Maritime Insurance Market Size to Hit $45.6B by 2034 | CAGR of 5.0%

Global Maritime Insurance Market Size, Share, Analysis Report By Product Type (Hull & Machinery Insurance, Cargo Insurance, P&I Insurance, War Risk Insurance, Liability Insurance) Coverage Type (Vessel Insurance, Cargo Insurance, Liability Insurance, War & Political Risk Insurance) Application (Commercial Shipping, Offshore Energy, Port Operations, Yachting & Leisure) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

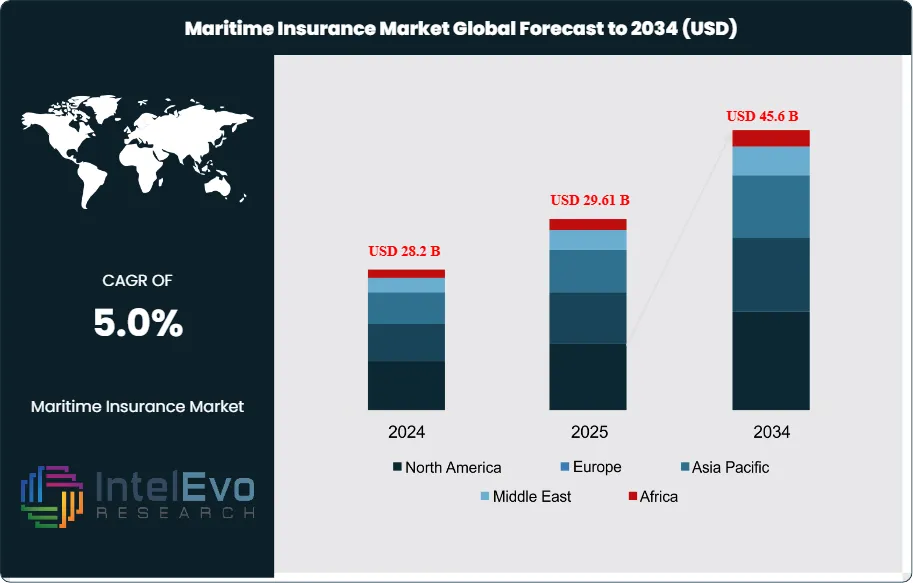

The Maritime Insurance Market is projected to reach approximately USD 45.6 billion by 2034, rising from USD 28.2 billion in 2024, and expanding at a CAGR of 5.0% during the forecast period from 2024 to 2034. This steady growth is driven by increasing global seaborne trade, expansion of commercial shipping fleets, and rising awareness of risk coverage for cargo, hull, and marine liabilities. Growing exposure to climate-related disruptions, geopolitical trade uncertainties, and stricter maritime regulations is further reinforcing demand for comprehensive and specialized marine insurance solutions worldwide.

Get More Information about this report -

Request Free Sample ReportThe maritime insurance market forms a critical pillar of the global shipping and logistics ecosystem, providing risk mitigation and financial protection for vessels, cargo, terminals, and related maritime assets. This market encompasses a wide range of insurance products, including hull and machinery insurance, cargo insurance, protection and indemnity (P&I) coverage, and liability insurance for shipowners, operators, and charterers. Maritime insurance serves diverse end-users such as shipping companies, freight forwarders, port operators, and offshore energy firms, ensuring business continuity and regulatory compliance in the face of operational, environmental, and geopolitical risks.

The market is experiencing steady growth, driven by the expansion of global trade, increasing vessel traffic, and heightened awareness of risk management in the maritime sector. Key growth catalysts include the digitalization of insurance processes, adoption of advanced analytics for risk assessment, and the integration of telematics and IoT for real-time monitoring of vessels and cargo. The market is also benefiting from regulatory changes, such as the International Maritime Organization’s (IMO) environmental mandates, which are prompting shipowners to seek specialized coverage for compliance-related risks.

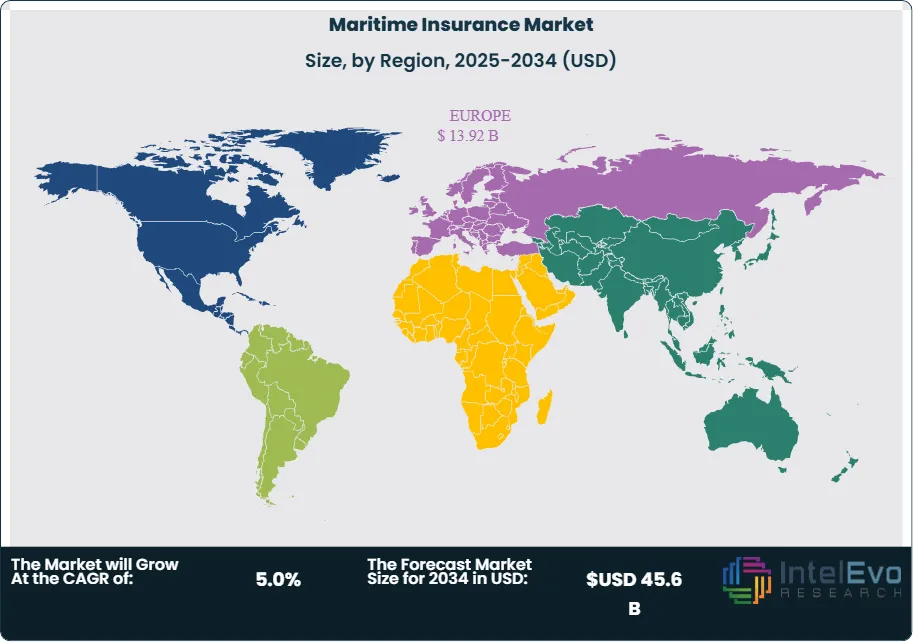

Europe leads the global maritime insurance market, with London maintaining its status as the world’s primary marine insurance hub. The Asia-Pacific region is the fastest-growing segment, fueled by the rapid expansion of shipping fleets in China, Singapore, and South Korea, as well as the region’s increasing share of global trade. North America remains a significant market, supported by robust port infrastructure, a large merchant fleet, and a mature insurance industry.

