Lifestyle Sneaker Market Size, Share & Growth Forecast 2025–2034

Global Lifestyle Sneaker Market Size, Share & Industry Analysis By Product Type (Low-Top, Mid-Top, High-Top), By Category (Men, Women, Kids), By Distribution Channel (Online Retail, Specialty Stores, Brand Outlets), By Price Range (Mass, Premium, Limited Edition), By End Use (Casual Wear, Streetwear, Athleisure), Region & Key Players – Market Dynamics, Consumer Trends, Competitive Landscape, Brand Strategies & Forecast 2025–2034

Report Overview

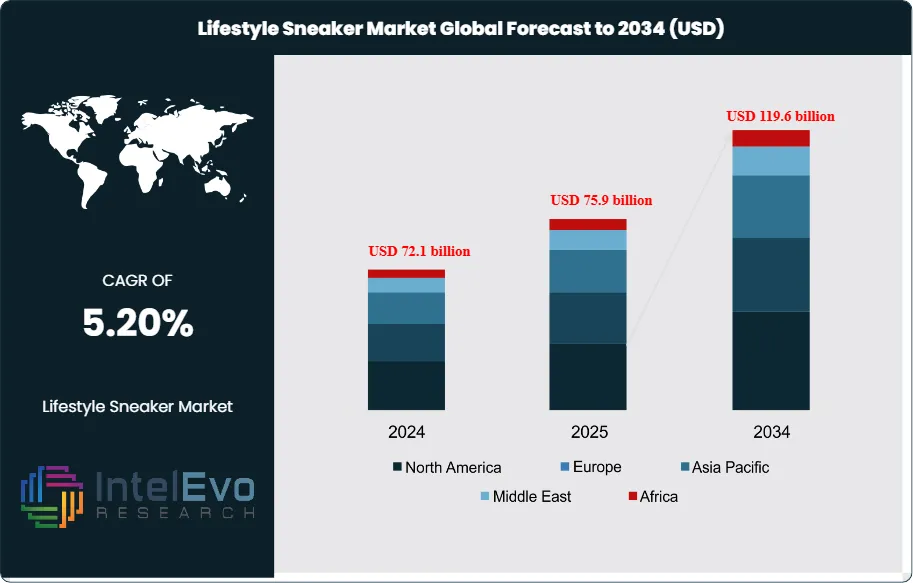

The Lifestyle Sneaker Market is estimated at USD 72.1 billion in 2024 and is on track to reach roughly USD 119.6 billion by 2034, implying a compound annual growth rate of 5.2% over 2025–2034. This growth is driven by the convergence of fashion, sportswear, and street culture, with sneakers increasingly positioned as everyday lifestyle essentials rather than purely athletic footwear. Rising influence of social media, celebrity collaborations, and limited-edition drops is accelerating demand, while younger consumers continue to prioritize comfort, brand identity, and customization. Expansion of direct-to-consumer channels and premiumization trends are further strengthening long-term market momentum across both developed and emerging economies.

Get More Information about this report -

Request Free Sample ReportLifestyle sneakers sit at the intersection of fashion and casual footwear. They deliver comfort, style, and versatility for daily use rather than performance sport. Demand intensifies as dress codes relax and athleisure and streetwear move into workplaces. Younger consumers lead this shift and curate large collections; in the United States, individuals now own about 19 pairs of shoes on average, with lifestyle models taking a rising share of spend.

Macroeconomic conditions support this category. Rising disposable income enables greater spending on branded footwear. In the United States, disposable personal income grew about 3% in 2024, helping households sustain purchase frequency despite inflationary pressure. An influential sneakerhead community amplifies demand. About 8% of buyers identify with this group, yet 33% of them shop monthly, while roughly 66% of mass-market consumers purchase sneakers twice a year or less. Targeted drops, collaborations, and limited releases allow brands to capture price premiums and deepen loyalty in this segment.

Supply-side dynamics remain intense. Global majors compete with agile niche labels, relying on outsourced production clusters across Asia for scale and cost efficiency. Digital channels reshape route-to-market. In 2020, online sales accounted for about 27% of U.S. shoe revenue, and this share continues to climb as e-commerce platforms and sneaker trading apps expand. Brands deploy AI-based recommendation engines, demand-forecasting tools, and automated fulfillment to reduce stockouts, shorten design cycles, and tailor assortments across direct-to-consumer and wholesale channels.

