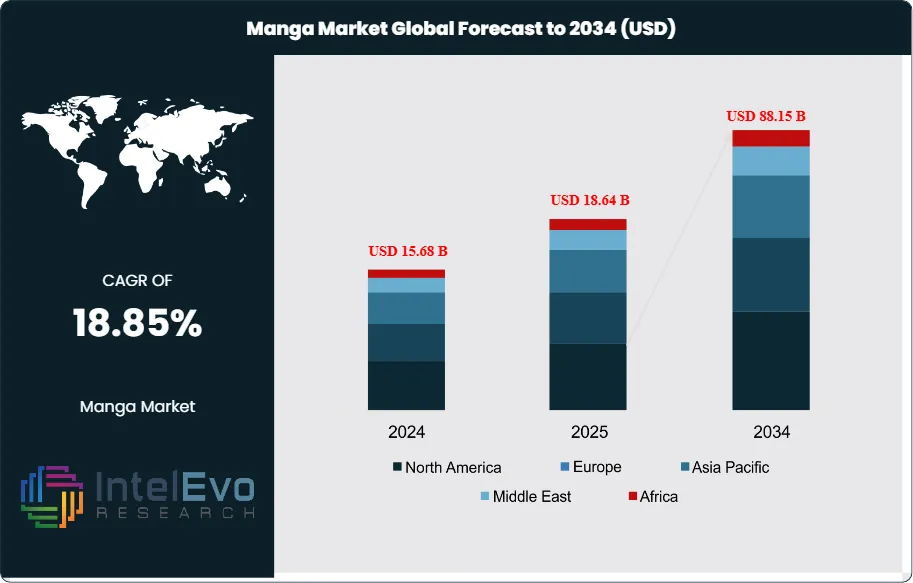

Manga Market size to Reach $88.15 Bn by 2034 | 18.85% CAGR Growth

Global Manga Market Size, Share, Analysis Report Genre (Action And Adventure, Romance And Drama, Sci-Fi And Fantasy, Sports, Others) ,Content Type (Digital, Printed) ,Gender (Female, Male) , Audience (Adults (Aged Above 16 Years), Children And Kids (Aged Below 10 Years), Teenagers (Aged Between 10 To 16 Years)) ,Distribution Channel (Offline, Online) Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview

The Manga Market size is expected to be worth around USD 88.15 billion by 2034, rising sharply from USD 15.68 billion in 2024, and expanding at a robust CAGR of 18.85% during the forecast period from 2024 to 2034. This exceptional growth is fueled by the global surge in anime adaptations, digital manga platforms, and mobile reading applications that are rapidly expanding readership beyond traditional markets. Increasing popularity among Gen Z and millennial audiences, coupled with cross-media monetization through streaming, gaming, and merchandise, is positioning manga as a dominant force in the global entertainment and pop culture economy.

Get More Information about this report -

Request Free Sample ReportThe global manga market represents one of the most dynamic and rapidly expanding entertainment sectors, characterized by its unique blend of storytelling artistry and cultural significance. The remarkable growth trajectory is driven by several key factors including the increasing global popularity of Japanese culture, widespread digital adoption, and the growing accessibility of manga content through various digital platforms. The market's expansion is further supported by the rising acceptance of manga as a legitimate form of literature and entertainment across diverse age groups and cultural backgrounds.

The manga industry has evolved from its traditional Japanese roots to become a global phenomenon, with factors such as increasing internet penetration, smartphone adoption, and the proliferation of digital reading platforms significantly contributing to market growth. The industry benefits from strong intellectual property frameworks, innovative distribution channels, and the continuous creation of engaging content that appeals to both traditional manga enthusiasts and new readers worldwide. Additionally, the integration of manga with other media forms including anime, movies, and merchandise has created multiple revenue streams and expanded the market's reach beyond traditional boundaries.

