Middle East & Africa Generative AI in Testing Market Size| CAGR 15.35%

Middle East & Africa Generative AI in Testing Market Size, Share, Analysis Report Component (Software, Services), Deployment (Cloud, On-premises, Hybrid), Application (Automated Test Case Generation, Intelligent Test Data Creation, AI-Powered Test Maintenance, Predictive Quality Analytics, Technology, NL-to-Test, Agentic Orchestration, Vision & Model-Based UI Understanding, Retrieval-Augmented Testing, Test-Data Generators), Organization Size (Large Enterprises, SMEs), End Use (IT & Telecom, BFSI, Healthcare & Life Sciences, Retail & eCommerce, Manufacturing & Industrial, Public Sector & Education) Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview

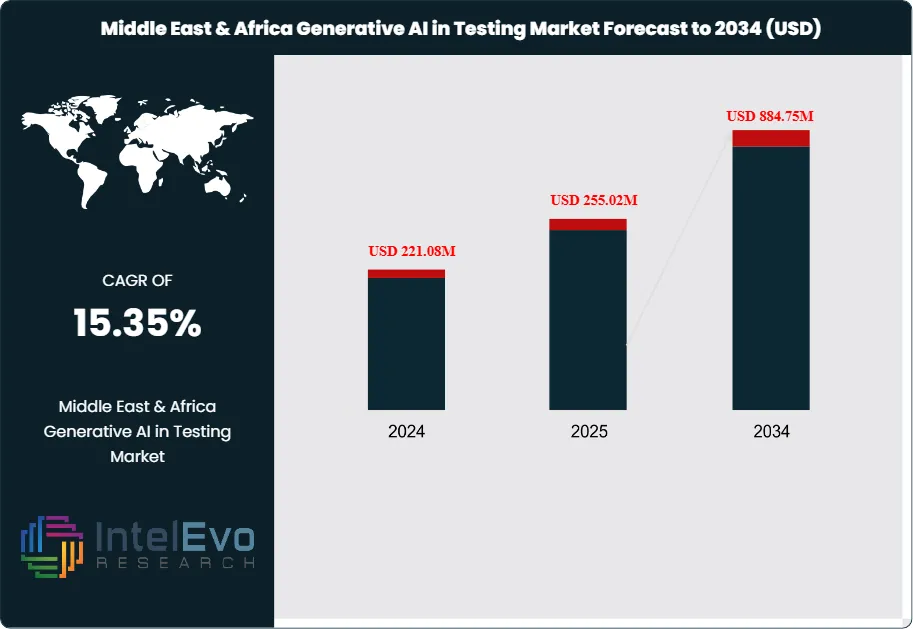

The Middle East & Africa (MEA) Generative AI in Testing Market was valued at approximately USD 221.08 million in 2024 and is projected to reach nearly USD 884.75 million by 2034, driven by accelerating digital transformation initiatives, enterprise cloud adoption, and increasing demand for AI-powered test automation across banking, telecom, and government sectors. Based on the projected growth trajectory, the market size for 2025 is estimated at approximately USD 255.02 million. From 2025 onward, the market is expected to expand at a compound annual growth rate (CAGR) of approximately 15.35% during 2025–2034, ultimately reaching around USD 884.75 million by 2034.

Get More Information about this report -

Request Free Sample ReportThis market is becoming a key player in the software quality assurance sector in the region by integrating machine learning models with automated testing processes. The growth is mainly due to the region's rising use of AI-driven DevOps, fast digital transformation in industries like banking, healthcare, telecom, and government services, and the increased need for quicker release cycles with fewer defects.

Generative AI improves the testing process by automatically generating test scripts, simulating real user scenarios, predicting defects before they happen, and enabling self-healing test frameworks. Factors such as the growing use of cloud-based testing platforms, the increasing complexity of software applications, and the need to cut down time-to-market are pushing organizations in MEA to embrace these solutions. However, challenges like the lack of skilled AI professionals and concerns about data privacy could hinder adoption if not addressed.

