Low Voltage Solid State Relay Market Size & Growth | CAGR of 6.5%

Global Low Voltage Solid State Relay Market Size, Share, Analysis Report By Mounting Type (PCB Mount, Panel Mount, DIN Rail Mount, Others), Type (AC/DC Solid State Relay, AC Solid State Relay, DC Solid State Relay), End User (Energy and Power, Food and Beverage, Industrial Automation, Automotive, Others) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

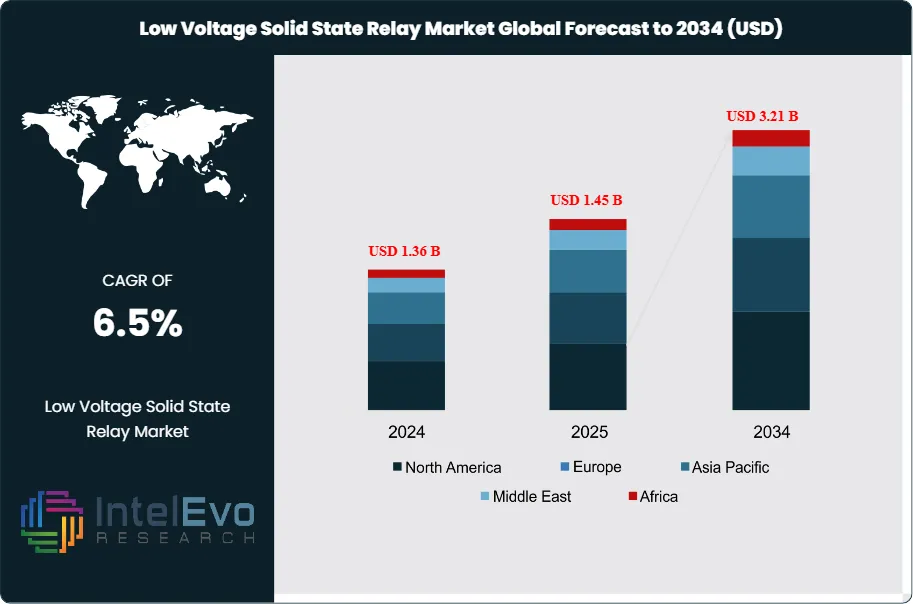

The Low Voltage Solid State Relay Market size is expected to be worth around USD 3.21 Billion by 2034, from USD 1.36 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2024 to 2034. The Low Voltage Solid State Relay market encompasses electronic switching devices that operate without moving parts, using semiconductor technology to control electrical circuits in applications requiring voltages typically below 1000V AC or 1500V DC. These devices provide superior reliability, faster switching speeds, and longer operational life compared to traditional electromechanical relays, making them essential components in industrial automation, building control systems, and consumer electronics applications.

Get More Information about this report -

Request Free Sample ReportThe market is experiencing robust growth driven by increasing industrial automation adoption, growing demand for energy-efficient switching solutions, and the expansion of smart building technologies. The shift toward Industry 4.0 and IoT integration is creating significant opportunities for solid state relay manufacturers to develop advanced products with enhanced control capabilities, remote monitoring features, and improved energy efficiency characteristics that support modern automation requirements.

