Legacy Chips Wafer Foundry Market Size USD 22.91B & 4.1% CAGR

Global Legacy Chips Wafer Foundry Market Size, Share & Semiconductor Supply Chain Analysis By Node Size (≥28nm), By End Use (Automotive, Industrial, Consumer Electronics), Capacity Utilization Trends, Geopolitical Impact, Foundry Competition, Key Manufacturers & Forecast 2025–2034

Report Overview

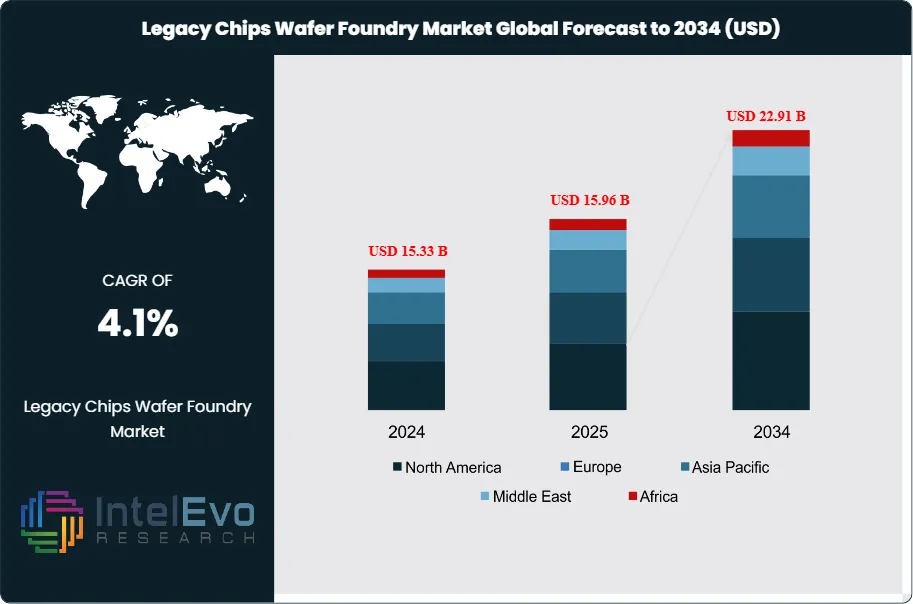

The Legacy Chips Wafer Foundry Market is estimated at USD 15.33 billion in 2024 and is projected to reach approximately USD 22.91 billion by 2034, registering a CAGR of about 4.10% during 2025–2034. Growth is being driven by sustained demand for mature-node semiconductors used in automotive electronics, industrial automation, and power management ICs, and connectivity chips, where long product lifecycles and reliability outweigh the need for advanced nodes. Rising electrification, vehicle semiconductor content growth, and government-backed capacity localization initiatives are reinforcing utilization rates at 90–130 nm and above, positioning legacy foundries as a strategic backbone of the global semiconductor supply chain.

Get More Information about this report -

Request Free Sample ReportDemand holds steady as automakers, industrial OEMs, and appliance brands rely on mature nodes for microcontrollers, analog, power management, sensors, and RF components where reliability, longevity, and cost control matter more than transistor density. You see a stable mix shift toward 200 mm capacity and mature 300 mm lines that support BCD, analog mixed signal, embedded non‑volatile memory, and MEMS. Post‑shortage normalization in 2024 resets inventories, yet order books remain firm in automotive and factory automation as model refresh cycles and platform redesigns extend product lifetimes.

Growth is anchored in predictable cost curves, long qualification cycles, and functional safety requirements in automotive electronics. AEC‑Q100 and ISO 26262 continue to raise the bar on quality, which sustains long tails for qualified parts and reduces node migration risk. On the supply side, trailing‑node investments target de‑bottlenecking and specialty processes rather than greenfield advanced fabs. Policy support favors resilience. Governments back regional capacity for strategic sectors, while customers dual‑source across Asia, North America, and Europe to reduce exposure to single‑point failures. Key risks remain. Export controls, energy price volatility, and episodic equipment lead‑times can tighten effective capacity. Pricing discipline will be tested if consumer electronics stays soft for longer than expected.

Process innovation focuses on quality and integration, not raw speed. Foundries expand portfolios in BCD for powertrain control, high‑voltage analog for industrial drives, and RF‑CMOS for connectivity modules. Embedded flash and OTP on mature nodes support firmware updates and secure boot in connected devices. DFM toolsets, automotive PPAP digitalization, and tighter yield analytics improve cycle time and cost per die. You should expect selective adoption of AI‑enabled process control to lift line yield and reduce excursion risk across 200 mm lines.

