Mobile CRM Market Size, Trends, Growth & Forecast 2034 | 12.3% CAG

Global Mobile CRM Market Size, Share & Analysis By Platform (IOS-based Mobile CRM App, Android-based CRM Platform App), By Application (Marketing Automation, Sales Automation, Contact Center Automation, Customer Service Management, Others), Industry Adoption Trends, Integration Capabilities & Forecast 2025–2034

Report Overview

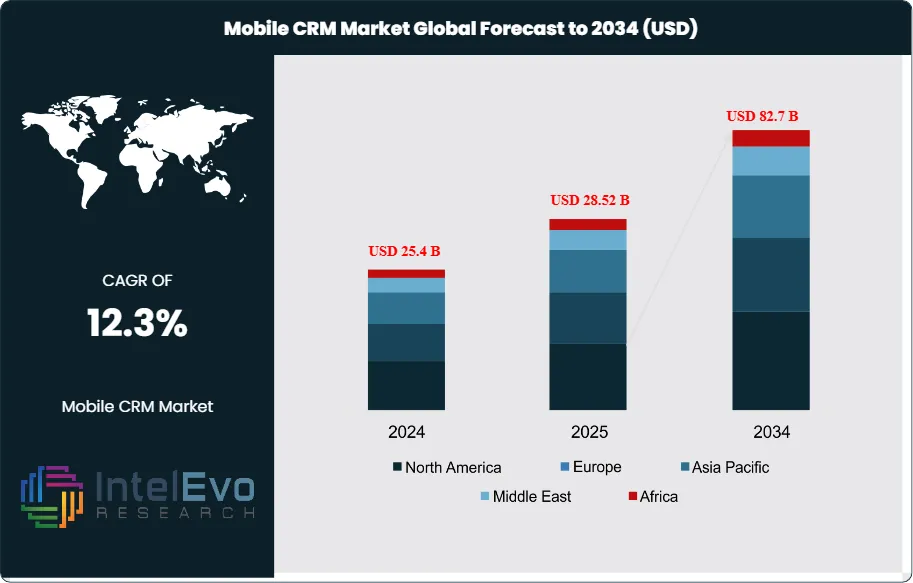

The Mobile CRM Market is projected to grow from approximately USD 25.4 billion in 2024 to around USD 82.7 billion by 2034, expanding at a CAGR of about 12.3% during 2025–2034. This surge reflects the rising global shift toward hybrid work models, real-time customer engagement, and AI-powered sales automation. Enterprises are rapidly adopting mobile-first strategies to boost productivity, strengthen client communication, and streamline workflows across distributed teams. As digital transformation accelerates worldwide, mobile CRM solutions are becoming essential for sustaining competitive advantage and driving customer-centric innovation.

Get More Information about this report -

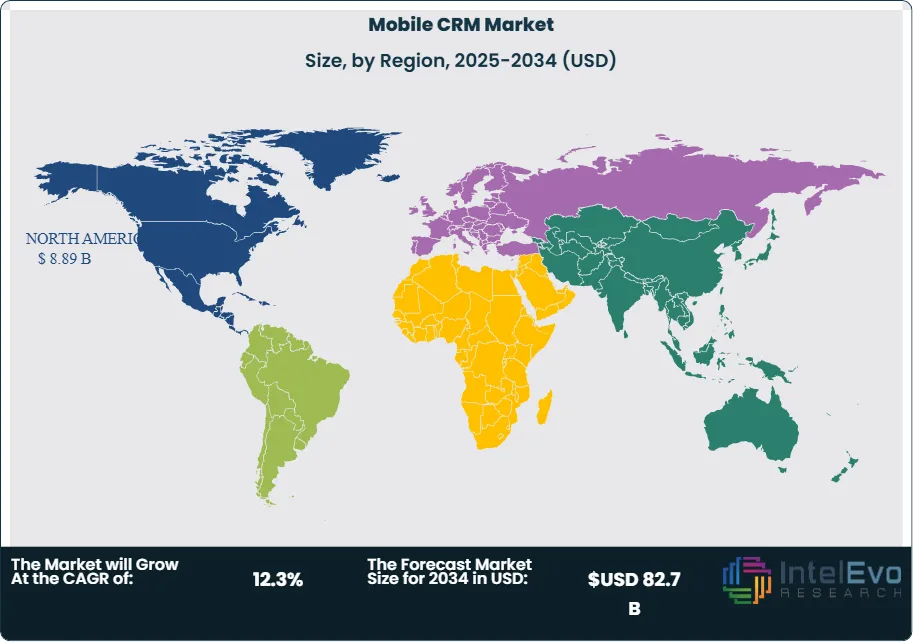

Request Free Sample ReportThis growth reflects the accelerating shift toward mobile-first business operations, where organizations increasingly rely on real-time access to customer data to drive engagement, efficiency, and decision-making. In 2024, North America led the market with a 35.6% revenue share, equivalent to USD 8.2 billion, underscoring its role as an early adopter of mobile-driven enterprise solutions.

