Mobile Hospitals Market Size, Growth Outlook | 14.5% CAGR

Global Mobile Hospitals Market Size, Share & Analysis By Type (Accident & Emergency Care Facility, General Surgery Facility, Diagnostics & Imaging Facility, Specialized Surgery Facility, Dental & Ophthalmic Facility, Others), By Function (Observation, Therapy /Treatment, Consultation, Intensive Care, Others), Industry Outlook, Government Initiatives & Forecast 2025–2034

Report Overview

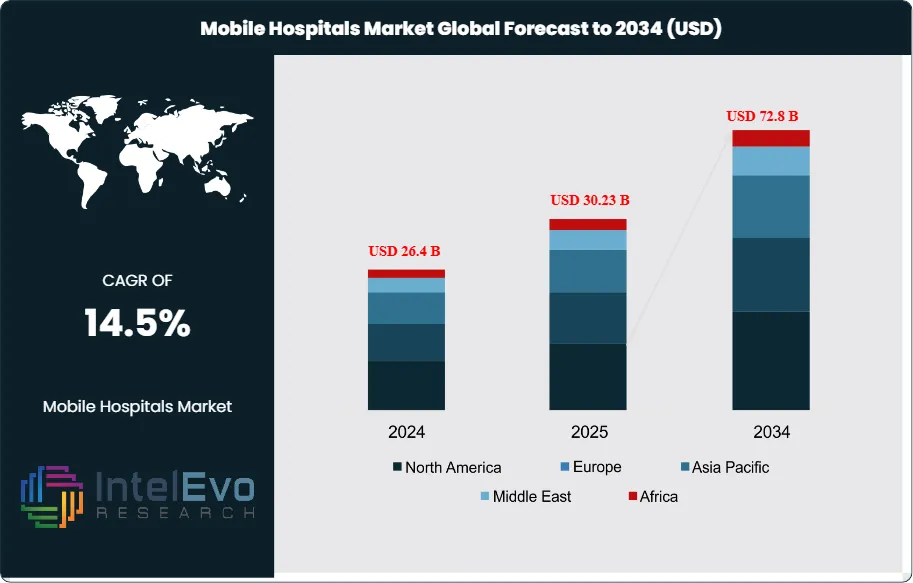

The Mobile Hospitals Market is estimated at USD 26.4 billion in 2024 and is on track to reach approximately USD 72.8 billion by 2034, implying a strong compound annual growth rate of about 14.5% over 2025–2034. Growing demand for rapid-deployment healthcare infrastructure—especially in disaster zones, military operations, rural communities, and epidemic response—is accelerating the adoption of mobile hospitals worldwide. Governments, NGOs, and private healthcare operators are increasingly shifting toward modular, AI-enabled clinical units that can be deployed in hours instead of months. As global health emergencies rise, mobile hospitals are becoming a cornerstone of resilient healthcare systems. The surge in telemedicine, point-of-care diagnostics, and solar-powered medical units is further reshaping the market landscape. With investments in defense healthcare, rural health missions, and emergency preparedness increasing globally, the demand curve is expected to strengthen even faster in the coming decade.

Get More Information about this report -

Request Free Sample ReportThe market has expanded significantly in recent years as healthcare systems face rising pressure from natural disasters, armed conflicts, pandemics, and remote-area needs. Between 2018 and 2022, mobile hospital deployments increased by over 40% across conflict zones and underserved rural areas. The growing demand for scalable, fast-response medical infrastructure has reshaped investment strategies among healthcare providers, NGOs, and defense agencies. Governments across North America, Europe, and Asia have allocated increased public health budgets to mobile units, especially following COVID-19, which highlighted gaps in rapid-deployment care models.

Key growth drivers include the rising frequency of climate-related disasters, conflict-induced displacement, and the global focus on emergency preparedness. Demand-side factors are fueled by rising populations in underserved regions and limited access to permanent healthcare facilities. Supply-side improvements—particularly in modular engineering, rapid transport capabilities, and compact medical technology—are accelerating adoption. However, the market faces challenges such as high deployment costs, complex logistics, and varying cross-border regulatory frameworks.

