Luxury Bedding Market Size, Share, Trends & Forecast 2034 | 4.3% CAGR

Global Luxury Bedding Market Size, Share & Analysis By Product Type (Blankets & Quilts, Bed Linen, Down Covers, Duvets, Mattresses, Pillowcases & Shams, Protectors, Others), By Distribution Channel (Online Stores, Specialty Bedding Stores, Home Decor Stores, Hypermarkets/Supermarkets, Others), By End-User (Residential, Commercial) Industry Regions & Key Players – Consumer Lifestyle Trends, Premiumization Drivers, Competitive Strategies & Forecast 2025–2034

Report Overview

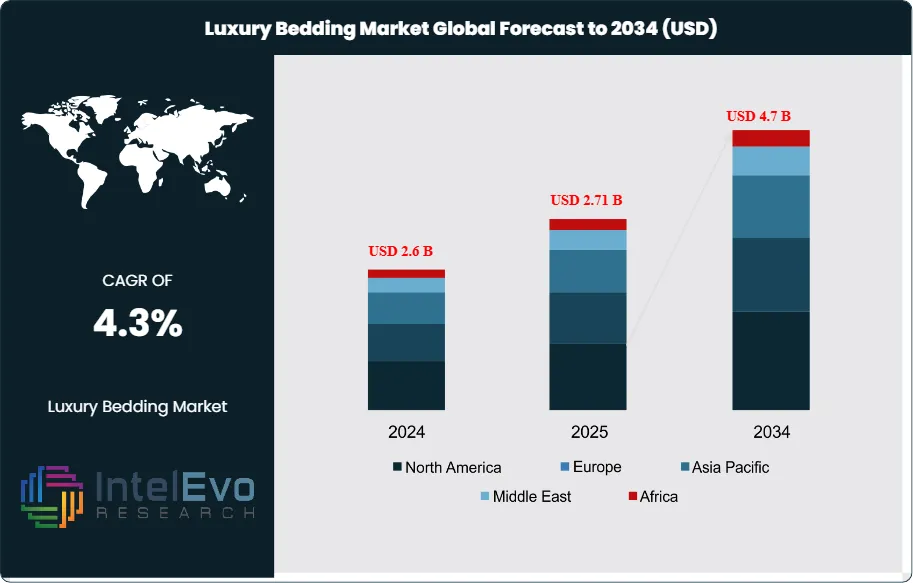

The Luxury Bedding Market is expected to grow to about USD 4.7 billion by 2034, rising from an estimated USD 2.6 billion in 2024. This growth will occur at a rate of around 4.3% from 2025 to 2034. The market is driven by a growing consumer interest in high-quality sleep, greater use of sustainable and hypoallergenic materials, and an increase in demand for luxury lifestyle products among wealthy consumers worldwide.

Get More Information about this report -

Request Free Sample ReportLuxury bedding represents a premium segment within the home furnishings industry, comprising high-quality sheets, duvets, pillowcases, comforters, and mattresses crafted from superior materials such as Egyptian cotton, silk, and linen. Beyond functionality, these products embody refinement, durability, and aesthetic value, catering to consumers who view sleep as an integral component of wellness and lifestyle enhancement. The category has evolved from being an elite indulgence to a mainstream aspiration for affluent households and hospitality establishments worldwide.

Several factors underpin the steady growth of this market. Rising global awareness of the importance of sleep quality has amplified demand for advanced bedding products that offer enhanced comfort and longevity. Increasing disposable incomes, particularly across emerging economies, are enabling more consumers to invest in luxury home goods. The expansion of the global hospitality industry further supports demand, as high-end hotels and resorts prioritize premium bedding to elevate guest experience. Additionally, product innovation—ranging from temperature-regulating fabrics to hypoallergenic and antimicrobial textiles—is broadening the appeal of luxury bedding among health-conscious and eco-aware buyers.

