MIDI Controller Market Size Growth, Trends | 2.8% CAGR Growth

Global MIDI Controller Market Size, Share & Analysis By Type (25 Key, 37 Key, 49 Key, 61 Key, 88 Key), By Application (Household, Stage), Industry Outlook, Digital Music Trends & Forecast 2025–2034

Report Overview

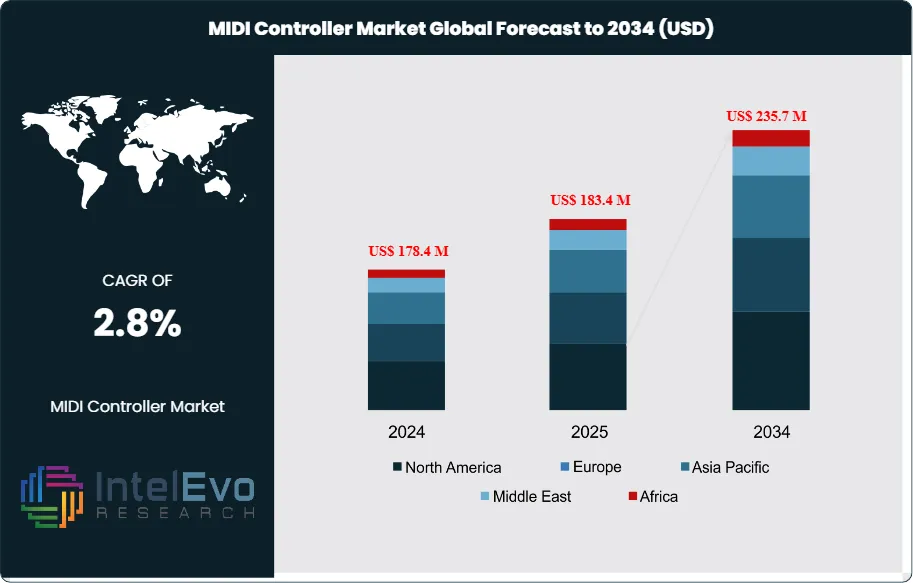

The MIDI Controller market is estimated at US$ 178.4 million in 2024 and is on track to reach roughly US$ 235.7 million by 2034, implying a compound annual growth rate of 2.8% over 2025–2034. The market is benefiting from the explosive rise of home studios, independent music production, and global creator-economy growth. With Gen-Z and millennial musicians driving massive adoption of compact, USB-powered controllers, the industry is evolving faster than ever. Social media music trends, AI-driven audio tools, and hybrid digital-analog workflows are further boosting the visibility and demand for advanced MIDI hardware.

Get More Information about this report -

Request Free Sample ReportMarket expansion remains steady, driven by the growing demand for digital music production tools across professional and home studios. MIDI controllers serve as a critical interface between human input and digital audio software, with adoption bolstered by a shift toward computer-based music creation. While the market experienced marginal growth over the past decade, the continued rise in independent music production and accessible recording technology sustains baseline demand.

Keyboard MIDI controllers dominate shipments due to their versatility, covering models from compact 25-key units to full-sized 88-key setups. These devices offer velocity-sensitive keys and pitch control, allowing producers to manipulate virtual instruments in real time. Their portability and integration with major DAWs (Digital Audio Workstations) make them a preferred tool in hybrid studio environments. Beyond keyboards, adoption of drum and wind controllers remains niche but stable, appealing to specific performance needs. Wind controllers simulate acoustic nuances such as breath pressure, while drum controllers mimic percussive inputs for beat composition.

A key demand-side factor remains the proliferation of affordable music production software, while supply-side momentum is shaped by OEM innovation in tactile responsiveness, compact form factors, and seamless connectivity with mobile and desktop platforms. Integration with USB and Bluetooth interfaces has also expanded accessibility across devices. Challenges persist around latency, device compatibility, and market saturation in mature regions.

Technology is shaping the market, particularly through the integration of AI-assisted music tools and real-time parameter automation. Smart MIDI controllers with customizable mapping and onboard memory are being deployed to streamline live performances and studio workflows. These improvements are accelerating replacement cycles among professional users.

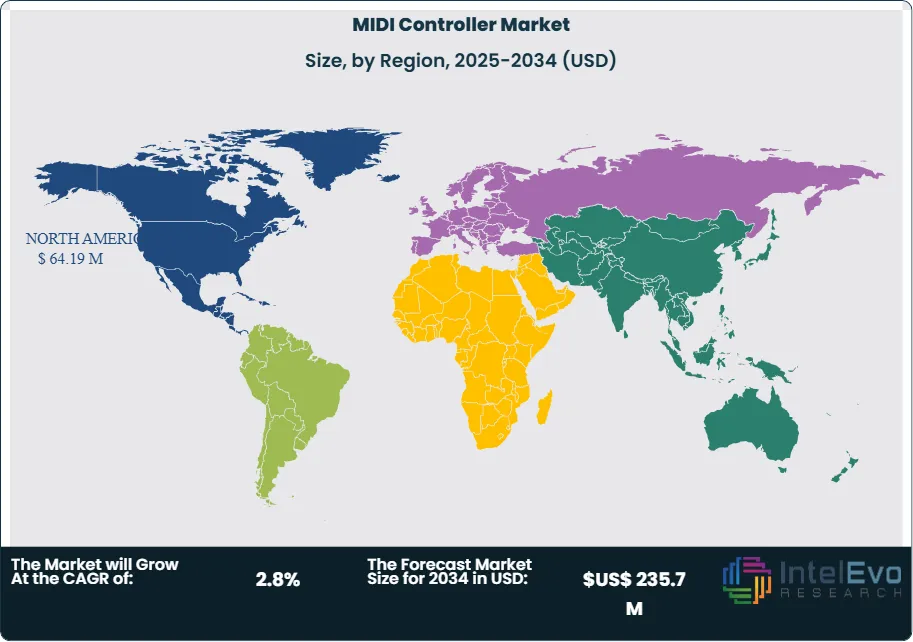

North America leads global demand, driven by a dense population of studio professionals, content creators, and educational institutions. Europe follows, particularly Germany and the UK. Asia Pacific, led by Japan and South Korea, is emerging as a manufacturing and consumption hub, attracting attention from mid-tier and budget-friendly brands. As music production continues to digitize, investors should watch for consolidation among hardware-software ecosystem providers and rising interest in subscription-linked hardware bundles.