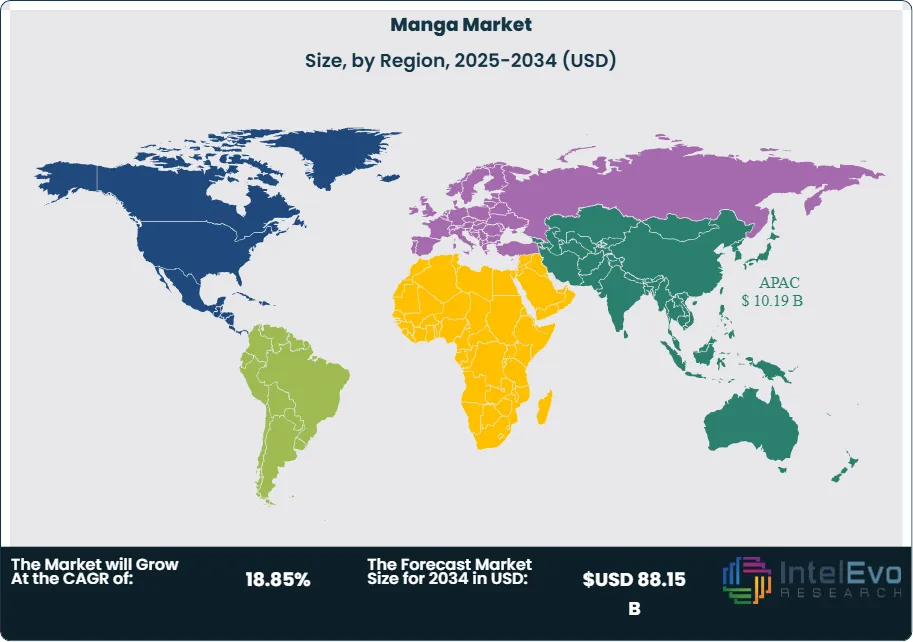

Asia Pacific dominated the manga market with a significant share in 2024. This dominance is primarily attributed to Japan's position as the birthplace of manga and its robust domestic consumption patterns. The region's leadership is reinforced by strong cultural affinity for manga content, established publishing infrastructure, and the presence of major manga publishers and distribution networks. Asia-Pacific continues to dominate the global manga market, with Japan holding a dominant share in this region.

The COVID-19 pandemic significantly accelerated the manga market's growth, particularly in the digital segment. Lockdown measures and social distancing requirements led to increased home entertainment consumption, with manga benefiting from this shift in consumer behavior. The online segment is projected to lead the revenue share in 2024, boosted by the convenience of e-commerce portals, pandemic-driven online activities, and free home delivery options for a wide range of comics. The pandemic also drove publishers to invest more heavily in digital platforms and online distribution channels, creating lasting changes in how manga content is consumed and distributed globally.

Regional conflicts and trade tensions between major economies have created both challenges and opportunities for the manga market. Trade disputes, particularly between the US and China, have led to increased tariffs on printed materials and intellectual property concerns, pushing companies to diversify their supply chains and focus more on digital distribution. These conflicts have also resulted in stricter regulations on content localization and cultural adaptation, requiring manga publishers to navigate complex international trade policies. However, these challenges have simultaneously accelerated innovation in digital distribution and cross-border licensing agreements, ultimately strengthening the global manga ecosystem's resilience.

Key Takeaways

- Market Growth: The Manga Market is expected to reach USD 88.15 Billion by 2034, driven by digital expansion, global fan engagement, and diversified content strategies across genres and demographics.

- Genre Dominance: Action and adventure titles are the most popular segment, attracting devoted readership due to dynamic narratives and frequent anime adaptations. This genre consistently generates significant revenue, appealing to both teen and adult demographics worldwide.

- Content Type Dominance: Digital manga has become the dominant content format, thanks to the accessibility of mobile apps and platforms that enable instant access to vast libraries. Subscriptions and micropayments are fueling monetization and expanding the market footprint.

- Gender Dominance: Male audiences account for a substantial share of consumption, gravitating toward action, fantasy, and mature-themed manga. Publishers often prioritize marketing campaigns and release schedules to engage this high-value segment.

- Audience Dominance: Adults aged above 16 years form the core revenue-driving audience, demonstrating strong willingness to purchase premium editions, merchandise, and collector’s items. Mature narratives and complex themes resonate particularly well with this group.

- Distribution Channel Dominance: Online channels have overtaken offline retail as the leading distribution method, with e-commerce platforms, subscription apps, and direct-to-consumer sales driving volume growth and reducing reliance on physical stores.

- Driver: Growing global appetite for Japanese pop culture and cross-media adaptations is fueling demand, with anime, video games, and merchandise serving as powerful catalysts.

- Restraint: Intellectual property piracy and the persistence of scanlations threaten revenue and undermine legitimate distribution channels.

- Opportunity: Localized content and expansion into emerging markets present compelling growth avenues for publishers willing to invest in translation and distribution partnerships.

- Trend: Collectors’ editions, premium packaging, and limited-release volumes are becoming popular strategies to differentiate products and boost profitability.

- Regional Analysis: Asia Pacific remains the largest and most dynamic region, with Japan at the forefront of production and consumption. North America follows as a rapidly growing market, while Europe shows steady interest across digital and print formats.

Genre Analysis:

Action And Adventure Leads With over 30% Market Share In Manga Market

Action and adventure manga consistently dominate the market due to their dynamic storytelling, intense visual appeal, and broad demographic reach. Titles in this genre often feature compelling protagonists, high-stakes conflicts, and intricate world-building, which translate well into anime and video game adaptations. The success of franchises like One Piece, Naruto, and Attack on Titan has set benchmarks for global popularity. Publishers heavily invest in marketing these series, recognizing their capacity to drive cross-media revenue streams and merchandise sales. With robust fan bases across Asia Pacific, North America, and Europe, action and adventure manga remain the cornerstone of publisher catalogs and a critical driver of overall industry growth.