The market’s expansion is being fueled by the widespread use of smartphones and tablets, coupled with the growing prevalence of remote and hybrid work environments. Mobile CRM platforms enable sales, marketing, and customer service teams to seamlessly update and manage customer interactions in real time, resulting in improved collaboration, higher productivity, and enhanced customer experiences. According to industry estimates, businesses using mobile CRM report a 14.6% increase in sales productivity, with 65% of sales teams meeting their quotas compared to just 22% among firms without mobile CRM integration. This stark performance gap highlights the technology’s role as a critical enabler of revenue growth and operational agility.

Demand is also being driven by organizations seeking to strengthen customer relationships through greater accessibility and personalization. Mobile CRM applications allow employees to access key insights during field visits, tailor communications to individual customer needs, and make faster, data-driven decisions. At the same time, integration with artificial intelligence, big data analytics, and communication channels such as email, social media, and instant messaging is transforming mobile CRM into a hub for predictive customer insights and personalized marketing strategies. Enhanced security protocols and regulatory compliance features are further bolstering adoption among industries handling sensitive data, including banking, healthcare, and retail.

Regionally, adoption patterns highlight both saturation and opportunity. While North America and Asia-Pacific are advancing rapidly, Europe remains comparatively underpenetrated, with mobile CRM adoption estimated at just 34% in 2024. This lag presents substantial growth prospects for providers seeking to expand their footprint in the region. Meanwhile, businesses worldwide are aligning their digital strategies with mobile-first expectations, as 57% of consumers report they would not recommend a company with a poorly optimized mobile interface, and half would abandon a brand’s website altogether if it lacks mobile usability. As enterprises prioritize mobile accessibility and customer-centric engagement models, mobile CRM is expected to remain a cornerstone of digital transformation strategies well into the next decade.

Key Takeaways

- Market Growth: The global mobile CRM market was valued at USD 25.4 billion in 2024 and is projected to reach USD 82.7 billion by 2034, expanding at a CAGR of 12.3% from 2025–2034. Growth is fueled by rising demand for real-time customer data access, mobile workforce enablement, and the integration of AI-driven insights into CRM platforms.

- Operating System: Android-based CRM applications held over 68% of the market share in 2024, supported by Android’s vast global smartphone penetration and cost accessibility, particularly across emerging markets.

- Application: Sales automation was the leading application area in 2024, accounting for more than 37% of revenue, as organizations increasingly prioritize mobile-enabled tools to streamline workflows, reduce administrative tasks, and boost salesforce productivity.

- Driver: Businesses using mobile CRM report up to a 14.6% increase in sales productivity, with 65% of sales teams meeting their quotas compared to just 22% for non-users. This measurable performance gap is a primary driver of adoption.

- Restraint: Data security and privacy concerns remain a key barrier, with compliance costs rising as companies adapt mobile CRM systems to meet stringent regulations such as GDPR in Europe and CCPA in the U.S.

- Opportunity: Europe presents a significant growth opportunity, with mobile CRM penetration at only 34% in 2024. Providers offering tailored, compliance-ready solutions stand to capture substantial market share as adoption accelerates.

- Trend: Integration of mobile CRM with AI and big data analytics is reshaping customer engagement, enabling predictive insights and hyper-personalized interactions. Vendors such as Salesforce and Microsoft are embedding advanced AI into mobile platforms to differentiate offerings.

- Regional Analysis: North America led the market in 2024 with a 35.6% share, generating USD 8.2 billion in revenue, driven by early adoption and strong cloud infrastructure. Asia-Pacific is emerging as the fastest-growing region, fueled by rapid digital transformation in banking, retail, and telecom sectors.

Platform Analysis

As of 2025, Android-based CRM platforms continue to dominate the mobile CRM market, accounting for over two-thirds of total adoption. This strong position is driven by Android’s global reach, with the operating system powering the majority of smartphones across both developed and emerging markets. Its open-source framework offers developers significant flexibility, enabling businesses to customize applications to fit diverse workflows and customer engagement strategies. The affordability of Android devices, particularly in Asia-Pacific, Latin America, and Africa, makes these platforms attractive to small and medium-sized enterprises (SMEs) seeking scalable, cost-effective CRM solutions.

In addition to accessibility, Android-based CRM systems excel in interoperability, allowing seamless integration with third-party business tools, databases, and cloud platforms. This integration capability supports real-time analytics, predictive insights, and automated customer engagement, giving enterprises greater agility in decision-making. Enhanced developer community support further accelerates innovation, with features such as AI-powered lead scoring, customer segmentation, and personalized marketing now standard across leading Android CRM applications. This ecosystem strength ensures that Android-based solutions remain central to the market’s expansion, particularly in regions prioritizing affordability and flexibility.