Key Takeaways

- Market Growth: The global MIDI controller market was valued at US$100.8 million in 2018 and is projected to reach US$120.0 million by 2028, growing at a modest CAGR of 2.7%. Growth is driven by rising adoption of digital music production tools and the expansion of home-based studios.

- Product Type: Keyboard MIDI controllers account for over 60% of global revenue due to their versatility and widespread compatibility with digital audio workstations. Their portability and integration features continue to make them the first choice among producers and performers.

- Application: Studio production remains the leading application segment, contributing more than 55% of market revenue. Increasing usage among independent musicians and small-scale producers supports steady demand in this category.

- Driver: The increasing availability of affordable DAWs and virtual instruments is fueling demand for MIDI controllers. Entry-level products priced under US$150 are expanding the user base among amateur producers and hobbyists.

- Restraint: Limited audio generation capability restricts standalone functionality. Dependence on external software or synthesizers reduces appeal for live performers seeking all-in-one solutions.

- Opportunity: Bluetooth-enabled and wireless MIDI controllers are gaining traction, particularly in the mobile production market. The segment is expected to grow at a CAGR above 3.5% through 2028, driven by demand for cable-free setups.

- Trend: Integration of AI-based features for real-time parameter control is reshaping controller design. Brands like Arturia and Native Instruments are adding smart mapping and onboard memory to enhance workflow efficiency.

- Regional Analysis: North America leads with a 35% market share, driven by a dense ecosystem of producers and studios. Asia Pacific shows the fastest growth, projected at a CAGR of 2.4%, led by increased consumer electronics manufacturing and rising demand in Japan, South Korea, and India.

Type Analysis

The compact-key segment dominates unit shipments. Compact models (25-key and 37-key) account for roughly 38% of global unit sales in 2025, driven by mobile producers and bedroom studios; these formats combined generated about US$42 million of revenue in 2025. Mid-size controllers (49-key and 61-key) serve working producers and small studios and represent roughly 30% of market value; their balance of playability and portability maintains steady demand. Full-size 88-key instruments capture a premium niche; they deliver higher ASPs and contributed an estimated 18% of 2025 revenue, led by buyers who require piano-grade keybeds for scoring and professional sessions.

Product development has concentrated on tactile quality, low-latency sensing, and onboard control surfaces. Manufacturers such as Native Instruments, Arturia, and Akai have pushed firmware features and deeper DAW integration, which supports higher replacement rates among pros. Expect incremental ASP growth of 1–2% annually through 2028 as manufacturers bundle software and mapping features.

Application Analysis

Home and personal studios remain the largest application. Household use accounted for approximately 55% of shipments in 2025 as more creators adopt DAWs and virtual instruments; this segment is the primary driver of volume growth. Stage and live-performance controllers account for about 28% of market value; demand here favors rugged builds, low-latency wireless options, and units with onboard memory for live sets. Other applications, including education, sound design, and installations, make up the remainder and show steady adoption at around 17% of value.

You should note that mobile workflows are shifting purchase patterns. Bluetooth and USB-C compatibility increased adoption in the household segment by an estimated 12% year on year through 2024; this trend is expected to continue and pressure legacy wired-only models.

End-Use Analysis

Professional studios and content creators drive higher revenue per unit. Commercial users, including scoring houses and recording facilities, represent roughly 40% of market revenue in 2025 due to preference for premium controllers and service contracts. Residential users, including independent musicians and hobbyists, provide the bulk of unit sales and sustain volume growth; they represented about 45% of units in 2025. Industrial or institutional purchases, such as education and broadcast, account for the remaining 15% and often favour bundled hardware-software packages.

Replacement cycles differ by end-use. Commercial buyers refresh hardware every 3 to 5 years. Residential buyers replace less frequently but expand portfolios as software instruments proliferate.

Regional Analysis

North America leads in revenue. The region held approximately 35% market share in 2025, equating to about US$64.19 million of the total US$183.4 million market that year; strong studio density and content creation ecosystems explain the lead. Europe followed at near 28% share and generated roughly US$31 million; Germany and the UK are primary demand centers. Asia Pacific shows the fastest growth, with a projected CAGR of about 2.4% through 2028 and a 2025 revenue share near 25 percent; Japan, South Korea, and China drive both manufacturing and consumption.

Latin America and the Middle East and Africa remain small but growing markets. Combined they account for roughly 12% of 2025 revenue. You should monitor APAC for mid-tier brand activity and North America for premium feature rollout and subscription bundling.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments:

By Type

- 25 Key

- 37 Key

- 49 Key

- 61 Key

- 88 Key

By Application

- Household

- Stage

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | US$ 178.4 M |

| Forecast Revenue (2034) | US$ 235.7 M |

| CAGR (2024-2034) | 2.8% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (25 Key, 37 Key, 49 Key, 61 Key, 88 Key), By Application (Household, Stage) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Arturia S.A, Korg Inc., Focusrite Plc (Novation), Ik Multimedia Production Srl, Music Brands Inc. (Akai Professional), M-Audio, Samson Technologies, Studiologic (Fatar) |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date