Laser Displacement Sensor Market Size, Share & Growth | CAGR of 8.08%

Global Laser Displacement Sensor Market Size, Share, Analysis Report By Measurement Range (2µm and Below, 3-10µm, 11-50µm, Above 50µm) Component (Software, Hardware, Services) Technology Type (Interferometry-based Sensors, Triangulation-based Sensors, Time-of-Flight Sensors) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

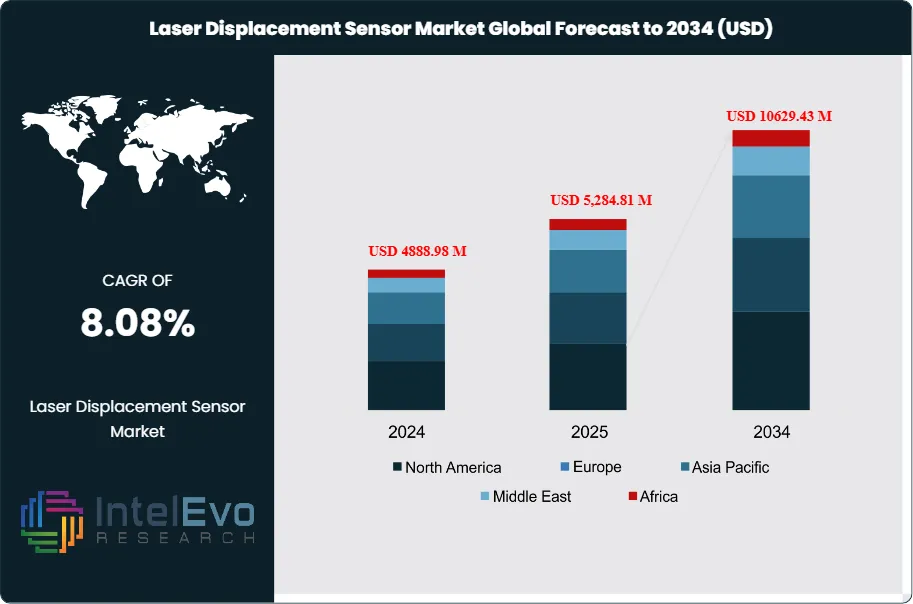

The Laser Displacement Sensor Market size is expected to be worth around USD 10629.43 Million by 2034, from USD 4888.98 Million in 2024, growing at a CAGR of 8.08% during the forecast period from 2024 to 2034. The laser displacement sensor market encompasses non-contact measurement devices that utilize laser technology to determine precise distances, displacements, and dimensional parameters of objects. These sensors operate primarily on triangulation and time-of-flight principles, providing high-accuracy measurements essential for quality control, automation, and precision manufacturing applications across diverse industrial sectors.

Get More Information about this report -

Request Free Sample ReportThe market experiences robust growth driven by increasing industrial automation, particularly in automotive and electronics manufacturing where precision measurement is critical. The integration of Industry 4.0 technologies and IoT connectivity has accelerated demand for smart sensing solutions. Advanced CMOS technology and miniaturization trends have enhanced sensor performance while reducing costs, making these devices more accessible to mid-tier manufacturers.

