Medical Writing Market Size, Trends & Forecast | 10.9% CAGR

Global Medical Writing Market Size, Share & Analysis Type (Clinical Writing, Regulatory Writing, Scientific Writing), Application (Medical Journalism, Medical Education, Medico Marketing), End-User (Pharmaceutical & Biotechnology Companies, Contract Research Organizations) Industry Regions & Key Players – Outsourcing Trends & Forecast 2025–2034

Report Overview

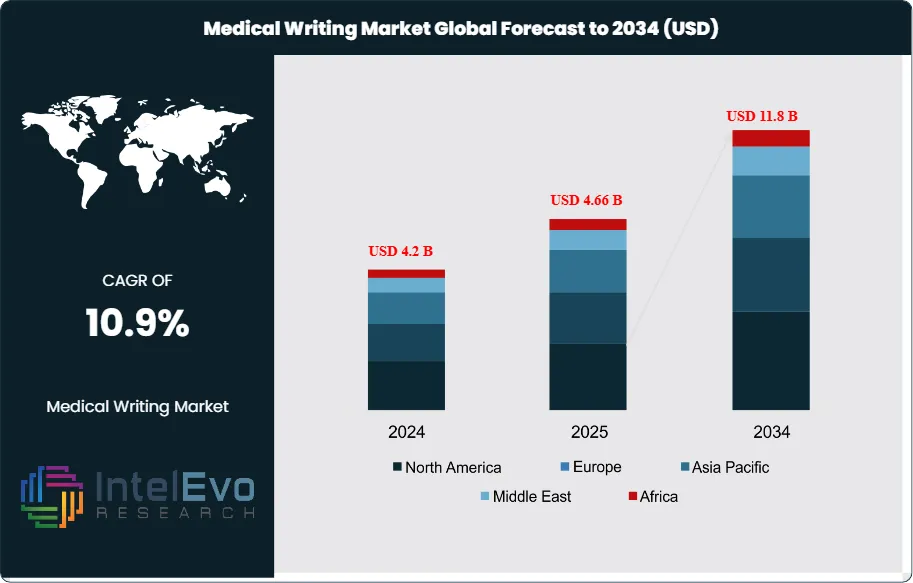

The Medical Writing Market is projected to grow from USD 4.2 Billion in 2024 to approximately USD 11.8 Billion by 2034, expanding at a CAGR of around 10.9% during 2025–2034. The increasing volume of clinical research, regulatory submissions, and real-world evidence studies is driving strong demand for professional medical writing services. Pharma, biotech, and CROs are increasingly outsourcing documentation to specialized writers to accelerate approvals and improve scientific communication. Digital transformation and AI-assisted writing tools are further enhancing content accuracy, compliance, and workflow efficiency across the healthcare ecosystem. This sustained growth reflects the rising complexity of medical research, stricter compliance requirements, and the need for clear, accurate, and evidence-based communication across the life sciences ecosystem.

Get More Information about this report -

Request Free Sample ReportMedical writing services encompass a broad spectrum of activities, ranging from regulatory submissions, clinical trial documentation, and safety reports to scientific publications, patient education resources, and promotional materials. These services are delivered by highly skilled professionals—including medical writers, editors, and regulatory specialists—who act as crucial intermediaries between researchers, regulators, healthcare providers, and patients. By translating complex scientific findings into accessible and compliant documentation, medical writing plays an indispensable role in supporting drug approvals, medical device launches, and the dissemination of scientific knowledge.

The market is witnessing increasing demand due to the surge in clinical trials and R&D activity, particularly in oncology, rare diseases, and advanced therapies. Pharmaceutical and biotechnology companies are outsourcing medical writing tasks at a greater pace to streamline timelines, ensure regulatory accuracy, and reduce costs. Additionally, the expanding role of real-world evidence (RWE) and the adoption of digital health solutions are creating new opportunities for specialized medical writing that integrates data analytics with clinical narratives.

