Luxury Pet Accessories Market Size, Trends & Forecast | 7.2% CAGR

Global Luxury Pet Accessories Market Size, Share & Analysis By Product Type (Beds, Apparel, Toys, Feeding Accessories), By Pet Type (Dogs, Cats, Others), By Distribution Channel (Online, Specialty Stores), Premium Pet Care Trends, Consumer Spending Patterns, Competitive Landscape & Forecast 2025–2034

Report Overview

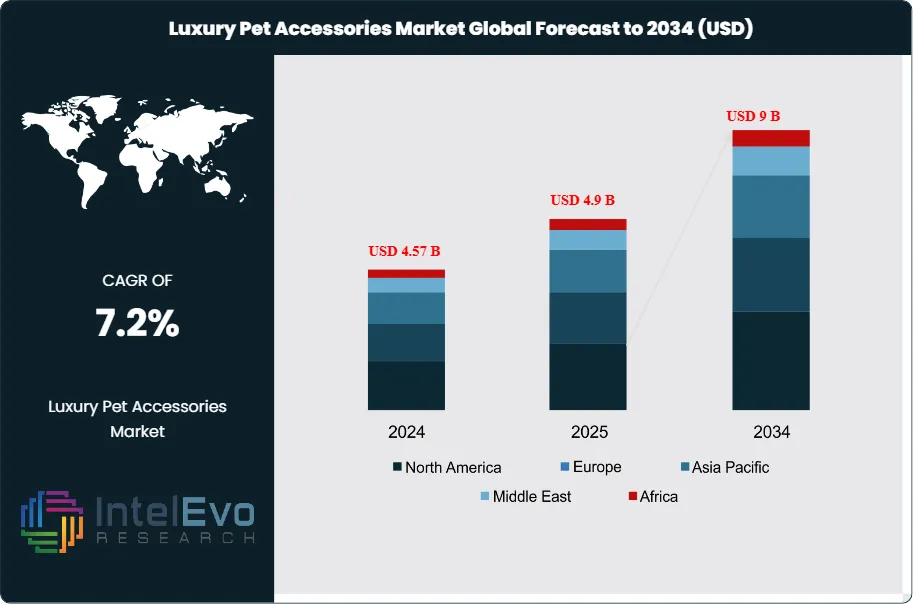

The Luxury Pet Accessories Market is projected to increase from USD 4.9 Billion in 2025 to around USD 9 Billion by 2034, growing at a CAGR of approximately 7.2% during 2025–2034. Growing humanization of pets and rising disposable incomes are significantly boosting demand for premium pet lifestyle products. Brands are focusing on personalization, eco-friendly materials, and fashion-driven designs to appeal to modern pet owners. As pet culture continues to evolve globally, luxury accessories are becoming a symbol of identity, style, and emotional bonding. This growth reflects the convergence of rising pet ownership, increasing disposable income, and the cultural shift toward treating pets as integral members of the family.

Get More Information about this report -

Request Free Sample ReportLuxury pet accessories encompass a wide range of premium products such as designer collars, apparel, carriers, and beds, crafted with superior materials, distinctive designs, and enhanced functionality. What once were considered indulgent items are now viewed as lifestyle purchases, aligning closely with trends in the broader luxury goods sector. Affluent pet owners are driving demand for these products, seeking both aesthetic value and comfort for their pets, while luxury brands are capitalizing on this trend by extending their portfolios into pet-centric collections.

Europe represents one of the largest and most lucrative markets, with over 88 million households owning pets. According to FEDIAF, the region’s non-food luxury pet accessories segment is valued at roughly €21.2 billion annually, underscoring the scale of opportunity. High demand for stylish, high-quality items resonates strongly with Europe’s fashion-conscious consumer base, where the willingness to spend on premium pet products mirrors broader luxury consumption patterns.

Global luxury houses such as Prada, Versace, and Louis Vuitton have already established their presence in this niche, offering products like $300 designer collars and pet beds exceeding €1,000. These high-value items combine functional utility with brand prestige, reinforcing the market’s positioning within the premium category. Additionally, strategic collaborations—such as Milan-based Poldo Dog Couture’s partnerships with Moncler and Dsquared2—have enhanced visibility and created exclusive collections that appeal to discerning consumers.

Consumer sentiment further validates this trend. Research by Euromonitor International indicates that 71% of global pet owners consider pets part of the family, directly fueling demand for luxury accessories that reflect care, status, and lifestyle alignment. This emotional connection, paired with the aspirational nature of luxury brands, is expected to sustain long-term growth, as owners increasingly seek products that blur the lines between human and pet luxury markets.

Key Takeaways

- Market Growth: As of 2024, the Luxury Pet Accessories Market is valued at USD 4.3 billion and is projected to reach USD 8.9 billion by 2034, expanding at a CAGR of 7.2%. Growth is underpinned by rising disposable incomes, pet humanization, and the entry of leading luxury fashion brands.

- Pet Type: Dogs account for nearly 60% of global spending in 2025, as owners prioritize premium beds, apparel, and interactive accessories, reinforcing their dominance in luxury pet categories.