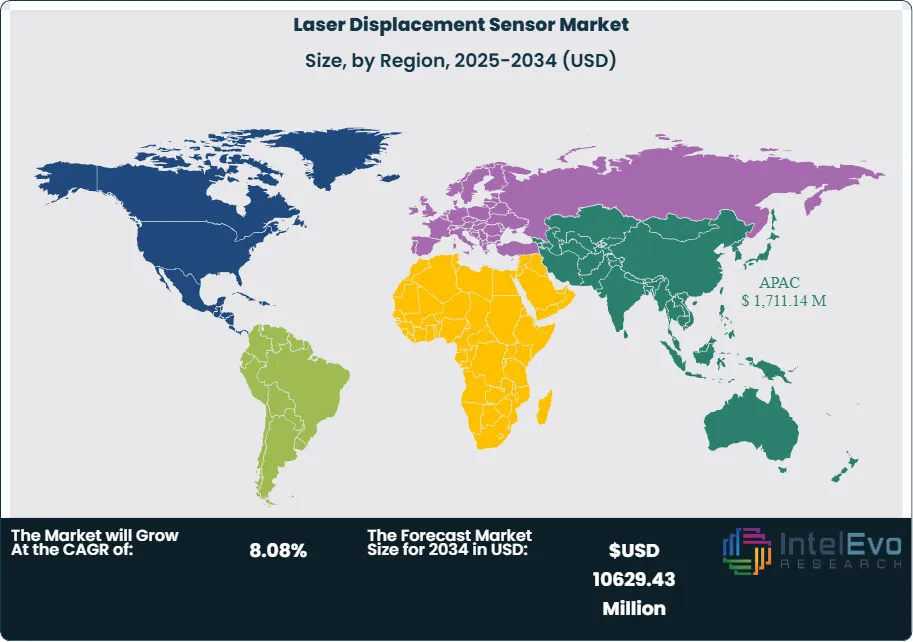

Asia-Pacific dominates the global landscape, accounting for approximately 45% of market revenue, led by Japan's technological leadership and China's manufacturing expansion. North America and Europe follow with 25% and 22% market shares respectively, driven by automotive innovation and industrial automation investments. Emerging markets in Southeast Asia and Latin America show promising growth potential due to industrialization trends.

The pandemic initially disrupted supply chains and manufacturing activities, causing a temporary 15-20% market contraction in 2020. However, the subsequent recovery has been strong, with increased focus on automation and contactless measurement technologies driving demand. The shift toward remote monitoring and quality control has particularly benefited laser displacement sensor adoption in pharmaceutical and food processing industries.

Recent geopolitical tensions have prompted supply chain diversification strategies among key manufacturers. Export restrictions on advanced semiconductor components have influenced sensor pricing and availability. Companies are increasingly localizing production and developing alternative supplier networks to mitigate trade-related risks while maintaining technological competitiveness.

Key Takeaways

- Market Growth: The Laser Displacement Sensor Market is expected to reach USD 10629.43 Million by 2034, fueled by rising industrial automation across automotive and electronics sectors, where accurate measurement capabilities are essential for maintaining production quality and operational efficiency.

- Measurement Range Dominance: The 3-10µm range leads the market due to its optimal balance between precision and cost-effectiveness for electronics manufacturing applications.

- Component Dominance: Hardware components lead the market, primarily due to fundamental sensor demand and regular replacement cycles.

- Technology Type Dominance: Triangulation-based sensors dominate the market, driven by their proven reliability and mature manufacturing processes.

- End-User Industry Dominance: Automotive holds the largest share in the industrial application segment, owing to stringent quality control requirements and high automation adoption.

- Drivers: Key drivers accelerating growth include industrial automation adoption and IoT integration demands, which boost market expansion through enhanced precision requirements and connectivity needs.

- Restraints: Growth is hindered by high initial investment costs and supply chain complexities, which create challenges such as adoption barriers for small manufacturers and component availability issues.

- Opportunities: The market is poised for expansion due to opportunities like emerging market industrialization and sensor miniaturization advances, which enable broader application scope and cost reduction potential.

- Trends: Emerging trends including AI-powered measurement analytics and 5G connectivity integration are reshaping the market by enabling real-time data processing and remote monitoring capabilities.

- Regional Leader: Asia-Pacific leads owing to strong manufacturing base and technological innovation. Southeast Asia and Latin America show high promise due to rapid industrialization and automation adoption.

Measurement Range Analysis:

The measurement range segmentation reflects the diverse precision requirements across industrial applications. The 3-10µm range has emerged as the dominant category due to its sweet spot positioning between ultra-high precision and cost-effectiveness. This range provides sufficient accuracy for electronics manufacturing, automotive component inspection, and general industrial automation while maintaining reasonable pricing structures. The segment benefits from mature manufacturing processes and established supply chains, making it accessible to a broader range of industrial users. The growing trend toward miniaturization in electronics and automotive components has further strengthened demand for sensors in this precision category, as manufacturers seek reliable measurement solutions that balance performance with economic viability.

Component Analysis:

Hardware components dominate the market through fundamental sensor demand and regular replacement cycles inherent in industrial applications. The hardware segment encompasses the core sensing elements, optical components, and electronic interfaces essential for measurement functionality. This dominance reflects the capital-intensive nature of precision measurement systems and the ongoing need for hardware upgrades and replacements in manufacturing environments. The segment benefits from technological advancement cycles that drive periodic equipment updates and the integration complexity that requires specialized hardware solutions. As industrial automation advances, hardware requirements continue evolving, creating sustained demand for next-generation sensor components and supporting infrastructure.