Technology is central to market expansion. Advances in telemedicine, AI-powered diagnostics, and compact life support systems have transformed mobile hospitals into fully functional care hubs. Newer models now integrate digital health records, real-time patient monitoring, and remote consultation capabilities. Automation of sterilization and patient tracking also reduces manpower requirements and improves efficiency.

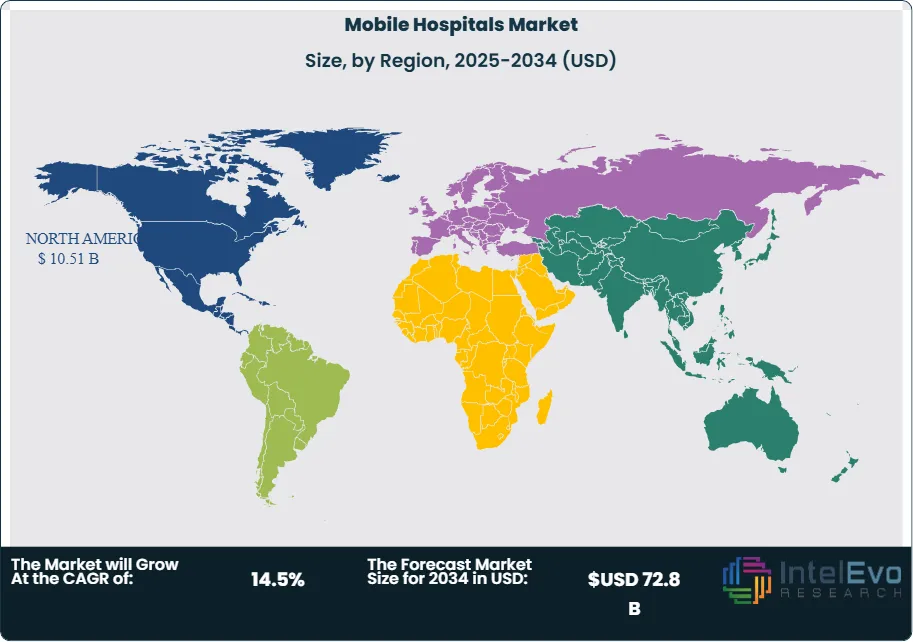

North America leads in market share due to strong public health infrastructure, military applications, and FEMA-backed funding initiatives. Europe follows, with increased deployments in Eastern European border zones. Meanwhile, Asia Pacific is emerging as a high-growth region, driven by government investments in disaster-prone countries such as India, Indonesia, and the Philippines. Sub-Saharan Africa is also gaining investor attention, with multi-stakeholder collaborations focused on maternal health and epidemic response.

Looking ahead, investor interest is expected to concentrate around modular hospital platforms, AI-integrated diagnostics, and mobile ICUs tailored for extreme conditions. The combination of rising emergency healthcare demand and portable medical technology will continue to define the market's trajectory through 2034.

Key Takeaways

- Market Growth: The global mobile hospitals market is projected to grow from USD 26.4 billion in 2024 to USD 72.8 billion by 2034, registering a CAGR of 14.5% over the forecast period. Growth is driven by rising demand for emergency response infrastructure, especially in disaster-prone and underserved regions.

- Application: The Accident & Emergency Care Facility segment led the market in 2023, capturing over 27.5% of total revenue. This is attributed to the increasing need for rapid medical deployment in conflict zones, natural disaster areas, and large-scale public events.

- Service Type: Therapy/Treatment Services accounted for the highest share by service in 2023 at 29.8%, driven by demand for mobile surgical units, outpatient care, and chronic disease management in regions lacking permanent facilities.

- Driver: Government-backed initiatives and military investments are fueling growth. In 2023, North America alone invested over USD 8.3 billion in mobile healthcare units, with FEMA and the U.S. Department of Defense expanding mobile ICU and triage capabilities.

