Lockout Tagout Equipment Market Size, Growth & Forecast | 6.1% CAGR

Global Lockout Tagout (LOTO) Equipment Market Size, Share & Analysis By Product Type (Electrical Equipment Lockouts, Valve Lockouts, Others) By Application (Energy and Power, Machinery, Petrochemical, Chemical, Others), By End-User (Manufacturing, Energy, Utilities) Industry Regions & Key Players – Workplace Safety Regulations & Forecast 2025–2034

Report Overview

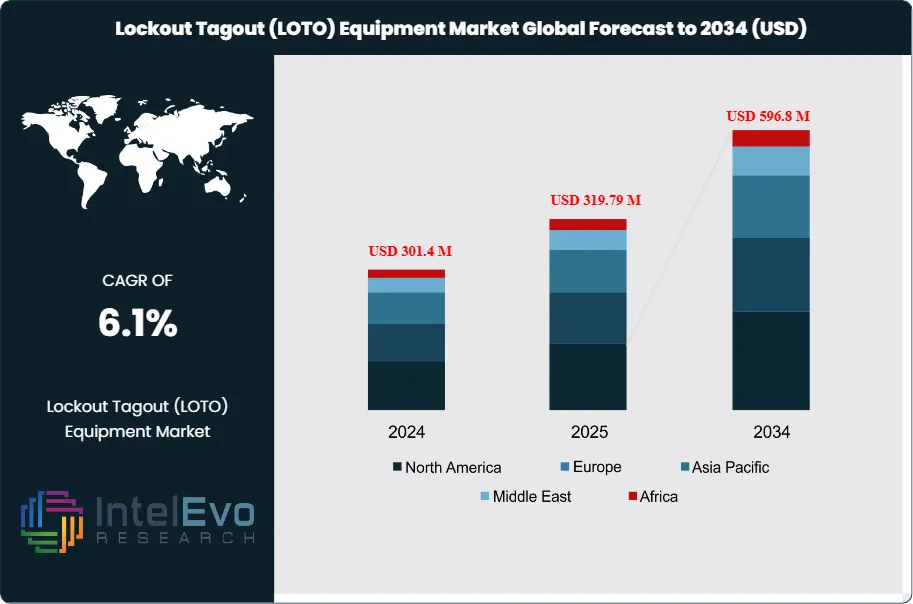

The Lockout Tagout (LOTO) Equipment Market is projected to rise from USD 301.4 Million in 2024 to approximately USD 596.8 Million by 2034, growing at a CAGR of around 6.1% during 2025–2034. Growing emphasis on workplace safety compliance and accident prevention is driving increased adoption of LOTO systems across industrial facilities. Rising automation and expansion of manufacturing operations in emerging economies are accelerating demand for standardized safety procedures. As organizations prioritize employee protection and regulatory adherence, LOTO solutions are becoming essential to safe industrial operations worldwide. This steady growth reflects the rising importance of workplace safety, stricter compliance regulations, and the increasing complexity of industrial operations worldwide.

Get More Information about this report -

Request Free Sample ReportLOTO equipment plays a crucial role in safeguarding workers by isolating hazardous energy sources and preventing the accidental activation of machinery during servicing or repair. The range of products includes padlocks, circuit breaker lockouts, valve lockouts, hasps, and warning tags—each designed to protect maintenance personnel across critical industries such as manufacturing, energy, oil and gas, construction, and utilities.

Regulatory pressure continues to be a primary market driver. In the United States, OSHA regulations require strict adherence to energy control procedures, while EU-OSHA mandates in Europe set equally rigorous standards. These frameworks compel organizations to adopt robust LOTO protocols, significantly influencing purchasing decisions. The Bureau of Labor Statistics underscores the importance of these measures, reporting that effective lockout tagout systems help prevent over 120 deaths and 50,000 injuries annually, while failures in compliance still account for dozens of fatalities and thousands of serious accidents each year.

The market has also been shaped by increasing enforcement activity. From October 2022 to September 2023, OSHA issued 2,532 LOTO-related citations across 1,368 inspections, resulting in USD 20.7 million in penalties. Food manufacturing, fabricated metals, and plastics were among the most penalized sectors, highlighting significant compliance gaps and reinforcing the demand for reliable, standards-driven equipment.