Regulatory and risk factors grow more prominent. Stricter environmental standards push brands toward recycled materials, traceable supply chains, and transparent labor practices, raising compliance costs but also enabling premium positioning. Trade policy shifts and currency volatility can affect input pricing and margins, while intellectual property enforcement remains critical against counterfeits. Regionally, North America and Europe show signs of saturation with high per-capita ownership, whereas Asia Pacific, Latin America, and the Middle East present faster growth, underpinned by urbanization, rising incomes, and an expanding middle class. These structural drivers, combined with digital and design innovation, position lifestyle sneakers as a resilient yet highly competitive investment theme through 2034.

Key Takeaways

- Market Growth: The lifestyle sneaker market stands at USD 72.1 billion in 2024 and will reach USD 119.6 billion by 2034, implying a CAGR of 5.2% over 2025-2034.

- Product Type: Low-top sneakers lead the product mix with a 62.1% share, 2023 as consumers favor casual, versatile designs for daily wear.

- Price Range: The under 50 USD, 2023 price band captures 32.5% share, 2023 and anchors volume growth in cost-sensitive consumer segments.

- Driver: Men account for 56.3% share of end-user spending, 2023 and drive repeat purchases as lifestyle sneakers replace other casual footwear in male wardrobes.

- Restraint: Heavy reliance on offline channels, which hold 69.2% of sales, 2023, constrains digital reach and increases exposure to fluctuations in store traffic.

- Opportunity: Online and omnichannel models gain room to scale as the remaining estimated: 30.8% share, 2023 of sales migrates to digital platforms that can broaden assortments and enhance data-driven merchandising.

- Trend: Emerging segments, including women and younger consumers, represent estimated: 43.7% share, 2023 of demand and will reinforce style-led collections that track a 5.2% category CAGR over 2024-2034.

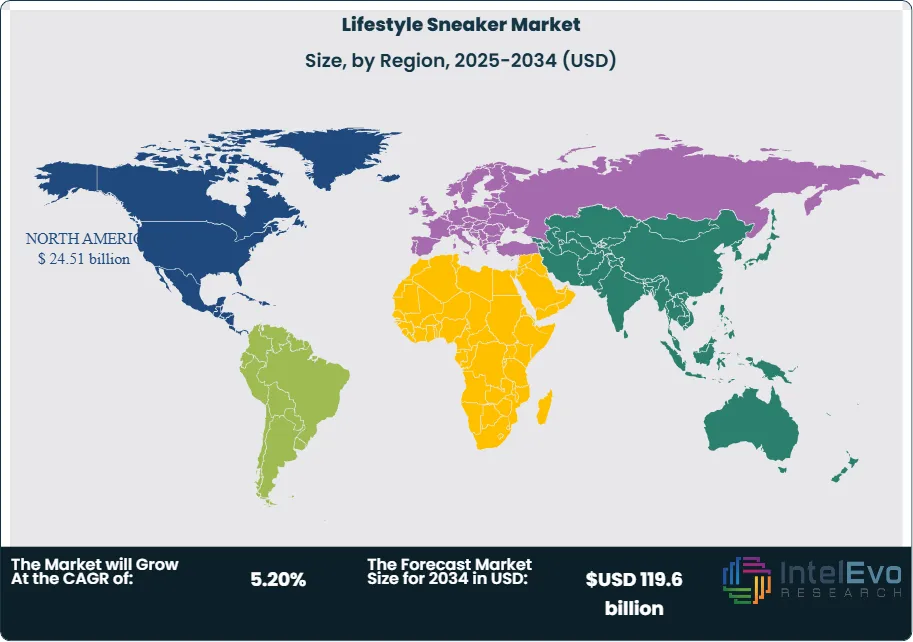

- Regional Analysis: North America leads with 34.2% market share, 2023, while Asia-Pacific could reach estimated: 30.0% share, 2030 as urbanization and income growth accelerate lifestyle sneaker adoption.

By Product Type

The lifestyle sneaker market in 2025 continues to see low-top models positioned as the primary choice for most consumers. They hold more than 60 percent of global volume and appeal to buyers who want shoes suited for daily movement, travel, or casual work settings. You see steady demand for this category because it offers comfort, neutral styling, and wide availability across premium, midrange, and entry-level brands. As athleisure remains part of everyday wardrobes, low-top sneakers fit multiple use cases without adding weight or bulk.

Mid-top sneakers maintain a smaller share but attract shoppers who want extra ankle coverage without committing to full high-top designs. Casual athletes and urban commuters often choose this segment. Brands use this space to test new materials and hybrid designs that sit between sport and lifestyle footwear. Growth remains moderate, but interest has risen in markets where consumers seek practical alternatives to full athletic shoes.

