Microparticulated Whey Protein Market 2024–2034 | Growth Outlook

Global Microparticulated Whey Protein Market Size, Share & Analysis By Type (Isolate, Concentrate, Hydrolysate), By Application (Bakery, Dairy, Sports Nutrition), By End-User Industry Outlook, Functional Ingredient Trends & Forecast 2025–2034

Report Overview

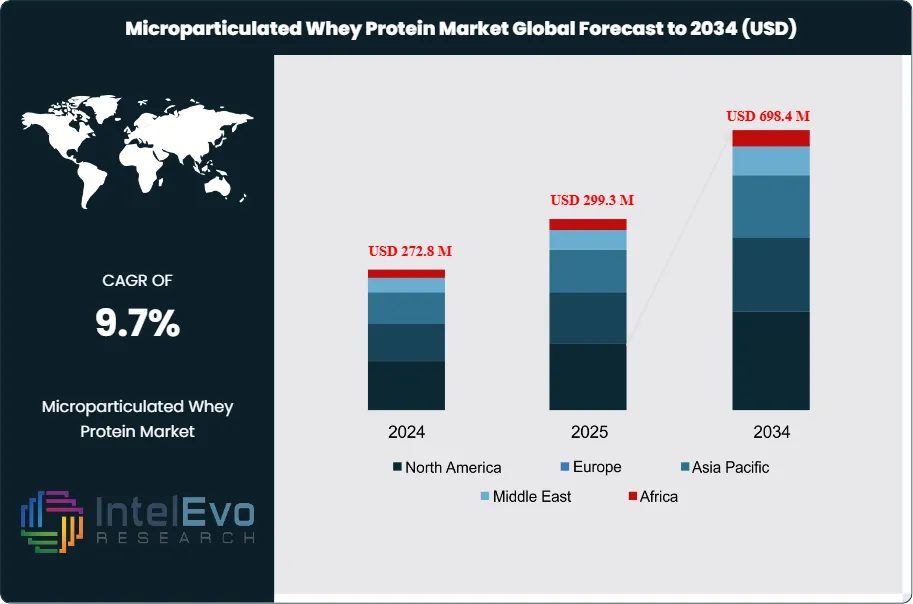

The Microparticulated Whey Protein market is valued at USD 272.8 million in 2024 and is projected to reach approximately USD 698.4 million by 2034, reflecting a strong CAGR of about 9.7% during 2025–2034. The surge in high-protein functional foods, clean-label formulations, and reduced-fat dairy innovations is accelerating global demand. Food manufacturers are increasingly adopting microparticulated whey as a superior fat replacer to improve texture, creaminess, and nutritional value without compromising taste. With sports nutrition, meal replacements, and ready-to-drink beverages gaining mass-market traction, this protein ingredient is emerging as a cornerstone of next-generation nutrition solutions.

Get More Information about this report -

Request Free Sample ReportThis expansion reflects a steady shift in global nutritional priorities, as consumers increasingly favor high-protein, low-fat, and functional food products. Microparticulated Whey Protein (MWP), produced through controlled thermal and mechanical treatment of standard whey, delivers enhanced solubility, improved texture, and superior digestibility, making it well suited for modern nutrition-focused formulations.

MWP has become a preferred ingredient across sports nutrition, dietary supplements, and high-protein dairy products due to its ability to replicate fat-like mouthfeel while maintaining low caloric density. Current production processes typically involve heating whey to approximately 90°C and applying pressures of up to 140 bar, resulting in uniform microparticles that perform consistently across a wide range of food matrices.

Demand growth has been particularly strong in North America and Western Europe, where protein-fortified foods have transitioned from niche offerings to mainstream consumption. In the United States, protein supplement sales surpassed USD 9 billion in 2024, with MWP gaining market share due to its clean-label positioning and compatibility with reduced-calorie formulations.

Advancements in formulation technology now allow manufacturers to incorporate up to 15% protein in 2 kcal/ml solutions, enabling innovation in ready-to-drink beverages, medical nutrition, and clinical nutrition products. These capabilities are expanding application potential beyond traditional sports nutrition into therapeutic and lifestyle-oriented segments.

The Asia-Pacific region is emerging as a key growth engine, supported by urbanization, rising disposable incomes, and rapidly expanding fitness cultures. Sports nutrition sales in markets such as India and Vietnam recorded a 34% year-over-year increase, signaling accelerating adoption of protein-enriched products across developing economies.

Despite strong demand, supply-side constraints persist. Limited raw whey availability and energy-intensive processing have contributed to a 6.2% increase in input costs between 2022 and 2024. Additionally, heightened regulatory scrutiny surrounding protein claims and labeling requirements in regions such as the European Union and Australia necessitates careful compliance management.

In response, manufacturers are investing in precision processing technologies and clean energy integration to stabilize operating margins and improve production efficiency. These initiatives are helping offset cost pressures while supporting sustainability objectives.

Strategically, product development efforts are shifting toward novel applications, including bakery, snacks, and hybrid plant-protein blends that enhance nutritional value without compromising taste or mouthfeel. Capital inflows are increasingly targeting mid-scale processors capable of agile formulation, rapid innovation, and faster market deployment.

