Load Balancer Market Forecast Size, Growth & Trends | 15.1% CAGR

Global Load Balancer Market Size, Share & Analysis By Component, (Hardware, Software, Services), By Type, (Local Load Balancers, Global Load Balancers), By Deployment, (On-premise, Cloud), By Enterprise Size, (Large Enterprises, SMEs), By Industry Vertical, (BFSI, IT & Telecom, Retail, Government, Manufacturing, Healthcare, Others), Network Optimization Trends, Competitive Landscape & Forecast 2025–2034

Report Overview

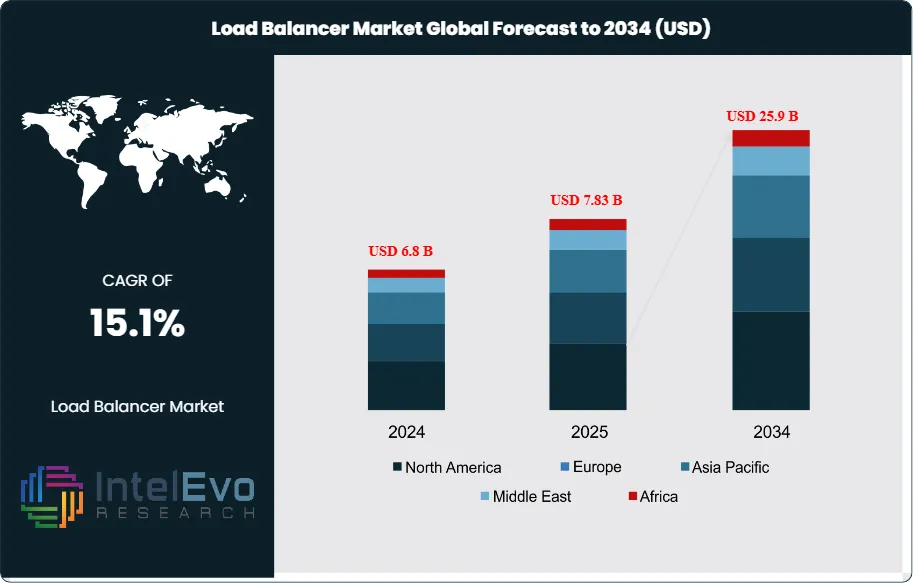

The Load Balancer Market is valued at approximately USD 6.8 Billion in 2024 and is projected to reach nearly USD 25.9 Billion by 2034, expanding at a CAGR of around 15.1% during 2025–2034. The surge in multi-cloud deployments, API-driven applications, and AI-enabled traffic optimization is reshaping demand globally. As enterprises scale microservices and edge workloads, advanced load-balancing tools are becoming mission-critical for reliability, latency reduction, and zero-downtime performance.

Get More Information about this report -

Request Free Sample ReportThis trajectory reflects a market that is scaling from foundational, hardware-centric application delivery controllers to software-defined, cloud-native, and managed services models. Based on the current run-rate, the market is set to more than triple (+USD 13.9 billion, ~3.6x expansion) over the decade, with a mid-cycle inflection surpassing USD 10.2 billion by 2028 as enterprises re-platform latency-sensitive workloads and modernize network stacks.

Demand is underpinned by three durable forces: the migration of enterprise applications to multi-cloud and hybrid environments; the proliferation of connected endpoints and microservices architectures; and the non-negotiable requirement for always-on digital experiences. On the supply side, vendors are shifting toward elastic, subscription-based offerings that bundle L4–L7 traffic management with security controls (WAF, DDoS mitigation) and observability. Key growth drivers include surging internet traffic, containerized deployments (e.g., Kubernetes Ingress), and edge computing, which together increase the frequency and amplitude of traffic spikes that load balancers must absorb. Principal challenges remain architectural complexity, skills gaps in SRE/NetOps teams, and concerns over vendor lock-in and regulatory constraints such as data residency, all of which can elongate decision cycles and total cost of ownership.

