Marine Mining Market Size, Share & Growth Outlook | CAGR 33.1%

Global Marine Mining Market Size, Share & Industry Analysis by Resource Type (Polymetallic Nodules, Seafloor Massive Sulfides, Cobalt-Rich Crusts), by Mining Technology (Remote-Operated Vehicles, Autonomous Underwater Vehicles, Hydraulic Lifting Systems), by Water Depth (Shallow, Deep Sea), by Application (EV Batteries, Renewable Energy Storage, Electronics, Aerospace & Defense), by End User (Mining Companies, Energy Firms, Government Agencies) – Market Dynamics, Environmental Impact, Regulatory Framework, Competitive Landscape, Key Players & Forecast 2025–2034

Report Overview

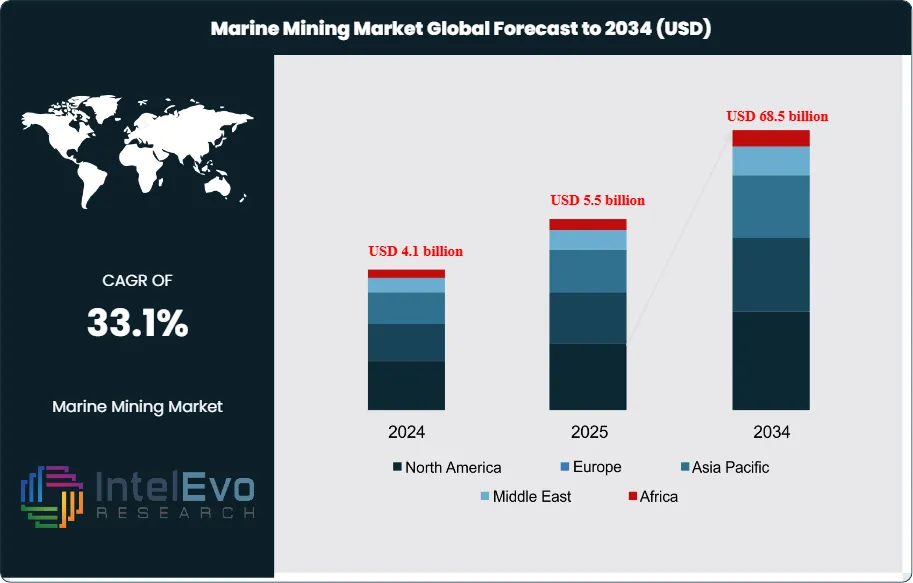

The Marine Mining Market is estimated at USD 4.1 billion in 2024 and is projected to reach approximately USD 68.5 billion by 2034, registering a robust compound annual growth rate (CAGR) of about 33.1% during 2025–2034. This exceptional growth trajectory is driven by rising global demand for critical minerals such as cobalt, nickel, copper, and rare earth elements essential for electric vehicles, renewable energy systems, and advanced electronics. Increasing depletion of terrestrial mineral reserves, coupled with technological advancements in deep-sea exploration and extraction, is accelerating commercial interest in marine mining. Additionally, government-backed strategic mineral security initiatives and growing investments in offshore resource development are positioning marine mining as a pivotal pillar in the future global raw materials supply chain.

Get More Information about this report -

Request Free Sample ReportThis rapid expansion reflects a structural shift in how industries source critical minerals. Historically, seabed extraction was limited by high costs and technical barriers. Over the past decade, however, advances in subsea robotics, drilling systems, and remote operations have reduced costs and improved efficiency, opening new opportunities for commercial-scale projects. The market’s trajectory is shaped by rising demand for metals such as cobalt, nickel, and rare earth elements, which are essential for batteries, renewable energy systems, and advanced electronics. With terrestrial reserves under pressure, marine deposits are emerging as a viable alternative.

On the demand side, the global transition to electric vehicles and renewable power is driving unprecedented consumption of cobalt and rare earths. For example, the International Energy Agency projects demand for critical minerals used in clean energy technologies could quadruple by 2040. On the supply side, declining ore grades on land and geopolitical risks in traditional mining hubs are accelerating interest in seabed resources. At the same time, environmental regulations and concerns about ecological impacts remain a key challenge. Companies must balance extraction with sustainability, as regulators and stakeholders scrutinize the long-term effects on marine ecosystems.

Technology is central to the market’s evolution. Remotely operated vehicles, autonomous seabed crawlers, and AI-driven mapping tools are enabling precise exploration and safer extraction at depths exceeding 4,000 meters. Digital monitoring systems are also improving operational transparency, which is critical for regulatory compliance and investor confidence. These advances are making projects more commercially viable and reducing operational risks.

