Lubricants Market Size, Share & Growth Outlook | CAGR 5.1%

Global Lubricants Market Size, Share & Industry Analysis By Product Type (Mineral Oil, Synthetic, Bio-Based), By Application (Automotive, Industrial, Marine, Aviation), EV Impact on Lubricant Demand, Sustainability & Low-Emission Formulations, Digital Monitoring Trends, Regional Outlook, Key Manufacturers & Forecast 2025–2034

Report Overview

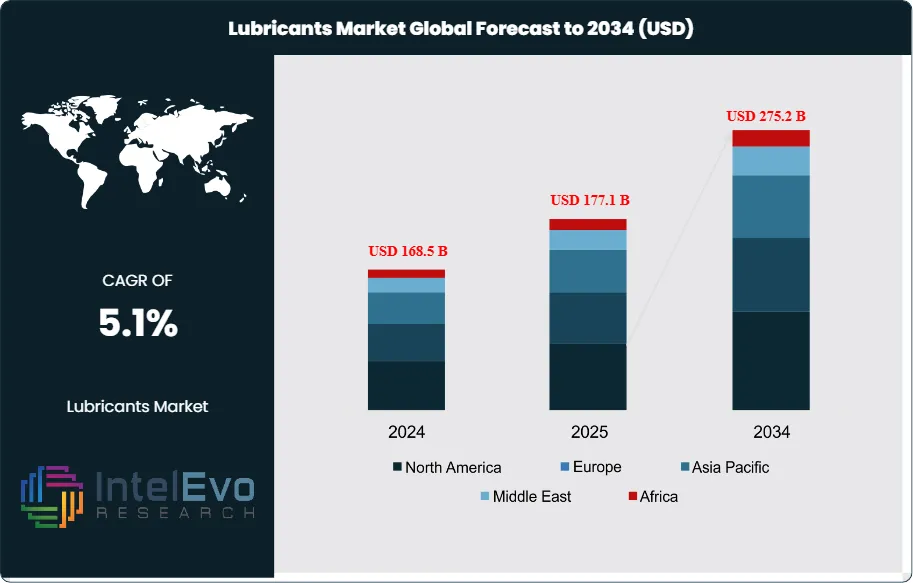

The Lubricants Market is estimated at USD 168.5 billion in 2024 and is projected to reach approximately USD 275.2 billion by 2034, registering a compound annual growth rate (CAGR) of about 5.1% during 2025–2034. This steady expansion reflects sustained demand from automotive, industrial manufacturing, and energy sectors, alongside rising vehicle parc growth in emerging economies. In parallel, the accelerating shift toward high-performance synthetic and bio-based lubricants is reshaping product mix and value realization. Increasing emphasis on equipment longevity, fuel efficiency, and emissions reduction is further reinforcing lubricant consumption across both mature and developing markets, supporting long-term industry momentum.

Get More Information about this report -

Request Free Sample ReportThe market has expanded steadily over the past decade, supported by rising industrial output, increasing vehicle ownership, and the growing need for specialized formulations across automotive, manufacturing, marine, and energy sectors. While demand growth has moderated compared with earlier cycles, the market continues to demonstrate resilience, with steady replacement demand and new applications sustaining long-term consumption.

Automotive lubricants remain the largest segment, accounting for more than 50% of global demand, driven by the expansion of passenger and commercial vehicle fleets. Industrial lubricants are also gaining traction, supported by manufacturing growth in Asia and the modernization of equipment in developed economies. Marine and aviation lubricants, though smaller in scale, are expected to see stable demand as global trade volumes recover and fleet upgrades require higher-grade formulations.

Several demand-side drivers are shaping the market outlook. Rising adoption of energy-efficient vehicles is increasing the need for advanced lubricants with improved thermal stability and lower viscosity. Industrial users are seeking products that extend equipment life and reduce downtime, creating opportunities for synthetic and semi-synthetic blends. On the supply side, volatility in crude oil prices and tightening environmental regulations present challenges, particularly for producers reliant on conventional base oils. The transition toward bio-based lubricants is gaining momentum, with regulatory support in Europe and North America accelerating adoption.

Technology is reshaping the competitive landscape. Digital monitoring systems that track lubricant performance in real time are being integrated into industrial operations, reducing waste and improving predictive maintenance. Artificial intelligence and automation are enabling more precise formulation development, while additive technologies are enhancing lubricant efficiency and durability. These advancements are expected to support premiumization and margin expansion for producers.