Technological innovation is another key growth catalyst. With the expansion of industrial automation and connected devices, manufacturers are introducing advanced, technology-enabled LOTO systems that integrate with IoT platforms for real-time monitoring and enhanced safety assurance. Furthermore, as sustainability becomes central to corporate priorities, companies offering eco-friendly or recyclable LOTO solutions are gaining traction among organizations seeking to reduce environmental impact.

Emerging economies, particularly in Asia-Pacific and Latin America, present notable opportunities as rapid industrialization, stronger safety mandates, and a heightened focus on workforce protection drive market adoption. Collectively, these dynamics position the LOTO equipment industry as a vital enabler of occupational safety, regulatory compliance, and operational resilience in the evolving global industrial landscape.

Key Takeaways

- Market Growth: The global Lockout Tagout (LOTO) Equipment Market is projected to expand from USD 301.4 million in 2024 to USD 596.8 million by 2034, reflecting a CAGR of 6.1%. Growth is underpinned by stricter global workplace safety mandates, rising penalties for non-compliance, and increasing automation across industrial sectors.

- Driver: Strong regulatory enforcement from agencies such as OSHA in the U.S. and EU-OSHA in Europe continues to drive adoption, as companies are compelled to implement reliable hazardous energy control systems to protect workers and avoid costly violations.

- Restraint: High upfront costs and workforce adaptation challenges hinder adoption, particularly among small and medium-sized enterprises that face budgetary limitations and resistance to shifting from traditional practices.

- Opportunity: The growing demand for IoT-enabled LOTO devices that enable real-time monitoring, compliance tracking, and predictive safety management presents a significant growth avenue for manufacturers.

- Trend: A rising emphasis on eco-friendly and sustainable LOTO solutions—including recyclable materials and low-impact designs—reflects the alignment of industrial safety practices with broader ESG and sustainability goals.

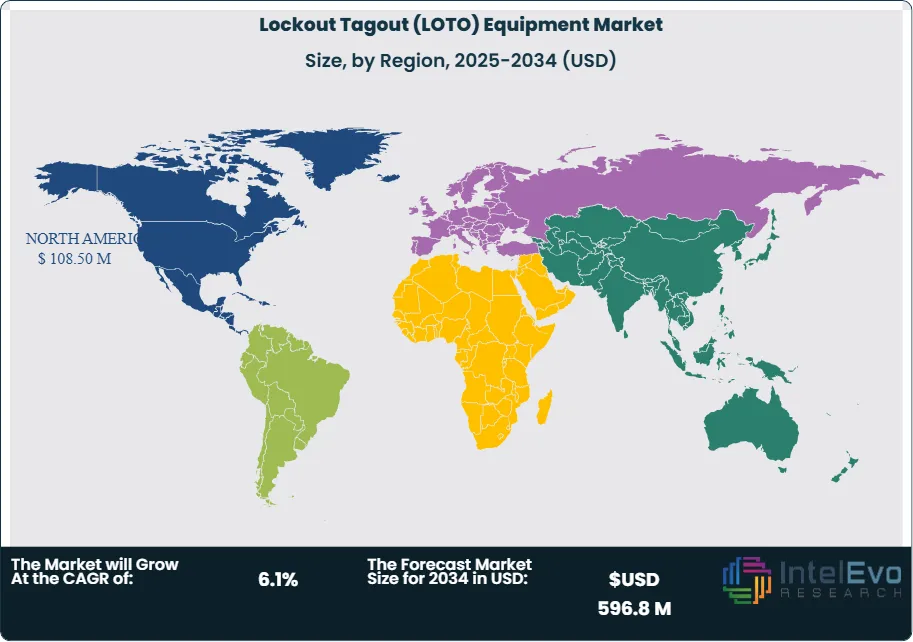

- Regional Analysis: North America leads with about 36% market share due to robust OSHA enforcement and mature industrial infrastructure, while Asia-Pacific is emerging as the fastest-growing region, driven by rapid industrialization, stricter safety mandates, and rising investment in workplace safety technologies.

