Low-Latency Content Sharing Market Trends, Growth | 23.4% CAGR

Global Low-Latency Content Sharing Market Size, Share & Analysis By Content-Type (Audio Content Sharing, Video Content Sharing, Data Content Sharing), By Deployment Mode (Cloud-Based, On-Premise), By Industry Vertical (Media and Entertainment, Healthcare, Education, Gaming, Financial Services, Telecommunications, Automotive), Industry Outlook & Forecast 2025–2034

Report Overview

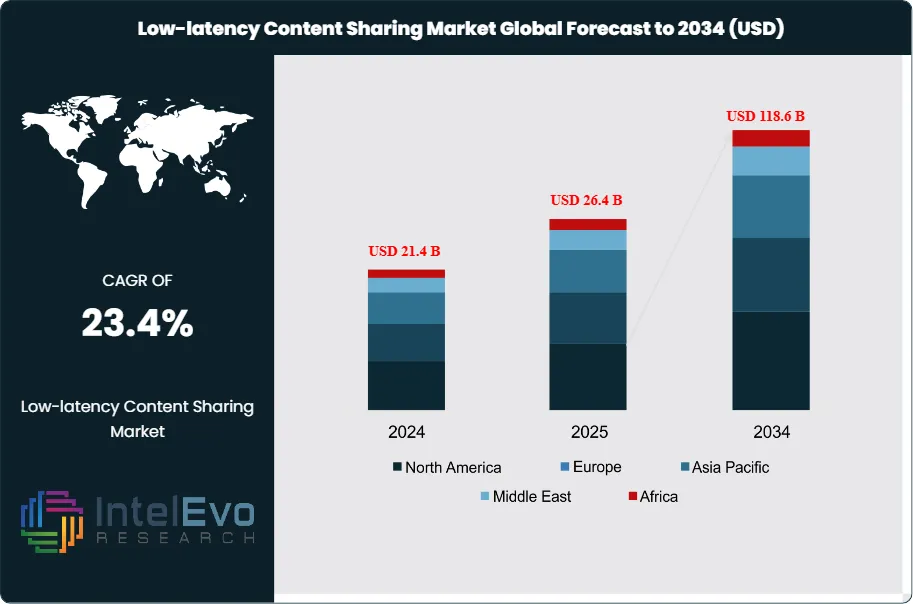

The Low-Latency Content Sharing Market is expected to be worth USD 21.4 billion in 2024. It should grow to about USD 118.6 billion by 2034, showing a strong annual growth rate of around 23.4% from 2025 to 2034. The market is benefiting from the growing use of real-time communication tools, edge-enabled content delivery, and high-performance interactive applications in both consumer and business settings. As global users seek seamless and fast content experiences, demand is rising in video collaboration, live streaming, gaming, and immersive media.

Get More Information about this report -

Request Free Sample ReportThe rapid shift to real-time digital communication is changing the low-latency content sharing landscape. Both businesses and consumers want instant access to video, audio, and interactive media. This demand is driving platforms to implement systems that can deliver performance with sub-second round-trip times. Cloud-based collaboration tools, high-quality video conferencing, and virtual event platforms have become critical for corporate productivity and unified communication.

In 2024, live-streaming platforms continued to grow, making up over 30% of global revenue. This growth is supported by creator monetization, interactive chat features, and events that can handle a high number of users. The increase in the market is closely linked to rising user expectations for seamless, high-quality content experiences.

Online gaming is a key driver of low-latency demand, with over 3.4 billion users worldwide needing ultra-low latency, often below 50 milliseconds, for competitive and immersive gameplay. Real-time interaction in esports, cloud gaming, and social gaming is changing data routing strategies and infrastructure purchases across major markets.

Hyperscalers and telecom companies are increasing the number of edge computing nodes to support fast delivery pipelines. These setups ensure that content-processing occurs closer to users, which helps to reduce issues like jitter, packet loss, and delays. Consequently, edge integration is becoming essential in modern content delivery networks.

