Maltitol Market Size | Growth Outlook & 4.0% CAGR

Global Maltitol Market Size, Share & Analysis By Form (Powder and Crystal, Liquid and Syrup), By Source (Corn, Wheat, Others), By Application (Food, Beverages, Pharmaceuticals, Personal Care), By End-User Industry, By Distribution Channel Industry Dynamics, Health & Wellness Trends, Competitive Landscape & Forecast 2025–2034

Report Overview

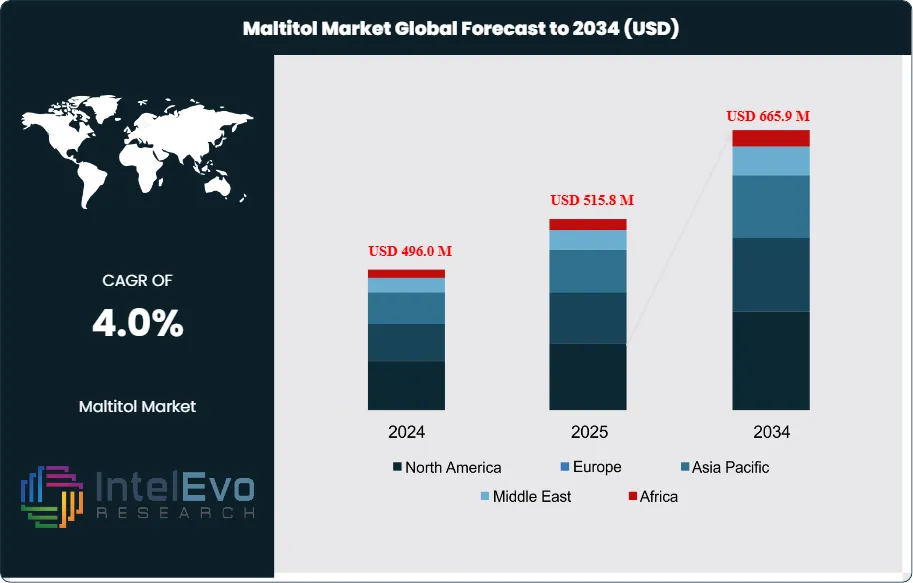

The Maltitol Market is estimated at USD 496.0 million in 2024 and is on track to reach nearly USD 665.9 million by 2034, reflecting a steady CAGR of 4.0% during 2025–2034. Growth is fueled by rising global demand for low-calorie, sugar-free, and diabetic-friendly food products, especially within the bakery, confectionery, and beverage sectors. As consumers shift toward clean-label and functional sweeteners, maltitol is gaining prominence for its sugar-like taste with fewer calories. With food brands accelerating innovation in "better-for-you" formulations and e-commerce boosting the visibility of health-oriented products, the maltitol market is becoming increasingly influential across nutrition, wellness, and specialty food platforms.

Get More Information about this report -

Request Free Sample ReportDriven by a sustained shift in consumer preferences toward low-calorie, sugar-reduced products, the maltitol market has evolved from a niche segment into a significant ingredient category within the food, beverage, and pharmaceutical industries. Historically, demand for maltitol has grown steadily as health awareness surrounding diabetes, obesity, and overall caloric intake has intensified. With approximately 70–90% of the sweetness of sucrose but nearly half the calories, maltitol is gaining traction as a sugar substitute that does not compromise taste or mouthfeel—key attributes in applications such as sugar-free confectionery, baked goods, chewing gum, and chocolates.

From a supply perspective, maltitol is primarily derived from starches such as corn and wheat, offering a relatively stable production base. However, raw material price volatility and processing costs remain moderate challenges to scalability, particularly in price-sensitive markets. On the demand side, the influence of health-driven regulations—including sugar taxes and stricter food labeling laws—continues to favor the adoption of alternative sweeteners like maltitol. Moreover, maltitol’s lower glycemic index and non-cariogenic properties enhance its appeal in diabetic-friendly and oral health-related formulations.

Technological advancements in ingredient processing and formulation science are also accelerating the adoption of maltitol across newer product categories, including functional foods, nutritional supplements, and personal care items. Innovations in encapsulation and controlled-release technologies are improving its performance in pharmaceutical applications, further expanding its addressable market.

