Methyl Methacrylate (MMA) Market Size, Share & Growth | CAGR of 6.1%

Global Methyl Methacrylate (MMA) Market Size, Share & Industry Analysis By Production Route (ACH, C4, Bio-Based), By Application (PMMA Sheets, Automotive Components, Electronics Displays, Construction, Medical Devices), By End-Use Industry, Sustainability & Recycling Initiatives, Regional Outlook, Key Manufacturers, Market Dynamics, Competitive Strategies, Trends & Forecast 2025–2034

Report Overview

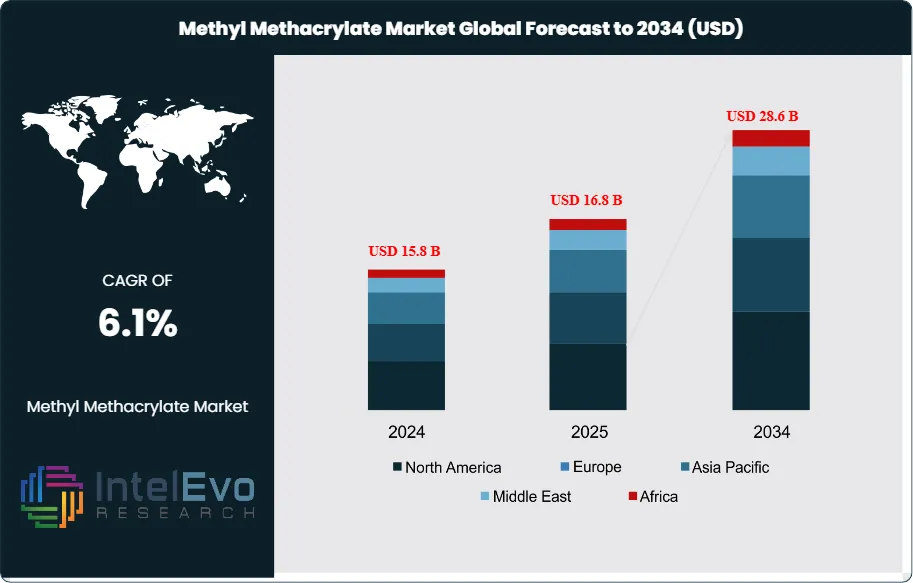

The Methyl Methacrylate (MMA) market is estimated at USD 15.8 billion in 2024 and is projected to reach approximately USD 28.6 billion by 2034, registering a compound annual growth rate (CAGR) of about 6.1% during 2025–2034. This steady expansion is driven by rising demand for PMMA in construction, automotive, electronics, and signage applications, where lightweight, transparency, and durability are critical performance attributes. Ongoing infrastructure development, growth in electric vehicles, and increased use of acrylic sheets as glass substitutes are further supporting market momentum, while capacity additions and bio-based MMA innovations are shaping long-term industry competitiveness.

Get More Information about this report -

Request Free Sample ReportThis growth reflects the expanding role of MMA as a critical feedstock for polymethyl methacrylate (PMMA) resins and plastics, which are widely used in automotive, construction, electronics, and medical applications. Demand has steadily increased over the past decade, supported by rising consumption of lightweight and durable materials, and the market is expected to maintain a strong upward trajectory as industries prioritize performance, safety, and sustainability.

On the demand side, the automotive and construction sectors remain the largest consumers, accounting for more than 55% of global MMA usage in 2023. The shift toward lightweight vehicles and energy-efficient buildings is accelerating adoption of PMMA-based products. Supply-side dynamics are shaped by capacity expansions and integration strategies among leading producers. However, volatility in raw material prices, particularly acetone and hydrogen cyanide, continues to pose risks to margins. Regulatory pressures are also reshaping the industry. In Europe, the MMAtwo project aims to recycle 27,000 tons of PMMA waste annually into 12,250 tons of recycled MMA, signaling a clear move toward circular production models.

Technological advances are influencing production methods. The acetone cyanohydrin (ACH) process remains dominant, but alternative routes with lower environmental impact are gaining traction. Companies are investing in process efficiency, digital monitoring, and automation to reduce costs and emissions. These developments align with broader sustainability targets and are expected to influence investment decisions across the value chain.