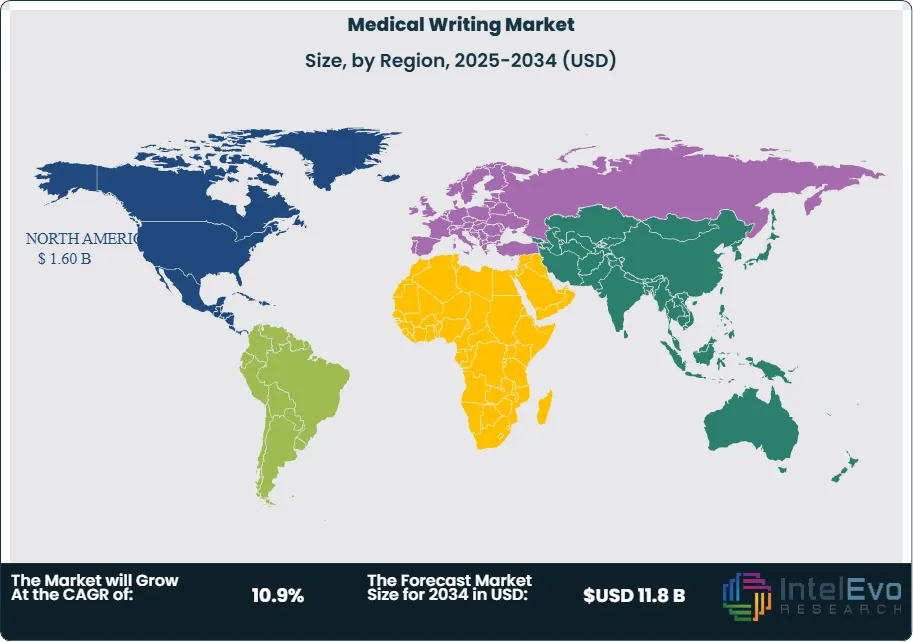

Regionally, North America leads the market, supported by its strong base of pharmaceutical and biotech companies as well as well-defined regulatory frameworks. Europe follows closely, driven by a rising emphasis on compliance and medical publications, while the Asia-Pacific region is emerging as a fast-growing hub due to the increasing outsourcing of clinical research and the availability of skilled medical writers at competitive costs.

As healthcare innovation accelerates and regulatory scrutiny intensifies, the medical writing market is expected to remain a critical enabler of scientific transparency, compliance, and effective communication. Its growth trajectory underscores the strategic importance of high-quality medical writing in bridging the gap between scientific research and practical healthcare applications.

Key Takeaways

- Market Growth: The global medical writing market was valued at USD 4.2 Billion in 2024 and is projected to reach USD 11.8 Billion by 2034, expanding at a CAGR of 10.9%. Growth is driven by rising clinical trial activity, stricter regulatory requirements, and increased outsourcing by pharmaceutical and biotech firms.

- By Type: Clinical writing accounted for the largest revenue share of 41.4% in 2024, reflecting its essential role in preparing clinical trial reports, regulatory submissions, and safety documentation that are critical for drug approvals.

- By Application: Medical journalism and publications represented about 40.5% of the market in 2024, highlighting the growing importance of disseminating research findings and supporting evidence-based medical practice through peer-reviewed articles and scientific communications.

- Driver: The surge in global R&D investment and clinical trial volumes, particularly in oncology, rare diseases, and biologics, is accelerating demand for high-quality medical writing services that ensure accuracy, compliance, and clarity.

- Restraint: A shortage of skilled medical writers with domain expertise and the high cost of maintaining specialized teams are limiting market scalability, especially for smaller firms.

- Opportunity: Expanding applications of real-world evidence (RWE), digital health solutions, and AI-driven writing support tools present opportunities to develop innovative service offerings and improve efficiency in medical writing workflows.

- Trend: The industry is witnessing a shift toward outsourced and offshore medical writing services, with Asia-Pacific gaining traction as a cost-effective hub while AI-assisted tools are being adopted to streamline regulatory and scientific documentation.

- Regional Analysis: North America led with a 38% share in 2024, supported by a strong pharmaceutical pipeline and established CROs, while Asia-Pacific is expected to record the fastest growth due to expanding clinical research activity and availability of skilled talent at lower operational costs.

Type Analysis

As of 2025, clinical writing continues to represent the largest share of the global medical writing market, contributing over 41% of total revenues. This dominance is attributed to the central role clinical documentation plays in the drug development process. Clinical writers are responsible for producing essential documents such as clinical trial protocols, study reports, investigator brochures, and informed consent forms—all of which are mandatory for ensuring the credibility and regulatory acceptance of trial data. The rise in the number of global clinical trials, particularly in oncology and rare disease research, has reinforced demand for highly specialized clinical writing services.