- Product Type: Luxury toys lead demand in 2025, fueled by consumer interest in interactive, enrichment-driven, and wellness-focused pet products that combine functionality with aesthetics.

- Distribution Channel: Specialty pet stores capture about 40% of the market in 2025, providing curated luxury assortments and personalized services that resonate with high-income buyers.

- Driver: The continued humanization of pets drives market growth, with 71% of global owners identifying pets as family members, directly influencing luxury spending patterns.

- Restraint: High price points—including premium collars around USD 300 and designer beds exceeding €1,000—limit broader adoption, keeping the market concentrated among affluent households.

- Opportunity: Luxury brand collaborations and cross-industry partnerships—such as Poldo Dog Couture with Moncler and Dsquared2—are expanding product visibility and consumer reach in 2025.

- Trend: A surge in exclusive designer launches and limited-edition collections is reshaping the market in 2025, with brands like Louis Vuitton, Prada, and Versace positioning pet products as status-driven lifestyle accessories.

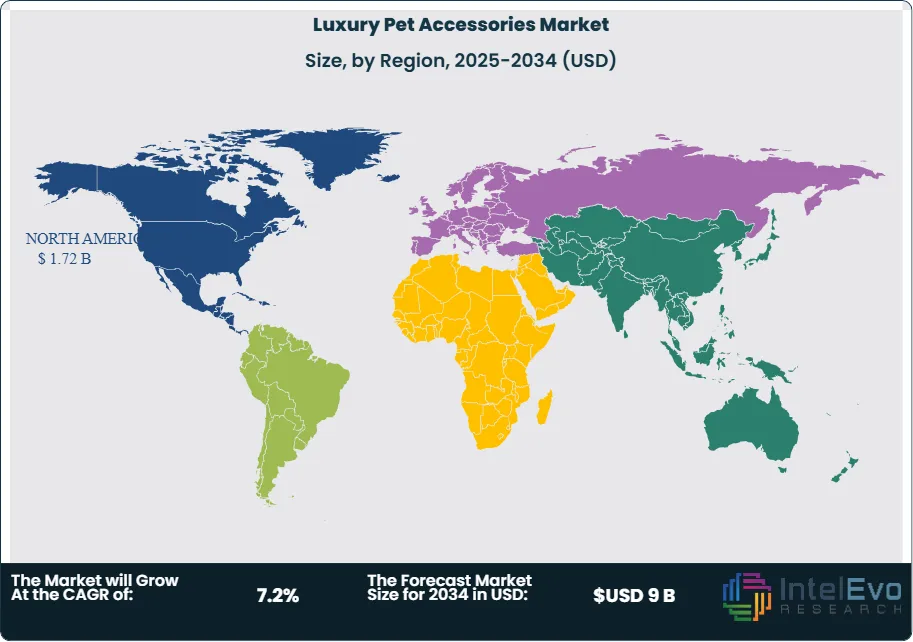

- Regional Analysis: North America holds about 35% market share in 2025, supported by premiumization trends and high pet ownership, while Europe remains a key hub with 88+ million pet-owning households and a luxury non-food accessories market valued above €21.2 billion annually.

Type Analysis

In 2025, dogs remain the dominant category in the luxury pet accessories market, accounting for close to 60% of total spending. Their strong presence reflects both their widespread popularity as companion animals and the extensive product variety designed specifically for them. Owners are increasingly investing in high-quality apparel, bespoke beds, and interactive toys that emphasize both comfort and style. This pattern is closely tied to the broader cultural shift of pet humanization, where owners treat dogs as family members and willingly allocate disposable income to enhance their pets’ lifestyles.

Cats represent the second-largest share of the market, with demand expanding steadily as cat ownership rises globally. Luxury products such as climbing structures, premium grooming kits, and specialized toys are gaining traction, especially among urban households where cats are preferred for their adaptability to smaller living spaces. While their market share trails that of dogs, the growing appetite for feline-specific accessories reflects a significant opportunity for brands targeting this segment.

The “other pets” category, including birds, reptiles, and small mammals, is comparatively smaller but evolving into a niche growth space. Luxury items like customized enclosures, decorative habitats, and premium wellness products are being adopted by a select but growing base of affluent pet owners. This diversification signals that luxury spending on pets is no longer limited to traditional categories, extending across a wider spectrum of companion animals.

Product Type Analysis

By product category, toys represent the largest segment in 2025, as they combine entertainment with health and wellness benefits. Premium toys, often made with durable materials and designed for mental stimulation, resonate with owners looking to support their pets’ development and overall well-being. The emphasis on interactive and enrichment-focused products reflects consumers’ growing awareness of pets’ psychological and physical needs.

Pet apparel is also expanding rapidly, with owners using luxury clothing and costumes as a means of self-expression and status. Designer coats, seasonal outfits, and limited-edition collections are increasingly marketed as extensions of fashion-forward lifestyles. Similarly, collars, harnesses, and leashes have evolved from functional tools to fashion statements, often featuring high-end leather, precious metals, and personalized engravings.