Technology innovation is reshaping adoption patterns. AI- and ML-enhanced engines are moving from reactive to predictive traffic steering, enabling automated failover and adaptive capacity planning. Cloud-native designs are displacing appliance footprints through programmable data planes (including eBPF), API-centric control, and deep integration with service meshes. Illustrative moves include decentralized approaches such as ZeroLB by Kong—reducing reliance on traditional load balancers by embedding routing into the mesh—and portfolio consolidation exemplified by Progress’s USD 258 million acquisition of Kemp to expand application management breadth.

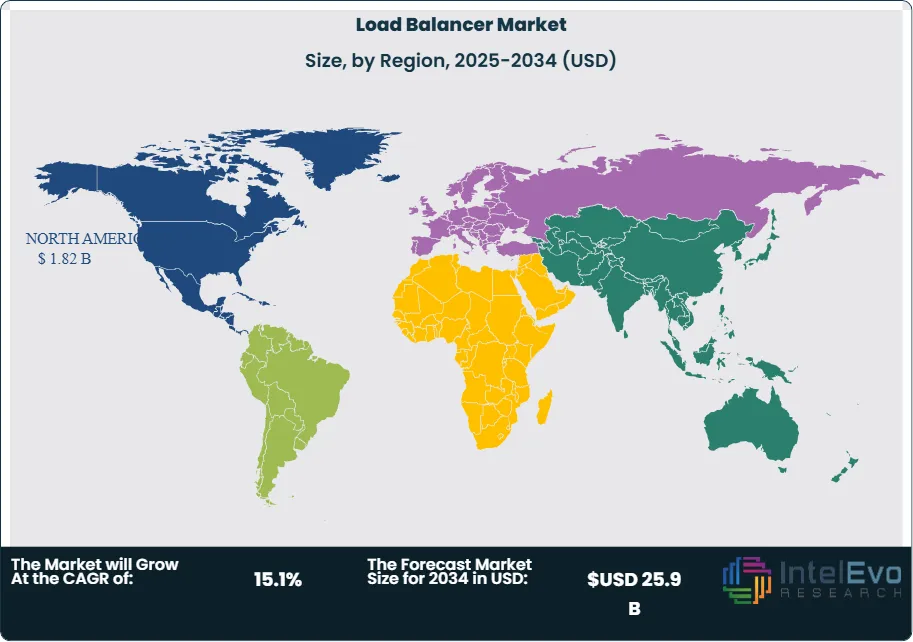

Regionally, North America leads on revenue, supported by hyperscaler ecosystems and early adopter enterprises, while Europe maintains steady modernization linked to privacy and digital sovereignty initiatives. Asia–Pacific is the fastest-growing corridor, propelled by rapid digitization in India and Southeast Asia and accelerated 5G/edge rollouts; investors should watch cloud-native and managed load-balancing services in these markets. Emerging opportunities span API security convergence, telemetry-rich analytics, and offload to smartNICs/DPUs—capabilities that reduce latency and operating expense while hardening resilience across distributed, multi-cloud topologies.

Key Takeaways

- Market Growth: The global Load Balancer market was USD 6.8 Billion in 2024 and is projected to reach USD 25.9 Billion by 2034 at a 15.1% CAGR—an incremental expansion of ~USD 13.9 billion (~3.6x)—driven by multi-cloud adoption, microservices, and always-on digital experiences; the base remains hardware-heavy (56% in 2024), even as software/cloud models accelerate.

- Segment Dominance – Deployment Model: On-premise led with 52.4% share in 2024 (~USD 2.83 billion), sustained by data-sovereignty mandates, low-latency requirements, and sunk capex in enterprise data centers; cloud-managed load balancing is scaling faster as organizations re-platform tier-1 applications.

