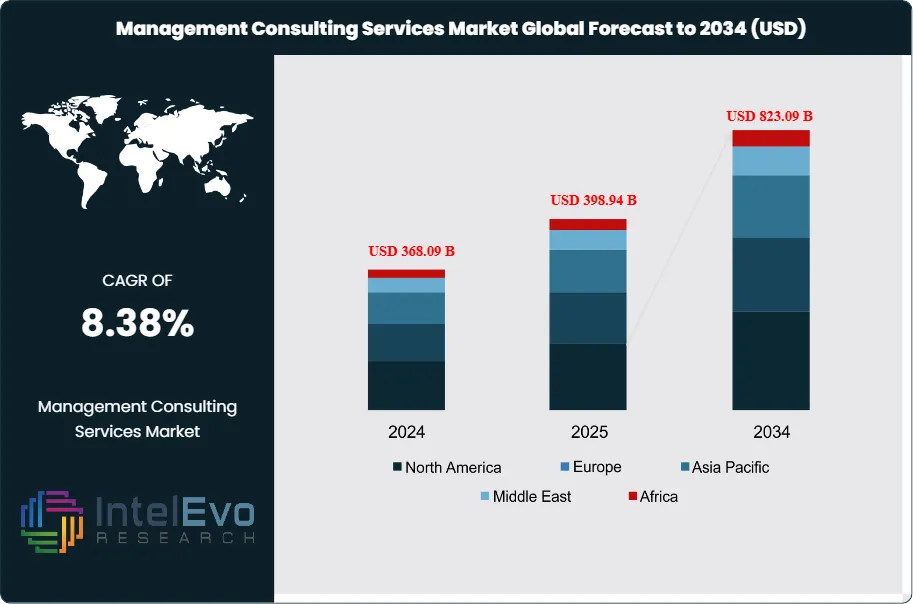

Management Consulting Services Market Size, Share to Reach $823.09 Bn by 2034

Global Management Consulting Services Market Size, Share, Analysis Report By Service Type (Consulting (Strategy, Operations, Technology, HR), Financial Advisory), Enterprise Size (SME, Large Enterprises), Delivery Model (Consulting (On-site, Remote/Virtual, Hybrid)), Industry Vertical (Healthcare, Manufacturing, BFSI, IT & Telecom, Government, Retail & E-Commerce) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

The Management Consulting Services Market size is expected to be worth around USD 823.09 Billion by 2034, from USD 368.09 Billion in 2024, growing at a CAGR of 8.38% during the forecast period from 2024 to 2034. The management consulting services market encompasses comprehensive advisory and implementation services provided to senior management of organizations with the goal of improving business strategy effectiveness, organizational performance, and operational processes. This market represents the broadest area within the consulting industry, accounting for between 50% and 55% of the total consulting market globally.

Get More Information about this report -

Request Free Sample ReportThe ecosystem includes diverse disciplines ranging from strategy development and operations optimization to technology implementation and human resources management, serving organizations across all industries and sizes. Management consulting firms examine organizational inefficiencies, analyze complex business challenges, and employ their expertise to devise strategic solutions that enhance competitive positioning and operational excellence.

The management consulting services market is experiencing robust growth driven by accelerating digital transformation initiatives and increasing demand for specialized expertise in navigating complex business environments. Key growth catalysts include the integration of artificial intelligence, machine learning, and data analytics capabilities that enable consultants to provide predictive insights and evidence-based recommendations. The market benefits from rising globalization pressures that prompt companies to seek expert guidance for international expansion, regulatory compliance, and cross-border operations management. Additionally, the growing emphasis on environmental, social, and governance (ESG) initiatives is creating substantial demand for sustainability consulting, compliance advisory services, and risk management expertise across diverse industry verticals.