Beds and furniture are another significant category, designed not only to maximize pet comfort but also to integrate seamlessly with luxury home interiors. High-end feeding accessories and grooming products further strengthen the market, especially as consumers prioritize sustainable materials and ergonomic designs. Meanwhile, other product types—including smart pet cameras, travel carriers, and custom-made accessories—are creating new revenue streams and addressing niche demands from high-income households.

Distribution Channel Analysis

In 2025, specialty pet stores remain the leading distribution channel, contributing close to 40% of total revenue. Their success stems from curated product selections, knowledgeable staff, and the trust they cultivate with affluent consumers who seek expert advice before purchasing premium products. These stores continue to serve as influential touchpoints for luxury brands to showcase exclusivity and personalized service.

Online retail platforms are expanding at a faster pace, offering unparalleled convenience and global access to luxury brands. Consumers increasingly turn to e-commerce to explore premium collections, limited editions, and hard-to-find items, supported by sophisticated logistics networks and secure digital payment systems.

Department stores and supermarkets/hypermarkets are also expanding their premium pet sections, appealing to convenience-driven shoppers who prefer to purchase luxury pet items alongside other goods. In addition, boutique shops and direct-to-consumer channels are thriving, particularly in markets where exclusivity, craftsmanship, and customization are key selling points. These outlets often cater to consumers seeking unique, handmade, or bespoke accessories that reinforce the luxury value proposition.

Regional Analysis

North America continues to lead the global luxury pet accessories market in 2025, accounting for nearly 35% of global revenue. With a market value exceeding USD 1.5 billion, the region’s growth is supported by high disposable incomes, widespread pet ownership, and a strong inclination toward premium and personalized pet products. Advanced retail infrastructure, the presence of numerous luxury boutiques, and robust e-commerce platforms further reinforce its market strength. Social media influence—particularly celebrity pet culture—continues to shape purchasing behavior, amplifying demand for premium accessories. Europe remains a critical hub, driven by its focus on sustainable and eco-friendly luxury products. With over 88 million pet-owning households, the region’s non-food pet accessory segment is valued at more than €21.2 billion annually. Strict quality and safety regulations also enhance consumer trust, while established fashion capitals like Milan and Paris provide fertile ground for cross-brand collaborations in pet luxury goods. Asia Pacific is emerging as the fastest-growing region, with countries such as China, Japan, and South Korea leading demand. Rising disposable incomes, rapid urbanization, and cultural shifts toward treating pets as lifestyle companions are fueling premium purchases. Local e-commerce giants are also making luxury pet products more accessible, boosting regional growth. In the Middle East & Africa, rising affluence and a growing interest in pet wellness and fashion are creating niche opportunities, particularly in urban centers. Similarly, Latin America is witnessing steady growth, supported by an expanding middle class, rising pet adoption rates, and the rapid penetration of e-commerce platforms that make high-end pet items more widely available.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Pet Type

- Dogs

- Cats

- Other Pet Types

By Product Type

- Apparel

- Collars, Harnesses, and Leashes

- Beds & Furniture

- Toys

- Feeding Accessories

- Grooming Products

- Other Product Types

By Distribution Channel

- Specialty Pet Stores

- Online Retail Stores

- Department Stores

- Supermarkets & Hypermarkets

- Other Distribution Channels

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 4.9 B |

| Forecast Revenue (2034) | USD 9 B |

| CAGR (2025-2034) | 7.2% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Pet Type (Dogs, Cats, Other Pet Types), By Product Type (Apparel, Collars, Harnesses, and Leashes, Beds & Furniture, Toys, Feeding Accessories, Grooming Products, Other Product Types), By Distribution Channel (Specialty Pet Stores, Online Retail Stores, Department Stores, Supermarkets & Hypermarkets, Other Distribution Channels) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Moshiqa, FitFurLife, Ruffwear, Hartman & Rose, Puppia, Wolfgang Man & Beast, LoveThyBeast, Pet Interiors, K&H Pet Products, Mungo & Maud, Canine Styles, Buddy Belts, Wild One, For The Furry, Furbo |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Luxury Pet Accessories Market?

The Global Luxury Pet Accessories Market is expected to grow from USD 4.9 Billion in 2025 to USD 9 Billion by 2034, at a CAGR of 7.2%. Rising pet humanization, premium lifestyle trends, and personalized product demand are driving market expansion.

Who are the major players in the Luxury Pet Accessories Market?

Moshiqa, FitFurLife, Ruffwear, Hartman & Rose, Puppia, Wolfgang Man & Beast, LoveThyBeast, Pet Interiors, K&H Pet Products, Mungo & Maud, Canine Styles, Buddy Belts, Wild One, For The Furry, Furbo

Which segments covered the Luxury Pet Accessories Market?

By Pet Type (Dogs, Cats, Other Pet Types), By Product Type (Apparel, Collars, Harnesses, and Leashes, Beds & Furniture, Toys, Feeding Accessories, Grooming Products, Other Product Types), By Distribution Channel (Specialty Pet Stores, Online Retail Stores, Department Stores, Supermarkets & Hypermarkets, Other Distribution Channels)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Luxury Pet Accessories Market

Published Date : 06 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date