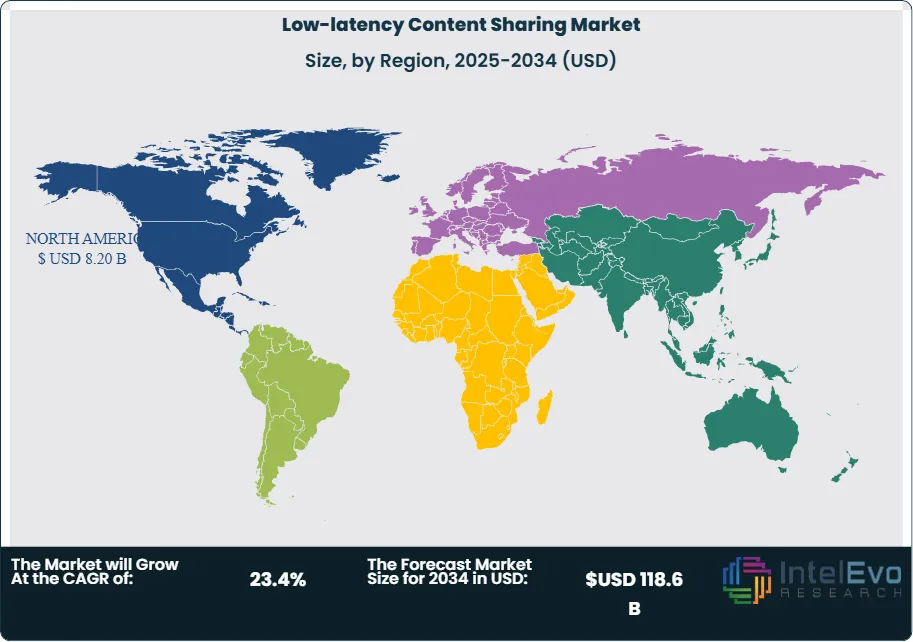

North America leads in infrastructure readiness, with over 65% of mobile traffic routed through low-latency networks as of 2024. Early adoption of 5G, strong fiber networks, and significant spending by businesses strengthen the region’s competitive position.

Meanwhile, Asia Pacific is turning into the fastest-growing region. Growing 5G access in India, South Korea, Japan, and Southeast Asia, along with increasing digital media consumption, is creating a high demand for low-latency content delivery solutions. This regional growth is attracting investments in telecom upgrades, local data centers, and real-time processing options.

Market growth is limited by rising bandwidth costs, which went up about 9% year-on-year due to supply chain issues and delays in Western Europe’s data center operations. Additionally, regulatory challenges around cross-border data transfer, content moderation, and platform compliance complicate multinational operations.

These challenges are especially tough for providers in the Middle East and Africa, where inconsistent infrastructure and uneven policies slow the rollout of modern low-latency services. Providers must tackle these issues while ensuring service reliability and meeting strict delivery standards.

New developments in AI-based compression, adaptive bitrate optimization, and machine learning routing have become key to reducing latency. By 2024, over 40% of global content platforms had adopted AI-enabled traffic routing for ongoing performance adjustments and automatic content prioritization. Improvements in optical fiber capacity and software-defined networking are changing cost-performance dynamics, allowing operators to deliver more throughput with lower operational costs.

Enhanced automation in content workflows enables real-time load balancing and congestion management, ensuring that high-resolution formats like 4K and 8K video streams are transmitted smoothly even during peak traffic.

Investor confidence in the market is robust, with more than USD 12 billion in private equity and venture capital recorded in 2023. Funding is directed toward platforms and infrastructure providers that support real-time interaction, immersive media formats, and large-scale collaboration.

As content ecosystems progress toward mixed-reality environments, AI-driven engagement, and seamless multi-device functionality, industry players face a clear challenge: shorten end-to-end delivery time while meeting increasing demands for concurrency and resolution. These changes will help ensure that the low-latency content sharing market continues to grow strongly through 2034.

Key Takeaways

- Market Growth: The global low-latency content sharing market reached USD 21.4 billion in 2024 and is forecast to hit USD 118.6 billion by 2034, growing at a CAGR of 23.4%. Growth is driven by rising demand for real-time digital interaction in sectors like gaming, telemedicine, and enterprise collaboration.

- Application: Live video streaming led the market with over 28% revenue share in 2023, driven by consumer preference for uninterrupted, high-resolution content and monetization models adopted by platforms like Twitch and YouTube Live.

- End Use: The gaming industry remains a core adopter, supported by a global user base exceeding 3.2 billion and infrastructure demands for sub-50 millisecond latency in competitive and cloud-based gameplay environments.

- Driver: Increased deployment of 5G and edge computing infrastructure is accelerating content delivery performance. In 2023, over 65% of North American mobile traffic was routed through low-latency networks, improving user experience for high-bandwidth applications.

- Restraint: Rising infrastructure costs pose a challenge. Bandwidth pricing climbed 9% year-on-year due to supply chain constraints and delayed data center projects, particularly in Western Europe and parts of Latin America.

- Opportunity: Asia Pacific presents strong potential, with India, South Korea, and Indonesia recording high adoption growth. The region is projected to register a CAGR above 24% through 2032, supported by rapid 5G rollout and increasing demand for mobile content sharing.

- Trend: AI-based traffic management is gaining traction. Over 40% of major platforms integrated machine learning algorithms for predictive routing and bitrate adjustment in 2024, reducing latency while supporting concurrency at scale.

