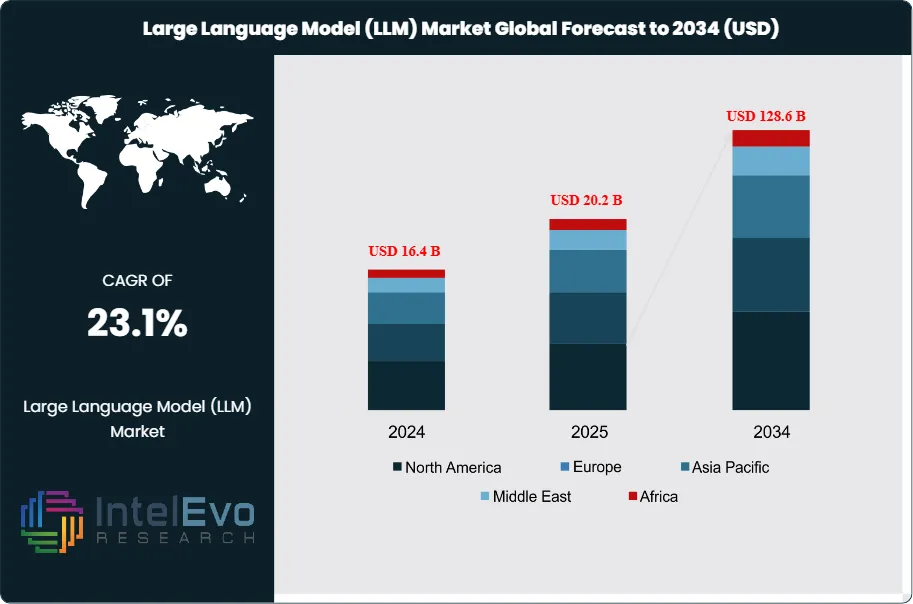

Large Language Model Market Size USD 128.6B & 23.1% CAGR

Global Large Language Model (LLM) Market Size, Share & Competitive Intelligence By Model Type, By Deployment (Cloud, On-Premise), By Application (Chatbots, Coding Assistants, Search, Content Generation), By End User, Investment Trends, Key Players & Global Forecast 2025–2034

Report Overview

The Large Language Model (LLM) Market is estimated at USD 16.4 billion in 2024 and is projected to reach approximately USD 128.6 billion by 2034, registering a robust CAGR of about 23.1% during 2025–2034. This sustained expansion reflects the rapid shift from experimental use cases to enterprise-scale deployments across customer service, software development, data analytics, healthcare, and financial services. Growing adoption of domain-specific and multilingual models, alongside advances in retrieval-augmented generation and cost-efficient small language models, is accelerating monetization. In parallel, rising demand for AI copilots, automation of knowledge work, and integration of LLMs into core business workflows is positioning the market as a foundational pillar of the global AI economy over the next decade.

Get More Information about this report -

Request Free Sample ReportThis rapid expansion reflects the accelerating adoption of generative AI across industries, driven by advances in natural language processing and the growing need for efficient data handling, automation, and digital interaction. Over the past three years, LLMs have moved from experimental deployments to mainstream enterprise adoption, with 67% of organizations now integrating generative AI tools into their operations. The market’s trajectory suggests that adoption will continue to deepen as models become more reliable, cost-efficient, and adaptable to industry-specific use cases.

Demand-side growth is being fueled by enterprises seeking to automate customer service, streamline content creation, and improve decision-making. In financial services, for example, 60% of Bank of America’s clients already use LLM-based solutions for investment and retirement planning. Supply-side advances are equally significant. Models such as GPT-4, capable of processing up to 1 million tokens, are enabling complex applications ranging from software development to multilingual translation. At the same time, smaller models like Microsoft’s PHI-2, with 2.7 billion parameters, are outperforming larger peers in coding tasks, highlighting efficiency gains that reduce infrastructure costs and broaden accessibility.

The speed of deployment is another critical factor. Nearly half of surveyed organizations report being able to implement generative AI tools within one to four months, underscoring the scalability of LLM adoption. This rapid integration creates opportunities for competitive advantage in customer engagement, product development, and operational efficiency. However, the market faces challenges. Only 23% of companies are currently deploying or planning to deploy commercial LLMs, reflecting concerns around privacy, data security, and ethical use. Regulatory scrutiny is expected to intensify, particularly in finance and healthcare, where compliance and risk management are paramount.