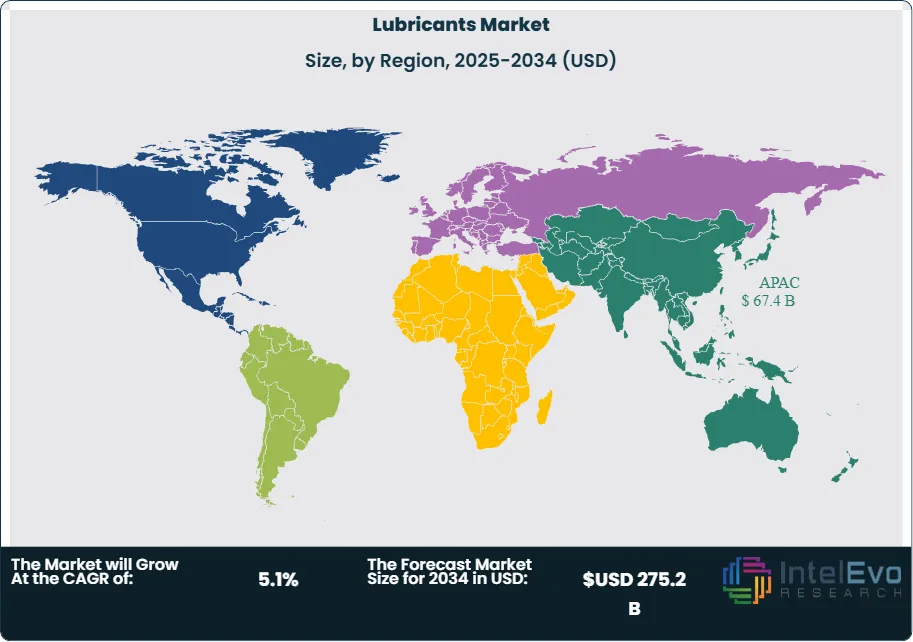

Regionally, Asia-Pacific dominates consumption, accounting for over 40% of global demand, led by China and India’s automotive and industrial sectors. North America and Europe remain mature but important markets, with growth centered on synthetics and environmentally compliant products. Emerging opportunities are visible in the Middle East and Africa, where infrastructure expansion and industrialization are driving lubricant requirements. For investors, the most attractive hotspots lie in synthetic lubricants, bio-based alternatives, and digitalized service models that align with sustainability and efficiency priorities.

Key Takeaways

- Market Growth: The global lubricants industry was estimated at USD 168.5 billion in 2024 and is forecasted to climb to USD 275.2 billion by 2034, advancing at a compound annual growth rate (CAGR) of 5.1% between 2023 and 2032. This expansion is being fueled by the steady rise in automotive consumption, the broadening of industrial activities, and the increasing reliance on high-performance fluids for modern machinery.

- By Type: Synthetic lubricants accounted for 39.3% of global revenue in 2022, driven by superior thermal stability, extended drain intervals, and adoption in premium automotive and industrial applications. Mineral oils remain widely used but face pressure from regulatory and efficiency requirements.

- By Application: Automotive lubricants represent over 50% of total demand, with engine oils, gear oils, and transmission fluids driving consumption. Industrial lubricants follow, supported by hydraulic systems, compressors, and heavy machinery in manufacturing and construction.

- Driver: Global vehicle ownership exceeded 1.4 billion units in 2022, directly fueling lubricant consumption. Expanding transportation fleets in Asia and Africa are expected to add significant incremental demand through 2032.

- Restraint: The rapid adoption of electric vehicles, which require up to 30% fewer lubricants than internal combustion engine vehicles, poses a long-term risk. EVs are projected to represent 18% of global vehicle sales by 2030, reducing demand for conventional engine oils.

- Opportunity: Bio-based lubricants are gaining traction, with the segment expected to surpass USD 5.5 billion by 2030 at a CAGR above 6%. Regulatory incentives in Europe and North America are accelerating adoption, creating a high-growth niche for producers.

- Trend: Digital monitoring of lubricant performance is expanding, with predictive maintenance solutions reducing downtime by up to 20%. Companies such as Shell and ExxonMobil are investing in AI-driven lubricant management platforms to strengthen aftermarket services.

- Regional Analysis: Asia-Pacific accounted for over 40% of global lubricant demand in 2022, led by China and India’s automotive and industrial sectors. North America and Europe remain mature markets with strong demand for synthetics and eco-friendly products, while the Middle East and Africa are emerging growth hubs supported by infrastructure and energy investments.

Type Analysis

The global lubricants market in 2025 continues to be defined by three primary categories: mineral, semi-synthetic, and synthetic formulations. Synthetic lubricants remain the largest and fastest-growing segment, accounting for more than 39% of global revenue in 2024 and projected to expand at a CAGR above 4% through 2032. Their dominance is linked to superior performance in high-temperature and high-load environments, making them essential for advanced automotive engines, aerospace applications, and heavy industrial machinery. Producers such as ExxonMobil and Shell are expanding premium synthetic portfolios to capture this demand.