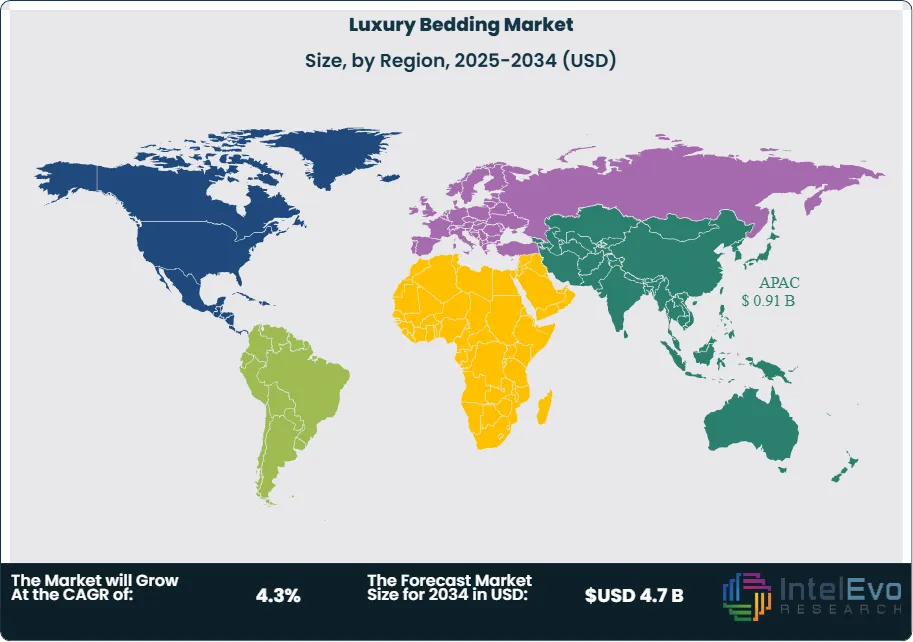

Regional trends reveal significant opportunities across both mature and developing markets. North America and Europe maintain strong demand, driven by established consumer preference for premium home furnishings and robust hospitality investments. Meanwhile, Asia-Pacific is emerging as a key growth hub, supported by rising urban affluence, changing lifestyle aspirations, and rapid expansion of luxury hotels across China, India, and Southeast Asia.

The sector is also witnessing transformative shifts in distribution. E-commerce platforms and direct-to-consumer models have made premium bedding more accessible, enabling brands to expand their global reach with targeted marketing strategies. Furthermore, sustainability has become a defining purchase criterion. Growing interest in organic, ethically sourced, and environmentally friendly bedding materials is creating opportunities for brands that emphasize responsible production practices.

Overall, the luxury bedding market is positioned for continued expansion, supported by lifestyle-driven consumption, innovations in textile technology, and growing demand from both residential buyers and commercial establishments. For investors and market participants, segments focusing on sustainable product lines and digital-first sales strategies represent high-potential growth avenues over the coming decade.

Key Takeaways

- Market Growth: The global luxury bedding market is forecasted to rise from USD 2.6 billion in 2024 to USD 4.7 billion by 2034, reflecting a CAGR of 4.3%. This growth trajectory is underpinned by heightened consumer emphasis on sleep wellness, rising household incomes, and increased procurement by the luxury hospitality industry.

- Product Type: Bed linen remains the cornerstone of the category, accounting for more than 41% of revenues in 2025. Its dominance stems from strong demand for premium fabrics such as Egyptian cotton, silk, and high-thread-count weaves, which are prized for durability and comfort.

- End Use: Residential buyers represent the largest demand pool, holding over 68% of the market. Purchases are being driven by lifestyle upgrades, wellness-oriented spending, and a surge in home décor investments influenced by hybrid and remote work arrangements.

- Driver: Growing recognition of sleep as a key component of overall health is accelerating uptake of luxury bedding. Products featuring hypoallergenic materials, moisture-control fabrics, and advanced temperature regulation are gaining traction among wellness-conscious consumers.

- Restraint: Premium pricing continues to be the most significant barrier to mass adoption. Middle-income households in emerging economies remain constrained by affordability, limiting penetration beyond affluent consumer segments.

- Opportunity: Sustainability has become a powerful differentiator. Demand is expanding for bedding made from organic cotton, ethically harvested silk, bamboo-based fibers, and low-impact manufacturing processes, creating long-term growth prospects for eco-focused brands.

- Trend: Digital commerce is reshaping distribution strategies. Direct-to-consumer models, online personalization, and subscription-based offerings are enabling brands to strengthen global reach and build deeper customer loyalty.

- Regional Analysis: Asia-Pacific is emerging as the fastest-growing region, with China and India driving expansion through urban affluence and rapid hotel development. North America and Europe continue to demonstrate steady demand, supported by established premium brand loyalty and mature retail channels.

Product Type Analysis

Bed Linen continues to dominate the luxury bedding market in 2025, accounting for more than 41% of total revenues. Demand is sustained by consumer preference for high-thread-count sheets, pillowcases, and fitted sheets crafted from premium materials such as Egyptian cotton, silk, and linen. This segment is further reinforced by rising awareness of sleep health and the appeal of hypoallergenic fabrics, making it the core driver of the luxury bedding category.

Blankets & Quilts remain a staple purchase, particularly in colder geographies where warmth and design converge. Premium materials such as cashmere, merino wool, and organic cotton are increasingly adopted, with manufacturers emphasizing layered bedding aesthetics and eco-friendly sourcing to capture discerning buyers.

Down Covers are witnessing consistent demand, especially in North America and Europe, where colder climates favor lightweight yet insulating products. The market is benefiting from heightened awareness around ethical sourcing of down feathers, with brands promoting responsibly produced products as part of their sustainability agenda.

Duvets are expanding steadily, favored for their versatility and ability to align with seasonal decor trends. High-end consumers are drawn to duvets made from silk, down, and other natural fibers, which offer both practical comfort and aesthetic adaptability across different climates.