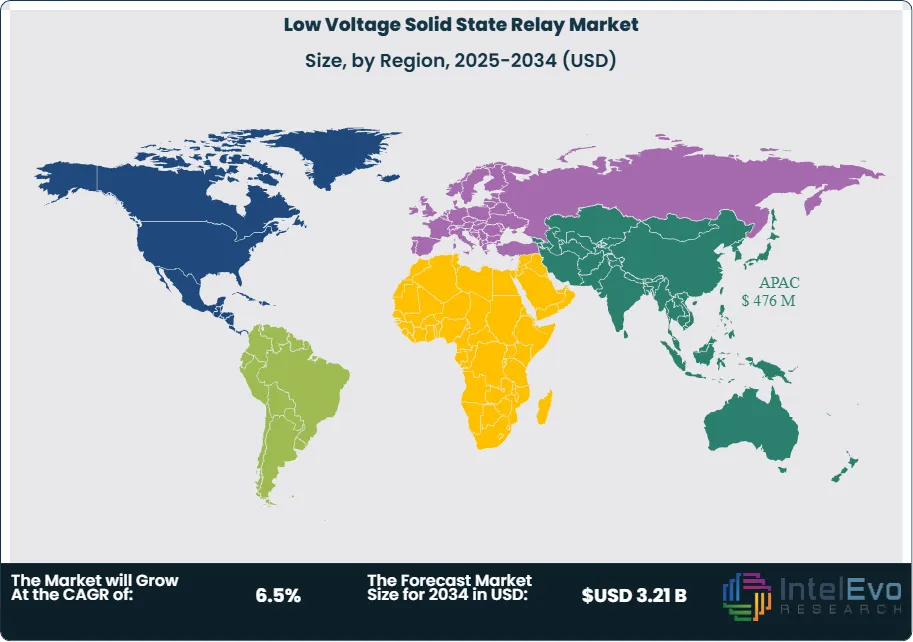

Asia-Pacific dominates the global market with a commanding 34.2% share, driven by China's manufacturing prowess and the region's rapid industrialization. North America and Europe follow as significant markets, supported by advanced automation adoption and stringent energy efficiency regulations. The regional distribution reflects the concentration of manufacturing activities and the varying levels of industrial automation adoption across different geographic markets.

The pandemic initially disrupted supply chains and manufacturing operations but ultimately accelerated the adoption of automation technologies as companies sought to reduce labor dependencies and improve operational resilience. This trend boosted demand for solid state relays in automated systems, remote monitoring applications, and contactless control solutions that aligned with health safety requirements and operational continuity objectives.

Recent US tariff policies and trade tensions are affecting component sourcing strategies and manufacturing location decisions for solid state relay producers. Companies are diversifying their supply chains, establishing regional manufacturing capabilities, and adjusting pricing strategies to mitigate the impact of trade policy changes while maintaining competitive positioning in key markets.

Key Takeaways

- Market Growth: The Low Voltage Solid State Relay Market is expected to reach USD 3.21 Billion by 2034, propelled by rising industrial automation implementation, heightened demand for energy-efficient switching technologies, and the proliferation of intelligent building systems.

- Mounting Type Dominance: Panel mount configurations dominate the mounting segment, driven by installation convenience and maintenance accessibility.

- Product Type Dominance: AC relays lead the product segment due to wide application compatibility and mature technology advantages.

- End User Dominance: The energy and power sector dominates the low voltage solid state relay market due to extensive applications in power generation, distribution systems, and renewable energy infrastructure.

- Drivers: Key drivers accelerating growth include industrial automation expansion and energy efficiency requirements, which boost market expansion through enhanced operational performance and cost savings.

- Restraints: Growth is hindered by high initial costs and thermal management challenges, which create barriers such as implementation complexity and design considerations.

- Opportunities: The market is poised for expansion due to opportunities like IoT integration and renewable energy growth, which enable smart control systems and sustainable energy management.

- Trends: Emerging trends including miniaturization and smart connectivity are reshaping the market by enabling compact designs and intelligent control capabilities.

- Regional Leader: Asia-Pacific leads owing to manufacturing concentration and industrial growth. Latin America and Middle East show high promise due to infrastructure development and industrial expansion.

Mounting Type Analysis:

Panel Mount Leads With more than 40% Market Share In Low Voltage Solid State Relay Market: Panel mount configurations lead the mounting segment by offering superior installation convenience, maintenance accessibility, and operational flexibility compared to PCB mount alternatives. Panel mount solid state relays provide easier troubleshooting, replacement procedures, and visual status indication, making them ideal for industrial environments where maintenance efficiency is critical. This mounting approach enables better heat dissipation, simplified wiring configurations, and enhanced protection against environmental factors. The segment's dominance reflects the practical advantages panel mounting offers in real-world applications where serviceability and reliability are paramount considerations.