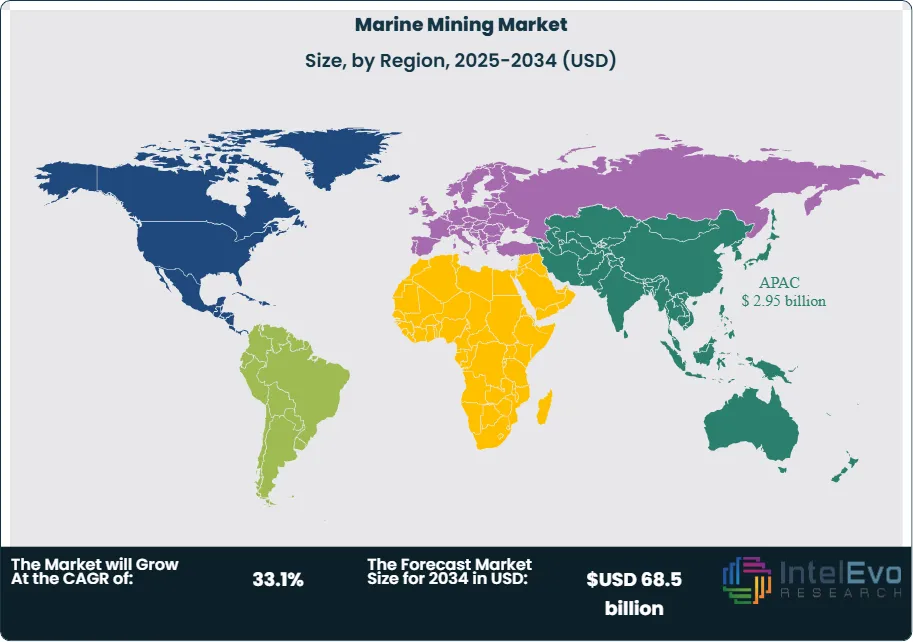

Regionally, the Pacific Ocean is the most active zone, with the Clarion-Clipperton Zone between Hawaii and Mexico holding an estimated 21 billion tons of polymetallic nodules. Countries such as China, Japan, and South Korea are investing heavily in exploration programs, while European nations are funding pilot projects to secure future supply chains. Emerging hotspots include parts of the Indian Ocean and coastal Africa, where exploration licenses are expanding. For investors, the next decade will be defined by early-mover advantages in regions with favorable regulatory frameworks and proven resource potential.

Key Takeaways

- Market Growth: The global Marine Mining Market is projected to expand from USD 4.1 billion in 2024 to USD 68.5 billion by 2034, registering a CAGR of 33.1%. Growth is driven by rising demand for critical minerals used in clean energy, electronics, and advanced manufacturing.

- Mining Method: Deep-sea mining accounted for 76.8% of total revenue in 2023, supported by large-scale projects in the Clarion-Clipperton Zone and the use of remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) for efficient extraction.

- Resource Type: Polymetallic nodules and sulfides lead the market due to their high concentrations of manganese, nickel, copper, and cobalt. A single nodule can contain up to 28% manganese, 1.3% nickel, 1.1% copper, and 0.2% cobalt, making them a critical supply source for battery and renewable energy industries.

- Driver: Global demand for critical minerals is accelerating. The International Energy Agency projects consumption of lithium, nickel, cobalt, and rare earth elements to rise by at least 30% by 2040, with marine deposits positioned to fill supply gaps as terrestrial reserves decline.

- Restraint: Environmental concerns and regulatory scrutiny remain significant barriers. Exploration depths ranging from 800 to 6,500 meters increase ecological risks, slowing project approvals and raising compliance costs for operators.

- Opportunity: Asia Pacific’s dominance, with a 74.6% market share in 2023, highlights strong investment potential. Emerging exploration zones in the Indian Ocean and coastal Africa present high-growth opportunities for early entrants seeking to diversify supply chains.

- Trend: Adoption of advanced subsea robotics, AI-driven mapping, and digital monitoring systems is reshaping operational efficiency. Companies are deploying autonomous seabed crawlers to improve precision and reduce extraction risks, signaling a shift toward technology-intensive mining models.

- Regional Analysis: Asia Pacific leads the market, anchored by China, Japan, and South Korea’s aggressive exploration programs. North America and Europe are expanding pilot projects, with both regions expected to post double-digit CAGR through 2033 as they seek to secure critical mineral supply for clean energy transitions.

Type Analysis

By 2025, dredging systems continue to hold a significant share of the marine mining market, accounting for more than 37% of global revenues. Their dominance is linked to their efficiency in extracting loose sediments, aggregates, and shallow-water mineral deposits. These systems remain the preferred choice for construction-related resources such as sand, gravel, and gemstones, where operational costs are lower and extraction methods are well established. The segment is expected to maintain steady growth as demand for construction materials rises in emerging economies.

Remote Operated Vehicles (ROVs) have gained momentum as deep-sea exploration expands. Representing a substantial portion of the market, ROVs are now integral to projects targeting polymetallic nodules and hydrothermal vent deposits at depths exceeding 4,000 meters. Their precision, coupled with reduced ecological disruption compared to traditional methods, makes them a critical technology for high-value mineral recovery. Companies in Japan, South Korea, and the United States are investing heavily in ROV fleets to secure long-term access to seabed resources.