Product Analysis

As of 2025, electrical equipment lockouts represent the largest share of the global LOTO equipment market, accounting for more than 32% of overall revenue. This dominance is attributed to the persistent priority of electrical safety in industrial operations, where exposure to uncontrolled electrical energy continues to be one of the most frequent causes of workplace accidents. Electrical lockouts are indispensable in ensuring compliance with safety regulations and reducing the incidence of electrical injuries, making them a cornerstone of industrial safety strategies.

Valve lockouts also form a significant product category, particularly within industries such as oil and gas, petrochemicals, and water treatment, where the accidental release of hazardous substances can pose severe risks to both employees and the environment. These devices play a critical role in preventing leakage, managing pressure, and ensuring safe isolation of process flows, thereby reinforcing operational safety in high-risk sectors.

The “Others” segment, which includes cable lockouts, circuit breaker lockouts, and pneumatic lockouts, serves as a versatile solution set for industries with specialized energy isolation needs. While smaller in market share, these products are vital in providing comprehensive coverage across diverse industrial settings, ensuring that safety protocols extend beyond standard electrical and valve applications. Together, these product segments highlight the market’s ongoing evolution toward specialized, fit-for-purpose LOTO solutions that address distinct operational risks.

Application Analysis

In 2025, the energy and power sector remains the leading application area for LOTO equipment, commanding over 44% of the market. This dominance reflects the high safety compliance requirements in energy generation, transmission, and distribution, where hazardous energy incidents can have catastrophic consequences. Stringent enforcement of global safety regulations and heightened focus on workforce protection are sustaining demand for robust lockout solutions in this sector.

The machinery segment also represents a substantial application area, particularly within manufacturing industries. The widespread use of automated and heavy equipment has increased the need for effective lockout systems to prevent accidental start-ups during maintenance. By reducing risks of injury and downtime, LOTO solutions are helping manufacturers align with productivity and safety goals simultaneously.

Within petrochemical and chemical industries, lockout tagout equipment has become indispensable in controlling complex systems involving flammable or reactive substances. Preventing unplanned equipment activation or leaks is vital to maintaining operational continuity and avoiding environmental hazards. Beyond these sectors, industries such as construction, food and beverage, and general manufacturing also rely on tailored lockout protocols, further extending the scope of applications. Collectively, these patterns emphasize that demand for LOTO solutions is strongest in industries where stringent regulatory oversight and high operational risks converge.

Regional Analysis

North America continues to lead the global market in 2025, supported by rigorous enforcement of OSHA standards, a mature industrial base, and a strong safety culture among large enterprises. The U.S., in particular, accounts for a major share of global demand, fueled by both regulatory penalties for non-compliance and the ongoing adoption of advanced safety technologies. Europe remains another critical region, driven by EU-OSHA directives and strong safety compliance across energy, utilities, and manufacturing industries. The region’s growing emphasis on sustainability is also pushing manufacturers to introduce eco-friendly and recyclable LOTO equipment, aligning safety practices with broader ESG mandates. Asia-Pacific is emerging as the fastest-growing market, propelled by rapid industrialization in countries like China, India, and Southeast Asia. Governments across the region are tightening safety regulations, while multinational manufacturers expand operations, creating robust demand for advanced LOTO solutions. Latin America and the Middle East & Africa represent growing opportunities as industrialization accelerates and awareness of occupational safety rises, particularly in oil and gas and heavy manufacturing sectors. Overall, the regional outlook underscores a dual market trend: mature regions driving compliance-based adoption, and emerging markets fueling growth through industrial expansion.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Product Type

- Electrical Equipment Lockouts

- Valve Lockouts

- Others

By Application

- Energy and Power

- Machinery

- Petrochemical

- Chemical

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 301.4 M |

| Forecast Revenue (2034) | USD 596.8 M |

| CAGR (2025-2034) | 6.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Electrical Equipment Lockouts, Valve Lockouts, Others) By Application (Energy and Power, Machinery, Petrochemical, Chemical, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Master Lock, Brady, Panduit, ABUS, Honeywell, American Lock, Rockwell Automation, ZING Green Safety Products, Accuform Manufacturing, Value-Tech Products Sdn. Bhd., Accuform, Marst Safety Equipment (Tianjin) Co. Ltd, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Lockout Tagout (LOTO) Equipment Market

Published Date : 06 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date