- Segment Dominance – Product Scope: Global load balancers (GSLB) captured >67% share in 2024 (~USD 3.62 billion), reflecting multi-region architectures, anycast/DNS traffic steering, and CDN integration that prioritize uptime and geo-redundancy for mission-critical services.

- Driver: Enterprise concentration remains high—Large Enterprises accounted for 64.5% of spend (~USD 3.48 billion) in 2024—while IT & Telecom was the top vertical at 22.4% (~USD 1.21 billion), underpinned by 5G rollouts, OTT traffic, and encrypted L7 workloads that require elastic, policy-aware balancing.

- Restraint: Architectural complexity and migration risk slow cloud transitions; with >50% of 2024 spend tied to on-prem and 56% to hardware, organizations face longer integration timelines and higher TCO for hybrid operations, alongside skills gaps across SRE/NetOps and compliance constraints.

- Opportunity: Cloud-native and managed L7 load balancing (including API-aware WAF/DDoS bundles) in Asia–Pacific is poised for outperformance (mid-teens CAGR expected), creating a multi-billion-dollar revenue pool by 2033 as digital infrastructure scales in India and Southeast Asia.

- Trend: Adoption is shifting toward software-defined, programmable data planes (e.g., service mesh/Envoy, eBPF) and AI-assisted traffic management for predictive autoscaling and failure remediation; cloud platform offerings (e.g., AWS, Azure, GCP) and decentralized approaches (e.g., mesh-embedded routing) are compressing appliance footprints.

- Regional Analysis: North America led with ~33.7% share in 2024 (~USD 1.82 billion) supported by hyperscaler ecosystems and early enterprise modernization; Europe follows with steady upgrades around digital sovereignty, while Asia–Pacific is the fastest-growing investment hotspot, outpacing the global CAGR on accelerating cloud, 5G, and edge deployments.

Component Analysis

Hardware remains the revenue anchor in 2025, underpinned by deterministic performance, L4–L7 offload (SSL/TLS termination, compression), and appliance-grade reliability demanded by high-throughput data centers. Building on its 56% share in 2024 (≈USD 3.0 billion), hardware still accounts for just above half of spend in 2025 (≈USD 3.8 billion out of an estimated USD ~7.0 billion market), supported by refresh cycles, data-center consolidation, and latency-sensitive workloads in regulated environments.

Software and services are growing faster than the total market as enterprises standardize on cloud-native stacks and shift to subscription and managed models. Virtual/software load balancers, service-mesh integrations, and provider-managed offerings (e.g., application gateways paired with WAF/DDoS) are expanding at a mid-to-high-teens pace, 200–400 bps above the market CAGR through 2030. By the late 2020s, software-plus-services is on course to overtake appliances on new deployments, helped by API-first control planes, automation, and lower initial capex.

Type Analysis

Global load balancers (GSLB) continue to lead on value creation, reflecting multi-region active-active architectures and stringent SLOs for digital channels. After capturing >67% in 2024 (≈USD 3.6 billion), GSLB represents roughly two-thirds of 2025 spend (≈USD 4.7 billion), powered by geo-routing, anycast/DNS steering, and disaster recovery requirements in e-commerce, fintech, and media. The ability to route around regional failures and reduce user-perceived latency is translating directly into higher attach rates for observability and security add-ons.

Local load balancers remain essential for intra-region distribution, east–west traffic, and Kubernetes ingress, particularly in edge locations and private clouds. Growth is sustained by microservices adoption and 5G/MEC rollouts, where localized traffic shaping and mTLS termination are required close to the workload. Vendors are bundling L7 policy, rate limiting, and API analytics to defend share in latency-critical sites.

Deployment Analysis

On-premise incumbency remains material—over 52.4% in 2024 (≈USD 2.83 billion)—as enterprises balance sovereignty, deterministic performance, and sunk capex. In 2025, hybrid dominates: on-premise still holds a slight majority of revenue, but its share is gradually diluting as refresh decisions pair appliances with virtual editions and cloud gateways for unified policy. Highly regulated BFSI, public sector, and exchange-connected workloads continue to favor on-prem for compliance and ultra-low latency.