As the market matures, competitive differentiation will extend beyond protein concentration to include digestibility, sourcing transparency, and sustainability credentials. These factors are reinforcing the long-term value proposition of Microparticulated Whey Protein within an increasingly competitive global protein economy.

Key Takeaways

- Market Growth: The global Microparticulated Whey Protein market reached USD 272.8 million in 2024 and is projected to grow at a CAGR of 9.7%, hitting USD 698.4 million by 2034. Growth is driven by rising demand for protein-enriched, low-fat, and clean-label formulations across food and beverage sectors.

- Product Type: Microparticulated whey protein isolate leads with a 46.4% revenue share, driven by its high protein purity and compatibility with functional food and clinical nutrition applications.

- Form: Powder form accounts for 74.3% of total market volume, offering manufacturers flexibility in blending, storage, and transportation for large-scale formulation needs.

- Grade: Food-grade variants represent 68.5% of global demand, reflecting regulatory alignment and safety compliance for use in mainstream food and beverage products.

- Application: Ready-to-drink beverages hold 29.9% of the market, supported by increased consumer preference for convenient, high-protein products, particularly among fitness-focused demographics.

- Driver: Clean-label trends and protein fortification demand are accelerating adoption. In 2024, 67% of new product launches in functional beverages included whey-based proteins, with MWP preferred for its solubility and neutral taste.

- Restraint: High production costs tied to energy-intensive processing and raw material volatility have led to a 6.2% increase in average input costs between 2022 and 2024, limiting margins for small and mid-sized manufacturers.

- Opportunity: Asia-Pacific presents high growth potential, with India and Vietnam seeing over 30% annual growth in sports nutrition sales. Local demand for protein supplements is outpacing supply, creating space for regional manufacturing investments.

- Trend: Manufacturers are integrating MWP into non-traditional categories such as bakery and plant-protein blends. Formulations now include up to 15% MWP in 2 kcal/ml products, enabling calorie control without sacrificing texture.

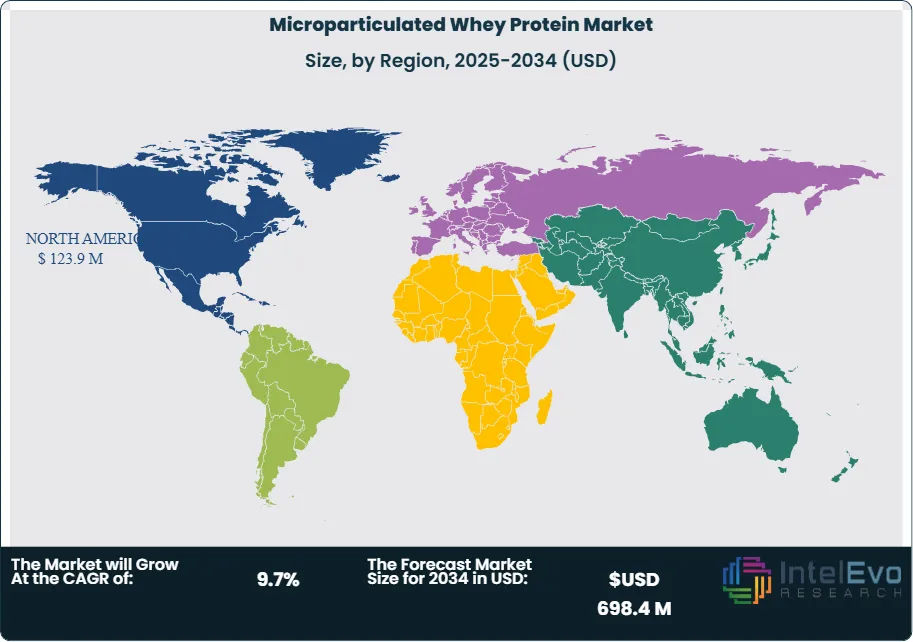

- Regional Analysis: North America leads with a 45.4% market share, valued at USD 123.9 million in 2025. Growth in Asia-Pacific is accelerating, driven by expanding health awareness and urban dietary shifts, with a projected CAGR exceeding 9.4% through 2034.

Type Analysis

Microparticulated Whey Protein Isolate continues to lead the market by type, accounting for 46.4% of global revenue in 2025. Its dominance is attributed to a high protein-to-fat ratio, making it the preferred ingredient in sports nutrition, clinical nutrition, and high-performance functional foods. As consumer demand for lean protein sources increases, especially among athletes and health-focused demographics, Isolate remains central to product formulations aiming to deliver maximum nutritional benefit with minimal caloric load.

Concentrate holds a steady position in the market due to its affordability and sufficient protein levels for mainstream dietary applications. It remains widely used in standard protein powders, dairy blends, and everyday nutritional products. Hydrolysate, while representing a smaller segment, is gaining share at a faster rate. Its rapid absorption and improved digestibility make it well-suited for use in infant nutrition, post-exercise recovery formulas, and medical foods. However, higher production costs continue to limit broader adoption. From 2025 onward, manufacturers investing in hydrolysis technologies and cost-efficient production methods are likely to capitalize on rising interest in advanced protein solutions.