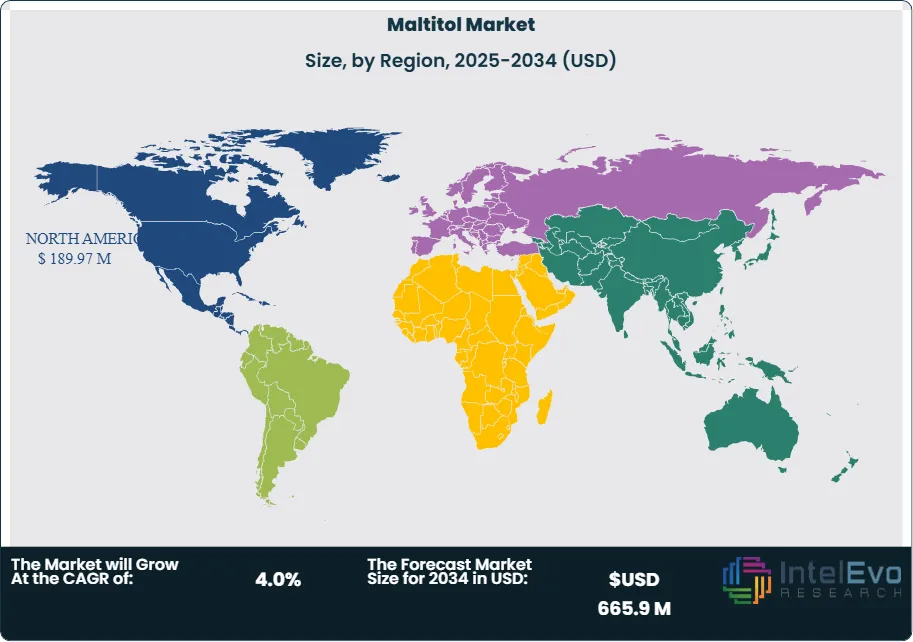

Regionally, North America leads the global landscape, accounting for an estimated 38.3% of total market share in 2024. The region benefits from a mature health-conscious consumer base and an advanced food manufacturing infrastructure. Europe follows closely, supported by strong regulatory backing for sugar reduction and high demand for clean-label, diabetic-friendly products. Meanwhile, Asia-Pacific is emerging as a high-growth region due to rising urbanization, expanding middle-class income levels, and growing awareness of lifestyle diseases—making it a key investment hotspot over the forecast period.

Collectively, these factors position maltitol as a strategic ingredient in the evolving global push toward healthier, low-sugar consumption patterns, with steady long-term growth prospects.

Key Takeaways

- Market Growth: The global Maltitol market is projected to grow from USD 496.0 million in 2024 to approximately USD 665.9 million by 2034, registering a compound annual growth rate (CAGR) of 4.0%. This growth is largely driven by rising demand for low-calorie sweeteners amid increasing health concerns over sugar consumption and metabolic disorders.

- Form: Powder and crystal maltitol dominate the market with a 67.2% share in 2024, favored for their stability, ease of handling, and compatibility with dry food formulations such as baked goods and confectionery products.

- Raw Material Source: Corn-derived maltitol leads the market, accounting for 48.1% of total global production. Its prevalence is attributed to widespread corn availability, particularly in North America and Asia, ensuring cost-effective large-scale manufacturing.

- Application: The food and beverage sector remains the largest end-use industry, consuming 52.2% of total maltitol output in 2024. The ingredient is widely used in sugar-free candies, chewing gums, and low-GI bakery products due to its sugar-like texture and mouthfeel.

- Driver: Heightened global awareness of lifestyle-related diseases such as obesity and type 2 diabetes is accelerating demand for alternative sweeteners. The non-cariogenic and low glycemic properties of maltitol make it a key ingredient in diabetic-friendly product lines across developed markets.

- Restraint: Price sensitivity and fluctuating raw material costs pose significant challenges, particularly in emerging economies. Supply chain pressures related to corn and wheat sourcing may impact production margins and limit market penetration in cost-sensitive regions.

- Opportunity: Asia-Pacific is emerging as a high-growth opportunity, with increasing urbanization and rising health consciousness driving adoption of sugar substitutes. The region is expected to witness a higher-than-average CAGR through 2034, supported by expanding food manufacturing infrastructure.

- Trend: Rising demand for clean-label, functional ingredients is pushing manufacturers to innovate maltitol formulations for use in nutraceuticals and personal care products. Companies are investing in technologies that enhance solubility and flavor stability, widening its application base.

- Regional Analysis: North America led the global market with an estimated valuation of USD 189.2 million in 2024, backed by a strong consumer shift toward sugar reduction and mature regulatory frameworks. Meanwhile, Europe and Asia-Pacific are poised for steady growth, with the latter emerging as a key investment destination due to evolving dietary patterns and regulatory support.

Form Analysis

As of 2025, powdered and crystalline maltitol continue to lead the global maltitol market, accounting for approximately 67.2% of total demand. This dominance is rooted in the form’s functional versatility and its close sensory similarity to sucrose, which makes it especially valuable in confectionery applications such as sugar-free chocolates, gums, and hard candies. Its fine particle size, extended shelf life, and easy integration into dry mixes and baking formulations give it a substantial edge in commercial food processing environments.