Cloud load balancing is the structural growth engine, approaching parity by the latter 2020s as organizations consolidate tooling around provider-native gateways and third-party virtual appliances. Drivers include OpEx flexibility, autoscaling, global reach, and tight integration with CI/CD and Zero Trust controls. Expect cloud to surpass 50% share on new deployments by 2028–2029, with managed services capturing outsized growth in midmarket and greenfield builds.

Enterprise Size Analysis

Large enterprises remain the demand center, contributing 64.5% of 2024 spend (≈USD 3.5 billion) and still exceeding 60% in 2025. Their complex estates—spanning multi-cloud, private DCs, and edge—require advanced health checks, programmable data planes, and granular policy, alongside integrated WAF/DDoS and analytics. Multi-region failover testing and SRE-led reliability programs are increasing attach rates for premium features and support tiers.

SMEs are the fastest-rising cohort as managed L7 services and usage-based pricing compress time-to-value. Adoption is buoyed by SaaS-native architectures and container platforms, with SME growth expected to outpace the total market by 200–300 bps through 2030. This segment increasingly opts for opinionated, secure-by-default bundles that minimize NetOps overhead while meeting audit and uptime requirements.

Industry Vertical Analysis

IT & Telecom remains the single largest vertical—22.4% in 2024 (≈USD 1.2 billion)—and continues to expand in 2025 as 5G cores, streaming, and API-heavy services push encrypted L7 traffic and throughput peaks. BFSI ranks among the top adopters, driven by real-time payments, open banking, fraud analytics, and stringent resilience testing that favor GSLB and active-active topologies.

Retail/e-commerce and healthcare are the fastest climbers, propelled by peak-event elasticity, omnichannel experiences, telehealth, and HIPAA/GDPR-grade controls. Manufacturing is lifting investments around Industry 4.0 and edge gateways, while government programs prioritize sovereignty and continuity, sustaining on-prem and hybrid patterns.

Regional Analysis

North America remains the revenue leader with ~33.7% share in 2024 (≈USD 1.82 billion) and an estimated ≈USD 2.35 billion in 2025, anchored by hyperscaler ecosystems, early adoption of service-mesh patterns, and a high concentration of digital-native enterprises. Europe follows with steady modernization bounded by digital sovereignty and data-residency frameworks, sustaining hybrid topologies and regional GSLB deployments.

Asia Pacific is the fastest-growing corridor, outpacing the global CAGR through 2030 on the back of cloud adoption in India and Southeast Asia, domestic hyperscalers in China, and accelerated 5G/edge investments. Latin America and the Middle East & Africa are scaling from a smaller base with double-digit growth, led by fintech, e-commerce, and public-sector digitization that increasingly prefer managed L7 services to bridge skills and capex constraints.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Component

- Hardware

- Software

- Services

By Type

- Local Load Balancers

- Global Load Balancers

By Deployment

- On-premise

- Cloud

By Enterprise Size

- Large Enterprises

- SMEs

By Industry Vertical

- BFSI

- IT & Telecom

- Retail

- Government

- Manufacturing

- Healthcare

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 6.8 B |

| Forecast Revenue (2034) | USD 25.9 B |

| CAGR (2024-2034) | 15.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component, Hardware, Software, Services, By Type, Local Load Balancers, Global Load Balancers, By Deployment, On-premise, Cloud, By Enterprise Size, Large Enterprises, SMEs, By Industry Vertical, BFSI, IT & Telecom, Retail, Government, Manufacturing, Healthcare, Others |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Radware, Amazon Web Services, Inc., A10 Networks, Inc., Imperva, International Business Machines (IBM) Corporation, Google LLC, Kemp Technologies, Inc., F5, Inc., Citrix Systems, Inc., Microsoft Corporation, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date