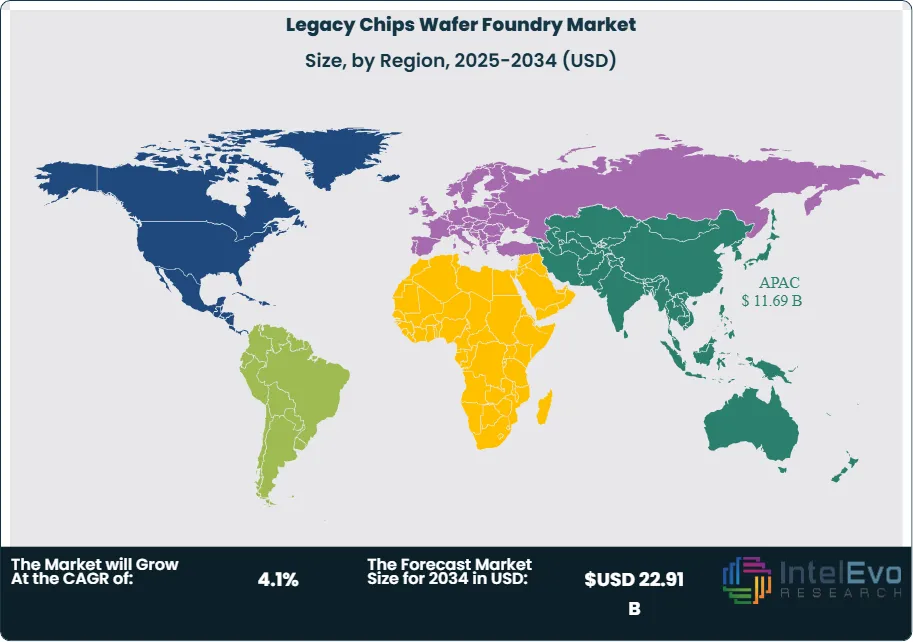

Asia Pacific dominates with 76.2% share and USD 11.68 billion revenue in 2024, led by China, Taiwan, Japan, and South Korea with deep 200 mm bases and ecosystem depth. North America and Europe are priority build‑out regions tied to automotive and industrial reshoring; awards, long‑term purchase agreements, and take‑or‑pay structures underpin committed volumes. Watch Southeast Asia and India for incremental subcontract capacity and back‑end integration that strengthens regional supply assurance.

Key Takeaways

- Market Growth: The market stands at USD 15.33 billion in 2024 and is projected to reach USD 22.91 billion by 2034 at a 4.10% CAGR, supported by steady demand for mature-node MCUs, analog, PMICs, sensors, and RF in automotive and industrial systems. You will see resilient orders as long qualification cycles and cost targets keep designs on legacy nodes.

- Process Node: The 28 nm node leads with 43.6% share due to its balanced performance, embedded NVM options, and cost advantages for mixed-signal and connectivity use cases. It remains the preferred node for high-volume consumer and industrial derivatives that do not require advanced logic density.

- Application: Automotive electronics account for 41.8% of demand as OEMs scale semiconductors for powertrain control, ADAS, body electronics, and infotainment. Functional safety standards and long product lifecycles anchor multi-year volumes on qualified, mature processes.

- Driver: Stable bills of materials and proven reliability on 200 mm lines drive procurement, with buyers favoring nodes that meet AEC‑Q100 and ISO 26262 requirements. Foundry roadmaps prioritize specialty processes such as BCD, high‑voltage analog, and RF‑CMOS to support electrification and industrial automation.

- Restraint: Capacity remains concentrated and tool availability for 200 mm expansions is tight, creating allocation risk during demand spikes. High regional concentration also exposes supply to geopolitical and logistics disruptions that can extend lead times.

- Opportunity: Specialty power, BCD, and analog‑mixed signal on 28–90 nm nodes offer margin resilience and design‑in longevity in EV, factory automation, and medical devices. Regional diversification and government-backed programs create room for new 200 mm capacity and mature 300 mm conversions you can lock via long-term agreements.

- Trend: Customers are signing take‑or‑pay and multi‑year LTAs to secure automotive‑grade supply, while foundries digitize PPAPs and deploy yield analytics to improve cycle times. Refurbished tool strategies and selective 300 mm mature-node offerings are lifting output without advanced-node capex.

- Regional Analysis: Asia Pacific leads with 76.2% share and USD 11.68 billion revenue in 2024, underpinned by deep manufacturing bases in China, Taiwan, Japan, and South Korea. North America and Europe are emerging as expansion hotspots tied to reshoring, automotive hubs, and industrial capacity adds that reduce single‑region dependency.

Process Node Analysis

The 28 nm node remains the anchor of mature-node production in 2025, accounting for an estimated 43.6% share on the strength of balanced performance, embedded NVM options, and competitive cost per die across mixed-signal, connectivity, and controller designs. 40/45 nm and 65 nm continue to serve large consumer, automotive, and industrial programs where reliability, voltage handling, and long qualification cycles outweigh the value of smaller geometry. Nodes at 90 nm and above retain relevance in power, analog, RF, and secure microcontrollers that require proven process stability and long product lifetimes.

