Mattress Market Size USD 102.4B & 7.7% CAGR Forecast 2034

Global Mattress Market Size, Share & Consumer Lifestyle Analysis By Product Type (Innerspring, Memory Foam, Latex, Hybrid), By Size, By Distribution Channel (Online, Offline), Sleep Health Trends, Regional Demand Patterns, Key Brands & Forecast 2025–2034

Report Overview

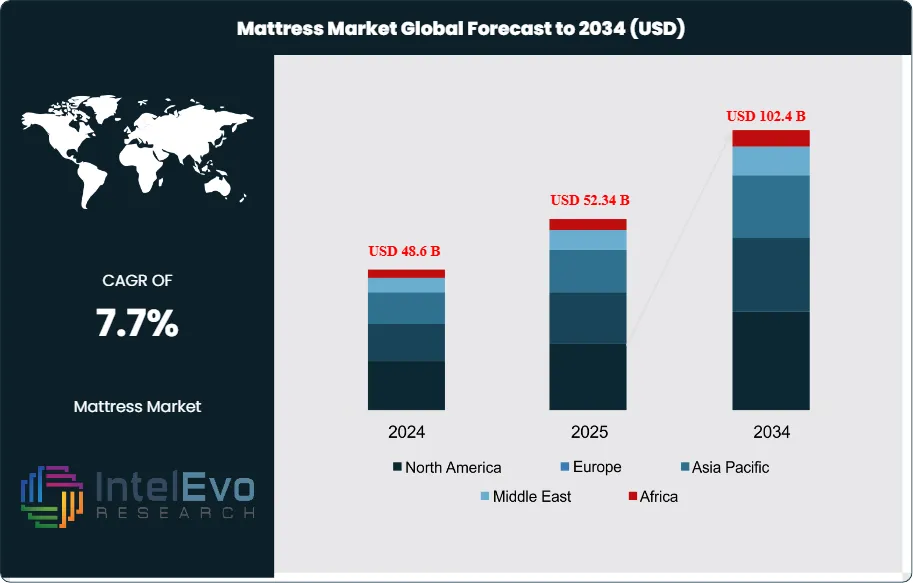

The Mattress Market is estimated at USD 48.6 billion in 2024 and is projected to reach approximately USD 102.4 billion by 2034, registering a CAGR of about 7.7% during 2025–2034. Market growth is being driven by rising consumer focus on sleep health, increasing replacement demand, and rapid expansion of online mattress retail and direct-to-consumer brands. Urbanization, growth in the middle-class population, and premiumization trends—such as hybrid, memory foam, and adjustable mattresses—are further supporting value expansion. In addition, hospitality sector recovery and real estate development in emerging economies are reinforcing long-term demand, positioning the mattress market for sustained, structurally driven growth over the next decade.

Get More Information about this report -

Request Free Sample ReportThe market expanded on the back of rising home spending, steady household formation, and shorter replacement cycles that now range between seven and nine years in key markets. E-commerce reshaped buying behavior. Bed-in-a-box offerings and transparent online comparison lifted penetration to an estimated 25 to 30 percent of unit sales in the United States and Western Europe. Price points remain clear for consumers. The Sleep Foundation cites USD 800 to 2,500 for queen memory foam models and USD 1,200 to 2,000 for hybrids, which draw buyers seeking stronger edge support and temperature control.

Demand ties closely to sleep health. ResMed’s 2023 Global Sleep Survey reports 8 in 10 adults across 12 countries with disrupted sleep symptoms. Mexico and South Korea saw more than 85 percent of respondents report poor sleep quality. Japan reported 60 percent. The economic cost is material. Insufficient sleep is linked to over USD 411 billion in annual losses in the United States. You can position sleep-enhancing features as both wellness and productivity tools for households and employers. Replacement demand remains stable; new household formation and hospitality capex add cyclical upside.

Supply-side risks persist. Polyurethane foam, steel coil, and latex prices affect margins. Freight costs and return logistics pressure online models. Compliance is non-negotiable. U.S. flammability standards such as 16 CFR Part 1633 and EU chemical rules under REACH raise testing and sourcing requirements. Sustainability scrutiny is rising; take-back schemes and recycled content claims face tighter verification.

Technology is reshaping products and operations. Smart mattresses with embedded sensors, adjustable firmness, and app-based sleep tracking are moving from niche to mainstream. Cooling foams, phase-change materials, and zoned coil designs address heat and pressure pain points. Automated roll-packing, CNC foam cutting, and robotics improve throughput and unit costs. AI-driven fit tools guide buyers to the right firmness, which can lower returns.