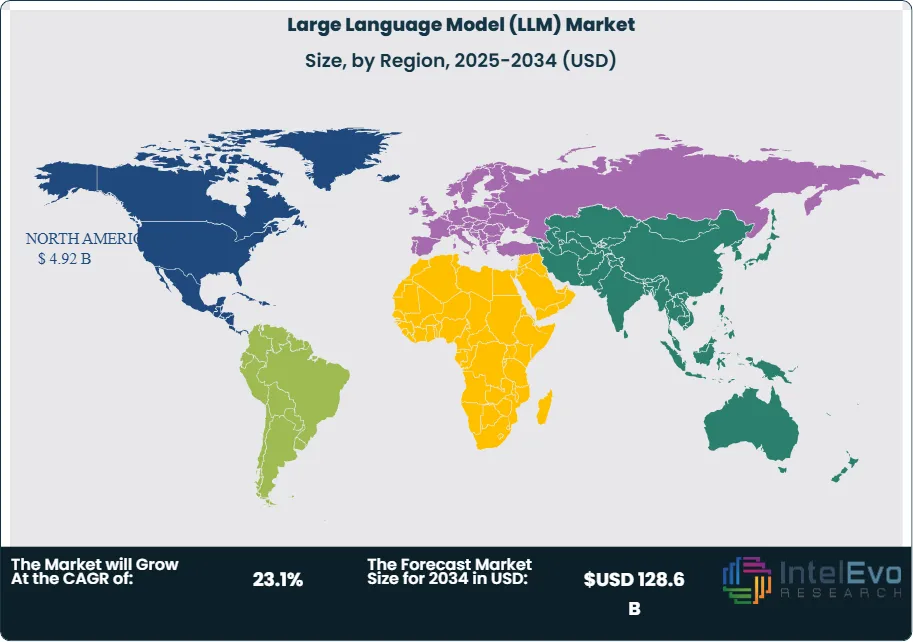

Regionally, North America leads adoption, supported by strong investment from technology firms and financial institutions. Europe is advancing under strict regulatory frameworks, while Asia-Pacific is emerging as a high-growth region, driven by demand in e-commerce, education, and government services. For investors, the most attractive opportunities lie in markets where regulatory clarity aligns with strong enterprise demand, particularly in customer service automation, healthcare analytics, and financial advisory solutions.

Key Takeaways

- Market Growth: The Large Language Model (LLM) market was valued at USD 16.4 billion in 2024 and is projected to reach USD 128.6 billion by 2034, registering a CAGR of 23.1%. Growth is driven by rising enterprise adoption of generative AI, automation of digital workflows, and demand for advanced natural language processing capabilities.

- Deployment: On-premises deployment accounted for 57.7% of revenue in 2023, reflecting enterprise concerns over data privacy and regulatory compliance. Cloud-based deployment is expected to gain share as organizations seek faster scalability and lower infrastructure costs.

- Application: Chatbots and virtual assistants represented 27.1% of the market in 2023, supported by strong adoption in customer service and enterprise communication. Their role in reducing operational costs and improving response times positions this segment for sustained growth.

- Industry Vertical: Retail and e-commerce led with 27.5% share in 2023, as companies increasingly deploy LLMs for personalized recommendations, automated product descriptions, and customer engagement. Financial services and healthcare are emerging as high-growth verticals due to demand for secure, AI-driven advisory and diagnostic tools.

- Driver: Enterprise adoption of generative AI is accelerating, with 67% of organizations already using LLM-powered tools for content creation. By 2025, 750 million applications are expected to integrate LLMs, and 50% of digital work could be automated through these models.

- Restraint: Commercial deployment remains limited, with only 23% of companies moving beyond pilot projects. Concerns around data security, ethical use, and regulatory oversight are slowing large-scale adoption.

- Opportunity: Smaller, optimized models such as Microsoft’s PHI-2 demonstrate efficiency gains over larger peers, creating opportunities for cost-effective adoption across mid-sized enterprises. Asia-Pacific markets, particularly in e-commerce and education, are expected to post double-digit CAGR through 2033.

- Trend: Market concentration remains high, with the top five LLM developers capturing 88.2% of global revenue in 2023. Consolidation and strategic partnerships are shaping competitive dynamics, while advancements in token processing and parameter efficiency are expanding use cases.

- Regional Analysis: North America led with 32.7% share in 2023, supported by advanced R&D infrastructure and early enterprise adoption. Europe is expanding under strict regulatory frameworks, while Asia-Pacific is emerging as the fastest-growing region, driven by large-scale digital transformation initiatives.

Type Analysis

High-performance concrete continues to dominate the advanced concrete market in 2025, supported by its superior strength, durability, and ability to withstand extreme environmental conditions. Demand is particularly strong in large-scale infrastructure projects such as bridges, highways, and high-rise buildings, where structural integrity and long service life are critical. The segment is projected to expand at a CAGR of over 7% through 2030, driven by government investments in resilient infrastructure and urban expansion across Asia and the Middle East.