- Regional Analysis: North America leads the market in infrastructure readiness and revenue share. Asia Pacific is closing the gap, fueled by investments in telecom upgrades and rising mobile internet penetration. Europe shows steady adoption but lags in latency optimization due to regulatory hurdles.

Content Type Analysis

Video content sharing remains the dominant content type in the global low-latency content sharing market, accounting for approximately 62.7% of total revenue in 2025. Its growth is fueled by widespread adoption across sectors requiring real-time communication and high-resolution media. Applications such as telemedicine, virtual education, and remote corporate training rely heavily on uninterrupted video delivery, creating consistent demand for high-performance streaming capabilities. The rise of hybrid work models and growing penetration of video conferencing platforms continue to push video content into the mainstream.

This segment also benefits from the increasing use of immersive technologies. Live sports streaming, interactive entertainment, and AR/VR experiences have strict latency requirements, making video content sharing a core driver of infrastructure development. Content providers are prioritizing speed and clarity, particularly in markets where consumer retention is tied to performance. As a result, investment in adaptive bitrate streaming and AI-enhanced delivery systems is concentrated in this segment.

Deployment Mode Analysis

Cloud-based deployment leads the market by a significant margin, capturing 76.4% of global revenue share in 2025. Organizations across industries are migrating to cloud platforms to enable faster deployment, lower infrastructure overhead, and scalable content delivery. The shift is especially pronounced among streaming platforms, enterprise collaboration tools, and education tech firms, which require rapid scaling based on fluctuating user loads. Cloud models also allow integration with edge computing and AI-based routing to maintain low-latency performance at global scale.

While the cloud model dominates, the on-premise segment is showing steady growth in industries with stricter data privacy and latency control requirements. Financial institutions, defense, and some healthcare providers continue to deploy on-premise systems to meet regulatory standards. This segment is projected to grow at a modest CAGR through 2032, supported by advances in hybrid architectures.

Industry Vertical Analysis

The media and entertainment industry continues to hold the largest share of the market in 2025, driven by growing demand for high-speed content delivery across live broadcasting, over-the-top (OTT) platforms, and esports. The segment leads adoption of low-latency infrastructure to support concurrent users, interactive features, and high-definition streaming. In 2024, major streaming providers increased infrastructure investments by over 15% to reduce latency and enhance viewer experience.

Gaming and education are fast-rising verticals. Cloud gaming platforms rely on sub-50 millisecond latency to maintain competitive playability, while online learning tools are being restructured to support synchronous video and interactive content. Financial services and healthcare are also expanding their use of low-latency systems, particularly for high-frequency trading and real-time diagnostics.

Regional Analysis

North America remains the leading region, holding a 38.3% revenue share in the global low-latency content sharing market. Its dominance is anchored by mature digital infrastructure, wide 5G coverage, and early adoption of edge computing. Key sectors such as finance, entertainment, and healthcare rely on near-instantaneous content transmission, with firms in the U.S. and Canada allocating higher budgets to low-latency technologies than any other region.

Asia Pacific is the fastest-growing region, supported by expanding digital ecosystems in India, China, and Southeast Asia. The region is expected to register a CAGR above 23% through 2032. Demand for real-time mobile content, rapid urban internet penetration, and growing investment in telecom infrastructure are driving uptake. Meanwhile, Europe shows stable growth, though deployment delays and regulatory barriers have slowed adoption in some countries. The Middle East and Africa remain under-penetrated but are beginning to see targeted investments in latency-sensitive sectors like telehealth and education.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Content-Type

- Audio Content Sharing

- Video Content Sharing

- Data Content Sharing

By Deployment Mode

- Cloud-Based

- On-Premise

By Industry Vertical

- Media and Entertainment

- Healthcare

- Education

- Gaming

- Financial Services

- Telecommunications

- Automotive

- Other Industry Verticals

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 21.4 B |

| Forecast Revenue (2034) | USD 118.6 B |

| CAGR (2024-2034) | 23.4% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Content-Type (Audio Content Sharing, Video Content Sharing, Data Content Sharing), By Deployment Mode (Cloud-Based, On-Premise), By Industry Vertical (Media and Entertainment, Healthcare, Education, Gaming, Financial Services, Telecommunications, Automotive, Other Industry Verticals) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Cloudflare, Inc., Cisco Systems, Inc., Amazon Web Services, Inc., Verizon Communications Inc., Google LLC, Fastly, Akamai Technologies, Inc., Huawei Technologies Co., Ltd., Ericsson, Microsoft Corporation, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Low-latency Content Sharing Market

Published Date : 11 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date