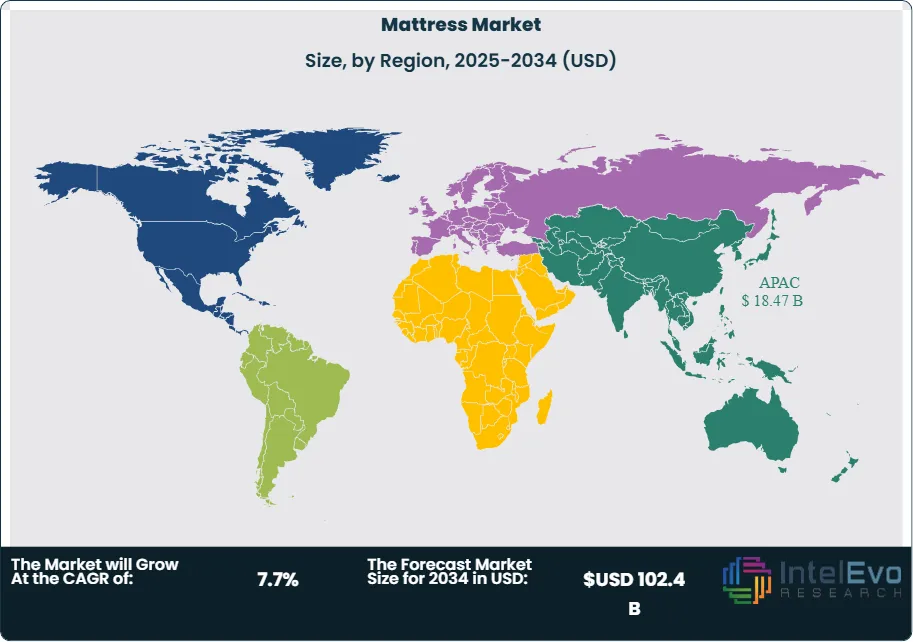

Regional patterns are clear. North America leads on revenue with a premium mix. Asia Pacific will post the fastest growth, driven by urban middle-class households in China, India, and Southeast Asia. Europe shows steady replacement-led demand. Latin America, led by Mexico, offers online growth potential. The Middle East benefits from a healthy hotel pipeline. Watch premium hybrids, cooling systems, smart features, and omnichannel models in the United States, China, and India.

Key Takeaways

- Market Growth: The mattress market was valued at USD 48.6 billion in 2024 and is set to reach USD 102.4 billion by 2034, reflecting a 7.7% CAGR on the back of resilient replacement demand and rising spend on sleep quality. The growth outlook benefits from broad consumer focus on sleep health and better product transparency across channels.

- Segment Dominance: Foam leads product type with 45% share in 2023 as consumers prioritize contouring support and motion isolation. Price clarity reinforces adoption; a queen memory foam typically ranges from USD 800 to 2,500, while hybrids run USD 1,200 to 2,000.

- Segment Dominance: Offline distribution commanded 68% of sales in 2023 because many buyers still prefer in-store testing before purchase. Online continues to expand but remains a minority channel relative to brick-and-mortar points of sale.

- Driver: The sleep health gap fuels demand; 8 in 10 adults across 12 countries report at least one symptom of disrupted sleep, indicating persistent unmet need. Insufficient sleep costs the U.S. economy about USD 411 billion annually, sharpening the value case for sleep-enhancing products in homes and hospitality.

- Restraint: Compliance requirements add testing, documentation, and time-to-market friction, with all mattress sets needing to meet the U.S. open-flame standard 16 CFR Part 1633 before sale. Federal guidance specifies flammability performance and testing protocols, increasing regulatory overhead for manufacturers and importers.

- Opportunity: Asia Pacific offers the strongest upside, already at 38% share and USD 16.68 billion in 2023, with structural tailwinds from urbanization and middle-class expansion. Regional revenue is projected to grow at about 6.9% CAGR through 2030, with India expected to post the highest country-level growth.

- Trend: Hybrids are gaining traction as buyers seek cooling, stronger edge support, and balanced responsiveness at mid-tier price points of roughly USD 1,200 to 2,000 for a queen. Sustainability is rising in purchase criteria, with brands expanding eco-friendly lines and certifications, signaling a broader shift to safer and lower-impact materials.

- Regional Analysis: Asia Pacific leads on unit volumes and growth, while North America remains a high-value market anchored by established brands such as Tempur Sealy and Serta Simmons. Europe shows steady replacement-led demand, and APAC outpaces other regions on CAGR, positioning China and India as priority investment corridors.