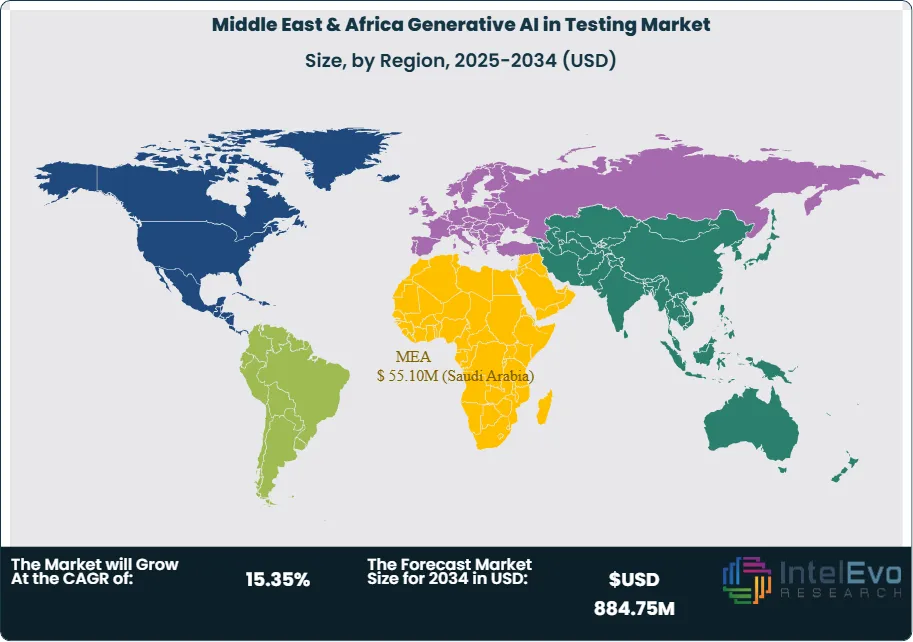

Regional Analysis (short): In MEA, adoption is strongest in Gulf Cooperation Council (GCC) countries, particularly the UAE, Saudi Arabia, and Qatar. This is due to strong digital transformation policies, innovation programs led by the government, and rapid investment in AI infrastructure. Bahrain is also emerging as a leader in enterprise AI testing adoption, backed by its tech startup ecosystem and robust IT outsourcing industry.

COVID-19 Impact: The pandemic sped up digital adoption across MEA, forcing businesses to move to remote development and testing environments. This shift led to greater reliance on cloud-based AI testing tools, allowing distributed teams to maintain quality assurance without needing physical infrastructure.

Regional Conflicts & Tariffs: While political instability in some MEA regions can disrupt cross-border trade in tech products, GCC countries have maintained stable environments that attract global AI solution providers. Import tariffs on specialized testing hardware are generally low in the Gulf States, but they can be higher in some parts of Africa, affecting localized deployment strategies.

Trade Deals: The UAE-Israel Abraham Accords and Gulf-Africaan tech cooperation agreements have improved the flow of AI technologies into the region. This has strengthened partnerships between MEA enterprises and global software testing vendors. Additionally, free trade agreements under the African Continental Free Trade Area (AfCFTA) are gradually reducing barriers for tech adoption across African states.

Key Takeaways

- Market Growth: MEA Generative AI in Testing market to grow from USD 220 million in 2024 to USD 885 million by 2034, at a CAGR of 15.4%.

- Component Dominance: Software platforms dominate due to demand for end-to-end automated AI-powered testing suites.

- Deployment Dominance: Cloud-based deployment leads due to scalability, cost efficiency, and remote collaboration capabilities.

- End-User Dominance: BFSI and telecom sectors account for the largest market share due to stringent testing requirements and digital-first business models.

- Application Dominance: Functional testing remains the top application segment, given its broad applicability across industries.

- Driver: Digital transformation initiatives and demand for faster, defect-free releases.

- Restraint: Shortage of AI-skilled testers and high initial setup costs.

- Opportunity: Integration of generative AI with low-code/no-code testing platforms and expansion into underpenetrated African markets.

- Trend: Rise of self-healing test frameworks and AI-powered predictive defect analysis.

- Regional Analysis: GCC leads in adoption, followed by Bahrain; North Africa and sub-Saharan Africa present strong untapped growth potential.

Component Analysis

The software segment has the largest share. This growth is driven by a demand for integrated AI testing platforms that offer automation, analytics, and defect prediction. Service components, which include implementation, training, and support, are also growing as businesses need help adopting AI-based testing strategies. Vendors are offering subscription-based pricing to make solutions more accessible for mid-sized companies.

Deployment Analysis

Cloud-based deployment is the most popular choice. It supports remote teams, is scalable, and reduces upfront costs. On-premises deployment still attracts government and defense organizations that have strict data security needs. Hybrid models are becoming more popular as businesses seek flexibility and control over sensitive test data.

Application Analysis

Functional testing leads the market. This is supported by generative AI's ability to create comprehensive and reusable test cases. Regression testing is also significant since AI-driven tools lessen the manual effort needed for repeated test cycles. Performance testing and security testing are gaining traction due to a rise in cyber threats.