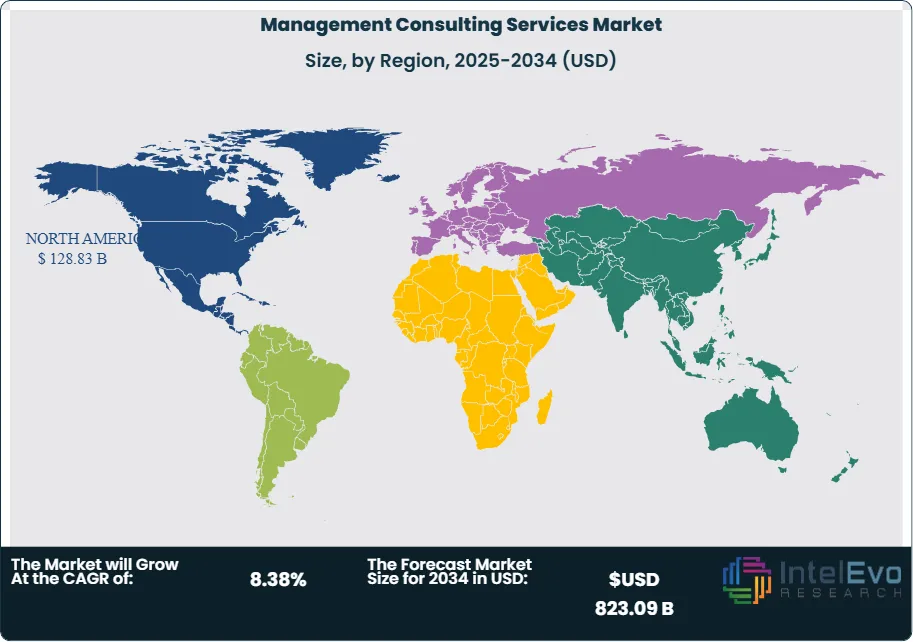

North America dominates the global management consulting services market, this leadership position stems from the concentration of major global corporations, robust financial sector, and advanced technological infrastructure that drives demand for sophisticated consulting services. The region's dominance is reinforced by the presence of leading consulting firms, established client relationships, and a dynamic startup ecosystem that requires strategic guidance. Asia-Pacific represents the fastest-growing regional market with significant projected CAGR, driven by rapid digitalization, infrastructure investment, and expanding middle-class economies seeking business optimization expertise.

The COVID-19 pandemic fundamentally accelerated the adoption of management consulting services as organizations faced unprecedented operational disruptions and strategic challenges. The crisis created urgent demand for crisis management consulting, business continuity planning, and digital transformation advisory services as companies rapidly shifted to remote operations and digital-first business models. While initial economic uncertainty temporarily reduced consulting budgets in some sectors, the long-term impact has been overwhelmingly positive, with organizations recognizing the critical value of external expertise in navigating complex challenges, implementing technology solutions, and building organizational resilience against future disruptions.

Rising geopolitical tensions and trade restrictions have significantly influenced management consulting demand patterns, creating opportunities for advisory services in supply chain diversification, risk assessment, and regulatory compliance. International sanctions and export controls have driven demand for specialized consulting in trade compliance, sanctions management, and geopolitical risk analysis. Additionally, increasing emphasis on economic security and supply chain resilience has created substantial opportunities for consultants specializing in strategic sourcing, supplier diversification, and business continuity planning that address evolving geopolitical challenges.

Key Takeaways

- Market Growth: The Management Consulting Services Market is expected to reach USD 823.09 Billion by 2034, fueled by digital transformation acceleration and increased demand for specialized business expertise.

- Service Type Dominance: Technology Consulting leads market share due to digital transformation demand and AI integration requirements.

- Enterprise Size Dominance: Large Enterprises dominate, driven by complex operational requirements and substantial consulting budgets.

- Delivery Model Dominance: Remote/Virtual Consulting leads the delivery segment, primarily due to cost efficiency and global accessibility advantages.

- Industry Vertical Dominance: BFSI holds the largest share, owing to regulatory complexity and digital transformation pressures.

- Driver: Key drivers accelerating growth include digital transformation demand and regulatory complexity management, which boost market expansion through technology adoption requirements and compliance advisory needs.

- Restraint: Growth is hindered by talent shortage challenges and increasing costs with reducing margins, which create challenges such as delivery capacity constraints and competitive pricing pressures.

- Opportunity: The market is poised for expansion due to opportunities like AI-powered consulting services and emerging market penetration, which enable enhanced analytical capabilities and geographic diversification.

- Trend: Emerging trends including metaverse consulting services and modularization of service offerings are reshaping the market by enabling new business models and flexible engagement approaches.

- Regional Analysis: North America leads owing to corporate concentration and advanced infrastructure. Asia-Pacific shows high promise due to rapid digitalization and economic growth.

Service Type Analysis:

Technology consulting maintains a commanding position in the management consulting market, establishing itself as the most rapidly expanding segment due to exceptional demand for digital transformation expertise, artificial intelligence deployment guidance, and cybersecurity advisory solutions. This comprehensive segment includes cloud migration consultation, data analytics implementation services, and emerging technology integration support that organizations need to maintain competitiveness in progressively digitalized business environments. The sector's market leadership originates from the essential role that digital capabilities assume in organizational transformation processes, coupled with the inherent complexity of adopting new technological solutions and the widespread shortage of internal technical knowledge within companies. Organizations increasingly rely on specialized technology consultants to navigate the intricate landscape of digital innovation while ensuring successful implementation of advanced systems.