Type Analysis

Foam remains the largest product class, accounting for about 45% of global sales in 2024 as buyers favor contouring support and motion isolation in memory foam and related formulations. Hybrid models continue to gain share as consumers seek stronger edge support and better temperature control at mid-tier price points of roughly USD 1,200 to 2,000 for a queen, compared with USD 800 to 2,500 for memory foam alternatives. Innerspring retains a sizable installed base, but its relative share trails foam as preferences shift toward pressure relief and quieter construction in mature and developing markets alike.

You should expect the hybrid mix to rise further as brands refine coil zoning, cooling foams, and breathable covers to address heat and spinal alignment concerns at competitive price bands. Product development focuses on clear performance attributes that translate in-store and online, including firmness matching and motion transfer tests that reduce returns and improve satisfaction. The overall type mix will track wellness-led upgrades and replacement cycles, with foam and hybrid models best positioned to capture premium and upper mid-market demand in 2025 and beyond.

Distribution Channel Analysis

Offline retail remains the majority channel as shoppers prefer to test firmness, pressure relief, and edge support before purchase, reinforcing the role of specialty chains and furniture stores in guiding higher-priced decisions. In-store consultations, immediate service, and bundled financing continue to support average selling prices, even as online content shapes pre-visit research and shortlists.

Online penetration keeps rising as direct-to-consumer brands scale trials, free shipping, and simplified assortments that lower decision friction for you. Return rates for boxed beds average about 7% in industry tracking, signaling better fit tools and expectation setting compared with earlier cycles of the category. Transparent pricing and clear comparisons of foam and hybrid constructions improve conversion, while detailed education around temperature regulation and edge performance reduces post-purchase dissatisfaction.

End-Use Analysis

Household purchases account for roughly 78% of demand, supported by health-driven upgrades, shorter replacement cycles, and price transparency across foam and hybrid offerings. Sleep disruption remains prevalent, with 8 in 10 adults reporting at least one symptom of poor sleep, which elevates willingness to invest in comfort and support features that address heat and pressure points. The economic cost of insufficient sleep in the United States alone is estimated at about USD 411 billion annually, underscoring the productivity case for household investments in better sleep surfaces.

Commercial demand is steady, led by hospitality refresh cycles and brand standards that prioritize durability, hygiene, and guest satisfaction metrics in the upper midscale and upscale tiers. Healthcare settings add specialized needs for pressure redistribution and cleanability, which sustains premium specifications and recurring replacements in institutional channels. As travel activity normalizes and renovation pipelines progress, commercial volumes should provide a stable floor under total market growth through the forecast period.

Regional Analysis

Asia Pacific holds the largest share at about 38% in 2024, supported by rising disposable incomes, urban household formation, and broad manufacturing capacity across China, India, and Southeast Asia. The region’s large addressable base and ongoing upgrades in comfort and materials point to sustained gains in 2025 and beyond, with local and global brands expanding foam and hybrid lines for middle-income buyers. E-commerce adoption further widens access in second- and third-tier cities, while modern retail formats lift conversion in major metros.

North America represents roughly one third of global revenue and remains a high-value market anchored by established brands and a robust specialty retail footprint. Product mix skews toward premium foam and hybrids, aided by clear pricing, standardized sizes, and mature logistics for home delivery and returns. Europe continues to contribute meaningful replacement-led demand within a developed retail ecosystem, while producers align materials and testing with safety and quality standards across markets.

Get More Information about this report -

Request Free Sample ReportMarket Segment

Product Type Analysis

- Foam Mattresses

- Hybrid Mattresses

- Innerspring Mattresses

- Latex and Specialty Mattresses

- Product Mix Evolution and Outlook

Distribution Channel Analysis

- Offline Retail (Specialty Stores, Furniture Chains)

- Online & Direct-to-Consumer Channels

- Omnichannel Buying Behavior

- Channel-Wise Growth Outlook

End-Use Analysis

- Household / Residential

- Commercial (Hospitality, Healthcare, Institutional)

- Replacement vs New Installation Demand

Regional Analysis

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 48.6 B |

| Forecast Revenue (2034) | USD 102.4 B |

| CAGR (2024-2034) | 7.7% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type Analysis (Foam Mattresses, Hybrid Mattresses, Innerspring Mattresses, Latex and Specialty Mattresses, Product Mix Evolution and Outlook), Distribution Channel Analysis (Offline Retail (Specialty Stores, Furniture Chains), Online & Direct-to-Consumer Channels, Omnichannel Buying Behavior, Channel-Wise Growth Outlook), End-Use Analysis (Household / Residential, Commercial (Hospitality, Healthcare, Institutional), Replacement vs New Installation Demand) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Tempur Sealy International, Serta Simmons Bedding, Sleep Number, Kingsdown, Spring Air International, Hilding Anders, Sleepwell, Casper, Purple Innovation, Emma Sleep, Sheela Foam, Derucci |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date