S.p.A., 20 Microns Ltd., Keramost a.s., UMA Group of Kaolin, Active Minerals International, LLC, Shree Ram Minerals, Quarzwerke Group |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date