Form Analysis

In 2025, powder remains the dominant form in the Microparticulated Whey Protein market, capturing 74.3% of total demand. Its stability, long shelf life, and compatibility with dry blends make it the preferred format for protein bars, powdered beverages, and snack applications. Manufacturers benefit from easy handling, lower storage costs, and broader formulation flexibility. These advantages continue to drive high-volume use across food, supplement, and sports nutrition categories.

Liquid forms, while accounting for a smaller share, are growing steadily in line with rising demand for ready-to-drink (RTD) functional beverages. This segment is particularly active in sports drinks, medical nutrition, and performance beverages. As on-the-go consumption rises in urban centers, particularly in Asia and North America, liquid MWP solutions are expected to expand their market footprint. Their key advantage lies in offering immediate usability and smooth integration into beverages without reconstitution, which appeals to consumers seeking speed and convenience in nutritional intake.

Type Analysis

Food-grade Microparticulated Whey Protein represents the majority of consumption in 2025, holding 68.5% of the market. It is widely applied in protein-fortified dairy products, meal replacements, and clean-label snack categories. Its compliance with food safety regulations and performance across diverse applications have made it the default standard in mainstream food and beverage manufacturing.

Pharma-grade MWP, although smaller in market share, is experiencing increasing demand in medical nutrition, therapeutic formulations, and targeted supplements for aging populations. Its use is expanding in products tailored for digestion-sensitive consumers and patients requiring high bioavailability of essential amino acids. The aging global population and rising incidence of chronic illness are fueling this demand. In Europe and Japan, where geriatric nutritional needs are a policy priority, pharma-grade formats are being incorporated into clinical dietary interventions at a growing rate.

Application Analysis

Ready-to-drink (RTD) beverages account for 29.9% of application-based demand in 2025, the largest among all categories. The segment benefits from strong consumer interest in high-protein, portable nutrition. MWP’s ability to remain stable in liquid form without affecting mouthfeel or flavor is a critical advantage in RTD sports drinks, shakes, and clinical nutrition products.

Dairy products remain a key use case, particularly in yogurt, protein-enriched milk, and high-protein cheese. MWP improves texture and nutritional value while supporting high-protein claims. Nutritional products, including powders, bars, and fortified foods, are also a major area of growth. In 2025, product launches featuring MWP in the nutritional segment increased by over 18%, particularly in North America and Europe.

Pharmaceutical applications, though niche, are increasing steadily. MWP is incorporated into liquid nutrition products for patients with limited digestion capacity, while cosmetics use it in formulations for its bioactive peptides. Although smaller in volume, these segments represent high-margin opportunities and are expected to grow in double digits through 2030.

Region Analysis

North America leads the global market in 2025, accounting for 45.4% of revenue and valued at USD 123.9 million. This dominance is supported by a mature supplement industry, high consumer awareness, and broad retail access to protein-enriched products. The U.S. continues to drive product innovation, particularly in clinical nutrition and RTD beverages featuring MWP.

Europe remains the second-largest market, with steady demand driven by aging demographics and clean-label regulations that favor high-quality protein ingredients. Germany, the UK, and the Nordics are key markets due to proactive health trends and rising functional food adoption.

Asia Pacific shows the highest growth potential, driven by urbanization, increased disposable income, and growing interest in sports and wellness products. Countries like China and India are seeing over 10% annual growth in protein supplement sales, with local brands beginning to formulate with MWP to meet rising demand.

Latin America and the Middle East & Africa remain smaller but developing markets. Gradual economic improvement and health awareness are creating opportunities for regional entry, particularly in urban centers like São Paulo, Riyadh, and Johannesburg. While regulatory complexity and pricing remain challenges, multinationals are beginning to target these regions with affordable, locally adapted MWP-based products.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Isolate

- Concentrate

- Hydrolysate

By Form

- Powder

- Liquid

By Grade

- Food Grade

- Pharma Grade

By Application

- Ready-to-drink Beverages

- Dairy Products

- Nutritional Products

- Pharmaceuticals

- Cosmetics

- Others

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 272.8 M |

| Forecast Revenue (2034) | USD 698.4 M |

| CAGR (2024-2034) | 9.7% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Isolate, Concentrate, Hydrolysate), By Form (Powder, Liquid), Ву Grade (Food Grade, Pharma Grade), By Application (Ready-to-drink Beverages, Dairy Products, Nutritional Products, Pharmaceuticals, Cosmetics, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | MILEI GmbH, Sure Protein WPC550 (NZMP), Carbery, Leprino Foods, Nutra Solutions, Fonterra Future Dairy Private Limited, Sooro Renner, The Good Scents Company, CP Kelco, FrieslandCampina Ingredients, Arla Foods Ingredients, Makers Nutrition, LLC, NMZP |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Microparticulated Whey Protein Market

Published Date : 15 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date