Semi-synthetic lubricants, which blend mineral and synthetic bases, are gaining traction as a cost-effective alternative. They provide improved thermal stability and wear protection compared with mineral oils, while remaining more affordable than fully synthetic options. This balance has made them particularly attractive in emerging markets where cost sensitivity is high but performance requirements are rising.

Mineral lubricants, derived directly from crude oil, still represent a significant share of global consumption due to their wide availability and low cost. However, their growth is slowing as regulatory pressures and efficiency standards push end-users toward higher-performing alternatives. By 2030, mineral lubricants are expected to lose share to synthetics and bio-based formulations, especially in North America and Europe.

Product Analysis

Automotive oils remain the largest product category, representing more than half of total lubricant demand in 2024. Engine oils, gear oils, and transmission fluids continue to drive consumption, supported by a global vehicle fleet exceeding 1.5 billion units. Growth is particularly strong in Asia-Pacific, where rising car ownership and commercial fleet expansion sustain high demand.

Industrial oils form the second-largest segment, with applications across hydraulic systems, compressors, bearings, and gears. Industrial demand is being reinforced by manufacturing growth in Asia and the modernization of equipment in Europe and North America. Metalworking fluids, though smaller in scale, are critical in automotive and aerospace component production, with demand tied closely to global manufacturing output.

Marine lubricants, designed to withstand corrosion and extreme operating conditions, are a specialized but stable segment. Demand is supported by global shipping activity, offshore drilling, and naval operations. Increasing regulatory requirements on sulfur emissions are driving the adoption of higher-grade marine lubricants, creating opportunities for suppliers with advanced formulations.

End-Use Analysis

Transportation remains the dominant end-use sector, accounting for more than 50% of global lubricant consumption in 2024. This includes passenger vehicles, commercial fleets, and aviation. While electric vehicle adoption is expected to reduce demand for conventional engine oils, growth in commercial transport and aviation continues to sustain lubricant requirements.

The industrial sector is the second-largest end-user, spanning agriculture, mining, construction, and manufacturing. Industrial lubricants are critical for reducing downtime and extending equipment life, particularly in capital-intensive industries. Demand is expected to rise steadily in Asia-Pacific and the Middle East, where infrastructure and industrial investments remain strong.

Marine applications represent a smaller but strategically important end-use category. Commercial shipping, offshore rigs, and naval fleets require specialized lubricants that can withstand extreme conditions. Regulatory compliance on emissions and sustainability is reshaping this segment, with bio-based and low-sulfur lubricants gaining traction.

Regional Analysis

Asia-Pacific continues to lead the global lubricants market, accounting for more than 40% of total demand in 2024. China and India remain the largest consumers, driven by rapid industrialization, expanding automotive fleets, and infrastructure development. The region is projected to maintain a CAGR above 3.5% through 2032, making it the most attractive growth hub for producers.

North America and Europe represent mature but stable markets. Demand is shifting toward synthetic and environmentally compliant lubricants, supported by stringent emissions regulations and the adoption of advanced machinery. The U.S. remains a key market for premium automotive and industrial lubricants, while Europe is leading in bio-based lubricant adoption.

Latin America and the Middle East & Africa are emerging growth regions. Brazil and Mexico are driving demand in Latin America through automotive and industrial expansion. In the Middle East & Africa, infrastructure projects, energy sector investments, and rising vehicle ownership are expected to accelerate lubricant consumption. These regions present long-term opportunities for suppliers targeting cost-effective yet high-performance formulations.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Type

- Mineral

- Semi-Synthetic

- Synthetic

By Product

- Automotive Oils

- Industrial Oils

- Metalworking Fluids

- Hydraulic Oils

- Process Oils

- Marine Oils

- Greases

- Other Products

By End-Use Industry

- Transportation

- Industries

- Marine

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 168.5 B |

| Forecast Revenue (2034) | USD 275.2 B |

| CAGR (2024-2034) | 5.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type, Mineral, Semi-Synthetic, Synthetic, By Product, Automotive Oils, Industrial Oils, Metalworking Fluids, Hydraulic Oils, Process Oils, Marine Oils, Greases, Other Products, By End-Use Industry, Transportation, Industries, Marine |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Valvoline LLC, PetroFer Chemie, ExxonMobil Corp., Castrol India Ltd., Zeller Gmelin Gmbh & Co. KG, Chevron Corp., Lukoil, Royal Dutch Shell Co., Blaser Swisslube Inc., Amsoil Inc., Quaker Chemical Corp., PetroChina Company Ltd., Fuchs, Petrobras, JX Nippon Oil & Gas Exploration Corp., China Petrochemical Corp., Petronas Lubricant International, Idemitsu Kosan Co. Ltd., Total Energies, Buhmwoo Chemical Co. Ltd., Philips 66 Company, BP PLC., Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date