- Restraint: High capital costs and complex logistics remain key barriers. Initial deployment of modular hospitals can exceed USD 1 million per unit, limiting adoption in low-income countries without international aid or NGO partnerships.

- Opportunity: The Asia Pacific region presents high-growth potential, with mobile healthcare demand accelerating in India, China, and Southeast Asia. The region is forecast to grow at a CAGR above the global average, supported by disaster response programs and rural healthcare initiatives.

- Trend: Integration of digital diagnostics, telemedicine, and AI-driven triage is transforming mobile hospitals into connected care hubs. Key players are incorporating remote monitoring and EHR platforms to reduce dependency on on-site specialists.

- Regional Analysis: North America held the largest market share in 2023 at 39.8%, driven by established infrastructure and emergency preparedness funding. Asia Pacific is emerging rapidly due to infrastructure gaps, rising population density, and climate-related disaster risk.

Type Analysis

The Accident & Emergency Care Facility segment accounted for the largest share of the mobile hospitals market in 2023, capturing over 27.5% of total revenue. This dominance reflects the growing global need for rapid-response medical infrastructure in conflict zones, disaster-affected regions, and areas with minimal healthcare access. These mobile units are designed for urgent interventions, equipped with trauma care, life-saving equipment, and emergency personnel, making them indispensable during crises. The increasing frequency of natural disasters and armed conflicts has driven investments from both government and humanitarian organizations in this segment.

General Surgery Facilities also contribute significantly to market demand. These units serve populations in remote or underserved locations where permanent surgical infrastructure is absent or overwhelmed. They enable critical interventions such as appendectomies, hernia repairs, and wound debridement. Their utility is especially evident during public health emergencies or large-scale events, where traditional hospitals face capacity constraints. In many regions, they function as the only viable surgical solution during times of infrastructural failure or displacement.

The Diagnostics & Imaging Facility segment addresses the critical need for on-site diagnostic capabilities in mobile formats. These units provide X-ray, ultrasound, and basic laboratory services, enabling early diagnosis and treatment planning in field conditions. They are increasingly adopted by military units, NGOs, and public health agencies in response to disease outbreaks or trauma scenarios. The demand for mobile diagnostics is rising as healthcare systems shift toward decentralized models.

Specialized Surgery Facilities, although smaller in market share, provide focused care in areas like orthopedics, cardiovascular surgery, or neurosurgery. These high-complexity units are typically deployed in regions where specialist access is limited or during medical missions. Their role is growing as portable surgical technologies become more advanced and compact.

Dental and Ophthalmic Facilities cater to niche but essential healthcare needs. These units are crucial in rural settings where access to eye exams or dental procedures is non-existent. With rising awareness of oral and visual health, this segment is expected to grow steadily, especially in low-income regions supported by public health campaigns.

The Other Facilities segment includes mobile units dedicated to maternal care, mental health, pediatric services, and chronic disease management. This category reflects the market’s diversification and responsiveness to specific healthcare demands in vulnerable populations.

Function Analysis

The Therapy/Treatment function dominated the mobile hospitals market in 2023, accounting for more than 29.8% of the total share. These units play a critical role in administering wound care, medications, surgical aftercare, and chronic disease management in field conditions. Their flexibility and wide range of services make them the backbone of mobile medical deployments across conflict zones, disaster sites, and rural health missions.

Observation Units serve as intermediate care spaces for patients who require monitoring without intensive interventions. These units support post-operative recovery, infection monitoring, and chronic disease observation. Their importance is rising in mobile deployments where referral to full-scale hospitals is delayed or impractical. Governments and aid organizations increasingly deploy observation-focused units during outbreaks to isolate and monitor suspected cases.

Consultation Facilities enable general healthcare services such as medical check-ups, preventive care, and disease counseling. These mobile clinics bridge significant gaps in primary care, especially in regions lacking medical personnel. With the rise of non-communicable diseases and growing emphasis on prevention, consultation functions are seeing increased deployment in both urban and remote settings.