Application Analysis

Sales automation remains the largest application segment in 2025, holding more than one-third of the global mobile CRM market. Organizations are investing heavily in automating lead management, pipeline tracking, and forecasting to improve sales efficiency and reduce cycle times. The shift toward mobile-first sales strategies is evident, with companies reporting productivity gains of up to 15% when deploying mobile-enabled sales automation tools. These platforms also improve data accuracy and provide management with a unified view of sales activities, driving more precise resource allocation and strategic planning.

The evolution of sales automation is increasingly tied to advanced technologies. AI and machine learning integration has enabled predictive sales analytics, helping teams anticipate customer needs and personalize interactions at scale. Businesses adopting these AI-powered sales automation tools are achieving higher conversion rates and stronger customer loyalty. As competition intensifies across industries such as retail, BFSI, and telecom, sales automation within mobile CRM platforms is set to remain a cornerstone of revenue growth strategies.

End-Use Analysis

Mobile CRM adoption is accelerating across all end-user categories, with commercial enterprises leading uptake in 2025. Large-scale organizations are leveraging mobile CRM to streamline complex sales and marketing functions across distributed teams while ensuring consistent customer experiences across geographies. Residential-focused service providers, including real estate and consumer services, are also adopting mobile CRM to enable field agents to access and update client data in real time, enhancing service responsiveness.

SMEs, however, represent the fastest-growing end-user segment, benefiting from the affordability and scalability of mobile CRM platforms. With cloud-based deployment reducing infrastructure costs, SMEs are using mobile CRM to compete more effectively with larger players, particularly in managing customer relationships and executing targeted campaigns. This democratization of access highlights mobile CRM’s role as a vital tool for business growth across enterprise sizes.

Regional Analysis

North America continues to lead the global mobile CRM market in 2025, generating over one-third of total revenues. The region’s dominance stems from a mature digital ecosystem, strong presence of leading vendors such as Salesforce, Microsoft, and Oracle, and early adoption of advanced features like AI and big data analytics. Enterprises in the U.S. and Canada are heavily investing in mobile CRM to deliver personalized, omnichannel customer experiences, positioning the region as both an innovation hub and a revenue leader.

Asia-Pacific, meanwhile, is emerging as the fastest-growing market, propelled by rapid digital transformation across banking, retail, and telecom sectors. Countries such as India, China, and Southeast Asian nations are witnessing strong SME adoption, supported by government digitalization programs and expanding smartphone penetration. Europe, with comparatively lower penetration (around 34% in 2024), presents untapped potential as businesses in the region accelerate mobile-first strategies to improve customer engagement. Latin America and the Middle East & Africa are also gaining momentum, with mobile CRM adoption rising in response to growing e-commerce activity and the need for affordable, scalable business solutions.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Platform

- IOS-based Mobile CRM App

- Android-based CRM Platform App

By Application

- Marketing Automation

- Sales Automation

- Contact Center Automation

- Customer Service Management

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 25.4 B |

| Forecast Revenue (2034) | USD 82.7 B |

| CAGR (2024-2034) | 12.3% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Platform (IOS-based Mobile CRM App, Android-based CRM Platform App), By Application (Marketing Automation, Sales Automation, Contact Center Automation, Customer Service Management, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Salesforce, Inc., Microsoft Corporation, SAP SE, Oracle Corporation, Zoho Corporation Pvt. Ltd., HubSpot, Inc., SugarCRM Inc., Pipedrive OÜ, Freshworks Inc. (Freshsales), Zendesk, Inc., Infor Inc., Sage Group plc, Creatio, Keap (Infusionsoft), Nimble CRM, Insightly Inc., Apptivo Inc., Copper CRM, Bpm’online, ServiceNow, Inc., Monday.com Ltd. (CRM Module), ClickUp Inc. (CRM Extensions) |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Mobile CRM Market?

The Mobile CRM Market will rise from USD 25.4B in 2024 to USD 82.7B by 2034 at a 12.3% CAGR. Growing hybrid work adoption, AI automation, and real-time customer engagement fuel demand.

Who are the major players in the Mobile CRM Market?

Salesforce, Inc., Microsoft Corporation, SAP SE, Oracle Corporation, Zoho Corporation Pvt. Ltd., HubSpot, Inc., SugarCRM Inc., Pipedrive OÜ, Freshworks Inc. (Freshsales), Zendesk, Inc., Infor Inc., Sage Group plc, Creatio, Keap (Infusionsoft), Nimble CRM, Insightly Inc., Apptivo Inc., Copper CRM, Bpm’online, ServiceNow, Inc., Monday.com Ltd. (CRM Module), ClickUp Inc. (CRM Extensions)

Which segments covered the Mobile CRM Market?

By Platform (IOS-based Mobile CRM App, Android-based CRM Platform App), By Application (Marketing Automation, Sales Automation, Contact Center Automation, Customer Service Management, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date