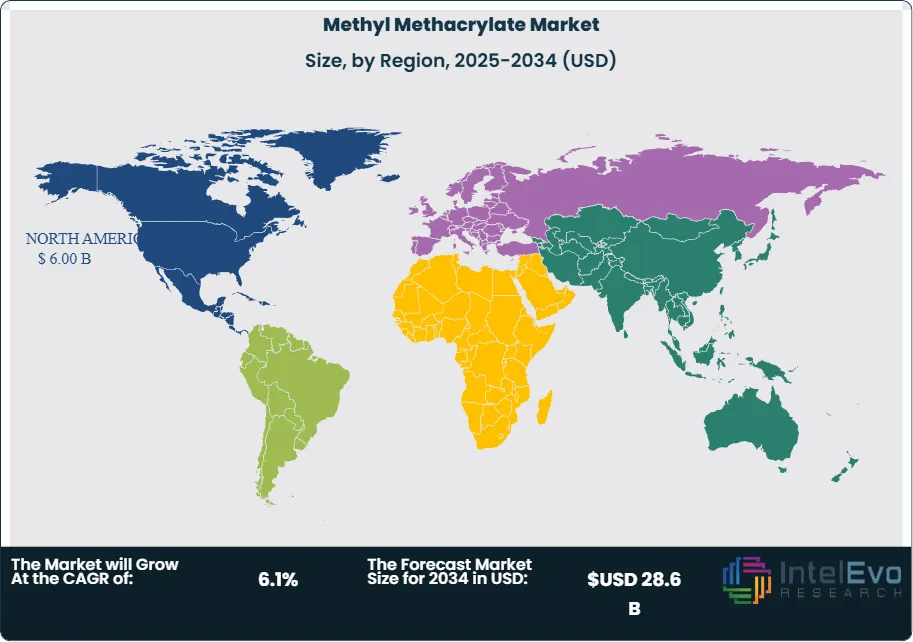

Regionally, Asia-Pacific leads the global market, accounting for over 45% of total consumption in 2023. China and South Korea dominate both production and exports, supported by large-scale manufacturing bases and access to raw materials. North America and Europe remain significant markets, driven by demand in automotive coatings, medical devices, and construction materials, while emerging economies in Southeast Asia and the Middle East are becoming attractive investment destinations due to rapid industrialization and infrastructure growth.

For investors, the MMA market presents opportunities in recycling technologies, capacity expansions in Asia-Pacific, and specialty-grade applications in healthcare and electronics. The combination of regulatory momentum, technological progress, and expanding end-use industries positions the market for sustained growth through 2034.

Key Takeaways

- Market Growth: The global Methyl Methacrylate (MMA) market is valued at USD 15.8 billion in 2024 and is projected to reach USD 28.6 billion by 2034, expanding at a CAGR of 6.1%. Growth is driven by rising demand for lightweight materials in automotive, construction, and electronics.

- By Raw Material: Acetone-based production accounts for 45.6% of the market in 2023, supported by the cost efficiency of the acetone cyanohydrin (ACH) process and its established supply chain.

- By Application: Chemical intermediates represent 34.5% of global demand, reflecting MMA’s critical role in producing coatings, adhesives, and specialty resins.

- By End Use: The buildings and construction sector holds 43.3% of consumption, with PMMA products favored for weather resistance, durability, and architectural aesthetics.

- By Distribution Channel: Indirect sales channels, including distributors and online platforms, account for 55.3% of total sales, highlighting the importance of established networks in reaching industrial buyers.

- Driver: Expanding automotive production, particularly in Asia-Pacific, is accelerating demand for PMMA-based coatings and glazing. Lightweight plastics contribute to fuel efficiency, with automotive applications expected to grow at over 7% CAGR through 2033.

- Restraint: Volatility in raw material prices, especially acetone and hydrogen cyanide, continues to pressure producer margins. Feedstock fluctuations have historically impacted profitability by up to 10–15% annually.

- Opportunity: Recycling initiatives, such as Europe’s MMAtwo project, are creating new revenue streams. The program targets recovery of 12,250 tons of recycled MMA annually, positioning circular production as a high-growth segment.

- Trend: Producers are investing in sustainable production technologies. Alternative processes with lower emissions are gaining traction, with leading companies piloting bio-based MMA routes to align with regulatory and ESG requirements.

- Regional Analysis: North America leads with a 40.6% share in 2023, supported by strong demand in automotive and construction. Asia-Pacific is the fastest-growing region, projected to expand above 7% CAGR, driven by industrialization in China, India, and Southeast Asia. Europe remains a key hub for recycling and sustainability-focused investments.

Type Analysis

By 2025, the Methyl Methacrylate (MMA) market continues to show clear preferences across feedstock types, with acetone maintaining its dominant role. Acetone-based production, primarily through the acetone cyanohydrin (ACH) process, accounts for more than 45% of global supply. Its cost efficiency and widespread availability make it the preferred route in regions with strong acetone production capacity, particularly in Asia-Pacific and North America. This pathway remains central to large-scale MMA output, despite rising interest in alternative methods.

Ethylene-based production is gaining traction due to its ability to deliver high-purity MMA, which is critical for advanced applications such as optical-grade plastics and specialty coatings. Although it represents a smaller share compared to acetone, demand for ethylene-derived MMA is expected to grow at a CAGR above 6% through 2030, supported by investments in high-performance materials. Methanol also plays a supporting role in the ACH process, offering flexibility in raw material sourcing and helping producers mitigate feedstock price volatility.