Content Type Analysis:

Digital Leads With more than 75% Market Share In Manga Market

Digital manga has surged ahead as the preferred format, propelled by widespread smartphone adoption, improved internet access, and subscription-based business models. Leading platforms such as VIZ Media’s app, Bilibili Comics, and ComiXology provide users with seamless access to thousands of titles, often with simultaneous Japanese releases. Digital distribution addresses many challenges of physical logistics, offering instant gratification and enabling publishers to reach global audiences without intermediaries. This shift also allows for enhanced analytics and targeted marketing, helping publishers fine-tune content recommendations and maximize reader retention. As digital consumption becomes mainstream, this segment is expected to solidify its leadership position further.

Gender Analysis:

Male readers remain the dominant consumer group in the manga market, particularly in the action, fantasy, and sci-fi genres. This demographic often exhibits high engagement levels, longer reading sessions, and a propensity to invest in merchandise and collector editions. Publishers strategically align release schedules and promotional campaigns to coincide with major anime adaptations and gaming tie-ins popular among male audiences. The strong purchasing power and loyalty of this segment underpin much of the market’s profitability. Despite growing female readership, male consumers continue to command the largest share, making them a primary target for new launches and marketing investments.

Audience Analysis:

Adults over 16 years old constitute the largest audience segment, driven by an appetite for mature storytelling and nostalgia for titles they grew up reading. This group is willing to pay premium prices for collector’s editions and special releases, fueling the success of limited runs and deluxe formats. Moreover, adult readers tend to consume manga across both print and digital channels, with a preference for unabridged and uncensored editions. Publishers are increasingly developing complex narratives and sophisticated themes to retain this segment, recognizing its role as the most lucrative and loyal demographic in the market.

Distribution Channel Analysis:

Online distribution channels have eclipsed traditional brick-and-mortar retail, thanks to the convenience, affordability, and vast selection they offer consumers. E-commerce platforms and subscription services are now the primary vehicles for manga sales, streamlining fulfillment and broadening global reach. Platforms like Amazon, VIZ Media’s website, and Bilibili Comics deliver both digital and physical formats, catering to diverse customer preferences. The efficiency and scalability of online distribution have proven essential in navigating supply chain disruptions and expanding into new regions. As consumer habits continue shifting online, this segment is poised for sustained dominance.

Region Analysis:

Asia Pacific dominated the manga market, with Japan holding a dominant share. This regional dominance is attributed to Japan's position as the birthplace of manga and its deeply embedded cultural significance within Japanese society. The region benefits from established publishing infrastructure, sophisticated distribution networks, and a mature ecosystem of creators, publishers, and consumers. Japan's influence extends beyond domestic consumption, with Japanese publishers and content creators setting global standards for manga quality and storytelling.

Other Asian markets, particularly South Korea and China, are experiencing rapid growth driven by increasing digital adoption and rising interest in manga-style content. North America represents the second-largest market, fueled by growing acceptance of manga as mainstream entertainment and successful anime adaptations that drive manga readership. European markets show steady growth, particularly in countries with strong comic book traditions.

The digital segment is expected to see the most significant growth across all regions, with mobile-first markets in Southeast Asia and Latin America presenting particularly strong opportunities. These emerging markets benefit from high smartphone penetration rates and young demographics that are naturally inclined toward digital content consumption. Regional growth patterns suggest that while Asia-Pacific will maintain its dominance, other regions will experience faster growth rates as manga culture becomes increasingly globalized.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Genre

- Action And Adventure

- Romance And Drama

- Sci-Fi And Fantasy

- Sports

- Others

Content Type

- Digital

- Printed

Gender

- Female

- Male

Audience

- Adults (Aged Above 16 Years)

- Children And Kids (Aged Below 10 Years)

- Teenagers (Aged Between 10 To 16 Years)

Distribution Channel

- Offline

- Online

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 15.68 B |

| Forecast Revenue (2034) | USD 88.15 B |

| CAGR (2025-2034) | 18.85% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Genre (Action And Adventure, Romance And Drama, Sci-Fi And Fantasy, Sports, Others)Content Type (Digital, Printed) Gender (Female, Male) Distribution (Channel, Offline, Online) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | IBM Corporation, Diebold Nixdorf, Incorporated, Honeywell International Inc., ePOS HYBRID, CCL Technology, Fujitsu, OLEA Kiosk., Gilbarco Veeder-Root Company., ITAB, Toshiba Global Commerce Solutions, MetroClick, NCR Corporation, StrongPoint, Pyramid Computer GMBH |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date