Demand concentrates on 200 mm capacity for 40–180 nm and selective mature 300 mm conversions for 28–65 nm where scale improves wafer economics. You will see investments prioritize specialty platforms such as BCD for power management, high-voltage analog for motor control, RF‑CMOS for connectivity, and embedded flash for secure boot and firmware updates. Constraints remain in refurbished tool availability for 200 mm expansions and in maintaining automotive-grade quality at rising volumes, which tightens effective capacity during cyclical spikes.

Outlook is steady. Electrification in transport and factory automation sustains multi-year tape-ins at 28–90 nm. As long as AEC‑Q100 and ISO 26262 requirements keep designs on validated nodes, take-or-pay and multi-year LTAs will underpin utilization while foundries deploy yield analytics to lift output without advanced-node capex.

Application Analysis

Automotive electronics leads with roughly 41.8% share as OEMs scale semiconductors for powertrain, body, chassis, infotainment, and ADAS where safety certification and 10–15 year lifecycles favor mature platforms. Industrial control systems form the second growth pillar, with PLCs, drives, sensors, and building automation requiring robust, long-lived components and secure MCU architectures. Smartphones, tablets, and home appliances continue to draw legacy nodes for PMICs, audio codecs, touch controllers, and connectivity chips where cost and power efficiency matter more than logic density.

Telecom and network infrastructure extend node lifetimes through baseband peripherals, RF front ends, timing, and switch management silicon that ride multi-year deployment cycles. Robotics and medical devices rely on legacy chips for motion control, power stages, and monitoring subsystems, prioritizing reliability, regulatory documentation, and predictable supply. You should expect stable volumes from these categories as platform redesigns refresh BOMs without forcing node migration.

The forward path hinges on three vectors. EV platform proliferation adds BMS, traction inverter, OBC, and thermal management content on BCD and high-voltage analog. Factory digitalization lifts sensor, actuator, and gateway demand with secure MCUs and industrial Ethernet PHYs. Appliance energy standards keep driving PMIC and motor control upgrades on proven processes that meet cost targets at scale.

Regional Analysis

Asia Pacific dominates with 76.2% share and about USD 11.68 billion revenue in 2024, reflecting deep 200 mm ecosystems and specialty process depth across China, Taiwan, Japan, and South Korea. Regional supply chains, OSAT density, and captive-foundry linkages support high-volume automotive, consumer, and industrial demand while buffering logistics risk. Southeast Asia and India are emerging as added capacity nodes for front-end and back-end operations as customers diversify footprints.

North America and Europe expand from a smaller base as reshoring programs, auto hubs, and industrial clusters secure mature-node supply for strategic sectors. Public incentives and customer-backed LTAs support selective capacity adds and mature 300 mm conversions, while buyers tighten dual-sourcing and qualification plans to reduce single-region dependency. For you, this translates to improved resilience and bargaining power on allocation and price over the medium term.

The global market is projected to rise from USD 15.33 billion in 2024 to USD 22.91 billion by 2034 at a 4.10% CAGR, with Asia Pacific remaining the anchor and Western regions contributing incremental, policy-led growth. Near-term risk centers on export controls, energy costs, and 200 mm tool constraints; the counterbalance is stable automotive and industrial order books that keep utilization high and pricing disciplined.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

Technology Node Analysis

- ≥180 nm

- 130 nm

- 90 nm

- 65 nm and Other Mature Nodes

Wafer Size Analysis

- 200 mm Wafers

- 300 mm Wafers (Legacy Lines)

Application Analysis

- Automotive Electronics

- Industrial Automation

- Power Management ICs

- Consumer & Connectivity

- Others (Medical, Energy, Defense)

End-User Analysis

- IDM Outsourcing

- Fabless Semiconductor Companies

- Tier-1 Automotive and Industrial OEMs

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 15.33 B |

| Forecast Revenue (2034) | USD 22.91 B |

| CAGR (2024-2034) | 4.1% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Technology Node Analysis, ≥180 nm, 130 nm, 90 nm, 65 nm and Other Mature Nodes, Wafer Size Analysis, 200 mm Wafers, 300 mm Wafers (Legacy Lines), Application Analysis, Automotive Electronics, Industrial Automation, Power Management ICs, Consumer & Connectivity, Others (Medical, Energy, Defense), End-User Analysis, IDM Outsourcing, Fabless Semiconductor Companies, Tier-1 Automotive and Industrial OEMs |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | TSMC, UMC, GlobalFoundries, SMIC, Tower Semiconductor, Vanguard International Semiconductor, Powerchip Semiconductor Manufacturing, HHGrace, Dongbu HiTek, Nexchip, Samsung Foundry, Intel Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Legacy Chips Wafer Foundry Market

Published Date : 25 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date