High-top sneakers continue to serve a niche audience. They appeal to collectors, retro-fashion buyers, and consumers who follow drop cycles closely. The price points tend to be higher due to materials, collaborative releases, and limited production runs. Although overall adoption is lower than other types, high-tops contribute to brand visibility and help companies strengthen relationships with sneaker communities worldwide.

By Application

Pavers represent a major application for lifestyle sneakers as buyers prioritize shoes that support long hours of walking in urban environments. You see the strongest demand in cities with high pedestrian traffic where residents depend on comfortable footwear for daily mobility. Brands focus on cushioning technologies and flexible materials to strengthen this usage segment. Market traction improves as consumers shift from traditional leather shoes to lightweight casual models.

Retaining wall environments such as rugged outdoor areas or work-adjacent spaces call for footwear with stronger support. Mid-top and selected high-top models gain attention in this segment due to their stability. Although smaller in volume, this application attracts consistent interest from professional users, hobbyists, and buyers in emerging markets where multipurpose footwear remains important.

Other applications, including light recreation, travel, and school use, continue to grow as global buyers look for versatile shoes that fit multiple parts of their daily routines. This segment benefits from year-round replacement cycles and rising adoption among younger consumers who prefer casual footwear over formal shoes.

By End-Use

Men remain the largest end-user group in 2025 and account for more than half of global purchases. Many prefer lifestyle sneakers that work across work, social, and weekend settings. You see strong interest in sport-inspired silhouettes, limited releases, and collaborations that target collectors and frequent buyers. Repeat purchasing is common, which keeps the men’s segment at the front of market expansion.

Women represent a growing base as athleisure and comfortable fashion continue to gain attention worldwide. Brands are widening color palettes, sizing options, and fit designs to match this shift. Adoption rises sharply in Asia and Europe, where fashion-conscious buyers replace traditional flats with casual sneakers for daily wear. This segment presents meaningful upside through 2030.

The children’s category is smaller but stable. Parents value durability and practicality, leading to consistent year-to-year sales. Growth improves in markets where school dress codes shift toward casual footwear. You also see higher replacement frequency due to rapid size changes, which helps maintain steady demand.

By Region

North America holds the largest share at more than 34 percent in 2025. The United States anchors this position due to strong sneaker culture, high disposable income, and active participation in limited-edition releases. Retail networks across specialty stores, brand outlets, and digital platforms give consumers wide access to new collections. You also see higher adoption of premium materials and exclusive drops, which strengthens revenue per pair.

Europe follows with strong penetration in markets such as Germany, the United Kingdom, and France. Buyers emphasize comfort and durability and have increased interest in environmentally conscious materials. Demand for lifestyle sneakers aligns with broader preferences for casual workwear, which supports sustained regional expansion.

Asia Pacific represents the fastest-growing market. Rising incomes, expanding urban populations, and increasing exposure to global fashion trends make this region a key growth engine. China, India, and Southeast Asia show high adoption among younger consumers who follow influencer-led styles. Latin America and the Middle East & Africa maintain smaller shares but continue to improve as retail distribution expands and online purchasing accelerates.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product Type

- Low-Top Sneakers

- Mid-Top Sneakers

- High-Top Sneakers

By End-User

- Men

- Women

- Children

By Price Range

- $0-$50

- $50-$100

- $100-$200

- $200-$300

- $300 and above

By Distribution Channel

- Online Stores

- Department Stores

- Specialty Stores

- Brand Outlets

- Discount Stores

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 72.1 billion |

| Forecast Revenue (2034) | USD 119.6 billion |

| CAGR (2024-2034) | 5.20% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type, Low-Top Sneakers, Mid-Top Sneakers, High-Top Sneakers, By End-User, Men, Women, Children, By Price Range, $0-$50, $50-$100, $100-$200, $200-$300, $300 and above, By Distribution Channel, Online Stores, Department Stores, Specialty Stores, Brand Outlets, Discount Stores |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Nike, Inc., Adidas AG, Puma SE, New Balance Athletics, Inc., Under Armour, Inc., ASICS Corporation, Skechers USA, Inc., Reebok International Ltd. (a subsidiary of Authentic Brands Group), Fila Holdings Corp., Converse Inc. (a subsidiary of Nike, Inc.), Vans (VF Corporation), Jordan Brand (Nike, Inc.), Saucony (Wolverine World Wide, Inc.), Brooks Sports, Inc. (lifestyle segment crossover), Diadora S.p.A., K-Swiss (a division of E-Land Group), On Running AG, Hoka One One (Deckers Outdoor Corporation), Crocs, Inc. (lifestyle crossover relevance), Balenciaga (Kering Group), Gucci (Kering Group) , Louis Vuitton (LVMH), |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date