Product Type Analysis:

The product type segment divides into AC and DC relays, with AC relays maintaining dominance through their superior application compatibility and mature technology foundation. AC solid state relays benefit from widespread adoption in motor control applications, heating systems, and lighting control where alternating current is the standard power source. Their established market presence, proven reliability, and cost-effectiveness make them the preferred choice for most industrial and commercial applications. The segment's leadership reflects the prevalence of AC power systems in global electrical infrastructure and the extensive experience manufacturers have developed in AC relay technologies.

End User Analysis:

The energy and power segment dominates the market driven by extensive deployment across power plants, substations, and renewable energy installations where SSRs provide superior reliability compared to mechanical relays. Critical applications include controlling heating elements in power generation equipment, managing motor drives, switching lighting systems, and integrating renewable energy sources like solar and wind into the grid. The sector's emphasis on minimizing downtime and maintenance costs makes SSRs attractive due to their longer operational life and resistance to environmental factors. Smart grid modernization initiatives further accelerate adoption as these systems require precise, fast-switching capabilities for load management and power quality control.

Regional Analysis:

Asia-Pacific Leads With nearly 35% Market Share In Low Voltage Solid State Relay Market: Asia-Pacific leads the global Low Voltage Solid State Relay market with a dominant 34.2% market share, primarily driven by China's manufacturing capabilities and the region's rapid industrial expansion. The region benefits from established electronics manufacturing infrastructure, competitive production costs, and growing domestic demand for automation solutions across various industries. China alone represents a significant portion of regional demand, supported by government initiatives promoting industrial modernization and smart manufacturing adoption.

North America maintains a strong market position through advanced automation adoption, stringent energy efficiency regulations, and technological innovation leadership. The region's mature industrial base, emphasis on operational efficiency, and early adoption of smart technologies create consistent demand for high-performance solid state relay solutions. The United States leads regional consumption, driven by extensive manufacturing activities and ongoing industrial modernization efforts.

Europe represents a stable market with steady growth supported by energy efficiency mandates, industrial automation initiatives, and technological advancement programs. The region's focus on sustainable manufacturing, renewable energy integration, and Industry 4.0 adoption creates opportunities for advanced solid state relay applications. Germany, France, and the United Kingdom lead regional demand through their strong industrial bases and commitment to technological innovation.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

Mounting Type:

- PCB Mount

- Panel Mount

- DIN Rail Mount

- Others

Type:

- AC/DC Solid State Relay

- AC Solid State Relay

- DC Solid State Relay

End User:

- Energy and Power

- Food and Beverage

- Industrial Automation

- Automotive

- Others

Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 1.45 B |

| Forecast Revenue (2034) | USD 3.21 B |

| CAGR (2025-2034) | 6.5% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Mounting Type: (PCB Mount, Panel Mount, DIN Rail Mount, Others), Type: (AC/DC Solid State Relay, AC Solid State Relay, DC Solid State Relay), End User:(Energy and Power, Food and Beverage, Industrial Automation, Automotive, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Schneider Electric, Crydom Inc. (Sensata Technology), Omron Corporation, IXYS Corp. (Littelfuse), ABB Ltd., STMicroelectronics, Rockwell Automation, Fujitsu Limited, Carlo Gavazzi, Sharp Corporation, Vishay Intertechnology |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Low Voltage Solid State Relay Market?

The Low Voltage Solid State Relay Market will hit USD 3.21 Bn by 2034, rising at 6.5% CAGR. Explore growth, key drivers & innovations shaping the industry.

Who are the major players in the Low Voltage Solid State Relay Market?

Schneider Electric, Crydom Inc. (Sensata Technology), Omron Corporation, IXYS Corp. (Littelfuse), ABB Ltd., STMicroelectronics, Rockwell Automation, Fujitsu Limited, Carlo Gavazzi, Sharp Corporation, Vishay Intertechnology

Which segments covered the Low Voltage Solid State Relay Market?

Mounting Type: (PCB Mount, Panel Mount, DIN Rail Mount, Others), Type: (AC/DC Solid State Relay, AC Solid State Relay, DC Solid State Relay), End User:(Energy and Power, Food and Beverage, Industrial Automation, Automotive, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Low Voltage Solid State Relay Market

Published Date : 18 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date