The COVID-19 pandemic initially disrupted global shipping and insurance operations due to port closures, crew change challenges, and supply chain bottlenecks. However, the crisis underscored the importance of comprehensive insurance coverage, leading to increased demand for pandemic-related and business interruption policies. The pandemic also accelerated digital transformation in the sector, with insurers adopting online platforms and remote claims processing. Rising geopolitical tensions, piracy, and climate-related risks are reshaping the maritime insurance landscape. Sanctions, trade disputes, and regional conflicts have increased demand for war risk and political risk insurance. Meanwhile, the growing frequency of extreme weather events and environmental incidents is driving demand for specialized coverage and risk engineering services.

Key Takeaways

- Market Growth: The Global Maritime Insurance Market is expected to reach USD 45.6 Billion by 2034, driven by global trade expansion, digital transformation, and evolving risk profiles in the shipping industry.

- Product Type Dominance: Hull & Machinery Insurance leads the segment, owing to the high value of vessels and the need for comprehensive asset protection.

- Coverage Type Dominance: Cargo Insurance holds a significant share, reflecting the vast volume of goods transported by sea and the complexity of global supply chains.

- Application Type Dominance: Commercial Shipping is the largest application segment, supported by the scale of international trade and the diversity of cargo types.

- Driver: Growth is propelled by increasing vessel traffic, regulatory changes, and the adoption of digital insurance solutions.

- Restraint: Market growth is hindered by high claims costs from catastrophic events and the complexity of underwriting emerging risks.

- Opportunity: The market is poised for expansion through the development of cyber risk insurance, environmental liability products, and tailored solutions for emerging markets.

- Trend: Digitalization, blockchain adoption, and parametric insurance products are transforming underwriting, claims, and customer engagement.

- Regional Analysis: Europe leads due to its established insurance hubs, while Asia-Pacific is the fastest-growing region, and North America maintains a strong presence.

Product Type Analysis

Hull & Machinery Insurance is the leading product category, providing coverage for physical damage to ships and their machinery. This segment is essential for shipowners and operators, given the high capital investment in vessels and the risks posed by collisions, groundings, and equipment failures. The demand for hull & machinery insurance is reinforced by regulatory requirements, lender mandates, and the need for business continuity in the event of major incidents. Cargo Insurance is another major segment, offering protection against loss or damage to goods in transit. The complexity of global supply chains, multimodal transport, and the high value of certain cargoes (e.g., electronics, pharmaceuticals) drive demand for comprehensive cargo insurance solutions.

Coverage Type Analysis

Protection & Indemnity (P&I) Insurance provides liability coverage for shipowners against third-party risks, including crew injuries, environmental pollution, and collision liabilities. P&I clubs, which operate on a mutual basis, play a central role in this segment, offering tailored coverage and risk management services. War Risk and Political Risk Insurance are gaining prominence due to rising geopolitical tensions, piracy, and sanctions. These products offer protection against losses arising from war, terrorism, and government actions.

Application Type Analysis

Commercial Shipping dominates the market, reflecting the scale and diversity of global maritime trade. This segment includes bulk carriers, container ships, tankers, and specialized vessels, all of which require tailored insurance solutions to address operational, environmental, and regulatory risks. Offshore Energy is a growing application, driven by the expansion of offshore oil, gas, and wind energy projects. These operations require specialized insurance for platforms, subsea equipment, and support vessels.

Region Analysis

Europe leads the global maritime insurance market, anchored by London’s historical role as the world’s marine insurance center. The region benefits from a concentration of insurers, brokers, and legal expertise, as well as a strong regulatory framework. Asia-Pacific is the fastest-growing region, driven by the expansion of shipping fleets, port infrastructure investments, and the region’s increasing share of global trade. Key markets include China, Singapore, and South Korea. North America maintains a significant market share, supported by a large merchant fleet, advanced port facilities, and a mature insurance sector. Latin America, Middle East & Africa are emerging markets, offering growth opportunities as regional trade and port development accelerate.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Product Type

- Hull & Machinery Insurance

- Cargo Insurance

- Protection & Indemnity (P&I) Insurance

- War Risk Insurance

- Liability Insurance

Coverage Type

- Vessel Insurance

- Cargo Insurance

- Liability Insurance

- War & Political Risk Insurance

Application Type

- Commercial Shipping

- Offshore Energy

- Port Operations

- Yachting & Leisure

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 29.61 B |

| Forecast Revenue (2034) | USD 45.6 B |

| CAGR (2025-2034) | 5.0% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type (Hull & Machinery Insurance, Cargo Insurance, Protection & Indemnity (P&I) Insurance, War Risk Insurance, Liability Insurance) Coverage Type (Vessel Insurance, Cargo Insurance, Liability Insurance, War & Political Risk Insurance) Application (Commercial Shipping, Offshore Energy, Port Operations, Yachting & Leisure) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Lloyd’s of London, Gard AS , The American Club, Swiss Re, Allianz Global Corporate & Specialty (AGCS) , China P&I Club, Tokio Marine , Brit Insurance, Munich Re, Skuld |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date