The Intensive Care segment, though smaller in market share, is vital for handling severe trauma and critical care cases. These mobile ICUs are equipped with ventilators, monitoring systems, and trained personnel, providing high-acuity care in transit or near-crisis zones. Demand for mobile intensive care surged during the COVID-19 pandemic and remains elevated due to ongoing disaster preparedness strategies.

Other Functional Units include specialized services such as mental health support, maternity care, pediatric health, and infectious disease control. Their growing presence illustrates how the mobile hospital market is expanding beyond acute and emergency care to include long-term and community health services.

End-Use Analysis

The Residential Building sector is the leading end-use category for mobile hospitals, driven by rising demand for healthcare in refugee camps, disaster shelters, and remote settlements. These units serve populations displaced by climate events, war, or infrastructure failure, offering essential care near temporary living quarters. Their use has increased notably in regions experiencing prolonged humanitarian crises.

Commercial Buildings, including large corporate campuses, event venues, and temporary work sites, also utilize mobile hospitals. Organizations operating in remote locations—such as oil rigs, mining operations, and construction megaprojects—require onsite medical care to reduce evacuation costs and ensure workforce safety. This end-use category is expected to grow as companies seek to manage occupational health risks proactively.

Industrial Buildings, such as factories and logistics hubs, are adopting mobile medical units to support workplace health, especially in high-risk industries. Onsite healthcare solutions improve emergency response times and reduce productivity loss from health-related incidents. With stricter occupational health regulations, this segment is projected to expand in both developed and developing economies.

Regional Analysis

North America retained its position as the dominant market in 2023, accounting for 39.8% of global revenue, or USD 8.3 billion. The region benefits from well-established emergency response systems, defense sector funding, and high adoption of advanced mobile technologies. Public agencies like FEMA and the U.S. Department of Defense continue to deploy mobile hospitals for natural disaster response, pandemic control, and military operations. Technological integration, including mobile CT scans and telemedicine-enabled units, also supports market maturity.

Asia Pacific is emerging as the fastest-growing region through 2030, driven by healthcare access gaps, population growth, and disaster vulnerability. Countries such as India, China, and the Philippines are investing heavily in mobile healthcare infrastructure for both rural outreach and urban emergency preparedness. Strategic initiatives by local governments, along with partnerships with international health organizations, are accelerating deployment. The region is expected to outpace global average growth rates, with double-digit CAGR projections through the end of the forecast period.

Europe follows closely, with significant deployments in Eastern Europe and border regions supporting refugee flows and humanitarian response. EU funding initiatives and civil protection programs have supported procurement of mobile medical infrastructure, especially for member states facing cross-border health challenges.

Latin America and the Middle East & Africa are gaining investor attention, particularly in underserved rural areas and post-conflict zones. Mobile hospitals in these regions often rely on NGO funding and international aid, with growing interest from public-private partnerships aiming to fill healthcare delivery gaps.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Accident & Emergency Care Facility

- General Surgery Facility

- Diagnostics & Imaging Facility

- Specialized Surgery Facility

- Dental & Ophthalmic Facility

- Others

By Function

- Observation

- Therapy /Treatment

- Consultation

- Intensive Care

- Others

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 26.4 B |

| Forecast Revenue (2034) | USD 72.8 B |

| CAGR (2024-2034) | 14.5% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Accident & Emergency Care Facility, General Surgery Facility, Diagnostics & Imaging Facility, Specialized Surgery Facility, Dental & Ophthalmic Facility, Others), By Function (Observation, Therapy /Treatment, Consultation, Intensive Care, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Vanguard Healthcare Solutions, EMS Healthcare Ltd., CGS Premier, Saba Palaye, Coastal Community Health Services, La Clinica Health Centers, Vetter GmbH, U-PROJECT, Alvo Medical, Aspen Medical, Lamboo Mobile Medical, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date