Regulatory writing also commands a significant portion of the market, supporting submissions to health authorities including the U.S. FDA, EMA, and other regional bodies. Deliverables such as investigational new drug applications, new drug applications, and marketing authorization filings are critical to securing approvals. With regulatory frameworks tightening worldwide, demand for precision-driven regulatory documentation continues to rise, creating strong growth opportunities for service providers in this category. Other segments, including scientific and educational writing, cater to academic, medical communications, and educational institutions, offering more specialized yet complementary contributions to the broader market.

Application Analysis

Within applications, medical journalism remains the largest contributor, accounting for more than 40% of global revenues in 2025. This segment encompasses the creation of health-related news articles, opinion features, and evidence-based analyses published across journals, magazines, and digital platforms. Growing public interest in health literacy, the rise of online medical content, and the need for timely, accurate reporting on pharmaceutical and healthcare developments have strengthened this segment’s leadership.

Other application areas include medical education and medico-marketing communications. Educational writing supports the creation of training materials, patient education guides, and academic course content for healthcare institutions. Meanwhile, medico-marketing focuses on promotional deliverables such as product brochures, advertising campaigns, and digital marketing assets for pharmaceutical and biotech companies. The expansion of multichannel marketing strategies in the healthcare industry is expected to fuel growth in this segment over the coming years.

End-User Analysis

By end-user, contract research organizations (CROs) hold a substantial share of the market in 2025. CROs increasingly outsource medical writing services to ensure accurate, compliant, and timely documentation for their clients’ research programs. The ability to deliver regulatory-compliant clinical trial documentation has made medical writing partnerships with CROs a strategic necessity for pharmaceutical and biotechnology companies aiming to accelerate development timelines.

Pharmaceutical and biotech firms themselves also account for a large share, as they continue to require in-house and outsourced medical writing for regulatory submissions, publications, and patient-focused communications. Other end-users include academic institutions, government bodies, and specialized medical communications agencies, each leveraging medical writing expertise for education, compliance, and knowledge dissemination purposes.

Regional Analysis

North America continues to dominate the global medical writing market, maintaining a share of approximately 38% in 2025. This leadership is underpinned by the region’s strong pharmaceutical and biotechnology pipeline, high volume of clinical trials, and a well-established regulatory framework. The U.S. remains the largest contributor, driven by a combination of stringent FDA requirements and a robust ecosystem of CROs and medical communications firms.

Europe follows closely, supported by the presence of leading pharmaceutical companies and a growing focus on compliance with EMA guidelines. Meanwhile, the Asia-Pacific region is emerging as the fastest-growing market, fueled by the outsourcing of medical writing services to countries such as India and the Philippines, which offer a skilled talent pool at competitive costs. With clinical trial activity expanding globally, demand for high-quality, cost-effective medical writing services is expected to rise across all major regions.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

Type

- Clinical Writing

- Regulatory Writing

- Scientific Writing

- Other Types

Application

- Medical Journalism

- Medical Education

- Medico Marketing

- Other Applications

End-User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Other End-Users

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 4.2 B |

| Forecast Revenue (2034) | USD 11.8 B |

| CAGR (2024-2034) | 10.9% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Type (Clinical Writing, Regulatory Writing, Scientific Writing, Other Types), Application (Medical Journalism, Medical Education, Medico Marketing, Other Applications), End-User (Pharmaceutical & Biotechnology Companies, Contract Research Organizations, Other End-Users) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Parexel International Corporation, Trilogy Writing & Consulting GmBH, Freyr, Cactus Communications, Labcorp Drug Development, IQVIA Holdings Inc., Omics International, Synchrogenix, Siro Clinpharm Private Limited, Quanticate International Limited, Inclin Inc., Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Medical Writing Market?

The Medical Writing Market is expected to grow from USD 4.2 Billion in 2024 to USD 11.8 Billion by 2034, at a CAGR of 10.9%. Increasing adoption of algorithmic trading, predictive analytics, and automated decision systems is transforming financial markets and boosting trading efficiency worldwide.

Who are the major players in the Medical Writing Market?

Parexel International Corporation, Trilogy Writing & Consulting GmBH, Freyr, Cactus Communications, Labcorp Drug Development, IQVIA Holdings Inc., Omics International, Synchrogenix, Siro Clinpharm Private Limited, Quanticate International Limited, Inclin Inc., Other Key Players

Which segments covered the Medical Writing Market?

Type (Clinical Writing, Regulatory Writing, Scientific Writing, Other Types), Application (Medical Journalism, Medical Education, Medico Marketing, Other Applications), End-User (Pharmaceutical & Biotechnology Companies, Contract Research Organizations, Other End-Users)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date