Autonomous Underwater Vehicles (AUVs), while still a smaller segment, are experiencing rapid adoption. Their ability to autonomously map large seabed areas with high-resolution bathymetric data is transforming early-stage exploration. By 2025, AUVs are increasingly deployed in large-scale surveys across the Pacific and Indian Oceans, providing essential data for site selection and risk assessment. This segment is projected to grow at double-digit CAGR through 2030 as exploration intensity accelerates.

Resource Type Analysis

Polymetallic nodules remain the most commercially attractive resource, representing over 31% of the market in 2025. Found in abundance across the Clarion-Clipperton Zone, these nodules contain high concentrations of manganese, nickel, copper, and cobalt. Their extraction is viewed as a strategic solution to supply shortages in battery and renewable energy industries. With global demand for cobalt projected to rise by more than 60% by 2030, nodules are expected to remain a focal point for investment.

Polymetallic sulphides, concentrated around hydrothermal vents, account for a growing share of the market. Rich in copper, zinc, gold, and silver, these deposits are technically challenging to extract but offer high-value returns. Mining companies in Canada and Europe are piloting projects to commercialize sulphide extraction, supported by rising demand from electronics and clean energy sectors.

Cobalt-rich ferromanganese crusts are also gaining importance. Deposited on underwater mountains, these crusts are valued for their cobalt and rare earth content. Despite high extraction costs, their strategic role in supplying critical minerals for electric vehicles and defense technologies is driving investment. Phosphorite deposits, meanwhile, are attracting attention from the agricultural sector. With global fertilizer demand expected to increase by 2% annually through 2030, seabed phosphorites are being explored as a long-term alternative to depleting land-based reserves.

Depth Analysis

Deep-sea mining dominates the market in 2025, accounting for more than 75% of total revenues. Operations at depths beyond 200 meters target polymetallic nodules, sulphides, and cobalt-rich crusts, which are critical for high-tech and renewable energy applications. The scale of untapped resources has attracted significant capital inflows, with over USD 2 billion invested in pilot projects since 2020. Despite environmental concerns, the segment is projected to expand at a CAGR above 30% through 2033.

Shallow-water mining, while smaller in scale, continues to play an important role. Focused on depths up to 200 meters, this segment supplies sand, gravel, phosphorites, and gemstones for construction, agriculture, and jewelry. Its appeal lies in lower operational complexity and reduced regulatory hurdles compared to deep-sea projects. Countries in Southeast Asia and Africa are expanding shallow-water operations to meet immediate domestic demand for construction aggregates and fertilizers.

Regional Analysis

Asia Pacific remains the global leader in marine mining, holding more than 72% of market share in 2025. China, Japan, and South Korea dominate exploration and extraction activities, supported by strong government funding and industrial demand for critical minerals. India and Southeast Asian nations are also scaling up exploration, particularly in the Indian Ocean, where new exploration licenses have been issued.

North America is emerging as a key growth region, driven by rising demand for cobalt, nickel, and rare earths in electric vehicle and defense industries. The United States and Canada are investing in pilot projects and partnerships with technology providers to secure long-term supply chains.

Europe is positioning itself as a strategic player, with the EU funding seabed exploration programs to reduce reliance on imports. The region’s demand is concentrated in high-tech manufacturing and renewable energy sectors. Meanwhile, Latin America and the Middle East & Africa are at earlier stages of development but are expected to attract investment as exploration expands into the South Atlantic and Indian Ocean basins.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Mining Method

- Remote Operated Vehicles (ROVs)

- Autonomous Underwater Vehicles (AUVs)

- Dredging Systems

- Hydraulic Suction Systems

- Others

By Resource Type

- Polymetallic Nodules

- Polymetallic Sulphides

- Cobalt-Rich Ferromanganese Crusts

- Phosphorite Deposits

- Rare Earth Elements (REEs)

- Others

By Depth

- Shallow Water Mining

- Deep-Sea Mining

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 4.1 billion |

| Forecast Revenue (2034) | USD 68.5 billion |

| CAGR (2024-2034) | 33.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Mining Method, (Remote Operated Vehicles (ROVs), Autonomous Underwater Vehicles (AUVs), Dredging Systems, Hydraulic Suction Systems, Others), By Resource Type, (Polymetallic Nodules, Polymetallic Sulphides, Cobalt-Rich Ferromanganese Crusts, Phosphorite Deposits, Rare Earth Elements (REEs), Others), By Depth, (Shallow Water Mining, Deep-Sea Mining) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Blue Ocean Minerals, De Beers Marine Namibia, Seabed Resources Development Limited, Marine Diamond Corporation Ltd., The Metals Company, Diamond Fields International Ltd., China Minmetals Corporation, Marine Mining Corp., Odyssey Marine Exploration, Inc., ION Engineering Group, Ocean Minerals LLC, UK Seabed Resources Ltd., DeepGreen Metals Inc., Neptune Minerals PLC, Nautilus Minerals Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date