Self-consolidating concrete is gaining traction due to its efficiency in reducing labor costs and improving construction speed. Its ability to flow easily into complex formworks without mechanical vibration makes it attractive for high-density reinforcement projects. Adoption is rising in both residential and commercial construction, with the segment expected to capture a growing share of the market as developers prioritize faster project completion and reduced maintenance costs.

Other specialty concretes, including lightweight and fiber-reinforced variants, are also expanding their footprint. These materials are increasingly used in industrial facilities and specialized applications such as precast elements, where weight reduction and enhanced crack resistance are essential. Collectively, these types are expected to account for a significant portion of incremental demand by 2030, particularly in emerging economies investing in modern construction technologies.

Application Analysis

Pavers represent one of the largest application segments, supported by rapid urbanization and the expansion of smart city projects. Municipalities and private developers are increasingly adopting high-performance and self-consolidating concrete for sidewalks, driveways, and public spaces. The segment is forecast to grow steadily, with Asia Pacific and Latin America driving demand through large-scale urban infrastructure programs.

Retaining walls are another critical application, particularly in regions with expanding transportation networks and hillside urban development. The use of advanced concrete in retaining walls ensures structural stability, reduces maintenance, and extends service life. With rising investments in road and rail infrastructure, this segment is expected to record consistent growth through 2030.

Other applications, including precast elements, drainage systems, and industrial flooring, are also expanding. These uses benefit from the versatility of advanced concrete types, which provide both structural strength and design flexibility. As industrialization accelerates in Asia and Africa, demand for these applications is projected to rise at above-average growth rates.

End-Use Analysis

The residential building sector remains a key driver of demand, supported by rapid urban population growth and government-backed affordable housing initiatives. Developers are increasingly adopting self-consolidating concrete to reduce construction time and improve quality, particularly in high-density housing projects.

Commercial buildings, including office complexes, shopping centers, and hospitality projects, represent another major end-use segment. The need for durable, aesthetically adaptable materials is fueling demand for high-performance concrete in this category. With global commercial real estate investment expected to rebound strongly post-2024, this segment is forecast to expand at a CAGR of nearly 6% through 2030.

Industrial buildings, including warehouses, factories, and logistics hubs, are also contributing to market growth. The rise of e-commerce and global supply chain expansion has accelerated demand for durable flooring and structural materials. Fiber-reinforced and lightweight concretes are increasingly used in these facilities to enhance load-bearing capacity and reduce long-term maintenance costs.

Regional Analysis

North America continues to lead the global market, accounting for more than 30% of revenue in 2025. The region benefits from advanced construction practices, strong investment in infrastructure renewal, and the presence of leading material suppliers. Federal funding for transportation and energy infrastructure is expected to sustain demand through the decade.

Europe remains a mature but stable market, supported by stringent environmental regulations and a strong focus on sustainable construction. The adoption of low-carbon and recycled concrete solutions is accelerating, particularly in Western Europe, where governments are prioritizing green building standards.

Asia Pacific is the fastest-growing region, projected to expand at a CAGR above 8% through 2030. Rapid urbanization, large-scale infrastructure projects in China and India, and rising investment in smart cities are driving demand. Latin America and the Middle East & Africa are also emerging as attractive markets, supported by government-backed infrastructure programs and industrial expansion. These regions are expected to capture a growing share of global demand as construction activity accelerates.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Deployment

- Cloud

- On-Premises

By Application

- Customer Service

- Content Generation

- Sentiment Analysis

- Code Generation

- Chatbots and Virtual Assistant

- Language Translation

By Industry Vertical

- Healthcare

- BFSI

- Retail and E-Commerce

- Media and Entertainment

- Others

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 16.4 B |

| Forecast Revenue (2034) | USD 128.6 B |

| CAGR (2024-2034) | 23.1% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Deployment, Cloud, On-Premises, By Application, Customer Service, Content Generation, Sentiment Analysis, Code Generation, Chatbots and Virtual Assistant, Language Translation, By Industry Vertical, Healthcare, BFSI, Retail and E-Commerce, Media and Entertainment, Others |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Microsoft Corporation, Baidu, Inc., NVIDIA, Amazon Web Services (AWS), Huawei Technologies Co., Ltd., Meta Platforms, Inc., IBM Corporation, OpenAI LP, Google LLC, Tencent Holdings Limited, Alibaba Group Holding Limited, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Large Language Model (LLM) Market

Published Date : 23 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date