Manufacturers favor powdered and crystalline maltitol not only for their formulation flexibility but also for their ability to support sugar replacement at nearly a 1:1 ratio, requiring minimal processing adaptation. This has proven especially beneficial in large-scale production lines focused on sugar-reduced products. Furthermore, increasing global regulatory pressure to cut added sugar content in packaged foods has driven demand for easy-to-incorporate alternatives. As health-conscious consumption becomes more mainstream, this form is expected to remain the backbone of product innovation in reduced-calorie food categories through 2030 and beyond.

Source Analysis

Corn remains the predominant source of maltitol production, contributing to approximately 48.1% of the market in 2025. Its dominance is underpinned by global corn abundance and cost-effective processing infrastructure in major producing regions such as North America and Asia. Corn-based maltitol benefits from stable pricing, scalability, and established enzymatic conversion technologies, all of which support consistent high-volume output. These factors have made corn a cornerstone of supply for manufacturers looking to meet growing demand for low-glycemic sweeteners.

Additionally, regulatory acceptance and consumer trust in corn-derived ingredients have reinforced its adoption across both mature and emerging markets. The neutral flavor profile and high purity of corn-based maltitol make it suitable for a wide range of applications, from bakery products to nutritional supplements. With global demand for healthier alternatives to refined sugar continuing to rise, corn is expected to maintain its leadership as a primary raw material source for maltitol production over the forecast period.

Application Analysis

In 2025, the food segment continues to be the primary driver of maltitol demand, contributing approximately 52.2% to total market consumption. Maltitol’s functional similarity to traditional sugar—particularly in terms of taste, texture, and browning behavior—makes it a preferred ingredient in sugar-free baked goods, confections, and processed snacks. Its non-cariogenic and low-glycemic properties also make it highly attractive for health-focused food product lines, particularly in diabetic-friendly and keto-oriented offerings.

As the market for clean-label, functional foods grows, maltitol is increasingly being incorporated into new product formulations targeting both general wellness and dietary-specific needs. From high-protein bars to low-calorie frozen desserts, manufacturers are leveraging maltitol to address consumer demand for indulgent yet healthier options. The ability to integrate seamlessly into existing manufacturing systems has further accelerated its adoption, particularly in regions where regulatory pressure to reduce added sugars is intensifying. Looking ahead, food applications are expected to remain the dominant use case for maltitol, supported by continuous product development and evolving consumer lifestyles.

Regional Analysis

In regional terms, North America continues to dominate the global maltitol market in 2025, accounting for approximately 38.3% of total consumption and reaching an estimated market value of USD 189.2 million. The region’s leadership is propelled by widespread consumer awareness of health risks associated with excessive sugar intake, such as obesity and diabetes, driving demand for low-calorie sweeteners in packaged foods. Regulatory initiatives like sugar taxes and transparent food labeling policies have further accelerated the transition toward alternative sweeteners, including maltitol.

Europe also represents a mature and regulation-driven market, particularly with strong demand for clean-label, non-GMO, and diabetic-friendly food products. Meanwhile, Asia Pacific is emerging as a high-potential growth region, fueled by urbanization, rising middle-class income, and growing interest in functional nutrition. Countries such as China, India, and Japan are witnessing increased investment in food manufacturing infrastructure, enabling wider access to sugar-reduced products. Although Latin America and the Middle East & Africa currently represent smaller shares, they are expected to experience steady growth supported by evolving dietary preferences and improved distribution channels. Overall, while North America maintains its leadership in 2025, the global maltitol market is becoming increasingly diversified in its regional dynamics.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Form

- Powder and Crystal

- Liquid and Syrup

By Source

- Corn

- Wheat

- Others

By Application

- Food

- Bakery and Confectionery

- Dairy Products

- Frozen Desserts

- Nutritional Supplements

- Others

- Beverages

- Carbonated Drinks

- Fruit Drinks and Juices

- Powdered Drinks and Mixes

- Pharmaceuticals

- Personal Care

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 496.0 M |

| Forecast Revenue (2034) | USD 665.9 M |

| CAGR (2024-2034) | 4.0% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Form (Powder and Crystal, Liquid and Syrup), By Source (Corn, Wheat, Others), By Application (Food (Bakery and Confectionery, Dairy Products, Frozen Desserts, Nutritional Supplements, Others), Beverages (Carbonated Drinks, Fruit Drinks and Juices, Powdered Drinks and Mixes), Pharmaceuticals, Personal Care) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Sinofi, ADM, Makendi WorldWide, Jungbunzlauer Suisse AG, Cargill, Incorporated, Shandong Futaste Co., B Food Science Co., Ltd., Mitsubishi Corporation Life Sciences Limited, Roquette Frères, Zhejiang Huakang Pharmaceutical Co., Ltd., Ingredion Incorporated, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date