Isobutylene-based production remains a niche but strategically important segment. Facilities with access to isobutylene as a byproduct of petrochemical operations are increasingly adopting this route to reduce costs and improve integration. While its market share is below 10%, the process is expected to expand in regions with strong refining and petrochemical clusters, particularly in the Middle East and parts of Asia.

Application Analysis

Chemical intermediates remain the largest application segment, accounting for more than 34% of global MMA demand in 2025. MMA’s role as a precursor to polymethyl methacrylate (PMMA) underpins its importance in automotive, construction, and electronics. Rising demand for lightweight plastics and transparent materials continues to reinforce this segment’s dominance.

Surface coatings represent another major application, with MMA-based formulations widely used in automotive paints, architectural coatings, and industrial finishes. Their weather resistance and durability make them essential for long-life performance in both infrastructure and vehicles. This segment is projected to grow steadily at around 6% CAGR, supported by construction activity in Asia-Pacific and refurbishment demand in developed markets.

Emulsion polymers, used in adhesives, sealants, and specialty paints, are also expanding. MMA enhances bonding strength and durability, making it a preferred additive in consumer and industrial products. With rising demand for water-based and low-VOC formulations, MMA’s role in emulsion polymers is expected to strengthen, particularly in Europe and North America where environmental regulations are stringent.

End-Use Analysis

The buildings and construction sector continues to dominate MMA consumption, representing over 43% of global demand in 2025. PMMA-based products are widely used in windows, panels, and decorative materials due to their clarity, strength, and weather resistance. Infrastructure development in Asia-Pacific and green building initiatives in Europe are expected to sustain growth in this segment.

The automotive industry is another critical end-use, with MMA used in light covers, trims, and coatings. As automakers pursue weight reduction and energy efficiency, MMA-based plastics are increasingly replacing heavier materials. The sector is forecast to grow at more than 7% CAGR through 2030, driven by electric vehicle adoption and demand for advanced coatings.

Electronics and paints and coatings also represent significant demand centers. MMA is used in display screens, optical components, and protective coatings for consumer electronics. In paints and coatings, MMA-based formulations are valued for their durability and finish, with applications spanning residential, commercial, and industrial projects. Together, these segments account for nearly one-third of global MMA consumption.

Regional Analysis

North America remains a leading market, accounting for more than 40% of global MMA revenues in 2025, valued at over USD 6 billion. Strong demand from automotive, construction, and electronics industries in the United States and Canada underpins this position. The region also benefits from advanced manufacturing capabilities and ongoing investments in sustainable production technologies.

Europe continues to expand steadily, supported by demand in automotive and construction. Germany, France, and the United Kingdom are key contributors, with regulatory emphasis on recycling and green materials driving adoption. Initiatives such as the MMAtwo project highlight Europe’s focus on circular production, which is expected to reshape supply chains over the next decade.

Asia-Pacific is the fastest-growing region, projected to expand at a CAGR above 7% through 2030. China, India, Japan, and South Korea are leading demand, driven by rapid urbanization, infrastructure development, and strong electronics manufacturing bases. The region’s large-scale industrialization and government-backed infrastructure projects make it the most attractive investment destination for MMA producers.

Latin America and the Middle East & Africa represent smaller but growing markets. Brazil and Mexico lead demand in Latin America, supported by construction and automotive production. In the Middle East, countries such as Saudi Arabia and the UAE are investing heavily in petrochemical integration and infrastructure, creating opportunities for MMA expansion. While their combined share is below 15%, both regions are expected to post above-average growth rates through 2030.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Feedstock

- Acetone

- Ethylene

- Methanol

- Isobutylene

- Others

By Application

- Chemical Intermediate

- Surface Coatings

- Emulsion Polymer

- Others

By End-Use

- Buildings & Construction

- Automotive

- Electronics

- Paints & Coatings

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 15.8 B |

| Forecast Revenue (2034) | USD 28.6 B |

| CAGR (2024-2034) | 6.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Feedstock (Acetone, Ethylene, Methanol, Isobutylene, Others), By Application (Chemical Intermediate, Surface Coatings, Emulsion Polymer, Others), By End-Use (Buildings & Construction, Automotive, Electronics, Paints & Coatings, Others), By Distribution Channel (Direct Sales, Indirect Sales) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | DuPont Inc, Kuraray Group, Arkema, Monómeros del Vallés S.L., Huntsman Corporation, BASF SE, LG Chem, Kowa India Pvt. Ltd., Evonik Industries AG, Heilongjiang Zhongmeng Longxin Chemical Co., Ltd., Lucite International, Dhalop Chemicals, Asahi Kasei Corporation, |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date