Mattresses have become a critical growth engine for the luxury bedding industry. Advances in memory foam, latex, and hybrid mattress designs are aligning with consumer demand for orthopedic support, spinal alignment, and improved sleep outcomes. This segment is also seeing rising traction in smart mattresses featuring temperature regulation and sleep-tracking technologies.

Pillowcases & Shams are gaining share as consumers invest in finer details of bedding decor. Luxury buyers are opting for silk, satin, and organic cotton pillowcases that combine skin-friendly properties with elegance, reflecting the rising importance of bedroom customization.

Protectors are benefiting from post-pandemic concerns around hygiene and longevity of premium bedding. Breathable, hypoallergenic, and waterproof protectors are increasingly preferred, especially in health-conscious urban households.

The Others category—including decorative cushions, bolsters, and bed skirts—remains niche but important for personalized and design-focused purchases. Interior design trends and bespoke customization are fueling steady demand, particularly in high-income urban markets.

Distribution Channel Analysis

Online Stores hold the leading position in luxury bedding distribution in 2025, accounting for over 30% of global sales. E-commerce platforms are capitalizing on digital-first strategies, offering consumers the ability to compare fabrics, prices, and designs with ease. Features such as virtual product previews, flexible return policies, and influencer-driven campaigns are making online retail the channel of choice for both established brands and direct-to-consumer players.

Specialty Bedding Stores continue to attract consumers seeking tactile product evaluation and expert guidance. With trained consultants and curated product assortments, these outlets appeal to high-net-worth buyers who prioritize fabric quality and in-store personalization. The segment is particularly strong in metropolitan markets where luxury retail spending is concentrated.

Home Décor Stores serve as integrated shopping destinations, allowing customers to pair luxury bedding with broader interior design themes. As affluent consumers increasingly demand cohesive home aesthetics, these stores provide a one-stop solution, reinforcing their steady role in distribution.

Hypermarkets and Supermarkets account for a smaller yet stable share, offering limited but competitive selections of premium bedding. The advantage of high foot traffic and impulse buying supports this channel, although its relevance is more prominent in mid-luxury segments rather than the ultra-premium tier.

The Others category—comprising luxury boutiques, pop-up retail formats, and direct sales via hospitality partnerships—plays a vital branding role. These outlets allow companies to position themselves as aspirational and exclusive, strengthening loyalty among high-spending customers.

End-User Analysis

The Residential Segment remains the largest consumer of luxury bedding in 2025, holding over 68% of the market. Growing investments in home improvement, coupled with rising emphasis on personal wellness, are driving premium purchases. Remote work trends have reinforced the importance of creating restful, aesthetically pleasing home environments, prompting consumers to spend more on high-quality mattresses, linens, and complementary bedding products.

The Commercial Segment—driven primarily by luxury hotels, resorts, and serviced apartments—continues to represent a critical revenue stream. The global rebound in tourism and the expansion of premium hospitality chains are fueling demand for premium duvets, pillows, and bed linens that enhance guest satisfaction. Upscale accommodations increasingly use luxury bedding as a differentiator to elevate brand value and customer experience. Although smaller in overall share compared to residential demand, the commercial market offers steady growth potential in line with the global luxury travel sector.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product Type

- Blankets & Quilts

- Bed Linen

- Down Covers

- Duvets

- Mattresses

- Pillowcases & Shams

- Protectors

- Others

By Distribution Channel

- Online Stores

- Specialty Bedding Stores

- Home Decor Stores

- Hypermarkets/Supermarkets

- Others

By End-User

- Residential

- Commercial

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 2.6 B |

| Forecast Revenue (2034) | USD 4.7 B |

| CAGR (2024-2034) | 4.3% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Blankets & Quilts, Bed Linen, Down Covers, Duvets, Mattresses, Pillowcases & Shams, Protectors, Others), By Distribution Channel (Online Stores, Specialty Bedding Stores, Home Decor Stores, Hypermarkets/Supermarkets, Others), By End-User (Residential, Commercial) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Pacific Coast, Hollander, Sferra, Frette, The White Company, Ralph Lauren Home, Boll & Branch, Matouk, Brooklinen (Luxe Collection), Anichini, Parachute Home, Peacock Alley |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Luxury Bedding Market ?

Discover the Global Luxury Bedding Market, set to reach USD 4.7 Billion by 2034, driven by premium sleep demand, sustainability, and lifestyle trends.

Who are the major players in the Luxury Bedding Market ?

Pacific Coast, Hollander, Sferra, Frette, The White Company, Ralph Lauren Home, Boll & Branch, Matouk, Brooklinen (Luxe Collection), Anichini, Parachute Home, Peacock Alley

Which segments covered the Luxury Bedding Market ?

By Product Type (Blankets & Quilts, Bed Linen, Down Covers, Duvets, Mattresses, Pillowcases & Shams, Protectors, Others), By Distribution Channel (Online Stores, Specialty Bedding Stores, Home Decor Stores, Hypermarkets/Supermarkets, Others), By End-User (Residential, Commercial)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date