Enterprise Size Analysis:

Large enterprises maintain a commanding position in the management consulting market, establishing themselves as the primary consumers of advanced consulting services due to their intricate operational demands, significant transformation investment capabilities, and extensive regulatory compliance responsibilities. These organizations encounter multifaceted business challenges encompassing global operations coordination, regulatory adherence across diverse jurisdictions, and comprehensive digital transformation projects that necessitate specialized external expertise. Their market dominance receives reinforcement through their capacity to finance extended strategic partnerships, execute organization-wide transformational changes, and apply consulting recommendations across multiple business divisions and international markets. Large enterprises possess the financial resources and organizational complexity that create sustained demand for high-level consulting services across various functional areas.

Delivery Model Analysis:

Remote and virtual consulting delivery models demonstrate exceptional growth rates, signaling a fundamental transformation toward cost-efficient, globally accessible service provision enabled by sophisticated collaboration platforms and advanced digital communication technologies. This innovative delivery approach significantly reduces project expenses, eliminates geographical limitations, and enables consulting organizations to leverage worldwide talent resources while offering clients enhanced engagement flexibility and accessibility. The accelerated adoption of virtual consulting reflects changing client preferences for efficient service delivery and consulting firms' recognition of technology's potential to expand their service reach while maintaining quality standards. This model transformation represents a strategic shift in how consulting services are conceptualized, delivered, and consumed in the modern business environment.

Industry Vertical Analysis:

BFSI Leads With over 30% Market Share In Management Consulting Services Market. The BFSI sector holds the leading position among industry verticals, demonstrating the industry's ongoing exposure to regulatory modifications, digital disruption from financial technology companies, and sophisticated risk management demands. Financial services organizations consistently require specialized knowledge in critical areas including regulatory compliance management, digital banking transformation initiatives, cybersecurity enhancement, and customer experience optimization strategies. This sector's prominent market position receives support from substantial consulting investment budgets, frequent regulatory changes requiring expert analysis and implementation guidance, and the essential nature of digital transformation for maintaining competitive advantages against emerging fintech challengers. The BFSI industry's complex regulatory environment and rapid technological evolution create continuous demand for specialized consulting expertise.

Region Analysis:

North America Leads With more than 35% Market Share In Management Consulting Services Market. North America holds a commanding position in the global management consulting market, establishing unparalleled market leadership through substantial revenue generation and market dominance. This regional supremacy is fundamentally anchored by the United States' overwhelming market presence, which demonstrates exceptional growth potential and market maturity.

Asia-Pacific emerges as the most rapidly expanding regional market for management consulting services, demonstrating exceptional growth momentum driven by accelerated economic development, comprehensive digitalization initiatives, and expanding middle-class populations actively seeking business optimization services. Major economies including China, India, and Southeast Asian nations are experiencing unprecedented consulting demand as organizations modernize their operations, implement advanced digital technologies, and pursue international expansion strategies.

Europe maintains a substantial and influential presence in the global management consulting landscape through well-established consulting relationships, regulatory complexity, and mature economies requiring strategic transformation guidance. The European market demonstrates consistent growth driven by sophisticated business environments, comprehensive regulatory frameworks, and established partnerships between consulting firms and major corporations.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Service Type

- Strategy Consulting

- Operations Consulting

- Technology Consulting

- Financial Advisory

- HR Consulting

Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

Delivery Model

- On-site Consulting

- Remote/Virtual Consulting

- Hybrid Consulting

Industry Vertical

- Healthcare

- Manufacturing

- BFSI

- IT & Telecom

- Government

- Retail & E-Commerce

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 398.94 B |

| Forecast Revenue (2034) | USD 823.09 B |

| CAGR (2025-2034) | 8.38% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Service Type (Strategy Consulting, Operations Consulting, Technology Consulting, Financial Advisory, HR Consulting), Enterprise Size (Small & Medium Enterprises, Large Enterprises), Delivery Model (On-site Consulting, Remote/Virtual Consulting, Hybrid Consulting), Industry Vertical (Healthcare, Manufacturing, BFSI, IT & Telecom, Government, Retail & E-Commerce) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Deloitte Consulting, PricewaterhouseCoopers (PwC), FTI Consulting, Slalom, Palantir Technologies, Pencil, IBM Consulting, Accenture, Booz Allen Hamilton |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Management Consulting Services Market

Published Date : 29 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date