End-User Analysis

The BFSI sector is the biggest consumer. This is because of regulatory demands and the need for high reliability in customer-facing digital applications. Telecom operators are second, driven by 5G rollouts and the need to ensure network performance. Healthcare, retail, and government sectors are also adopting AI-driven testing for critical systems.

Region Analysis

GCC countries, especially the UAE and Saudi Arabia, are leading the MEA market. This is due to proactive national AI strategies, strong investment in digital infrastructure, and many businesses undergoing digital transformation. Bahrain is emerging as a hub for AI adoption in testing, benefiting from its outsourcing industry and skilled workforce. North African countries like Qatar and Morocco are also showing interest in AI testing solutions. Future growth will be driven by increased cloud adoption in African nations and more partnerships between global vendors and local integrators.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Component

• Software

• Services

Deployment

• Cloud

• On-premises / Private Cloud

• Hybrid

Application

• Automated Test Case Generation

• Intelligent Test Data Creation (Synthetic)

• AI-Powered Test Maintenance (Self-Healing)

• Predictive Quality Analytics

Technology / Approach

• NL-to-Test (Code-LLMs, Copilot-style)

• Agentic Orchestration (multi-step workflows)

• Vision & Model-Based UI Understanding

• Retrieval-Augmented Testing (RAG for requirements/coverage)

• Test-Data Generators (tabular, time-series, anonymization)

Organization Size

• Large Enterprises

• SMEs

End Use

• IT & Telecom

• BFSI

• Healthcare & Life Sciences

• Retail & eCommerce

• Manufacturing & Industrial

• Public Sector & Education

Region

- GCC Countries

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Bahrain

- Oman

- Africa

- South Africa

- Kenya

- Nigeria

- Egypt

- Others

| Report Attribute | Details |

| Market size (2025) | USD 255.02M |

| Forecast Revenue (2034) | USD 884.75M |

| CAGR (2025-2034) | 15.35% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component (Software, Services), Deployment (Cloud, On-premises / Private Cloud, Hybrid), Application (Automated Test Case Generation, Intelligent Test Data Creation (Synthetic), AI-Powered Test Maintenance (Self-Healing), Predictive Quality Analytics, Technology / Approach, NL-to-Test (Code-LLMs, Copilot-style), Agentic Orchestration (multi-step workflows), Vision & Model-Based UI Understanding, Retrieval-Augmented Testing (RAG for requirements/coverage), Test-Data Generators (tabular, time-series, anonymization)), Organization Size (Large Enterprises, SMEs), End Use (IT & Telecom, BFSI, Healthcare & Life Sciences, Retail & eCommerce, Manufacturing & Industrial, Public Sector & Education) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Tricentis, Keysight (Eggplant), Applitools, Functionize, Parasoft, SmartBear, Mabl, Katalon, Sauce Labs, BrowserStack, LambdaTest, OpenText (Micro Focus), IBM, Microsoft, TestSigma, Diffblue |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Middle East & Africa Generative AI in Testing Market?

Middle East & Africa Generative AI in Testing market is set to grow from USD 221.08M in 2024 to USD 884.75M by 2034, at a CAGR of 15.35%. Explore trends, drivers, growth.

Who are the major players in the Middle East & Africa Generative AI in Testing Market?

Tricentis, Keysight (Eggplant), Applitools, Functionize, Parasoft, SmartBear, Mabl, Katalon, Sauce Labs, BrowserStack, LambdaTest, OpenText (Micro Focus), IBM, Microsoft, TestSigma, Diffblue

Which segments covered the Middle East & Africa Generative AI in Testing Market?

Component (Software, Services), Deployment (Cloud, On-premises / Private Cloud, Hybrid), Application (Automated Test Case Generation, Intelligent Test Data Creation (Synthetic), AI-Powered Test Maintenance (Self-Healing), Predictive Quality Analytics, Technology / Approach, NL-to-Test (Code-LLMs, Copilot-style), Agentic Orchestration (multi-step workflows), Vision & Model-Based UI Understanding, Retrieval-Augmented Testing (RAG for requirements/coverage), Test-Data Generators (tabular, time-series, anonymization)), Organization Size (Large Enterprises, SMEs), End Use (IT & Telecom, BFSI, Healthcare & Life Sciences, Retail & eCommerce, Manufacturing & Industrial, Public Sector & Education)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Middle East & Africa Generative AI in Testing Market

Published Date : 20 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date