Technology Type Analysis:

Triangulation-based sensors have established technological dominance through decades of refinement and industrial adoption. This technology's success stems from its reliability, proven accuracy, and cost-effectiveness compared to more complex alternatives like interferometry. The triangulation principle offers robust performance across various surface materials and environmental conditions, making it ideal for diverse industrial applications. Recent advances in CMOS imaging technology and laser diode efficiency have enhanced triangulation sensor capabilities while reducing manufacturing costs. The segment's maturity has created extensive expertise networks and standardized integration protocols, facilitating easier adoption and maintenance for industrial users seeking dependable measurement solutions.

End-User Industry Analysis:

Automotive Leads over 30% Market Share In Laser Displacement Sensor Market: Automotive leads industrial adoption due to its stringent quality control requirements and high automation levels. The automotive sector's demand for precise dimensional measurement in component manufacturing, assembly verification, and quality inspection has driven significant sensor deployment. This industry's continuous evolution toward electric vehicles and advanced manufacturing techniques has created new measurement challenges requiring sophisticated sensor solutions. The segment benefits from established automotive supply chains and long-term customer relationships, providing stable revenue streams for sensor manufacturers. Additionally, the automotive industry's global nature has facilitated international expansion opportunities for leading sensor companies.

Regional Analysis

Asia-Pacific Leads With more than 35% Market Share In Laser Displacement Sensor Market: Asia-Pacific maintains its leadership position in the laser displacement sensor market, driven by Japan's technological excellence and China's vast manufacturing base. Japan contributes approximately 59% of global production, leveraging companies like KEYENCE and Panasonic's advanced R&D capabilities and precision manufacturing expertise. China's rapid industrial automation adoption and electronics manufacturing expansion have created substantial sensor demand, while South Korea's semiconductor and automotive industries contribute significant market growth. The region benefits from integrated supply chains, lower manufacturing costs, and proximity to key end-user industries. North America and Europe each hold approximately 13% market shares, with North America focusing on automotive and aerospace applications, while Europe emphasizes precision manufacturing and industrial automation. Emerging regions including Southeast Asia, Latin America, and India show strong growth potential as they undergo industrialization and automation transitions, creating new opportunities for sensor deployment in manufacturing facilities and quality control systems.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

Measurement Range

- 2µm and Below

- 3-10µm

- 11-50µm

- Above 50µm

Component

- Software

- Hardware

- Services

Technology Type

- Interferometry-based Sensors

- Triangulation-based Sensors

- Time-of-Flight Sensors

End-User Industry

- Manufacturing

- Aerospace & Defense

- Automotive

- Electronics

- Other End-Use Industries

Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 5,284.81 Million |

| Forecast Revenue (2034) | USD 10629.43 Million |

| CAGR (2025-2034) | 8.08% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Measurement Range (2µm and Below, 3-10µm, 11-50µm, Above 50µm); Component (Software, Hardware, Services); Technology Type (Interferometry-based Sensors, Triangulation-based Sensors, Time-of-Flight Sensors) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | KEYENCE Corporation, Panasonic Corporation, SICK AG, Micro-Epsilon Messtechnik GmbH, Banner Engineering Corp, LMI Technologies Inc., Baumer Group, Anshan Guangzhun Technology, RIFTEK |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Laser Displacement Sensor Market?

Global Laser Displacement Sensor Market to reach USD 10.63B by 2034 at 8.08% CAGR. Explore growth trends, applications, and top market players.

Who are the major players in the Laser Displacement Sensor Market?

KEYENCE Corporation, Panasonic Corporation, SICK AG, Micro-Epsilon Messtechnik GmbH, Banner Engineering Corp, LMI Technologies Inc., Baumer Group, Anshan Guangzhun Technology, RIFTEK

Which segments covered the Laser Displacement Sensor Market?

Measurement Range (2µm and Below, 3-10µm, 11-50µm, Above 50µm); Component (Software, Hardware, Services); Technology Type (Interferometry-based Sensors, Triangulation-based Sensors, Time-of-Flight Sensors)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Laser Displacement Sensor Market

Published Date : 13 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date